Wonderful things happen at GIGA Shanghai on a daily basis, it all gets taken for granted IMO.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Rivia

That said, a lot of this is also simply the fact that Rivian and Lucid came to the market 10 years too late. Tesla enjoyed a near monopoly in EVs for a long time. Even once competition came in from Nissan, GM, and BWM, it was half-hearted at best. Rivian and Lucid entered the market right as the major, well funded players were entering it and long after Tesla had become a big success.

This is the action of a founder who has self-financed the business. Rivian is dropping $5billion on their factory. Tesla? $17m

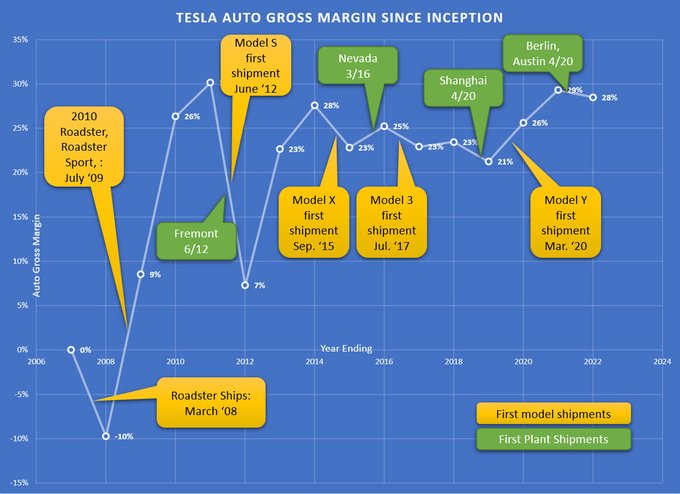

This chart is as much a testament to how differently a company is run by an owner operator versus one run by a person who is spending other people's money.Larry Goldberg tweeted this interesting chart:

So I created a companion one contrasting this with the other two major EV startups, Rivian and Lucid. Year 1 for Tesla corresponds to 2008 on the above chart. No commentary needed:

That said, a lot of this is also simply the fact that Rivian and Lucid came to the market 10 years too late. Tesla enjoyed a near monopoly in EVs for a long time. Even once competition came in from Nissan, GM, and BWM, it was half-hearted at best. Rivian and Lucid entered the market right as the major, well funded players were entering it and long after Tesla had become a big success.

This is the action of a founder who has self-financed the business. Rivian is dropping $5billion on their factory. Tesla? $17m

Yes

No.

GM/ Toyota pulled out and soldr auctioned everything that was useful/ working. Tesla won bids on $17 million worth.

Tesla Fremont Factory - Wikipedia

Fortunately, Tesla found a deal on a used stamping press to relocate to CA from Detroit ($6 Million instead of $50 million).

Gigapress

Trying to be less wrong

A huge part of Rivian’s problem is having chosen to start with pickup trucks and large SUVs, which are the most difficult segments to profitably electrify, except for maybe compact economy cars. Pickups & SUVs are the largest, least-efficient classes of mass-market vehicles sold to consumers, are driven longer distances often to more remote places, are used to tow or haul major loads, and need sturdy (heavy) structures and suspension for off-road driving. The engineering challenges with range, cost and charging speed are much harder.Rivian also bought a factory on the cheap, FWIW.

The huge dichotomy in gross margins cannot be explained away solely by first mover advantage. It is also a combination of great execution by Tesla and horrific execution by the others.

This is why no one has even tried to seriously address this segment yet for electrification, not even Tesla who are the best able to do so thanks to their industry-leading efficiency, powertrain cost and charging network. I’m including the F-150 Lightning as not being a serious attempt yet because it’s mostly a marketing and R&D exercise and Ford is mostly selling them for negative gross margin. Cybertruck is not Tesla’s sixth retail vehicle offering by random accident. Even introducing Model Y after Model 3 despite the vastly higher popularity of crossover SUVs was not a mistake or random decision; it happened because in 2017 it was easier to deliver a compelling, long-range, profitable sedan BEV than a heavier, draggier crossover.

Rivian decided to start the game with the difficulty level set to Expert and the financial result is not especially surprising.

Last edited:

Somehow Tesla was able to squeeze 500k/ year vehicles out of a factory they purchased for $17m. They've produced over a million vehicles out of that factory I believe. They cut ground in Texas only after their first factory was nearing completion.Rivian also bought a factory on the cheap, FWIW.

Rivian is barely cranking out 25k/ year and are now spending $5b to build a new factory.

These things are not the same.

Seven years and 130K miles later, I was still trying to find any squeaks and rattles. I believe they were way overstated. Each complaint got repeated many times giving that impression.Early model S was pretty rudimentary; no AWD, no parking sensors, squeaks and rattles.

My 2013 Model S pain points:Seven years and 130K miles later, I was still trying to find any squeaks and rattles. I believe they were way overstated. Each complaint got repeated many times giving that impression.

1. EMMC reached storage capacity, which cause random shutoffs of MCU while driving

2. Panoramic Sunroof leaked (even with latest rails, seals installed)

1. Did happen a few times. 2. Never happened and the car lived outside.My 2013 Model S pain points:

1. EMMC reached storage capacity, which cause random shutoffs of MCU while driving

2. Panoramic Sunroof leaked (even with latest rails, seals installed)

That's not cryptic at all.

No, Max Pain is at 190 - Yippee!Max pain is $185 i assume?

Here's my current strategy:

1. 90-95% HODL - this pays off eventually when FSD shows revenue growth/use cases in public rideshare, or if Grid Battery enters volume (competitive).

2. Rumor/news trade dips with 5% (Pays for expenses to maintain #1).

3. Stop HODLing Call Options -> @SunCatcher was right.

4. Grow my own business. THIS is why I'm not technically all in with TSLA, it's more like 75% TSLA/25% Business (like an R&D expense).

I believe the big run-up in 2021 had to do with Robinhood accounts and the sheer volume of sudden interest out of nowhere. Wallstreet couldn't keep up. That won't happen again IMO unless TSLA Legal gets really crafty, or some new administration enters the fold and cleans house (unlikely). So it boils down to EPS and margins which seem to be at a local maximum, if not threatened somewhat (price war with itself on the mission).

I also think they'll let TSLA run once the banks clear through those crazy Call Options. What was ITM a couple years ago just ain't so today.

Is this "Day Trading" approach a lost cause, would it not be smarter to just HODL it all or diversify? Yes, perhaps. But TSLA is not going to collapse, ever IMO, and with that risk off the table, playing the swings gives me an edge. I can see what's going on, it's getting stupid predictable, so why not have some fun. Those few shares I bought earlier this week are profitable - this helps with my spirit of the battle. It's uplifting on the worst days ever when you all are ready to throw in the towel.

2daMoon

Mostly Harmless

That's not cryptic at all.

So, does this mean that Shanghai is full of stars? (Rock stars?)

Or, is it about to be compressed into a small sun?

Anyone seen any media reactions to Masterplan 3? Outside the Tesla enthusiast sphere?

I think some junior factory workers are getting their first kiss.

I think some junior factory workers are getting their first kiss.

Sorry for the confusion on my Fremont data:

Factory: $42 million *

Equipment at Toyota auction: $17 million

Stamping Press: $6 million

Accelerating the transition to sustainable energy: priceless

*Toyota purchased $50 million in TSLA at IPO as part of the deal...

Factory: $42 million *

Equipment at Toyota auction: $17 million

Stamping Press: $6 million

Accelerating the transition to sustainable energy: priceless

*Toyota purchased $50 million in TSLA at IPO as part of the deal...

ZeApelido

Active Member

Drew has always looked more likely to me ever since JB Straubel left to work on battery recycling.

If only I was as smart as Drew, as hard working, and as dedicated to stick with a volatile startup, then I could have been CEO.

Alas, I’m stuck here with other low-life’s of TMC.

*Toyota purchased $50 million in TSLA at IPO as part of the deal...

Oh wow, that’s a piece of Tesla history I did not know before. Do we know when Toyota sold?

Oh wow, that’s a piece of Tesla history I did not know before. Do we know when Toyota sold?

Toyota sells all shares in Tesla as their tie-up ends

Toyota Motor Corp said on Saturday it had sold all shares in Tesla Inc by the end of 2016, having cancelled its tie-up with the U.S. luxury automaker to jointly develop electric vehicles.

So they sold a big chunk end of 2016. Interestingly, TSLA started going up quickly in 2017. But it wasn't until 2020 that it went bananas.

Toyota sells all shares in Tesla as their tie-up ends

Toyota Motor Corp said on Saturday it had sold all shares in Tesla Inc by the end of 2016, having cancelled its tie-up with the U.S. luxury automaker to jointly develop electric vehicles.www.reuters.com

Not that I know of, and I'm looking.Anyone seen any media reactions to Masterplan 3? Outside the Tesla enthusiast sphere?

But I wouldn't hold my breath.

Yeah but basically every asset went bananas in 2020, to varying degreesSo they sold a big chunk end of 2016. Interestingly, TSLA started going up quickly in 2017. But it wasn't until 2020 that it went bananas.

Everything from commodities to equities to home prices to crypto to Rolexes to art and rare bottles of wine

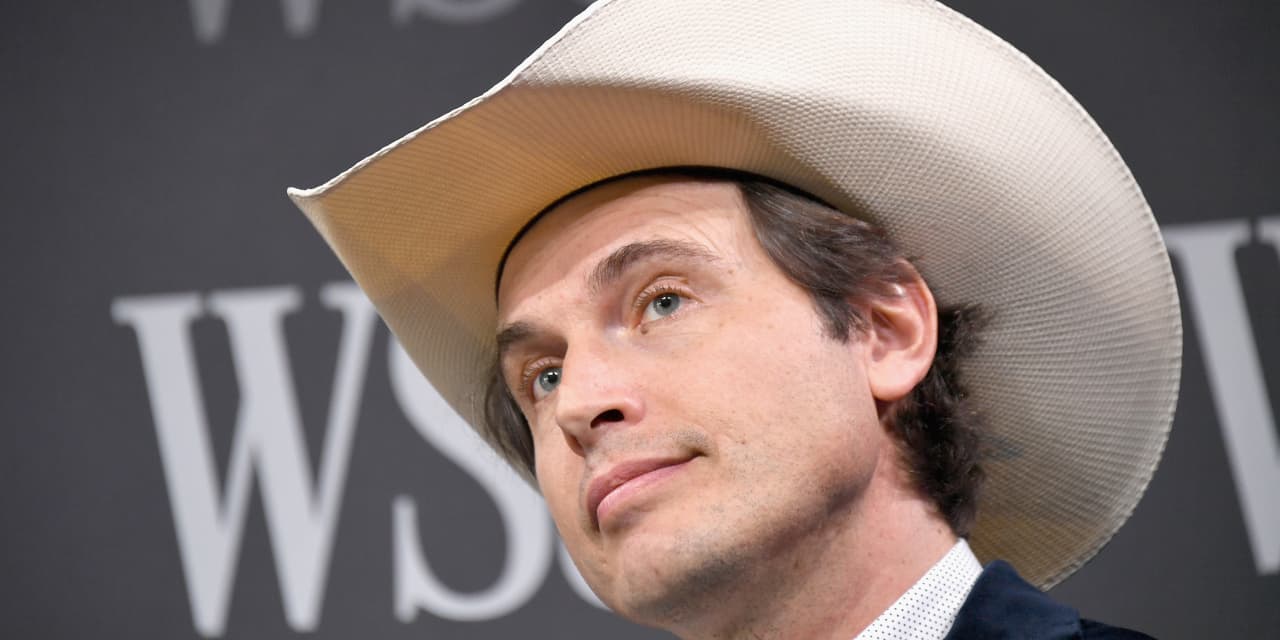

Did Kimble selling drop TSLA yesterday, and now TSLA is climbing again?

www.marketwatch.com

www.marketwatch.com

Edit -Thanks for pointing out that that's probably not a market moving amount, @ZsoZso .

Elon Musk’s brother nets $17 million through Tesla stock sales

Kimbal Musk, a Tesla board member and the brother of Elon, netted $17 million earlier this week as he exercised options and then sold those shares he acquired.

Edit -Thanks for pointing out that that's probably not a market moving amount, @ZsoZso .

Last edited:

As anything that starts with a T and ends with a A ....has ESL in the middle.I believe they were way overstated. Each complaint got repeated many times giving that impression.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K