Irrelevant to the discussion (maybe, maybe not), but possibly worth mentioning.

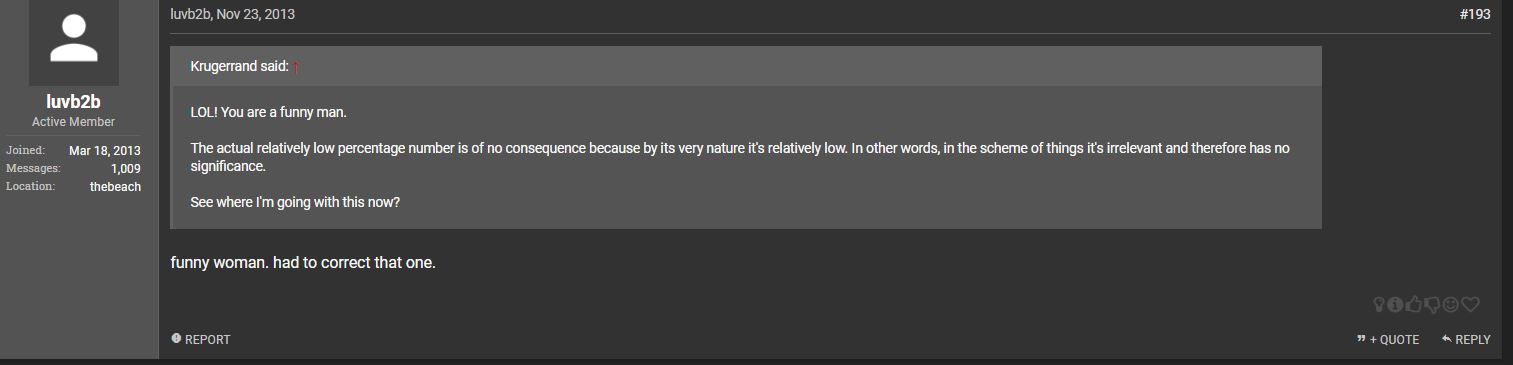

I've been following @luvb2b since 2013, and I happen to remember this post:

Firstly, a correction, I misremembered the GAAP profit @luvb2b is estimating for Q4: it's +$295m.

................

.................

He was pretty much the only modeler who expected Q3'2018 to be profitable, and got within 16% of the final profit, which was amazing.

..................

I've been following @luvb2b since 2013, and I happen to remember this post: