Mike Cannon-Brooks tweets about them quite oftenIm surprised this has never come up before. I hear a ton about Waymo and Cruise, but I became aware of Zoox today and they seem to be a player that is still different than either of the former two but not Tesla's model either. Im surprised I've not seem much discussion on them.

Self-driving car startup Zoox gets permit to transport passengers in California – TechCrunch

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Insurance will be a great addition to the company but it's not a core position, if it's late it's late.Still no Tesla insurance!!!

Just noting that any potential for Tesla having sandbagged MY release times is probably looking pretty smart right now. If the world goes into recession, the last thing Tesla wants is to have rushed a lot of cash out the door in order to create a surge of production. Yes, MY does expand the market somewhat, but it also cannibalizes the 3 - while 3 production will be surging due to the (current) uncorking of Fremont plus GF3 going online. If global auto sales are down due to a recession, said cannibalism would really hurt; M3 needs new EV demand growth to compensate for MY cannibalization.

When going into a recession, you need cash. With an unambitious starting date on MY production, Tesla can delay capital expenditures as needed and make sure that its cash supply remains strong.

Right now it looks like pretty much everyone is trying to cause a global recession. The US and China are ever deeper into a trade war, at the same time that China is having to try to crush dissent in Hong Kong, while Russia is doing the same in Moscow while simultaneously pushing toward a new nuclear arms race. Britain is doing their best to try to push Europe (but particularly themselves) into a recession, while Germany may already be going into a recession. It's a mess, and any party doing this could step back from the brink at any time. But will they?

If we are heading into a recession, the semi is the vehicle that should be prioritised. If the economics are a good as claimed then businesses will purchase regardless of the macroeconomic cycle as they will save money from day 1. cheap financing should also be readily available unless this recession turns into another liquidity crisis.

In other news, VW's Sebastian Willmann (VW's head of diesel development) says that diesel is now "absolutely clean". Also insists that "diesel will continue to be part of the drive solution for the VW brand in the future"

Interview with him being promoted by VW Switzerland:

Volkswagen Schweiz on Twitter

Interview with him being promoted by VW Switzerland:

Volkswagen Schweiz on Twitter

If we are heading into a recession, the semi is the vehicle that should be prioritised. If the economics are a good as claimed then businesses will purchase regardless of the macroeconomic cycle as they will save money from day 1. cheap financing should also be readily available unless this recession turns into another liquidity crisis.

Quite true. And there's basically zero cannibalization with Semi; it's an entirely supplemental market. So even if the amount of shipping is down, and diesel prices are down, it's still brand new sales.

That said, I'm not sure how well they could produce it soon even if they wanted to. They haven't even announced a location for production yet.

Comments on Twitter are not entirely kindly ...In other news, VW's Sebastian Willmann (VW's head of diesel development) says that diesel is now "absolutely clean". Also insists that "diesel will continue to be part of the drive solution for the VW brand in the future"

Interview with him being promoted by VW Switzerland:

Volkswagen Schweiz on Twitter

In other news, VW's Sebastian Willmann (VW's head of diesel development) says that diesel is now "absolutely clean". Also insists that "diesel will continue to be part of the drive solution for the VW brand in the future"

Interview with him being promoted by VW Switzerland:

Volkswagen Schweiz on Twitter

Rated "Funny" but really the correct rating would be "Sad" or "Angry".

Comments on Twitter are not entirely kindly ...

Indeed

Seems like you wasted a lot of time building defeat devices for your lemons then. #dieselgate

Smoking is absolutely healthy now. Has a filter in it.

I hope Google Translate is broken...

You are committing a genocide. You need to all go to jail.

LN1_Casey

Draco dormiens nunquam titillandus

In other news, VW's Sebastian Willmann (VW's head of diesel development) says that diesel is now "absolutely clean". Also insists that "diesel will continue to be part of the drive solution for the VW brand in the future"

Interview with him being promoted by VW Switzerland:

Volkswagen Schweiz on Twitter

Does anyone else notice the irony that their main picture up top is of all electric vehicles (all of which they have yet to produce) too?

Tslynk67

Well-Known Member

One more:Indeed

I find you "absolutely ethical".

Just checked out a diesel forum - people are hoping that the VW statement means new VW diesel models will be introduced in the US, although there's a lot of doubt that they will go that far.

Volkswagen exec reaffirms commitment to diesel: Now it is absolutely clean - TDIClub Forums

Typical quote: "When the elctric car thing bombs (there will be a surge of interest, since the whining Euro weenies and the looney idiots in the press tell everyone that they are the future) there MIGHT be a chance to buy another diesel from someone, maybe not VW though. Too bad, since after 50+ years of involvement, I have probably bought my last ever new VW (Q7 TDI)"

Volkswagen exec reaffirms commitment to diesel: Now it is absolutely clean - TDIClub Forums

Typical quote: "When the elctric car thing bombs (there will be a surge of interest, since the whining Euro weenies and the looney idiots in the press tell everyone that they are the future) there MIGHT be a chance to buy another diesel from someone, maybe not VW though. Too bad, since after 50+ years of involvement, I have probably bought my last ever new VW (Q7 TDI)"

j6Lpi429@3j

Closed

Re:recession fears.

I believe any fears for teslas market cap during a recession are unfounded based on 2 principles:

1) Tesla is still FOR NOW a very niche car maker. They do not produce 50% of the worlds cars. They can double, quadruple or even more in their sales over the next 2,3 years without reaching any upper limit caused by recessionary pressure. They can still take the money from every BMW, Mercedes,Land Rover and jaguar owner on the planet before they even need to think about lower end sales. Thats a HUGE market.

2) EVs (especially teslas) are dirt cheap to run. Like CRAZY cheap to run. they make massive economic sense. Very easy to make the argument in the market that your next car should probably be one with super-low fuel costs and virtually trivial servicing costs. "Can you really afford to buy another gas guzzler?"

plus time is ALWAYS on teslas side. As every day goes by, the 'normalization' effect of seeing an electric car increases, the FUD looks more and more desperate, the focus on environmental issues gets stronger, and the younger, more pro-environment, pro-EV customers get older, get better paid...buy their first car.

If all I cared about was TSLA stock, and I could press a button to create a recession, I think I'd be very tempted to do it.

I believe any fears for teslas market cap during a recession are unfounded based on 2 principles:

1) Tesla is still FOR NOW a very niche car maker. They do not produce 50% of the worlds cars. They can double, quadruple or even more in their sales over the next 2,3 years without reaching any upper limit caused by recessionary pressure. They can still take the money from every BMW, Mercedes,Land Rover and jaguar owner on the planet before they even need to think about lower end sales. Thats a HUGE market.

2) EVs (especially teslas) are dirt cheap to run. Like CRAZY cheap to run. they make massive economic sense. Very easy to make the argument in the market that your next car should probably be one with super-low fuel costs and virtually trivial servicing costs. "Can you really afford to buy another gas guzzler?"

plus time is ALWAYS on teslas side. As every day goes by, the 'normalization' effect of seeing an electric car increases, the FUD looks more and more desperate, the focus on environmental issues gets stronger, and the younger, more pro-environment, pro-EV customers get older, get better paid...buy their first car.

If all I cared about was TSLA stock, and I could press a button to create a recession, I think I'd be very tempted to do it.

anthonyj

Stonks

There’s no recession, and there will not be a recession. Unemployment low, strong earnings, etc.

“Wah trade war wah bonds”

Lol get out of here. I see so many freaking Tesla’s being sold. It’s insane. INSANE. The growth has become exponential here in the northeast. I was going to start a challenge: I would buy a share every time I see a Tesla. Nope not happening. I see 20-30 a day while casually driving/shopping at Costco and the mall...

The year is 2030 and the S&P just broke the 1 million level following an algo-induced short squeeze after Trump tweets, “President Ivanka headed to China to negotiate an even better deal for USA. Chinese seriously intimidated because she’s hot.” It has now been 12 years, a trade deal is nowhere in sight and despite a global economic collapse, the market still rallies 2% every time Trump tweets that a deal is close—which happens just about every day. The occasional down days are the result of rumors that the UK has scrapped yet another BREXIT plan.

“Wah trade war wah bonds”

Lol get out of here. I see so many freaking Tesla’s being sold. It’s insane. INSANE. The growth has become exponential here in the northeast. I was going to start a challenge: I would buy a share every time I see a Tesla. Nope not happening. I see 20-30 a day while casually driving/shopping at Costco and the mall...

The year is 2030 and the S&P just broke the 1 million level following an algo-induced short squeeze after Trump tweets, “President Ivanka headed to China to negotiate an even better deal for USA. Chinese seriously intimidated because she’s hot.” It has now been 12 years, a trade deal is nowhere in sight and despite a global economic collapse, the market still rallies 2% every time Trump tweets that a deal is close—which happens just about every day. The occasional down days are the result of rumors that the UK has scrapped yet another BREXIT plan.

Thekiwi

Active Member

Re:recession fears.

I believe any fears for teslas market cap during a recession are unfounded based on 2 principles:

1) Tesla is still FOR NOW a very niche car maker. They do not produce 50% of the worlds cars. They can double, quadruple or even more in their sales over the next 2,3 years without reaching any upper limit caused by recessionary pressure. They can still take the money from every BMW, Mercedes,Land Rover and jaguar owner on the planet before they even need to think about lower end sales. Thats a HUGE market.

2) EVs (especially teslas) are dirt cheap to run. Like CRAZY cheap to run. they make massive economic sense. Very easy to make the argument in the market that your next car should probably be one with super-low fuel costs and virtually trivial servicing costs. "Can you really afford to buy another gas guzzler?"

plus time is ALWAYS on teslas side. As every day goes by, the 'normalization' effect of seeing an electric car increases, the FUD looks more and more desperate, the focus on environmental issues gets stronger, and the younger, more pro-environment, pro-EV customers get older, get better paid...buy their first car.

If all I cared about was TSLA stock, and I could press a button to create a recession, I think I'd be very tempted to do it.

in a recession people & businesses stop or delay buying new cars as it’s one of the easiest discretionary spending items that can be cut. It doesn’t matter whether it’s ICE or EVs, a recession will be terrible for all car companies regardless.

One can debate the possible long term benefits of a recession for Tesla, but if I had to place bets on what the near term effect a recession would have on Tesla market cap I would say it is far more likely to be very detrimental than positive.

Corporate taxes are at an all time low, interest rates are near rock bottom, unemployment are at rock bottom, spending at an all time high.

The only recession marker is " bull market shouldn't be running this long". That's a stupid irrational justification for a recession. Name another recession when interest rates are this low?

Automation and globalization efficiency are keeping inflation in check which keeps interest rate in check..even with a fabricated trade war China.

The only recession marker is " bull market shouldn't be running this long". That's a stupid irrational justification for a recession. Name another recession when interest rates are this low?

Automation and globalization efficiency are keeping inflation in check which keeps interest rate in check..even with a fabricated trade war China.

2

22522

Guest

in a recession people & businesses stop or delay buying new cars as it’s one of the easiest discretionary spending items that can be cut. It doesn’t matter whether it’s ICE or EVs, a recession will be terrible for all car companies regardless.

One can debate the possible long term benefits of a recession for Tesla, but if I had to place bets on what the near term effect a recession would have on Tesla market cap I would say it is far more likely to be very detrimental than positive.

Not my role to predict the future, but my response to negative interest rates is durable goods purchases. Some people spend money while they still have it.

HG Wells

Martian Embassy

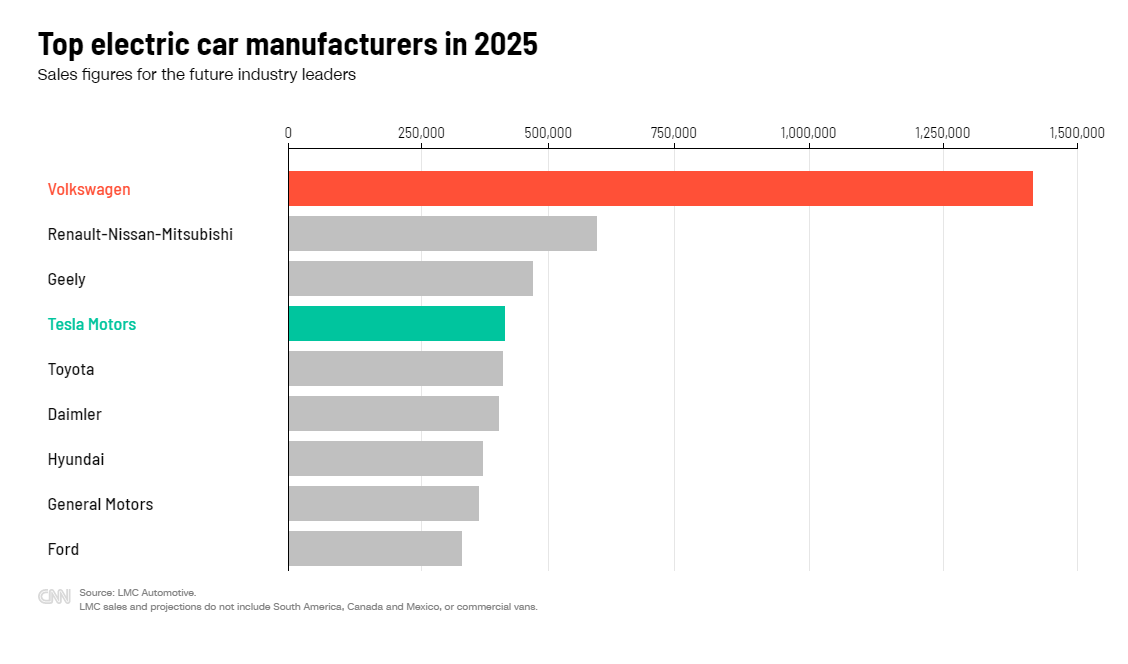

Article on CNN with projected electric car production for the year 2025.

Has Tesla only producing 412,000 per year in 2025.

The race to the electric car is just getting started

Has Tesla only producing 412,000 per year in 2025.

The race to the electric car is just getting started

Corporate taxes are at an all time low, interest rates are near rock bottom, unemployment are at rock bottom, spending at an all time high.

The only recession marker is " bull market shouldn't be running this long". That's a stupid irrational justification for a recession. Name another recession when interest rates are this low?

Automation and globalization efficiency are keeping inflation in check which keeps interest rate in check..even with a fabricated trade war China.

Because of this: “Warning signs that the U.S. economy could be barreling toward a recession quickly became alarm bells Wednesday after the Treasury bond yield curve—a key indicator that has preceded every major downturn over the past five decades—inverted for the first time since the Wall Street crash of 2007.”

Hopefully this time it’s wrong.

I wouldn’t brag too much about corporate taxes being low and interest rates near rock bottom. Those are levers that should be pulled only when we are IN a recession to help lift us out. Now when we have another recession, we cannot use those. When the economy does well, we (and the government) should not be going further into debt. That’s when we should be saving for a “rainy day”.

Unemployment and spending habits can quickly change in a matter of months. People can be extremely fickle.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M