If you look at the quote on Yahoo you'll see the bottom of the day's range is $298.80. It would've hit at $299.52.are you sure it hit it?

i'm closely looking and nothing i see more than -8% or so, not -10%

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Forbes mentions that M3 production is still below 5K/week

Others report here above 6K.

Which is fact and which is FUD?

4722 is a naive averaging of production across the whole quarter, including downtimes and, most importantly, lower rates early in the quarter than later in the quarter. Over 6k (actually over 7k, based on Vicki's numbers) is late December production rates. The biggest upgrade appears to be in the paint shop, which appears to have practically eliminated their rework needs.

Do keep in mind downtimes with those figures, of course.

Last edited:

Overlooked by the market but very important to notice:

75% of all 3s delivered came from new orders and NOT from reservation holders. That translates in a very strong demand on existing and available premium cost models.

With SR and cost reduction in place (note that a lot of people could not get the tax credit anyway because of salary) demand for the 3 and other models from the US should be stable and in my believe will grow in the US. Add to this higher demand from Europe and China respectively and you get a sense what we will see in 2019.

Many demand levers are still untapped: leasing, SR, other markets, ads and many more.

2k reduction is only in the US. If Tesla had a demand issue and wanted to counter it with price reduction than we would see global price reduction, leasing and deliver in not yet addressed markets e.g. Asia ex China, India, South America and a faster roll out of UK and Aussie.

was thinking same.

back of the envelope, that translates to a NA only run rate of 200K demand per year excluding the SR version and excluding leasing (those combined could double demand)

to be fair, some of that Q4 ordering was boosted by enthusiasm to get a car before $3750 drop in tax credit (my WAG, NA run rate for non SR would have been ~125K w/out it... doubling that for SR & leasing impact implies ~250K)

considering above, plus

- the Model 3 will only get better with time in several ways

- the best marketing for Tesla is vehicles out on the road, and test drives from highly satisfied family/friends

500K or greater global demand when SR is out seems like an easy bet to me.

I expect Model 3 to do vastly better in Japan than S or X due to its smaller size (an issue for Japanese parking realities).

by 2020 I think annual global demand for 3 will be ~750K, by 2022, over a million.

Tesla Shanghai building permit, finish in 180 days.

Can this be translated?

Pezpunk

Active Member

"With 61,394 Model 3s produced in a 13-week quarter, Tesla produced an average of 4,722 Model 3s per week in the December quarter. Yes, Tesla is still not making 5,000 Model 3s per week."

Question ... what is December a quarter of?

This farce is so outrageous and patently obvious that even the ineffective, disengaged SEC might have done something about it, if it weren't TSLA.

I'm hoping that at least a few "swing" traders and options jockeys (gamblers) on this board learn a not-too-expensive lesson here. Buy stock and hold for the long term (i.e. 3-5 years and maybe more). Save yourselves a lot of angst and money. JMO.

If anyone is mad about the whole FactSet "secret info" situation, complain to the SEC:

Tips, Complaints and Referrals Disclaimer Page

It'll take 10-15 minutes of your time.

"note that a lot of people could not get the tax credit anyway because of salary"

Interesting point. There is a large tranche of people that will be able to utilize the $3,750 tax credit.....

Well I guess we both do not have data to support that statement. So its like, you say I say...

However I have seen man discussions in social media from people who could not get the tax credit dues to their personal income situation thats a confirmation that people are out there and for those the $2k reduction is now worth a full $2k.

Thats a lot of money for many. So dependent how large this group is for them its a true 2k full TCO reduction for other with higher income able to use the still available(Jan 1st ) tax credit fully its of course different.

thanks, i'm back from an odd number of shares to an even number of sharesIf you look at the quote on Yahoo you'll see the bottom of the day's range is $298.80. It would've hit at $299.52.

It would be nice if NASDAQ SSCB wasn't in "surreal time" like trailing at least 6 hrs (4:15am!!)

https://www.nasdaqtrader.com/trader.aspx?id=ShortSaleCircuitBreaker

would not -10% be more like $297.38?

what am i missing??

Uptick Rule

:edit OOPS, close was 332.80 so $299.52 is 10% my bad

so for next 2 days we are kinda safe from shortz

Last edited:

RobStark

Well-Known Member

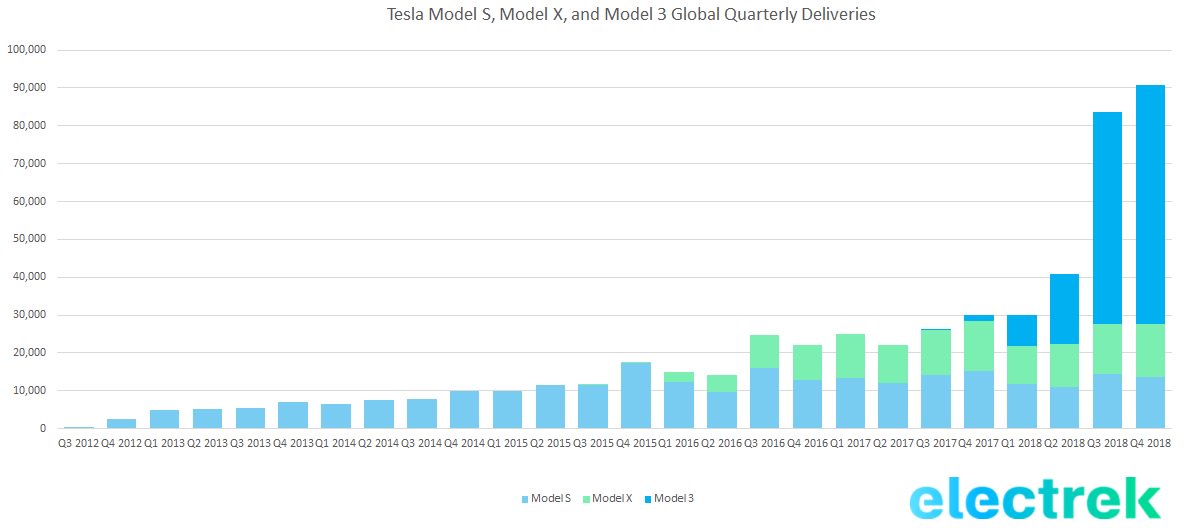

Why? They average around 25k per quarter. On purpose, due to cell supply limits.

S&X deliveries are down~2k units in 2018 vs 2017.

Fact Checking

Well-Known Member

So I guess for Q1 we need to find new ways to estimate P&D numbers?

For production numbers the VIN allocations method worked pretty well in Q4, with 97.7% accuracy:

So my official estimate for Q4 Model 3 production is 62,800

Just saying.

Here's the updated table:

Code:

Model 3 VIN allocation ratios:

Quarter Maximum VIN VIN increase Production VIN-to-Production-Ratio

==================================================================================

2018/Q1 20,581 +15,787 9,766 61.86%

2018/Q2 53,800 +33,219 28,578 86.02%

2018/Q3 116,270 +62,470 53,239 85.22%

==================================================================================

2018/Q4 ~189,964 +73,694 62,804 (est.) 85.22% (est.)

2018/Q4 189,964 +73,694 61,394 (real) 83.33% (real)BTW., note that the ratio of VINs allocated to VINs used for production is 1.2003 (!). I.e. there were 20.03% more VINs allocated than Model 3's produced in Q4. Using that 20% as an approximation for Q1'19 might work.

Paging @tsunamiofhurt as well whose model took 'VIN holes' into account as well.

Last edited:

S&X deliveries are down~2k units in 2018 vs 2017.

And? That's overwhelmingly within the margin of error. The cell capacity is not "exactly 100k units", it's "around 100k units". It depends on the 75/100 mix. IMHO, I'd expect the "100" fraction to rise with time, as people's expectations of EV ranges increase.

Pezpunk

Active Member

S&X deliveries are down~2k units in 2018 vs 2017.

perhaps the 146k increase in Model 3 deliveries had something to do with that 2k...??

Fact Checking

Well-Known Member

S&X deliveries are down~2k units in 2018 vs 2017.

Yes, but they probably sold more 100 kWh configurations in 2018 than in 2017 - the Model S/X average sales price was steadily increasing in 2018. The 100D and 100P uses 33% more 18,650 cells than the 75D configurations.

So the real supply constraint is the number of 18,650 cells per year, contracted from Panasonic, manufactured in Japan. If Tesla sells more 100D and 100P configurations then the unit count can drop below 100k. This is probably the reason for the 'approximately 100,000 units' language Tesla uses in their guidance.

Holy crap supposedly he had a production target of 91,500 and Phil Lebeau had heard higher than that. Could they really be that bad at their jobs? If they had told us their targets before the release we would have seen this 'miss' from a thousand miles away. Honestly, Troy's estimates helped me tremendously. At least those convinced me to stay away.CNBC: "Tesla's fourth quarter deliveries 'a big disappointment,' says Gene Munster"

Apologies if already posted. Also, probably uninteresting to you who are well versed in AI. A good layperson's summary of development and investment implications.

Tesla: The Autonomy Thesis - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

Tesla: The Autonomy Thesis - Tesla, Inc. (NASDAQ:TSLA) | Seeking Alpha

hacer

Active Member

...

- Model 3 inventory: deliveries reduced inventory by -1,756, while vehicles in transit went from 8,048 to 1,010, a reduction of -7,039 - the net increase in unsold inventory is 5,283 units, about a single day of production. Cash effect is about a $210m reduction of cash flow....

Joe F

Disruption is hard.

So post here - but as a specific topic gets discussed over a series of posts, we'll split it off to its own thread; this Master Thread will serve as the catch-all unless and until such a pattern emerges.

I should have taken an Evelyn Wood class...

Can this be translated?

特斯拉上海建筑许可证,180天完成。

Pezpunk

Active Member

Holy crap supposedly he had a production target of 91,500 and Phil Lebeau had heard higher than that. Could they really be that bad at their jobs? If they had told us their targets before the release we would have seen this 'miss' from a thousand miles away. Honestly, Troy's estimates helped me tremendously. At least those convinced me to stay away.

so this "miss" assessment isn't based on any evidence of production, or anything Tesla guided, or any perceived profitability threshold. it's just an arbitrary game of "i'm thinking of a number" from a guy outside the company.

wall street is weird.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K