Anyone have a spare couch that hasn't been shaken lately?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

my invoice says REMAN... i assume that means remanufactured ? so bad info from SC representativeMy service invoice said "REMAN" on it, if I recall. Not sure if the pack decal does or not...

Yeah, remanufactured. Bummer if they told you otherwise...my invoice says REMAN... i assume that means remanufactured ? so bad info from SC representative

Gigapress

Trying to be less wrong

So what? The IEA forecasts have been consistently wrong on renewable energy market projections, both for cost declines and production volume growth. Badly wrong, over and over and over again. There is systematic estimation bias that they still have not fixed. Why should we believe their latest estimates?This was brought up in the IEA Net Zero by 2050 roadmap. I recall posting it on here shortly after the report hit and to not great reception because of the implications.

But according to the IEA there is no scenario where we merely continue replacing fossil fuel energy with renewables and achieve net zero by 2050, the world actually needs to consume less power as a whole for it to be achieved.

And as you mentioned, efficiencies tend to be gobbled up and expanded upon. LED lighting is a good example where we’ve brought out this new lighting technology that consumes far less energy per lumen than incandescent bulbs so you’d expect energy usage would decrease right? No, we just end up lighting more and more things and to greater extents, and overall energy usage continues increasing regardless.

If we came out with technology today that let us half our energy usage per mile driven, would energy usage actually decrease or would miles driven just double?

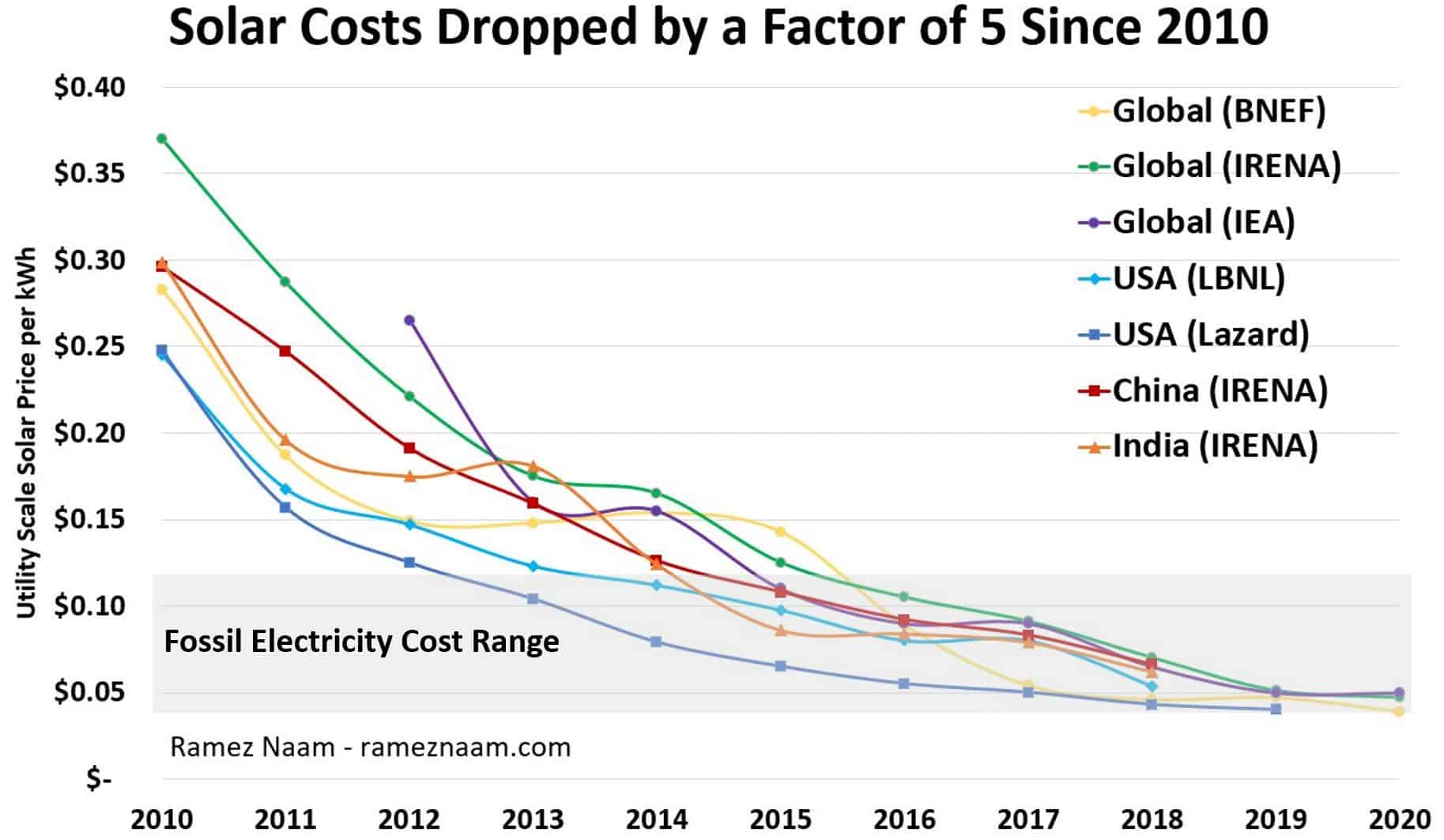

Look at these charts. This is an embarrassment.

Solar's Future is Insanely Cheap (2020)

This is part 1 of a series where I'll look at the future costs of clean energy and mobility technologies. This is a refresh of and expansion of my 2015 series on the future of

rameznaam.com

rameznaam.com

^This whole article is good and has more charts like these two.

Last edited:

ASY,HV 1.00 BATT,100KWH,CAT1,REMAN,SX(1107679-Yeah, remanufactured. Bummer if they told you otherwise...

01-A) good news new i am back to 100% charge

(ot) Ronan Farrow wrote a huge piece abut Elon on the New Yorker.

B

betstarship

Guest

(ot) Ronan Farrow wrote a huge piece abut Elon on the New Yorker.

I read it this morning and wasn't sure whether it was already posted here. As an investor in Tesla, some of the content is super relevant to me if it's factual.

Colin Campbell, VP of Powertrain, is leaving Tesla after 17 years: he's going to be CTO of Redwood Materials, with JB Straubel.

I had a once-in-a-lifetime experience at Tesla and, as an engineer, I can’t begin to summarize how many rewarding technical challenges I encountered while building our thrilling, safe, reliable, and increasingly affordable EVs. My time at the company began when we barely had a proof of concept and ends with millions of Teslas on the road worldwide. We not only made a difference on global emissions, but also forever influenced how the world thinks about transportation and helped to shape the product roadmaps of almost every other automaker. It’s been more rewarding and memorable than I could have imagined.

Seems amicable.

Source: Tesla loses one of its most senior engineering executives

I had a once-in-a-lifetime experience at Tesla and, as an engineer, I can’t begin to summarize how many rewarding technical challenges I encountered while building our thrilling, safe, reliable, and increasingly affordable EVs. My time at the company began when we barely had a proof of concept and ends with millions of Teslas on the road worldwide. We not only made a difference on global emissions, but also forever influenced how the world thinks about transportation and helped to shape the product roadmaps of almost every other automaker. It’s been more rewarding and memorable than I could have imagined.

Seems amicable.

Source: Tesla loses one of its most senior engineering executives

Since TSLA has existed there have been over-cautious warranty reserves, with actual expenses below accruals. That initially reflected minimal experience with Tesla, electric cars and each model. More recently the practice has been less over-reserved because there now is experience with Tesla, electric cars, and significant claim history for the present lineup and the battery variants deployed.Probably have been continuously reserving for projected warranty expenses for all items, including batteries.

For this thread that is enough detail, I think.

For more detail consult Tesla 10K disclosures and Warranty Week.

If there is much interest we can make a specific thread for the subject.

I have done the regular Warranty Week evaluations as well as Tesla disclosures. Warranty Week covers all public OEM's and many industries, if anybody is obsessive about the subject.

Is JB poaching as a directorColin Campbell, VP of Powertrain, is leaving Tesla after 17 years: he's going to be CTO of Redwood Materials, with JB Straubel.

I had a once-in-a-lifetime experience at Tesla and, as an engineer, I can’t begin to summarize how many rewarding technical challenges I encountered while building our thrilling, safe, reliable, and increasingly affordable EVs. My time at the company began when we barely had a proof of concept and ends with millions of Teslas on the road worldwide. We not only made a difference on global emissions, but also forever influenced how the world thinks about transportation and helped to shape the product roadmaps of almost every other automaker. It’s been more rewarding and memorable than I could have imagined.

Seems amicable.

Source: Tesla loses one of its most senior engineering executives

insaneoctane

Well-Known Member

I, for one, am totally OK with not getting an opportunity to rage buy more at sub-$200. I don't have much dry powder these days anyway.I'd love to be a contrarian indicator

I think it really comes down to - Did hedgies get enough of a draw down to be content and flip their shorts/bearish puts to calls or do they still want to hope for more a macro drawdown and have TSLA test the 200 day?

If it's the former, flipping their bets from bearish to bullish could put too much pressure on MM's to pin the stock below the current 230 Call Wall. We'll see tomorrow what happens with Open Interest/Volume chart

Captkerosene

Member

Not have a choice? Buffett and Munger have been very clear that they won't be investing in Tesla. Even if TSLA was the kind of business they invested in (it isn't), and it was at the right price (it isn't), they don't like Elon and don't want to be associated with him.If Tesla insurance and Tesla energy start eating into his insurance and utility profits he may not have a choice.

StarFoxisDown!

Well-Known Member

Yeah, the range of like 175-300 is a zone of boring for me. Not going to do either way. Below 175 and I'll pick up far out LEAPS, especially as further dated LEAPS open up. Share price north of 300 is when I'll start selling covered calls on my shares for income. Everything in between is like watching paint dry for meI, for one, am totally OK with not getting an opportunity to rage buy more at sub-$200. I don't have much dry powder these days anyway.

Nice pop there at the end with volume. That was the type of end of day I was hoping to see. Took a lot of volume at the very last second to make sure the stock didn't close at the exact high of the day. Overall pretty productive day. The stock dropped enough intraday close enough to close the gap from open and then rebounded.

It's funny given Berkshire's portfolio has so much overlap with tesla products - EVs, Energy, Insurance, even tech via Apple - that they have ignored Tesla as an investment when they must have the required technical foresight to see a winner.Not have a choice? Buffett and Munger have been very clear that they won't be investing in Tesla. Even if TSLA was the kind of business they invested in (it isn't), and it was at the right price (it isn't), they don't like Elon and don't want to be associated with him.

An interesting take I heard was that Buffet has to be the ringmaster in all his investments and hates being overshadowed - That's one of the reasons he has a big annual event in Omaha in a stadium for his AGM - He needs the limelight.

If Tesla stock was $50/share right now he might not buy as Elon's personality just overwhelms his.

willow_hiller

Well-Known Member

I read it this morning and wasn't sure whether it was already posted here. As an investor in Tesla, some of the content is super relevant to me if it's factual.

It seems to be mostly factual, but at the same time, devoid of meaning. The headline reads like some sort of deep investigative journalism (which everyone also assumes because of the author), but it's just a rehashing of the recent Starlink donation saga, and then some random ramblings about Elon's adolescence and early career.

Farrow's main point is that it's a problem that a private citizen is relied upon so much; but it's bizarre to blame Elon for being indispensable.

Nothing salacious, and as a result it's not gaining much traction on social media. You see a few "Oooh, an exposé by Ronan Farrow" posts, and then no follow-up because everybody went in expecting a scandal and came out with nothing new.

Since Mary is obviously leading, i wonder why WB would do thatFast forward, history will tell us, Ford, F currently trading at price first reached in 1993 (30 years ago), and General Motors, GM currently trading at price below their IPO date of 2010 (13 years ago), and Stellantis, STLA currently trading at price first reached in 2017, will fail faster than anyone believes. Their bread and butter, pickup trucks, will be outsold by Tesla combined in just a few short years. The looming strike by UAW representing 150,000 blue collar auto workers with current contract expiring September 14th, do not see the headlights of the Cybertruck in their rear view mirror. They are not even looking. And the Cybertruck is coming up fast.

This is concerning regarding UAW's approach:

View attachment 967095

‘We are burned out’: UAW ready to take on automakers in contract negotiations

Amid record profits, workers want to roll back concessions made to auto industry after the 2008 economic recessionwww.theguardian.com

Warren Buffet's Berkshire Hathaway just sold almost half their investment stake in GM, likely due to their slow transition to EVs and the looming strike. Hey Warren, come over to Tesla. We'll save you a seat.

Warren Buffett's Berkshire Hathaway cuts its stake in GM almost in half

Billionaire investor Warren Buffett's Berkshire Hathaway sold nearly half of its holdings in GM. Here are some possible reasons why.www.freep.com

I like your posts, but I'm pretty sure there's a rule about linking to your own social media here - especially now that X is for profit for creators. The mods frown on this forum being used as a distribution channel.Sure, the charging times were already posted

But the biggest TLDR is that Tesla is being ultra conservative on the 4680 charging curve, we can only speculate why

Maybe avoiding risks, maybe making the 4680 Model Y not a good deal due to the limited availability, although this doesn't make much sense because unless the customer goes into a deep dive it won't know how bad it charges currently

I see no technical reason for it at least no be a little bit better, at least on par with the LG packs coming out of Shanghai and Berlin, which aren't good chargers, at 32 minutes 10-80%

But 10-80% on 38 to 41 minutes for the Model Y 4680 in 2023 is bad, shameful even for Tesla to put on the market

Would like to hear if you guys have any other ideas

But, the new Cybercell should lower internal resistance a bit due to using DBE on anode and cathode, so the next clue will be for Cybertruck deliveries do happen and someone to record a charging session, even on V3 Supercharger will give us clues

Would be quite bad for Cybertruck to have a charging curve similar to that one, since a bigger pack on a V3 Supercharger would mean even more than 40 minutes 10-80%

Mods - If I'm wrong please community note me.

Mod: I'm away at a conference and hadn't seen the original post, but you are correct. @GhostSkater, please do not promote your own Xeets. --ggr

Last edited by a moderator:

Some reflection and silly patterns... the reversal did start Friday (in AH anyway).I give it by Friday (my 3 day rule). Things could look very different.

The mark is when TMC is (mostly) snippy, the FUD peaks, and we get the usual Mod warnings. However, it could be that the initial 3 day drop is half-way to the classic 6 day drop in SP, while 7 consecutive days is nearly unheard of.

So why did TSLA flip when there was no Tesla news other than something coughed up from an analyst, and wasn't news at all. Was it really the Put ammo depleted at 6 days? This also implies that Tesla doesn't need news for the pattern to repeat, they can just create their own... "Oh look, Tesla's future looks brighter!" (to paraphrase them). Go ahead... try and convince me that someone didn't already know this plan by Friday AH.

So rigged...

GhostSkater

Member

My bad didn't know thatI like your posts, but I'm pretty sure there's a rule about linking to your own social media here - especially now that X is for profit for creators. The mods frown on this forum being used as a distribution channel.

Mods - If I'm wrong please community note me.

I can do the post here directly in the future, just sharing because it's something I like to work on but have nothing to gain on it

Still going... 237 by morning according to my "Analysis."

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K