Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The number I'm interested in ground to seat in the lowest position. The overall height doesn't matter.It appears to have a more upright seating position and definitely increased ground clearance.

Cybertruck is estimated at 75 inches in height.

X is 66 (9 inches shorter)

Y is 64 (11 shorter, nearly a foot shorter)

3 is 57 (18 shorter, foot and a half)

S is 56 (19 shorter, tad over a foot and a half)

Gravimetric energy density increase does NOT necessitate a volumetric energy density increase.An increase in gravimetric energy density means more energy in the same number of same size cells. Pack volume would not change in this scenario. If Model X LR goes to a 4680 structural pack, I expect Tesla will reduce weight and reduce cell count rather than increase bty volume.

E.g. If all the cells had the same energy capacity as they do presently, but weighed half as much, then gravimetric energy density would double, but volumetric energy density would stay constant.

Conversely if each cell contained 1.5X the energy, but doubled in weight, then you would have more energy in the pack, with a gravimetric energy DECREASE..

i.e. Volumetric energy density is what controls how much energy will fit into a pack. Gravimetric energy density just controls how much the pack weighs.

I disagree with your ordering of new products, and timelines. Are you aware that McDonald's pays $22/hr to flip burgers in California? Then there's also sick time, and high turnover.

McDonald's president who made $7.4 million last year says proposal to pay fast-food workers $22 an hour is 'costly and job-destroying'

McDonald's president calls AB 257, or the FAST Act, 'costly and job-destroying.' A coalition led by chains like McDonald's has secured a referendum vote in November 2024.www.businessinsider.com

I'd say Optimus as a product is more likely to arrive before Robotaxi, not after 2030.5 as you suggest. Unlike FSD, the NHTSA has no say in delaying when Optimus goes to work.

Long before that, possibly within 2 years, Optimus will be working on the factory line in Tesla's Gigafactories, reducing the COGS of existing products. This means a gross margin increase for all existing products.

The method I used is only very rough. It is quite possible that FSD and Robotaxi enter their middle portion of the S curve while vehicles and energy are still in the middle (50%/year) part. Similarly, Optimus could occur at the same time (or even slightly before) as Robotaxi. All this does is increase the ramp rate (combined above 50%), reduce the ramp time, and hence the number of years that need to be discounted back to the present. The net effect is a small boost to the expected share price, but in the grand scheme it is small compared to other uncertanties.

The uncertainty in Robotaxi is not wether it works, but if Tesla can expand it quickly and profitably before competition comes.

The uncertainty in Optimus is both technical, can Tesla create a real-world reliable AI to do specific tasks without a lot of expensive specialised training. Burger flipping might be more difficult to do than it seems. If it were easy to automate then McDonald's or another burger chain would have created an an automated machine to do it. There is also the possibility of competition, the physical robot is difficult to design and make, but well within the capabilities of many companies. The software is more difficult, Tesla definitely has a lead in real world vision, but other companies have a lead in other aspects of the robot. There is a lot of development to do, Tesla might take a wrong turn, get stuck in a local maximum, or not solve the specific training for a task and adapt task to actual circumstances (flip burger task, in a particular store).

My guess is that Optimus will not be on general sale for at least 5 years, and then take several years to reach the steep part of the S curve, the beauty of my approach is that it does not need to be solved soon.

Just a correction but Tesla's guidance seems to be the worst case for auto growth of 1.8M, medium cause of 1.9M, and best case of 2M. There are many other areas of the business Tesla is posting triple digit percentage growth like Energy, Charging revenue, Insurance, FSD software, etc etc. So it's not out of the question that revenue growth will still hit 50% once you normalize to mid-case scenario.Yes, 2030.

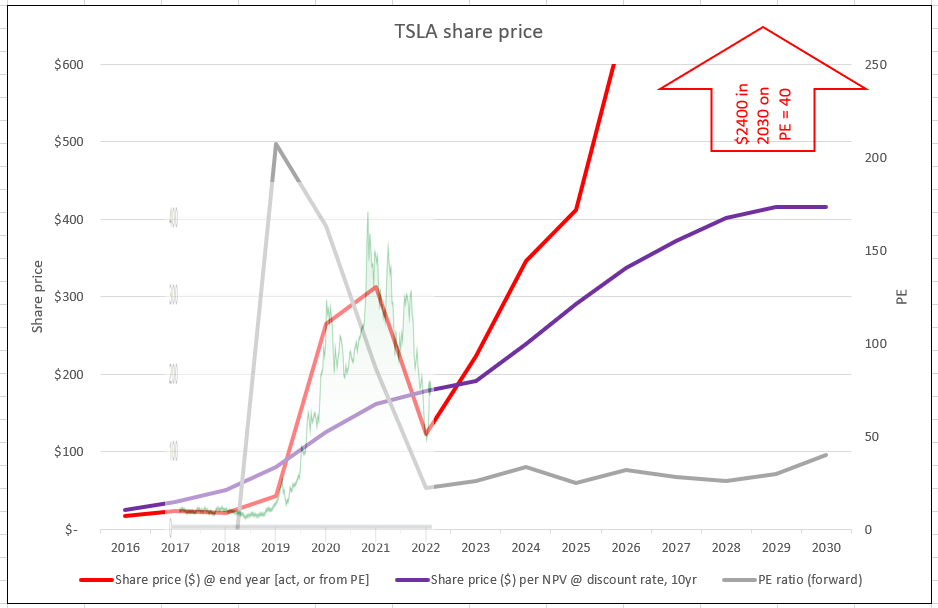

I guess one way of thinking about my calcs (combined with past share price behaviour) is that the share price in 2030 would be unlikely to be below $400 for very long*, or over $2400 for very long*, so would be more likely to be somewhere between the two for much of the time. This is of course assuming successful delivery on the vehicles, energy, and continued progress on FSD (i.e. to support high margins).

* Where "very long" might be a mispricing event that could persist for say 1-3 years.

The purple line is NPV-driven for $400 share price in 2030, whereas the red line is PE-driven for $2400. If you look carefully at the divergence between them what that is really telling you is that the stuff happening (or not happening) after 2030 is (or will be) critical to how the market views Tesla at that time. So if you show me how you calculate a plausible EPS stream in the period 2030-2040 then it becomes trivial to calculate the corresponding NPV-driven valuation. However the PE-driven valuation of $2400 is the market assuming no slowdown in rate of growth whatsoever.

You are aiming at the wrong issue. The way my model works it makes very little difference whether I dial in a 2.5kWh battery for a Cybertruck at launch, or 250kWh. In calculating the EPS stream the model just wants to know the sales volume, COGS, and price. My keeping tabs on the battery size is what allows me to cross check other stuff of interest. However I do acknowledge that I've used the battery size to get an insight into likely production ramp volumes. Anyway when Tesla start shipping the Cybertruck we can take a look at actual battery size, again for interest.

If you want to put your model on the table then it will be interesting to have a look at it. Personally I've always been pretty straightforward about how I look at this and what the results are, irrespective ofwhether they appear good, bad, or indifferent - and Ishow my workings. Interestingly I see this has led to both of us making our TSLA acquisitions in much the same time frame, i.e. late 2018 through to mid 2020. We both recognised the risk-reward window being very interestingly positioned in that period, and therefore significant undervaluation, so a t some level both our models at that time led to similar conclusions, so perhaps both our models are equally good.

Common sense is to realise that reversion to the mean is a very strong characteristic in human history; and so too are limits to growth. In the case of Tesla that is very important as the likely TSLA share price is highly sensitive to when the market thinks Tesla will come off-growth. Personally I'd rather figure that moment out in advance and try to reduce my exposure before everyone else does the same, ideally timing for some moment of irrational exuberance before the off-growth realisation comes. When that moment might be is not something I can yet discern, but at least I can try. (Well I can dream of trying).

I built Monte Carlo valuation models at my day job in the past, and fully agree that they are very dependent upon the inputs. Like you I think the best we've seen for Tesla is the ARK one. Model maintenance and auditability is always a nightmare, especially when modelling human-related stuff as opposed to physical systems, and maintaining Monte Carlo models is a non-trivial effort. But you know this.

Everyone likes to look at the upside cases and that is what your 2x and 25x undervalued comes from (which I like and agree with). We should also pay attention to the downside cases. For 2023 Tesla's own guidance is for deceleration to 37% production growth and there is also the possibility of further decreasing auto gross margins given the trend over the last four quarters and the price cuts. I'd like to hope that is only a temporary reduction in rate of growth and of margin, but in the downside case these things might persist. Just a simple scenario analysis makes it a struggle to achieve the 2030 targets in a high-value manner if these issues do persist, i.e. Tesla might be overvalued now (though I hope not and think not, as I think TSLA is at fair value now).

Irrespective we all need to continue to be vigilant in looking at all the available data as it becomes observable to us. (Again you know this.)

Suggesting the NHTSA is standing in the way of FSD is such a load of malarkey, there is nothing in the way.

To activate truly autonomous driving, a massive increase in utilization, vehicles out driving themselves around generating revenue etc, Tesla needs to own liability for the DDT within an ODD. Taking ownership of the DDT in a generalized Robotaxi the way FSD has been aimed will require such huge risk mitigation that it’s hard to even imagine right now, it surely will not happen with HW3. We don’t even know what that vehicle looks like right now, if we did then it would exist.

To activate truly autonomous driving, a massive increase in utilization, vehicles out driving themselves around generating revenue etc, Tesla needs to own liability for the DDT within an ODD. Taking ownership of the DDT in a generalized Robotaxi the way FSD has been aimed will require such huge risk mitigation that it’s hard to even imagine right now, it surely will not happen with HW3. We don’t even know what that vehicle looks like right now, if we did then it would exist.

Rashomon

Member

This is of course true, but normally we're looking at energy increases in the same cylindrical cell form factor. That's always a volumetric specific energy increase, and almost always is a specific gravimetric energy increase as well. Occasionally the cell gets a little heavier, so the percentage of specific gravimetric increase isn't quite as high as the specific volumetric increase, but that's relatively rare. This is really clear when you look at the history of 18650 cells which more than doubled in both values since their introduction by Sony in the early 1990s . . . Some of that is from simple engineering, such as the ability to draw thinner (and thus roomier and lighter) cylindrical casings than were used 30 years ago.Gravimetric energy density increase does NOT necessitate a volumetric energy density increase.

E.g. If all the cells had the same energy capacity as they do presently, but weighed half as much, then gravimetric energy density would double, but volumetric energy density would stay constant.

Conversely if each cell contained 1.5X the energy, but doubled in weight, then you would have more energy in the pack, with a gravimetric energy DECREASE..

i.e. Volumetric energy density is what controls how much energy will fit into a pack. Gravimetric energy density just controls how much the pack weighs.

Then there's specific gravimetric and specific volumetric energy density at the pack level, which comes from more efficient packaging and pack weight reduction. Here is where the BYD "blade" LiFeP packs make up a lot of the volumetric cell level energy disadvantage of LiFeP (long, relatively fire-safe rectangular blades can be packed tighter than cylinders) but the pack is still less energy dense by any measure than Tesla's best efforts.

FutureCTOwner

Member

Correct me if I am wrong, (I am not particularly experienced as an investor, having bought and held just one stock ... tesla since 2016), but my understanding is that teslas guidance is for 40-50% growth for the foreseeable future, which suggests S-curve type growth. This doesn't seem unreasonable, particularly if you watch Tony Seba's presentations where he discusses disruptive technologies and how analysts generally miss predictions as they predict linearly (see purple line in above graph as an example) whereas the reality for disruptive technologies tends to be an exponential curve (see red line in above graph).Take your pick.

Assuming the success case (but excluding full autonomy for robotics), anywhere from $400 (purple) to $2400 (red) depending on what rational approach one takes. Add in irrational factors and take your pick. Over the shorter term (~3yr) the market has tended to follow the red line (PE) but over the longer term (~10yr) it has tended to follow the puple line (NPV, i.e. discounting).

One needs to keep a sense of proportion on these things. At $2400 this corresponds to a market capitalisation of $8-trillion. The current (2022) market capitalisation of all stock markets in the world combined is about $105-trillion, and it was $93tn in 2020. Assume that global markets doubles every ten years (i.e. 7% annual growth) that means TSLA would be $8tn of $200tn i.e. 4% of world value at that point. Such concentrations of value have happened before in human history, but they are rare.

The purple line tends to get less good reception hereabouts

I know the graph is representing SP which can be divorced from companies fundamentals, but even so, is it not unreasonable to expect the SP to track approximately with the companies growth over the longer term, which would suggest that the red line may not be wildly optimistic but a real possibility?

Below is the series of graphs that Tony references in his talks.

Last edited:

NickFie

Member

Paradigm Shift in Progress!Many ICE rigs, like Mercedes or BMW depreciate rapidly, scary in fact. Based on what we've seen so far with the S, it will depreciate far less. Will that be the case with the 3's and the Y's? Based on the value of the 3 year lease returns, I would say they too will retain a lot of their value. However, that may be a factor of what other used BEV's are available in the future as well.

Several factors that influence Tesla price depreciation are subject to unconventional forces.

- Possibly lower demand. Inadequate new EV supply previously propped up used EV prices. Rising production volume permits lower new vehicle prices. This slices two groups of buyers out of the used car market - people who were unable to wait months for a new EV delivery; people who previously couldn’t afford a new EV.

- Possible lower value / possible increased supply. EVs are a young technology with rapid pace of improvement. Older Tesla’s have shortcomings relative to new ones that reduce perceived value. Less efficient, slower Supercharge rate, inferior Autopilot or FSD capability, less-capable media center, less-sophisticated suspension. These same factors could increase used EV supply as financially capable drivers adopt leasing to stay close to the leading edge.

- Possible higher value. As people learn about low maintenance costs for Tesla vehicles, they will be more willing to consider older vehicles.

I don’t have a sense how this will work out. It would be foolish to carry ICE market assumptions forward, however.

My wife and I bought new or lease-return vehicles. When loan interest rates are low, we finance about half the purchase price to avoid tapping investments that bring higher long-term returns. We drove the cars until they were unreliable, unsafe or too expensive to maintain.

Now I’m considering trading in my fully functional 2017 Model S. I upgraded the MCU and purchased FSD so the driving computer is upgraded. Tesla still hasn’t invited me to upgrade the cameras.

When I look at the new S or X I see:

- Faster Supercharge rates. Less time lost on road trips.

- Heat pump climate control. Longer range means less-frequent charge stops.

- Improved air suspension.

- Improved noise control.

- Much better MCU.

Thus I could add to the used EV supply.

2daMoon

Mostly Harmless

$1,000 by 2025, $10,000 by 2030.

Doesn’t hurt to dream big!

Cathie Wood recently said ARK expects an SP of $1500 in five years. So, maybe you aren't dreamin' big enough!

@Mike Ambler , if you find out, please message me.The number I'm interested in ground to seat in the lowest position. The overall height doesn't matter.

Surprised there's no comprehensive Tesla-for-Wheelchair-Guys blog anywhere; specs like this would be useful.

I have a model X for ease of stowing my wheelchair, but have a Cybertruck on order.

Last edited:

Artful Dodger

"Neko no me"

Pretty sure the lawyers are all about enriching themselves rather than having a goal of harming others.

Yeah, unjust enrichment is a form of harm (even when committed by lawyers).

"In laws of equity, unjust enrichment occurs when one person is enriched at the expense of another in circumstances that the law sees as unjust. Where an individual is unjustly enriched, the law imposes an obligation upon the recipient to make restitution, subject to defences such as change of position."

MC3OZ

Active Member

How does everyone interpret Jeff's comments on Sodium Batteries?Here is Dr. Jeff Dahn’s October 4, 2022 30 minutes presentation and Q&A, “The Role of Energy Storage and EV Charging in the War on Climate Change,”

Description:

On Oct. 4, 2022, Dr. Jeff Dahn spoke to volunteers at the EAC's Energy Action Team about the role of energy storage and EV charging in the war of climate change. Dr. Dahn is a professor at the Department of Physics & Atmospheric Science and the Department of Chemistry at Dalhousie University. He is also a globally recognized pioneer in the development of the lithium-ion battery and a recent winner of the 2022 Killiam Prize. He is currently working on the million-mile battery sponsored by Tesla Motors.

While he mentioned Tesla Battery Day, he did not elaborate other than to say that it is pretty incredible how much of what was presented that day has been achieved, without listing any.

Is the Dalhousie team doing Sodium Battery research for Tesla?

I am about 60% sure that they are, but I will need to watch the section again.

About 30 mins in cathode, sodium, iron and managese, anode carbon.

Might be a structured graphene anode, that works for sulphur and aluminum, might work for just about anything?

They are doing Sodium Battery research the real question is if it is for Tesla.

Last edited:

petit_bateau

Active Member

Mmmm .... there are several questions within this ....Correct me if I am wrong, (I am not particularly experienced as an investor, having bought and held just one stock ... tesla since 2016), but my understanding is that teslas guidance is for 40-50% growth for the foreseeable future, which suggests S-curve type growth. This doesn't seem unreasonable, particularly if you watch Tony Seba's presentations where he discusses disruptive technologies and how analysts generally miss predictions as they predict linearly (see purple line in above graph as an example) whereas the reality for disruptive technologies tends to be an exponential curve (see red line in above graph).

I know the graph is representing SP which can be divorced from companies fundamentals, but even so, its not unreasonable to expect the SP to track approximately with the companies growth over the longer term, which would suggest that the red line may not be wildly optimistic but a real possibility?

Below is the series of graphs that Tony references in his talks.

View attachment 903672

- Mathematically an S-curve is a "logistics" curve and that is what almost all the academic literature centres on. Only the early-ish part of that corresponds to something similarish to an exponential, but by no means all. To expect exponential through the full 20-year S-curve is not realistic. What we are unsure of is where either the Tesla automotive S-curve levels off, or the total auto industry one. But focussing on the Tesla one as that is where the TSLA share price comes from, my NPV pricing assumption is that nothing interesting happens after 2030 in either energy or automotive. That simplification is likely to be conservative, but is also why the purple TSLA share price line is in fact an S-curve. You can scrunch the x and y axis to stretch it to fit the standard S-curves for other industry transformations / technology adoptions, but what is being shown there is in fact a classic 15-year S-curve. It is definitely not at all linear, I am not guilty of that error. I have another version which looks out to 2040 for auto, here (below) , but I've not specifically modelled properly that for TSLA shareprice etc (yet) and you'll se it goes to 30m not 20m and so may be a full-cycle - we will see if we live that long. So if you pull the golden Tesla BEV piece out of the graphic below you'll discover it is an S-curve as well.

- In the case of Tesla we have multiple stacked S-curves. Automotive, each of various segments being progressively addressed. Energy, ditto. Insurance (probably financially trivial, I reckon maybe 5% mkt cap). Autonomy in all its guises, massive ramifications. Possibly a wider financial offering, perhaps icw Twitter, who knows. They don't all start at the same time. Maybe other stuff - heating etc. They are not all the same size. The overall effect tends to be to linearise growth more.

- There is some recent literature / study which actually says that it is best to model these things as stacked quadratics and they give lots of examples. Not as exponentials and not as logistics S-curves. . If you look back through the Quarterly thread ( Near-future quarterly financial projections ) several pages you'll see that I've posted a link to that suggestion, and made some comments on it. There are (imho) some good points in that suggestion.

- At the end of the day shareprice depends not on how the company is actually doing; nor even on how you or I think the company is doing; but only on how those who are active sellers/buyers of shares think the company is doing. Tesla didn't change its performance much in the last few years; and I didn't change my view of its performance much in the last few years; but those who were buying and selling ran it up from $100 to $400 and then back down to $120 in just two years or so, then back up to almost $200 in the last few weeks. So it doesn't matter how good a rational model we build for pricing that can get to a 'truth' within say 30-40% accuracy if it can get swamped by 400% of irrationality. Except of course to identify if there is any value at any point in time by selling out to (or buying from) a bigger sucker than ourselves.

- Not every company in a transforming industry survives and thrives, even those that started it. One of the S-curves in your list is air travel. If you take the whole aerospace industry over the last 100-years there was a study I saw a couple decades ago that showed only two made a cumulative net profit for shareholders : Boeing and Airbus. All the others ultimately were costly failures even if they started well and had good patches, each transforming the industry in their time. If one updated that study to today I think Boeing would be eliminated from the list. So Tesla's good position now could go horribly wrong. I hope not.

- Yes the red line (on PE x 40) to $2400 in 2030 is a real possibility. Take your pick. I for sure do not know. That is why I also plot the line towards $400 derived from the NPV analysis to ground myself in another view that may be equally rational, perhaps even more so. Everyone is very sniffy about going from $120 to $400 in 'only' 8-years. Maybe they are sniffy because they've seen $400 already (and lost it). Maybe they are sniffy because it has just run up from $120 to almost $200 in just the last few weeks. I don't know how or why those buyers and sellers who are active in the market today are reaching their decisions. My best guess is that a lot of them are driving on 40x trailing PE. But maybe some of them are operating on 30x fwd PE. Or maybe some are looking for the unity balance point in the fwd vs trailing PEG. Or maybe some are building an NPV model. Or even building a full industry adoption model with feedback loops. Or throwing darts and juggling animal bones. Overall that 40x trailing PE looks like a lot of folk may be using as their driver assistance - at least for now :

Cal1

Member

When in the last 5 years has Cathie been right?Cathie Wood recently said ARK expects an SP of $1500 in five years. So, maybe you aren't dreamin' big enough!

I am not sure what you are asking. Is there even such a thing as the "actual discount rate"? Does it not depend on many factors?

Most people seem to use risk free return + a term for risk, in 2019 people were using 9% to 12%, recently I've seen 12% to 14% used by different people for discount rates. The term for risk is to some extent subjective.

So in 2019 the TSLA was priced with the expectation that now it would be 223.5 * 1.09^3 to 223.5 * 1.12^3. Obviously the share price now did not meet that expectation, that is perfectly normal because the future contains many unknowns.

No, all I am saying is that there is a disconnect between the valuations on TMC and what the market indicates, or that discount rates are assumed to be very high.

I am not saying that any of these are right or wrong. They are all justifyable with reasonable sets of assumptions.

If markets are efficient then share price would reflect NPV of future earnings, growth companies would be fairly valued and reflect their future earnings potential.

Neither analyst nor TMC estimates for 2030 have changed much in the last year, but the share price changed by a factor of 4. Massive changes in implied discount rates.

For Tesla, there are multiple scenarios: speed of vehicle ramp, percent of total market reached, total market size, competitors, gross margins, operating efficiency, FSD complete, FSD take rate, robotaxi, robotaxi competitors, energy, real world AI, Optimus (when, how successful), new products, geopolitical issues, and many, many more. If you could estimate their probabilities and joint probabilities then you could create a monte-carlo simulation to get a Probability Density Function (PDF) of the company financials in 2030 (and future prospects), then do NPV calulations using a range of discount rates (to reflect the possible future risk free returns). This would give a PDF for the current expected TSLA price.

The only attempt at doing this I have seen is from ARK Invest, they did not do a particularly good job in my opinion, but I applaud the attempt. We get something like the same thing by aggregating the analyst (and others) share price targets, however there are unknown biases in this and most do not seem to even consider FSD, Robotaxi and Optimus, many do not even take energy into account. Even if FSD, Robotaxi and Optimus are considered low probability futures, their enormous upsides mean they could contribute a lot to the expected NPV.

A monte-carlo simulation is a lot of work, and results are probably highly dependent on subjective factors.

A simpler technique is to model TSLA as a 50% growth stock, this is basically company guidance, past growth is more like 60%. Then model the products as overlapping S curves. So vechicles is about 4-5 more years of 50% growth, energy is another 18 months, FSD (no Robotaxi) is another year, Robotaxi is 3 more years, and Optimus is 1-5 years. After these S curves growth will inevitably slow.

So we have:

Probability number of years factor product very high 4 - 5 5.1 - 7.6 cars very high 5.5 - 6.5 9.3 - 13.9 cars + energy high 6.5 - 7.5 13.3 - 21.9 cars + energy + FSD medium 9.5 - 10.5 47.1 - 70.6 cars + energy + FSD + Robotaxi low 10.5 - 15.5 70.6 - 536.3 cars + energy + FSD + Robotaxi + Optimus

The factor is used to multiply 2022 income ( $14.1B ) to get income at those years. Lower gross margins are somewhat offset by increased operating efficiency. Then divide by the expected number of shares (after further dilution), multiply by the low growth rate P/E multiple, then discount back to today.

The high probability cars+energy+FSD gives an expected share price now in the $350 - $550 range, and a low probability (Optimus) expected price up to $5,000. Using this very rough estimate TSLA is about 2x undervalued and may with low probability be up to 25x undervalued.

Unknown unknowns increase the range further. The current share price is at or just below the minimum expected share price according to this analysis, there is very little downside, but considerable upside. If Tesla continue executing as well as they have been this is a real chance that they will make a sucess or FSD, Robotaxi and Optimus. As time goes by and they become more likely then the share price should rise to reflect this.

Great analysis, but it doesn’t take into account the downside risk that Tesla will suddenly stop performing at their great historical level. For instance, Cybertruck success is not a given because they have novel difficult manufacturing processes to figure out. 4680 success is not a given, they have low yields still and it isn’t a guarantee that they will solve this. FSD has never been done before and it is possible it can’t be done without a lot more expensive car hardware and years more training. ETC. Now, I have been watching Tesla for over ten years and I have faith that Tesla will rise to these challenges, but a more risk adverse person who doesn’t know Tesla could look at these risks and say, wow, there‘s A LOT of uncertainty here and they could be right, which is reflected in the stock price level.

My point being that the current stock price is a reflection of this external uncertainty. From my perspective, it just means that it is under valued and the stock will rise as these uncertainties get resolved: Cybertruck production and profitability, 4680 production and yields, lithium supply and refining capacity, FSD, China demand, US recession or not, interest rate hikes, semi factory construction, Reno factory expansion, etc. As each of these get addressed, I expect the stock price to melt up nicely.

2daMoon

Mostly Harmless

2020?When in the last 5 years has Cathie been right?

Besides, we're dreaming... Don't harsh my mellow.

StarFoxisDown!

Well-Known Member

I'm not a big fan of Cathie but she absolutely nailed the valuation of TSLA back in 2018-2019 when ARK first put out their price target. People here seem to just go off of ARK's most recent PT's in the past 1-2 years and ignore that their original PT was a 1 trillion valuation....which TSLA hit.When in the last 5 years has Cathie been right?

Tesla shipped the Model S 60 years before the Model S plaid.How often has Tesla released a new product with the shortest range version?

One of many limiting factors Tesla will be dealing with at Cybertruck launch is battery supply. If 4680 supply is a limiting factor, they might decide it’s more profitable and gets more trucks under butts by releasing a truck with a smaller capacity first.

I do think quad 500 is most likely at launch, but it’s not a simple matter of “most expensive truck first”. There are more factors than just the sale price. Constraints will also dictate which vehicle gets launched first.

Last edited:

She sold when Tesla was trading at $700+ per share ($233 split adjusted) and bought when it was $101-120/ share.When in the last 5 years has Cathie been right?

I’m more of a HODL sort of guy, but in retrospect she sold when TSLA was overpriced and bought when it was at the bottom.

Hmm.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M