LOL, what a bada**!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Where's all the dry powder talk? This is when we buy. Who cares it's a falling knife. When I was down 32% @ 9.5 with AMD, people said it was going down to 2 dollars. Morgan Stanley said 6 dollars. Everyone said it's a *sugar* stock. My peers said I should just take my loses. I doubled down and doubled my position.

One bad quarter and everyone is extrapolating Tesla as a doomed company? You know just a year ago people were trying to figure out if Tesla is even capable of making cars for mass production. Elon yelling at investors, admitting not knowing what he is doing, working 120hrs/week and the company sounds like a cluster F.

One bad quarter and everyone is extrapolating Tesla as a doomed company? You know just a year ago people were trying to figure out if Tesla is even capable of making cars for mass production. Elon yelling at investors, admitting not knowing what he is doing, working 120hrs/week and the company sounds like a cluster F.

sundaymorning

Active Member

"Trying to please WS"? Wall Street is the thing that just gave Tesla 2.5 billion dollars.

It's not too much to ask Tesla to produce a year of profitability. They're already in the hole, and expected to go deeper.

I think the biggest thing analysts are asking is what changes the trend?

Again, Tesla is forecasting record deliveries in Q2 and STILL a loss.

What changes this trend? What's the path to profitability?

In 2018, the path to profitability was "start mass delivering the Model 3."

They did that, and yet it doesn't look like that's a sustainable profit. So what's the next path to profitability?

Path to profitability will be on Shanghai. Monroe has suggested that it could save Tesla 20%-40% in labor and material cost. Production of the 3 in Shanghai will open up EV incentives for them, which they cannot enjoy now. So the Model 3 in China will cost the Chinese even less, and bring Tesla more profits.

Next path to profitability is Maxwell, I don’t need to go further here as it would take too long to explain the benefits.

Refresh the damn SX and bring demand back up.

All the things mention above are not short term outlook, but once they’re achieved, watchout!

KSilver2000

Active Member

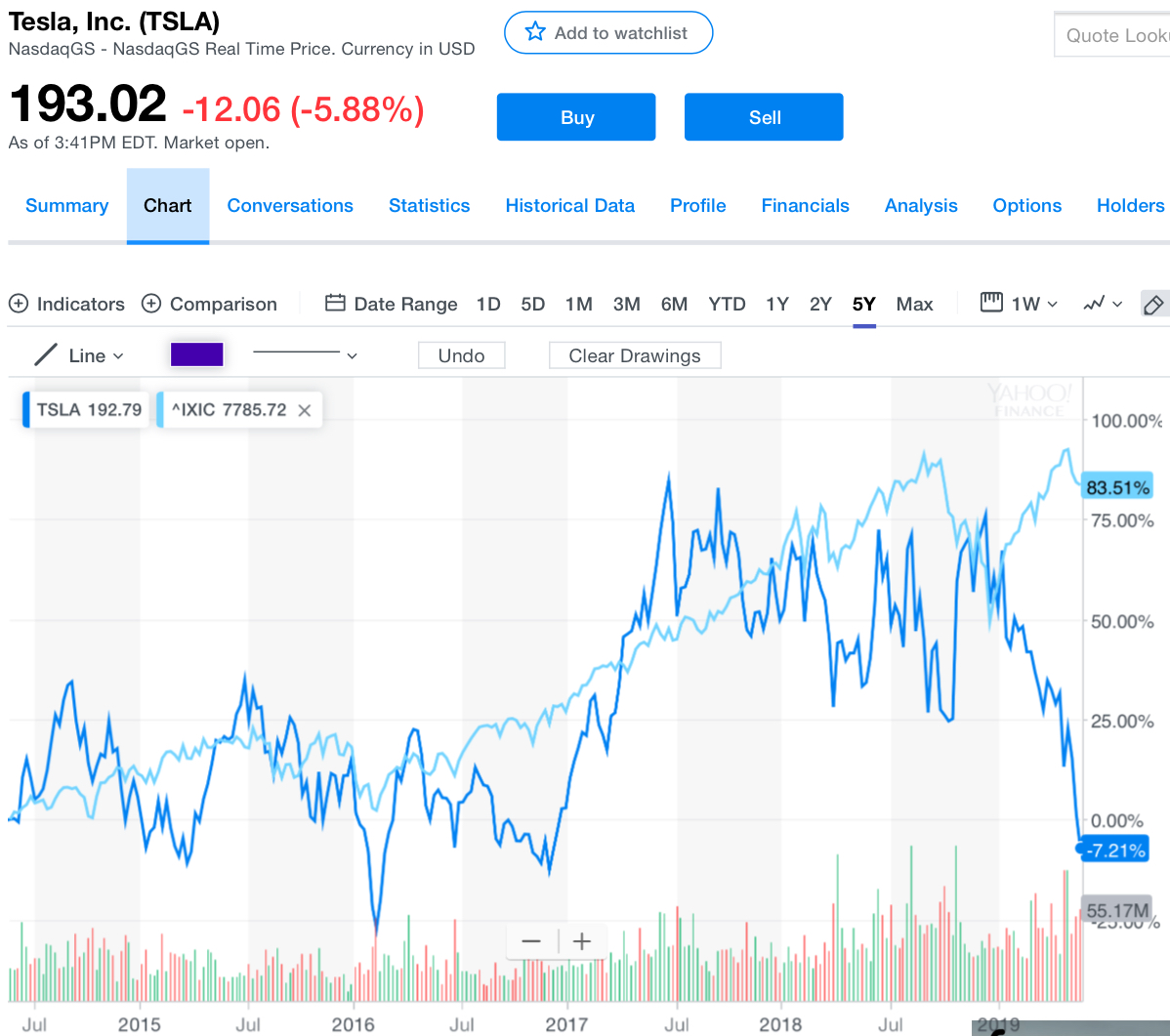

Of all the charts a trader/investor can look at, this is the type of chart I hate seeing the most.

sundaymorning

Active Member

Not that I support a buyout, but a buyout by a public company would allow private investors (and certain funds) to stay in. That is a HUGE difference, and one of the main reasons going private didn't happen. Also, Elon did not turn down $420, he was going to offer $420 to people that wanted to (had to) cash out. Those that stayed in would not get anything other than private shares.

I agree with you’re saying. But I would much rather be pushed out at $420 then to be brought back in at $300.

electracity

Active Member

Great product and I’m sure they will eventually succeed but if you sat down with a team of people you couldn’t plan and map out a worse PR strategy than what Tesla has done.

A business that becomes the most watched company in the world after 16 years of existence does not have a bad PR strategy.

How does you owning their stock help their mission (unless you bought at IPO or during an offering)? I get how buying their products helps.

Holding reduces the artificial volatility you folks are trying to induce. Volatility reduces the price a bit and may scare off the weak or ill-informed.

Volatility alone can slow Tesla's acceleration a tad by discouraging workers. Presumably why someone is paying you to help induce it.

Also, I vote the shares I own. Since there are many like me who know the score, that helps protect Tesla from being devoured and destroyed.

So, basically, my knowledge, values, and patience give me bigger stones than you.

Last edited:

sundaymorning

Active Member

LOL, what a bada**!

What on earth is he talking about, what am I missing?

There is really 0 reason besides being a Tesla bull to try and catch this falling knife right now. One can likely do better by buying in after Q2 and missing out on a little gain (if Tesla does surprise) than buying now and hoping for a bounce purely because of optimism and one’s biased affinity for Tesla.

i’d say better to be ahead of it, than reactive

Shorts and their horde of a-holes were just sitting in wait for a quarter like Q1. Now they are milking it for all its worth before Q2 revenues come out and potentially kills their narrative.

and yea, Musk has in large part created this problem all by himself. maybe he likes to create dire circumstances to motivate himself?

If we hit 90K deliveries they are all proven wrong...end of story. So they are doing the smart thing if you are short...hit em hard when a weakness is exposed before they get up again and hit back.

I don't know if they hit 90K or not. I am concerned about the slow delivery of the new S/X vehicles.

In any case we have no choice but to take it on the chin until Q2 earnings reports guys and gals. GLTAL...

Tesla gave the 90-100k guidance at the end of April, well into the quarter. So they must have had a good insight in deliveries and orders up to that moment, and had confidence in giving that guidance. Is it really that hard to reach 90k? They need to deliver 27k more cars than in Q1. That does not seem impossible given the spillover from Q1 to Q2, the horrible 12k S and X in Q1, and Model 3 production picking up steam (SR+). In Q1 they delivered half of the cars during the last 10 days. What if they do the same this time? (even if it is not desirable, due to the stress it puts on employees and customers).

What do you guys think of this plan? Sell 1,000 shares for every $10 drop in SP, and put half the cash into Jan 2021 Leaps 250 strike? Keep the other half of the cash as dry powder to buy back stock (or more LEAPS) when the drop appears to be over.

MartinAustin

Active Member

I got slashed by the falling knife as it passed through my hands at $226!!!Where's all the dry powder talk? This is when we buy. Who cares it's a falling knife

TradingInvest

Active Member

Yeah, we are now in 2013 territory, when they were only making a few Model S vehicles and nobody believed they would sell more than 20,000 cars/year. No Gigafactory, No Model X, no Model 3, no Y in development, no China Factory, no $25+ Billion in annual Revenue, no NY factory, no large Supercharger network, No 400,000+ cars in annual sales, No Autopilot and self driving around the corner, etc. It is so oversold it is comical. The question is how much lower can they push it before it snaps back hard?!?

In 2013 the float was more like ~110 million shares. Now more than 170 million shares.

Well, he probably has big news. Or no news. Or bad news. Or he's just bored. I get it. I'd be bored too if all I had to do was make an EV car company work globally, and make those cars into robots, and build space ships, and build tunneling machines and catapults that launch you at 200mph, and giant battery farms, and solar panels that look like roof tiles. Like, what does he do with the other 23 hours a day?What on earth is he talking about, what am I missing?

JRP3

Hyperactive Member

Refresh the damn SX and bring demand back up.

They just improved the vehicle with new motor and other efficiency boosts to improve the range. That's a demand lever.

Model 3 wins best $50 sports sedan at Motor Trend:

The Breakdown: How Did We Choose the Best $50K Sports Sedan? - MotorTrend

The Breakdown: How Did We Choose the Best $50K Sports Sedan? - MotorTrend

G

goinfraftw

Guest

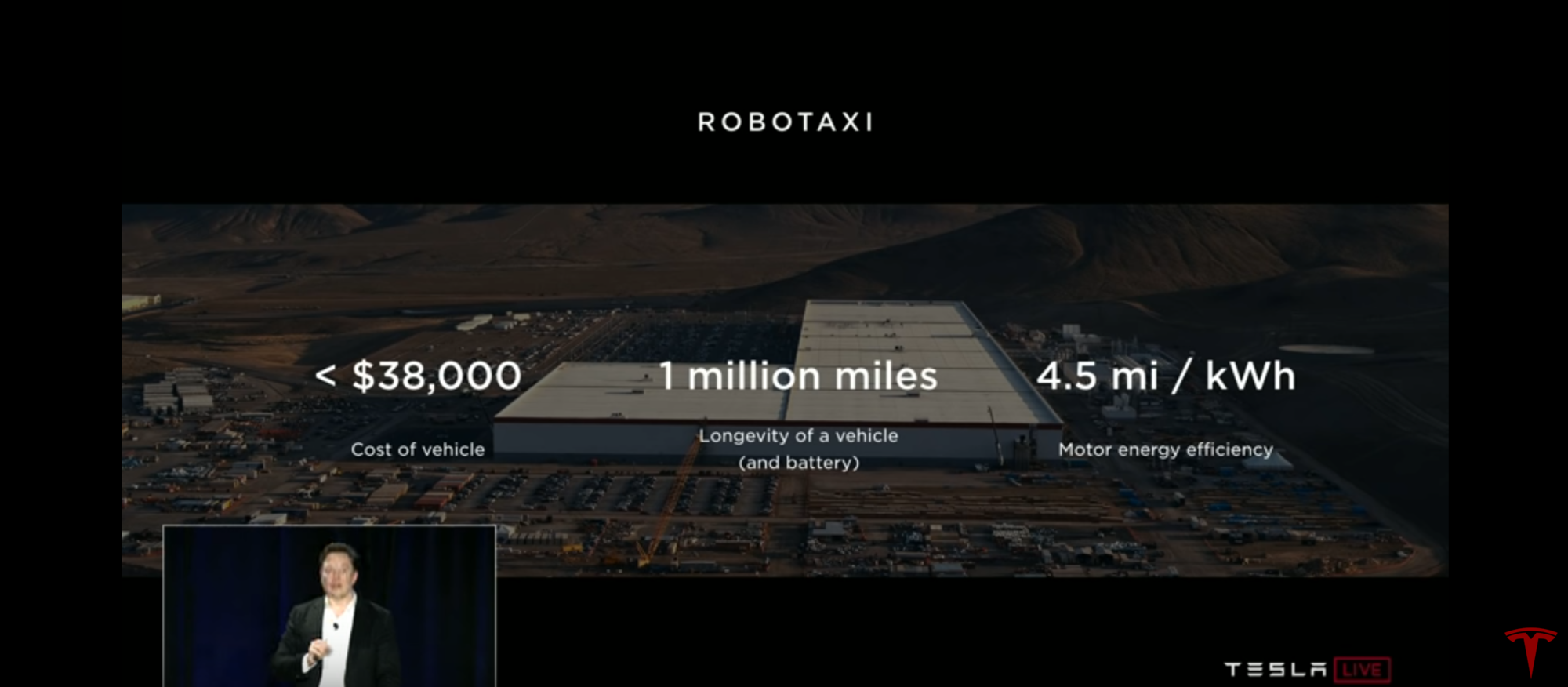

Anyone else laugh out loud, like I did, by the potentially obvious phallic symbol representation of Gigafactory 1 with these ridiculous stats for the Robotaxi? Wasn't the audience the institutional investors?

...it's dawned on me that I might still have the mind of a child, in my 30's, and Elon Musk isn't thinking like this. With that said, I'm really not sure anymore based on the current circumstances in the stock price.

...it's dawned on me that I might still have the mind of a child, in my 30's, and Elon Musk isn't thinking like this. With that said, I'm really not sure anymore based on the current circumstances in the stock price.

What on earth is he talking about, what am I missing?

Depends on how you want to interpreted.

Most like : Nothing

Bulls: Elon set a massive bear trap and is about to crush them

Bears: Elon is a lunatic and laughing himself to the bank while his investors lose everything..a true con man.

Webeevdrivers

Active Member

A business that becomes the most watched company in the world after 16 years of existence does not have a bad PR strategy.

I get what you are saying. No such a thing as bad publicity, but still.

StarFoxisDown!

Well-Known Member

My rational/logical investor side says that I wouldn't accept any buyout right now (ok maybe $500-600/share lol) because of the amazon'like run this company is going to go on over the next 10 years. But there's also a side of me that has a huge disdain for Wall St that has been there since I started trading 12 years ago and has only gotten stronger as I 've seen blatant manipulation, not just on Tesla but other stocks as well. I'd get a certain level of satisfaction from waking up to an announcement in the morning that Apple has bought Tesla for 65 billion just to F over the Wall St and shorts......and yes I do very much believe naked shorting is happening right now and is increasing. The daily volume each and every day with these consistent drops makes it very apparent to me.

I would gladly comprise and settle for Apple or another company taking a 10% stake right about now 10% would only cost them 3.5 billion...….that's nuts. If I were a big time investor with Apple I would be emailing Tim Cook nonstop daily to tell him to make something happen here at these prices.

10% would only cost them 3.5 billion...….that's nuts. If I were a big time investor with Apple I would be emailing Tim Cook nonstop daily to tell him to make something happen here at these prices.

Someone also mentioned Amazon and actually Tesla would make a really key partner for Amazon since they're going the route of having the own trucks, both for short range and long range and gasp...….planes. They could work with Tesla on building out the infrastructure for the Semi and become Tesla's biggest Semi customer as well as have Amazon invest in R&D into Electric planes with Tesla.

I would gladly comprise and settle for Apple or another company taking a 10% stake right about now

Someone also mentioned Amazon and actually Tesla would make a really key partner for Amazon since they're going the route of having the own trucks, both for short range and long range and gasp...….planes. They could work with Tesla on building out the infrastructure for the Semi and become Tesla's biggest Semi customer as well as have Amazon invest in R&D into Electric planes with Tesla.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K