12k/month at current rate is 200 dollars a month. Tesla is trying to match their FSD buy in price with sub fees.I don't think we will ever know. Tesla has always kept its take rate secret.

The FSD price drop is weird though. The only explanation I can think of is that they want to increase the take rate because they need the data from more drivers using FSD on Hardware 4. This would also explain why Tesla suddenly allowed FSD transfers.

But none of the motivation is clear because Tesla ain't talkin'.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

nativewolf

Active Member

Or they just want cash now. All those people that bought FSD basically underwrote the expenditure without gaining from share appreciation or from having a product. Financially silly. The cynic in me says Tesla wants more suckers.12k/month at current rate is 200 dollars a month. Tesla is trying to match their FSD buy in price with sub fees.

TrucksI was in Houston last week and did not see many Tesla there. Probably because gas is still very cheap there?

Time to watch inventory…

22101 200 miles search

48 yesterday morning, 38 today…

Once inventory is down prices might start creeping up

it’s just the Labor Day sale….

Down to 27 over the labor day week end. ... cheers!!

(All inventory not listed, so everything is conceptually in multiples ...)

Artful Dodger

"Neko no me"

Your guess is as good as mine. If indeed you believe something will be coming.

Could be this, from Apr 09, 2023:

Tesla to build Shanghai factory to make Megapack batteries - Xinhua

We heard another rumor recently that Tesla would begin construction of the Shanghai Megapack factory in September. I think this is the time. And it's for exports, too, just like Giga Shanghai. Should be immensely profitable, especially with the new 80 GWh/yr CATL LFP battery factory coming online soon just 3 km away.

Cheers!

Darkfox021

Member

Shutting down to retool in Q1 makes the most sense. Forgetting standard Q1 seasonality, if the IRA tax credit will be reduced, as Tesla is suggesting, there will likely be a pull forward in demand. Better to deliver those cars in Q4... snip

Model 3 Highland isn't currently available in North America, but there has to be a reason why it isn't available., We know it is eventually coming we don't know when.,

Last edited:

SunnylandY

Member

Maybe nobody watches NBC any more but they had a blurb on C-V2X this morning, all about how it will save kid's lives. They put up a graphic of all the car makes logos signed on to support it but I didn't see the big "T". Seems like a missed opportunity.

Update on my Model S purchase (and bad bug on Tesla’s part?)

Because I was lucky enough to get my trade-in valuation the day before the price drop and am finalizing my sale after, i’m worrying about making sure this transaction goes through. So I immediately on September 1st went through the app and filled out all the details. When I got to the payment part I made sure first that I had enough money in my primary checking account to pay fully in cash (no way I’m financing at this interest rate!). I was curious what the payment choices would be (bring a certified check, wire the money, personal check in advance, enter account numbers…). So therefore I was shocked after I hit the button for payment, it just stated $70,800 payment complete and zero owed.

Now I have no idea what happened. I can’t believe they charged it to the credit card, and now I’m in a panic that the payment will fail and the deal will fall through and I won’t get the FSD xfer because I can’t get another Model S in time, or my resale value will be lower…

I got an overdraft notice this morning from my secondary checking account, so mystery solved. My payment methods for the Tesla App (which I assumed were just for charging and merchandise) were first Apple Pay and secondly that secondary checking account.

It’s just astonishing to me that the App gave me no choice for the payment method on a $70k+ car purchase (and also that the bank allowed such a huge overdraft

Because I was lucky enough to get my trade-in valuation the day before the price drop and am finalizing my sale after, i’m worrying about making sure this transaction goes through. So I immediately on September 1st went through the app and filled out all the details. When I got to the payment part I made sure first that I had enough money in my primary checking account to pay fully in cash (no way I’m financing at this interest rate!). I was curious what the payment choices would be (bring a certified check, wire the money, personal check in advance, enter account numbers…). So therefore I was shocked after I hit the button for payment, it just stated $70,800 payment complete and zero owed.

Now I have no idea what happened. I can’t believe they charged it to the credit card, and now I’m in a panic that the payment will fail and the deal will fall through and I won’t get the FSD xfer because I can’t get another Model S in time, or my resale value will be lower…

I got an overdraft notice this morning from my secondary checking account, so mystery solved. My payment methods for the Tesla App (which I assumed were just for charging and merchandise) were first Apple Pay and secondly that secondary checking account.

It’s just astonishing to me that the App gave me no choice for the payment method on a $70k+ car purchase (and also that the bank allowed such a huge overdraft

Last edited:

12k and $200/month means 60 months to break even12k/month at current rate is 200 dollars a month. Tesla is trying to match their FSD buy in price with sub fees.

15k and $200/month means 75 months to break even

Both match. They just mean a different time period to break even. But that assumes the sub fee remains at $200/month for many years to come.

So I really don't think that's the explanation because if you buy it up front you protect against a rise in monthly sub fees. It is expected that with major improvements, both the subscription fee and the full-purchase price will go up dramatically.

60 month is the most common loan lease. Sub is taking away from fsd sales as monthly payment skyrockets due to rates. This is just a way to normalize somethings. Tesla much rather people buy than to sub. Those who wanted fsd subs because "monthly subscriptions is a positive for tsla stock" ended up with a nothing burger. You can check back to see how I viewed fsd subs..I hated the idea because most people will cancel fsd subs when the novelty wears off vs those who bought it and must live with it.12k and $200/month means 60 months to break even

15k and $200/month means 75 months to break even

Both match. They just mean a different time period to break even. But that assumes the sub fee remains at $200/month for many years to come.

So I really don't think that's the explanation because if you buy it up front you protect against a rise in monthly sub fees. It is expected that with major improvements, both the subscription fee and the full-purchase price will go up dramatically.

FreqFlyer

Active Member

Interesting, Tesla is displaying at the Munich Auto Show. One of Europe's largest auto shows. Wouldn't have anything with BYD being there would it?

www.voanews.com

www.voanews.com

Tesla, Chinese EV Brands Jostle for Limelight at German Fair

One of the world's biggest auto shows opened in Munich Monday, with Tesla ending a 10-year absence as race with Chinese rivals for electric dominance heats up

www.voanews.com

www.voanews.com

I look at it as supporting the mission. Of course, Tesla needs less support now than in 2013, so there's that. However, I'd rather give money where I know it will do some good rather than government where half of it's wasted or charity where it's virtually all wasted.Or they just want cash now. All those people that bought FSD basically underwrote the expenditure without gaining from share appreciation or from having a product. Financially silly. The cynic in me says Tesla wants more suckers.

Saudi Arabia to extend voluntary cut of 1 million barrels per day until the end of the year

Riyadh first applied the 1 million-barrels-per-day reduction in July.

EV tailwind - high oil prices,

Has this fastcompany hit piece been shared? Pretty hilarious and worth saving for a revisit in a year or two.

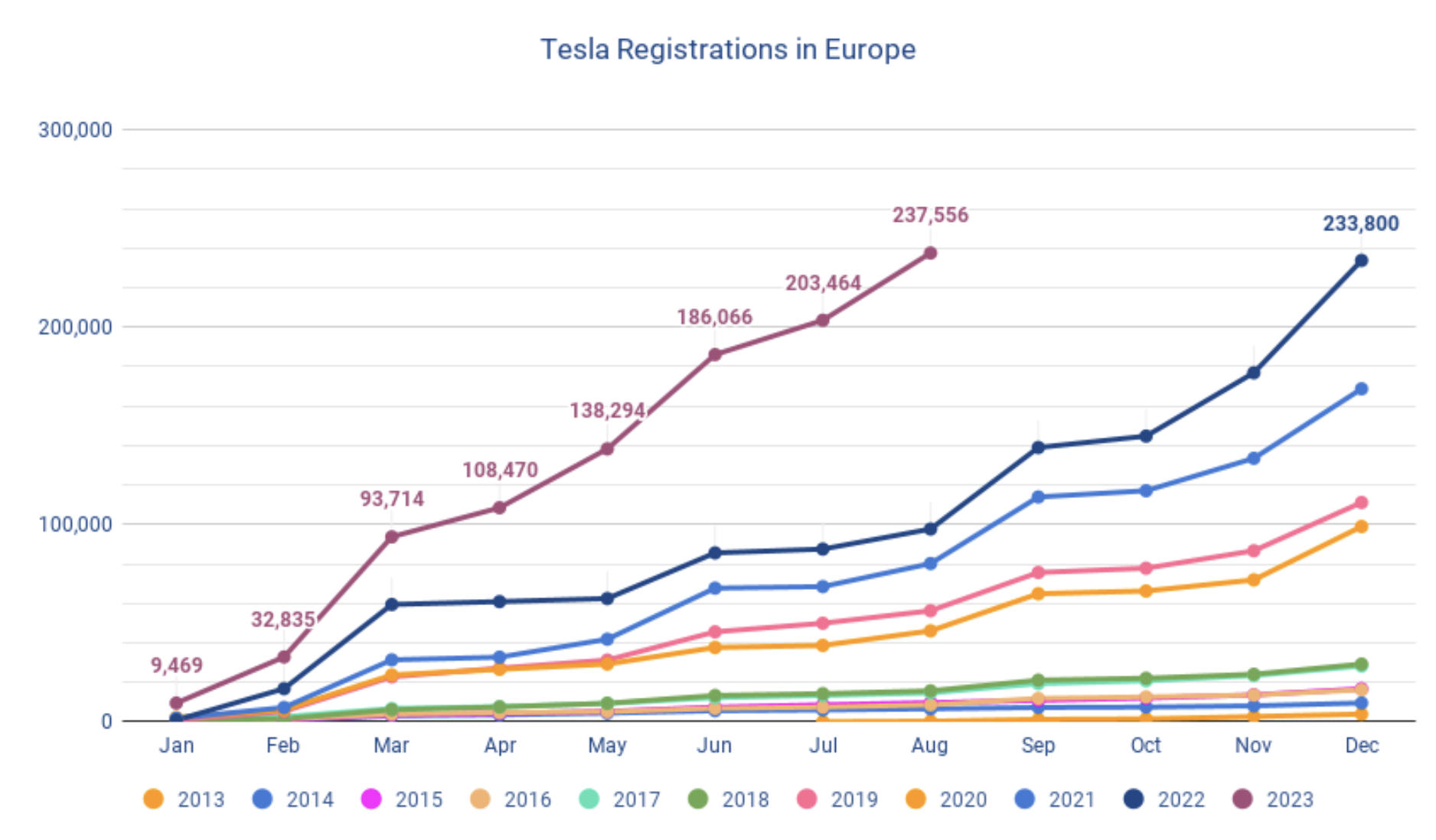

European registrations for August are complete, have now surpassed the number for the whole year of 2022. Also, more than twice as many cumulative registrations as last year at this point:

teslamotorsclub.com

teslamotorsclub.com

Wiki - Tesla Europe Registration Stats

This wiki belongs to the thread EU Market situation and outlook. Click HERE (CTRL-click to open in new tab) to add new data using a Google form. Any forum member can contribute. We encourage you to do so! Your entry will appear after the data is double-checked by other volunteers. If the data...

Yes....and No.Has this fastcompany hit piece been shared? Pretty hilarious and worth saving for a revisit in a year or two.

...

The FSD price drop is weird though. The only explanation I can think of is that they want to increase the take rate because they need the data from more drivers using FSD on Hardware 4. This would also explain why Tesla suddenly allowed FSD transfers.

...

It might partially be due to Elon's statement that HW4 will be ~6 months behind HW3 FSD software capability. If a newly bought car will have slightly worse or delayed FSD relative to one bought when the FSD price was $15K, maybe it makes sense to drop the price a bit.

DarkandStormy

Active Member

Both Berlin and Austin have already hit their 5k/week ramp rates earlier in this quarter. So they're not way behind Fremont. In fact, they're pretty much right at Fremont's pace. Berlin hit 5K/week back at the end of Q1 and Austin hit it in early May. Now the question becomes how consistent they were with those weekly rates. That'll be answered in 6 days, but if they were 90% consistent, then they are right on schedule with Fremont.

Obviously Shanghai was the exception and we all know the reasons why. Nothing's ever going to compare to Shanghai until Tesla has an army of Optimus running it's factories, not humans.

Also just a reminder, look back at what happened with Tesla's margins once they reach the 5k/week number for an entire quarter on the 3 and Y ramps. We have two factories that potentially just had their first quarters of at or near the full 5k/week number. Sure price cuts/incentives will eat somewhat into the realization of the improvement of gross margins thanks to Berlin/Austin averaging 5k/week for an entire quarter, but it will still make a material impact.

Per the wiki, Tesla sold ~32k MYs in 62 days of Q3 so far in Europe. That's just over 3.5k/week.

Last edited by a moderator:

Artful Dodger

"Neko no me"

Interesting, Tesla is displaying at the Munich Auto Show. One of Europe's largest auto shows. Wouldn't have anything with BYD being there would it?

Tesla, Chinese EV Brands Jostle for Limelight at German Fair

One of the world's biggest auto shows opened in Munich Monday, with Tesla ending a 10-year absence as race with Chinese rivals for electric dominance heats upwww.voanews.com

Lol, they should hand out free samples of Brandenburg wasser...

Prost!

P.S. Institutions buying this a.m.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M