Here's what various analysts are saying in the wake of the P&D report:

Consensus 2023 deliveries are 1.85mm. vs 1.31 in 2022, for an expected 41% YoY growth.

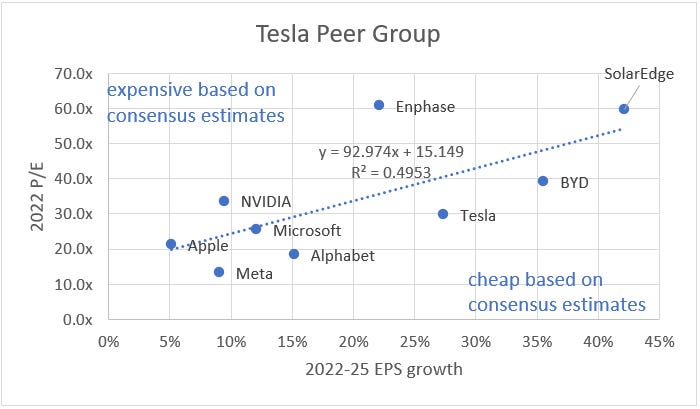

RBC: "Because of a greater focus on margins/profit, we are shifting entirely to earnings-based valuation metrics (avg. of EV/EBITDA and P/E, from avg. EV/Sales and EV/EBITDA). We now use 20x 2025 EBITDA and 30x 2025 P/E to get to our $186 PT [down from $225]." Note that RBC is projecting slightly lower than consensus deliveries for 2023, 2024, and 2025.

RBC: "IRA ... Model 3 Long-range subject to $55k cap but TSLA currently has no pricing on site, but we wouldn't be surprised to see it priced to qualify. However, IRS also appears to be leaning towards a rule that leased vehicles can get $7.5k credit and since these would be considered "commercial" then all TSLA vehicles may qualify if leased."

RBC: "Based primarily on updated deliveries, our 4Q22 revenue estimate goes to ~$23.7bn from ~$24.0bn. Visible Alpha consensus stands at $25.7bn, so a sizable revision should come. We model $250mm of credits. We model auto-gross margins ex-credits at 25.5% vs. Visible Alpha consensus at ~28.5%. Our diluted adjusted EPS decreases to $1.13 from $1.15 vs. consensus of $1.29. Our diluted GAAP EPS estimate is $1.02."

RBC maintains an outperform rating for TSLA. Upside scenario at $350/share, downside at $89/share.

Deutsche Bank: "4Q revenue forecast $23bn and gross margin at 26.3% (ex-credit), representing 50bps decline q/q leading to EPS of $1.00. Note that our 4Q estimates do not account for the expected one-time benefit from the company recognizing the rest of 40%+ in deferred revenue associated with FSD rollout in N. America. We estimate that including this benefit could boost 4Q gross profit by ~ $1bn and EPS by 24-26 cents."

Deutsche Bank: "Beyond the quarter, we expect challenging headlines around demand softening and associated price cuts to continue; recent reports already suggest Tesla may take an extended shutdown in Shanghai later this month around Chinese New Year."

Deutsche Bank: "Looking at the year ahead, we anticipate tailwinds from continued volume growth, diminishing ramp-up cost from Austin and Berlin eventually turning to COGS/vehicle tailwind, IRA benefits, lower raw materials costs, and ~100% FSD revenue recognition in N. America at ~90% gross margin. Main uncertainty comes from the macro environment and associated magnitude of price cuts required, as well as lithium prices. We now

model 9% reduction in global ASP as initial IRS guidance raises the risk the IRA consumer incentive of $7,500 may not benefit all variants of Model Y in the U.S., and we are tweaking down our 2023 deliveries estimate to 1.84m units (still +40% YoY), and revenue to $100.7bn." They are targeting 2023 EPS of $4.70,

Deutsche Bank: "All in, we lower our price target to $250 (from $270) based on the average of 40x our 2025 EPS and EV/sales multiple of 10x 2023 (both discounted back), reflecting slightly lower volume and reduced but still strong gross margin expectations. We continue to view Tesla as an EV leader in the autos sector thanks to its superior cost structure and agility in the midst of challenging macro conditions. In the near term, it is establishing more cost-efficient capacity to support meaningful growth. In midterm, the company is looking to launch its next-gen platform which should support multiple other vehicles and segments, and targeting $20k COGS/vehicle. Reiterate Buy."

Deutsche Bank: "Tesla is likely facing a mix of accelerated weak macro and some level of growing competition in China with compelling EVs that offer newer features. Relative to the U.S. and Europe, China is seeing more new credible products coming to market and ramping up in capacity. This year, competition has moved upward to the RMB 100-200k price segment (BYD, GAC Aion, Hozon Neta), away from low end mini car category (e.g., Wuling Hongguan, Great Wall ORA). In response to this, reports suggest Tesla is developing a revamped version of the Model 3 to reboot the appeal of the 5-year old electric sedan and lower costs meaningfully further. The redesigned model will move into production in third quarter of 2023 in Shanghai. Amid the accelerated weak macro and a more competitive EV market, pricing naturally becomes Tesla’s lever to pull, especially after several price hikes earlier last year."

Deutsche Bank: "We expect IRA to constitute a meaningful tailwind for the company, starting January 1. The battery manufacturing piece should amount to $45/kWh for the battery cells and packs made in-house (10 GWh capacity from pilot line in Fremont, and ramping up Austin capacity as fast as possible), and a piece of it to be shared with Panasonic for the batteries made by the JV in Nevada. The company has indicated in the Q3 earnings call that Austin’s battery output should be around 1,000 vehicle sets per week by the end of this year. We had previously estimated ... under the IRA, amounting to a ~$1,800/unit overall COGS reduction on a volume-weighted basis in the U.S, or ~$800/vehicle when averaged over global volumes."

Deutsche Bank: "Tesla indicated that it is extremely focused on its next-generation vehicle platform, which in our view should support several different top hats across multiple vehicle segments, as well as robotaxi. Development is well advanced, and SOP is targeted to be in 2024. The goal is for this platform to have a COGS of about $20k per vehicle (half of Tesla’s current one), and for Tesla manufacturing output of the vehicle to be twice as high as currently on similar footprint, with half the capex spent. Recall that the company had seemingly de-emphasized the development of the more affordable “Model 2” earlier on last year, to focus primarily on growing volumes of existing models at its current and new factories, and roll out its FSD software. This platform development would represent the re-acceleration of this effort for SoP in 2024, though the exact vehicle types are yet to be unveiled. We think this will be an important topic investors will look to understand better, given implications for volume trajectory in the years beyond 2023."

JP Morgan: 4Q EPS estimate at $1.16. "Our base case assumption is that y/y growth (while remaining impressive overall) is likely to decline each year from here on out (we forecast +26% growth in 2023, +24% in 2024, and +20% in 2025)."

JP Morgan: "...with significant capacity coming online in full year 2023 vs. 2022 (annual run-rate installed capacity as per the 3Q22 shareholder letter of >1.9 mn as Austin and Berlin ramp vs. 2022 deliveries of 1.3 mn), supply is unlikely to be the limiting factor for Tesla deliveries in 2023 that it has been in prior years, such that a material deliveries miss vs. expectation could be particularly injurious to long-term investor expectations. We are not materially lowering our estimates today (2023 goes to $4.60 from $4.84, 2024 to $5.15 from $5.35, and 2025 to $5.55 from $5.65) although we are reducing our December 2023 price target to $125 from $150 on expected multiple compression as growth expectations moderate."

JP Morgan has a underweight rating for TSLA. "Although both technology and execution risk seem substantially less than was once feared, expansion into higher volume segments with lower price points seems fraught with greater risk relative to demand, execution, and competition. Meanwhile, valuation appears to be pricing in upside related to expansion into mass-market segments well beyond our volume forecasts for the Model 3 and Model Y."

Citigroup: "Although the soft Q4 outcome isn’t entirely shocking given recent China COVID developments, the delivery miss (vs. reduced estimates & post recent price actions) will likely escalate concerns over NT macro/competitive demand pressures at a time when Tesla is adding significant capacity on existing products. At ~30x consensus ’22 EPS and with sentiment already quite negative, an argument can be made that much of the bad news is already priced in. But until gross margin visibility improves (Q4 results on Jan 25th), the stock might struggle to regain meaningful ground, and it doesn’t help that U.S. IRA guidelines appear to limit the $80k price cap to just the three-row Model Y variants."

Citigroup maintains a $176 price target.