#0, MSM, Shorties blowing things out of proportions, they have 1 more week of malarkeyI blame TSLA softness on a few things, in order of importance:

1) macro environment sucks

2) perception of Q3 delivery "miss"

3) People getting sick of Elon on Twitter and want nothing to do with him anymore

4) Twitter deal uncertainty

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

This all reminds me of Microsoft and Intel trying to capture the phone/mobile segment while not focusing on their core competency. Rarely do these half baked "next thing" rush pays off. So far GM's journey into electric cars and autonomous driving have landed them nothing but negative margins. But yes, keep adding more Tesla stuff into your portfolio...cause the difference here is Tesla has managed to turn a positive gross margin on all that you are copying.As best I can tell, this is just LG Energy trying to take advantage of the Inflation Reduction Act. They are using the GM brand, but I don't see where GM has anything to contribute from an engineering standpoint. As far as I know, GM has no expertise in batteries, BMS systems, pack design, software, or anything else that would make it an actual GM product.

This is also true of GM's EVs. The whole power train and associated software comes from LG Energy. GM is the brand, but it's mostly an LG car.

I'd love to know the details of the energy products deal between GM and LG. The whole thing sounds a little half-baked, but it does show that GM and LG realize that the market for these products is going to be huge in the US and they don't want Tesla to own 90% of the market.

Tesla: From a story business turned into a legitimate business

The rest: From a legitimate business turned into a story business

Last edited:

2daMoon

Mostly Harmless

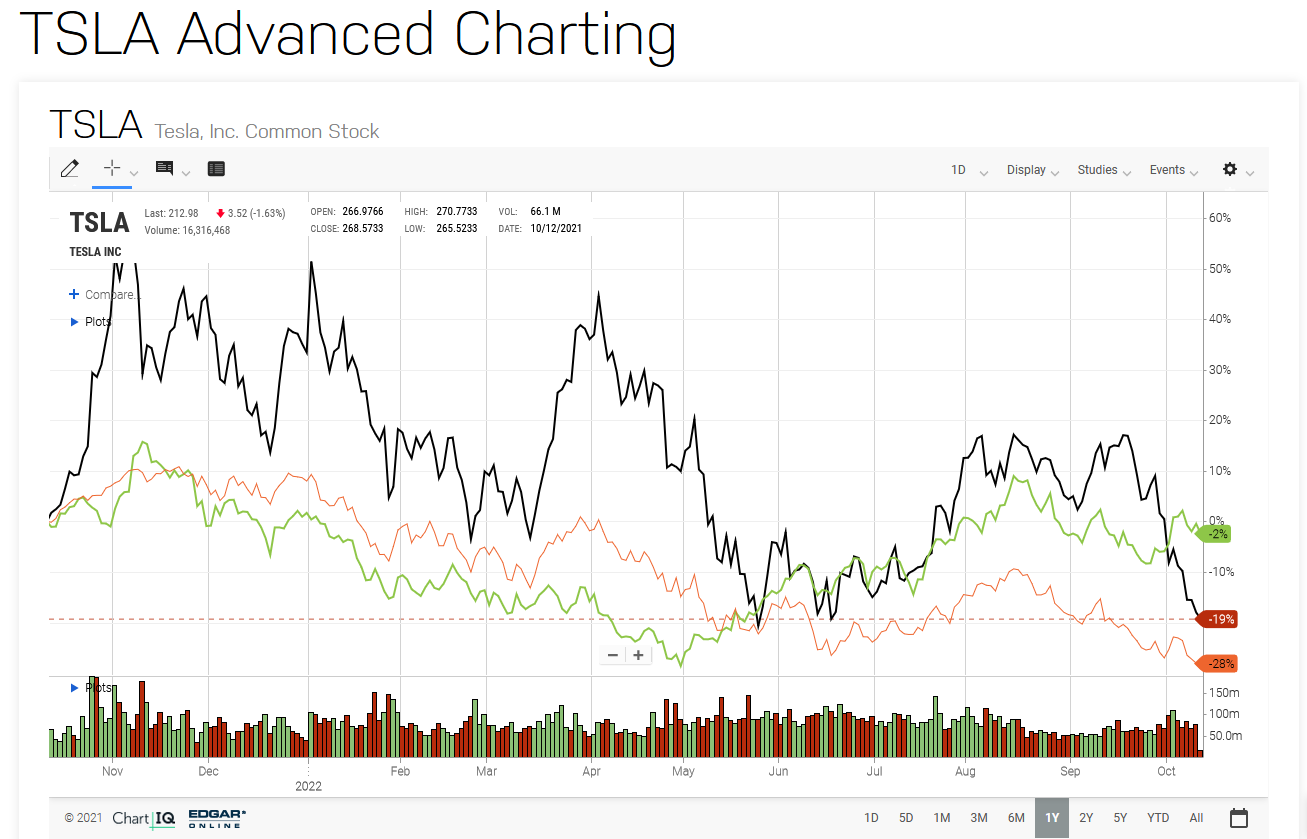

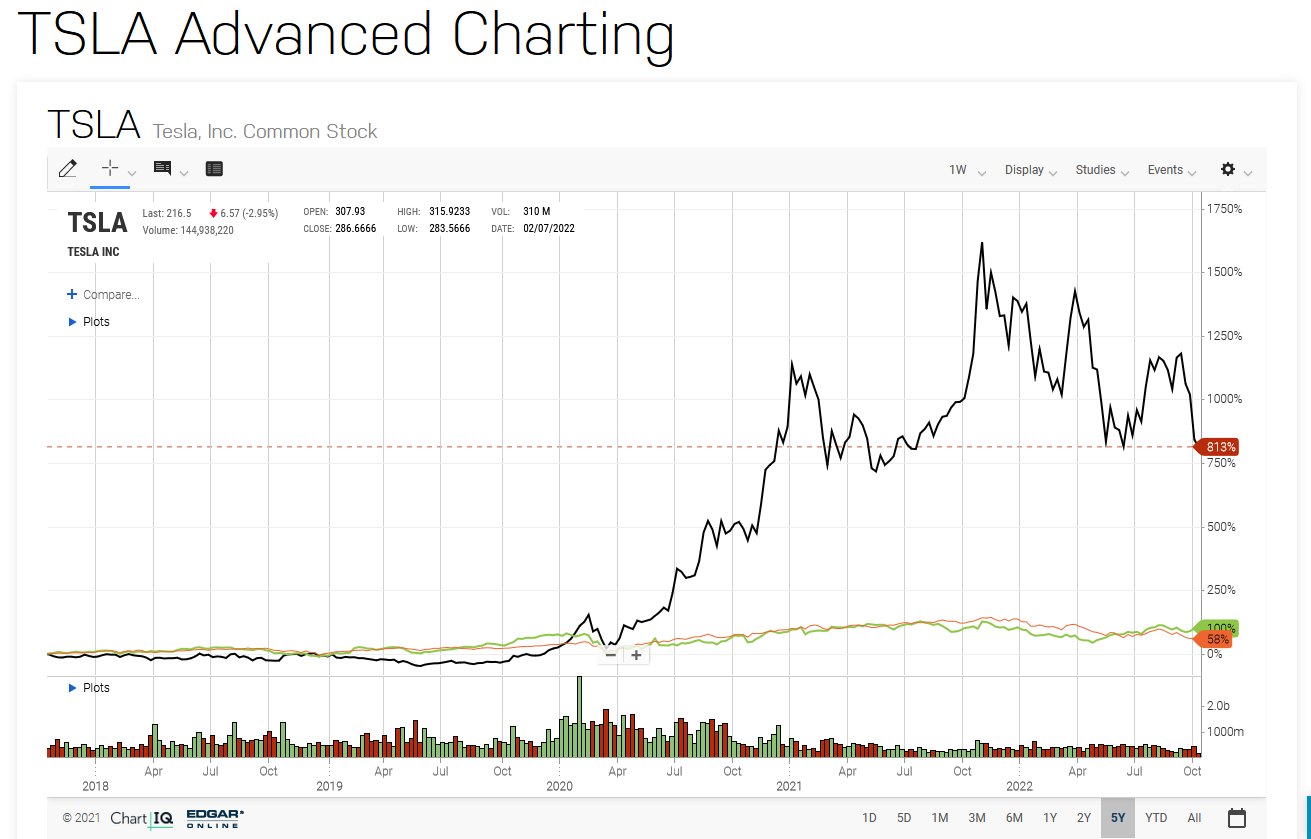

Consider this comparison, over the past year the decline in TSLA looks like it has followed the macro.

Overall, TSLA (black) has held its own against SP500 (green) and NASDAQ (red) trends. The FUD barrage over the past month may help explain the fall of late, despite another record quarter.

People will respond to emotion more often than they will take the time to study fundamentals. Eventually the facts will win out over the fantasy being presented.

We already know this won't go on forever. Change is the only constant in the universe, right?

There are examples of changes in TSLA to review over the past few years. Particularly of note would be the examples of what has happened when TSLA reversed after a down trend. For perspective, this current drop looks a lot like Feb-Mar of 2021 in both its depth and duration. Not that this means anything in regard to the future, other than being a measuring stick to reference against.

The company is in great shape. Time is on our side.

Just not in this particular moment.

HODL

Overall, TSLA (black) has held its own against SP500 (green) and NASDAQ (red) trends. The FUD barrage over the past month may help explain the fall of late, despite another record quarter.

People will respond to emotion more often than they will take the time to study fundamentals. Eventually the facts will win out over the fantasy being presented.

We already know this won't go on forever. Change is the only constant in the universe, right?

There are examples of changes in TSLA to review over the past few years. Particularly of note would be the examples of what has happened when TSLA reversed after a down trend. For perspective, this current drop looks a lot like Feb-Mar of 2021 in both its depth and duration. Not that this means anything in regard to the future, other than being a measuring stick to reference against.

The company is in great shape. Time is on our side.

Just not in this particular moment.

HODL

Knightshade

Well-Known Member

Still praying Elon pays the $1B, sucks up his mistake, and pumps everything back into TSLA.

Again that's not actually an option. The deal contains no "You decide you just don't want the deal and pay 1B" clause.

It's a "You refuse to close and the OTHER side can choose to EITHER take 1B -or sue for specific performance and make you close the deal anyway-"

Twitter picked the second one.

There's a whole thread about the deal if you want more info.

Elon & Twitter

Glad that you finally agree about how taking a minute to Tweet while sitting on the toilet probably isn't a huge time-sink for Elon. 😏 Elon must have serious digestive issues if he's only dealing with Twitter while on the toilet. Maybe that's why he didn't want to continue the legal action.

The sentiment is that we are going towards an economic recession, that’s usually when car salesI blame TSLA softness on a few things, in order of importance:

1) macro environment sucks

2) perception of Q3 delivery "miss"

3) People getting sick of Elon on Twitter and want nothing to do with him anymore

4) Twitter deal uncertainty

decline, and when car prices soften. On the other hand, something good always happens.

Yes, so was I. They asked me to change it to 'others', preferring anonymity themselves.Thanks.... I was concerned about the otters.

It is a repackaged/rebranded LG ESS product. GM continues the playbook of marketing over engineering.This all reminds me of Microsoft and Intel trying to capture the phone/mobile segment while not focusing on their core competency. Rarely do these half baked "next thing" rush pays off. So far GM's journey into electric cars and autonomous driving have landed them nothing but negative margins. But yes, keep adding more Tesla stuff into your portfolio...cause the difference here is Tesla has managed to turn a positive gross margin on all that you are copying.

Tesla: From story business to a legitimate business

The rest: From a legitimate business to a story business

LG ESS Commercial Energy and Home Energy Storage Solutions | LG USA

LG ESS Commercial and LG ESS Home 8, achieve pure independence. Equip your home or business with an energy storage solution.

A bit off topic, but perhaps others would never see if not brought forward

teslamotorsclub.com

teslamotorsclub.com

How much $ to retire and how to fund your lifestyle in retirement

Having retired 35 years ago, I agree with Stealth’s points. 35 years ago I could retire comfortably on a million. Nowadays it takes about 10 times that to have the same life. In my case, my wife and I had modest desires and requirements, so we were able to live and also grow our assets at about...

StealthP3D

Well-Known Member

From our narrow TSLA perspective the more material question is the size of the population that could afford, say, a Model 3 RWD. There is plentiful data on that sort of metric.

This article from Bloomberg provides a bit of context for the US:

electric-vehicles-are-out-of-reach-for-most-u-s-consumers

Oh, yes, media outlets like Bloomberg and Business Insider love to build and reinforce the narrative that EV's are too expensive for mass adoption. It's basically saying the old "EV's are nothing but toys for the rich" while couching it in more objective sounding language. But it is a false narrative for two very real reasons:

1) Most people can't afford a new car, period. This is a fact the media doesn't like to discuss. New cars are purchased by the economic upper half of the population (probably less than that) and everyone else gets hand-me-downs.

2) EV's only make up less than 6% of sales in the U.S. Obviously, there is no need to address the bottom 50% of the new car market until production capacity rises to the point that it can begin to fill that lower half of the new car market.

Between these two factors, the fact that most people can't afford a new EV is meaningless in terms of EV adoption and does not portend the end of the trend of mass adoption. Tesla is not done figuring out ways to make EV's faster, cheaper and better and we are still on the early part of the adoption curve (that's the part of the curve that is still becoming steeper).

The fact that Tesla's margins are massively higher than that of most ICE sales illustrates that EV prices are not the problem these media stories make them out to be. In fact, by ignoring that Tesla has industry leading margins, they obscure the one fact that shows it is ICE cars that are uneconomic to produce, not EV's.

Gigapress

Trying to be less wrong

I always heard "Sell the rumor, sell the news"We are about to hit 52 weeks low right before earnings. I thought in the good old times there was a run up before earnings. Now it’s an endless sell off before earnings.

As best I can tell, this is just LG Energy trying to take advantage of the Inflation Reduction Act. They are using the GM brand, but I don't see where GM has anything to contribute from an engineering standpoint. As far as I know, GM has no expertise in batteries, BMS systems, pack design, software, or anything else that would make it an actual GM product.

This is also true of GM's EVs. The whole power train and associated software comes from LG Energy. GM is the brand, but it's mostly an LG car.

I'd love to know the details of the energy products deal between GM and LG. The whole thing sounds a little half-baked, but it does show that GM and LG realize that the market for these products is going to be huge in the US and they don't want Tesla to own 90% of the market.

May also be part of making up for Bolt cell issues.

Same thing goes for Tesla, but they have been selling to 3rd parties. Self owned Gigafactory and Megacharger buffer storage will be at a cost disadvantage though.

Either they updated this, or I'm slipping.

Related people can be treated as unrelated.

(3) UNRELATED PERSON.— ‘‘

(A) IN GENERAL.—For purposes of this subsection, a taxpayer shall be treated as selling components to an unrelated person if such component is sold to such person by a person related to the taxpayer. ‘‘

(B) ELECTION.— ‘‘

(i) IN GENERAL.—At the election of the taxpayer (in such form and manner as the Secretary may prescribe), a sale of components by such taxpayer to a related person shall be deemed to have been made to an unrelated person. ‘‘

(ii) REQUIREMENT.—As a condition of, and prior to, any election described in clause (i), the Secretary may require such information or registration as the Secretary deems necessary for purposes of preventing duplication, fraud, or any improper or excessive amount determined under paragraph (1).

Last edited:

D

dm28997

Guest

HODL and hoping it stays cheap so I can buy more in the next few weeks; in the meantime we're co pilots in our Teslas with FSD beta enjoying the heck out of it. Even tempted to use margin or options but I don't need to as I have enough wealth to just buy shares.

Nothing new here with the sp as it was similar to other stocks like Apple in the past(when it was called Apple Computer)

Don't bother with the news either; such a waste of time. Bike riding today while the weather is just perfect.

Nothing new here with the sp as it was similar to other stocks like Apple in the past(when it was called Apple Computer)

Don't bother with the news either; such a waste of time. Bike riding today while the weather is just perfect.

Gigapress

Trying to be less wrong

That's a great point. I didn't think of that. I have been thinking that Tesla will keep their own Megapacks for developing their electric utility business, but maybe they won't do that in the US since the IRA gives such a strong cost advantage to selling them to somebody else.Per the IRA rules, to get the Advanced Manufacturing Credit, the manufacturer has the sell the product to an unrelated (not common tax structure) entity to get the credits. So LG can't get them if they have an in-house storage business.

May also be part of making up for Bolt cell issues.

Same thing goes for Tesla, but they have been selling to 3rd parties. Self owned Gigafactory and Megacharger buffer storage will be at a cost disadvantage though.

petit_bateau

Active Member

Haven't they got a shedload of pouch cells reclaimed for their joint LG and GM* warranty recall that need recycling into some other product rather than sticking in the garbage ?As best I can tell, this is just LG Energy trying to take advantage of the Inflation Reduction Act. They are using the GM brand, but I don't see where GM has anything to contribute from an engineering standpoint. As far as I know, GM has no expertise in batteries, BMS systems, pack design, software, or anything else that would make it an actual GM product.

This is also true of GM's EVs. The whole power train and associated software comes from LG Energy. GM is the brand, but it's mostly an LG car.

I'd love to know the details of the energy products deal between GM and LG. The whole thing sounds a little half-baked, but it does show that GM and LG realize that the market for these products is going to be huge in the US and they don't want Tesla to own 90% of the market.

Just saying ....

*(and a few other auto makers caught the same LG cold)

We are about to hit 52 weeks low right before earnings. I thought in the good old times there was a run up before earnings. Now it’s an endless sell off before earnings.

Not just earnings, but very likely record all time high earnings!

That's a great point. I didn't think of that. I have been thinking that Tesla will keep their own Megapacks for developing their electric utility business, but maybe they won't do that in the US since the IRA gives such a strong cost advantage to selling them to somebody else.

So spin off Tesla Energy ( roof, grid ) ? TSLA can sell to NOT A TESLA (NTSA) ...

Govt is referee, TSLA just plays the game, per their rules

Obviously I agree with everything you have said. I did not intend to imply anything else.Oh, yes, media outlets like Bloomberg and Business Insider love to build and reinforce the narrative that EV's are too expensive for mass adoption. It's basically saying the old "EV's are nothing but toys for the rich" while couching it in more objective sounding language. But it is a false narrative for two very real reasons:

1) Most people can't afford a new car, period. This is a fact the media doesn't like to discuss. New cars are purchased by the economic upper half of the population (probably less than that) and everyone else gets hand-me-downs.

2) EV's only make up less than 6% of sales in the U.S. Obviously, there is no need to address the bottom 50% of the new car market until production capacity rises to the point that it can begin to fill that lower half of the new car market.

Between these two factors, the fact that most people can't afford a new EV is meaningless in terms of EV adoption and does not portend the end of the trend of mass adoption. Tesla is not done figuring out ways to make EV's faster, cheaper and better and we are still on the early part of the adoption curve (that's the part of the curve that is still becoming steeper).

The fact that Tesla's margins are massively higher than that of most ICE sales illustrates that EV prices are not the problem these media stories make them out to be. In fact, by ignoring that Tesla has industry leading margins, they obscure the one fact that shows it is ICE cars that are uneconomic to produce, not EV's.

And always buy at the peak!I always heard "Sell the rumor, sell the news"

Webeevdrivers

Active Member

3 and 4 for sure. At least with the people we talk to. There will be new investors but I think there are a lot that will wait out the recovery and bolt. They are tired of the drama. We are still medium long. Age thing.I blame TSLA softness on a few things, in order of importance:

1) macro environment sucks

2) perception of Q3 delivery "miss"

3) People getting sick of Elon on Twitter and want nothing to do with him anymore

4) Twitter deal uncertainty

Not just earnings, but very likely record all time high earnings!

WS seems to want a beat in expected record earnings before they buy back.

Record earnings will just appear like a miss to them it seem

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K