In case you're interested, somebody just shared your model on r/teslainvestorsclub.

Thank you for the heads up!

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

In case you're interested, somebody just shared your model on r/teslainvestorsclub.

I found it interesting that Troy is estimating 7.7k US produced vehicles sold in China in Q1 (2.4k S/X & 5.3k M3).

His total Fremont/GF3 China sales range is 15.7k - 20.7k units. That's more than I was expecting.

More than you were expecting Troy to say or more than you are expecting for delivery?

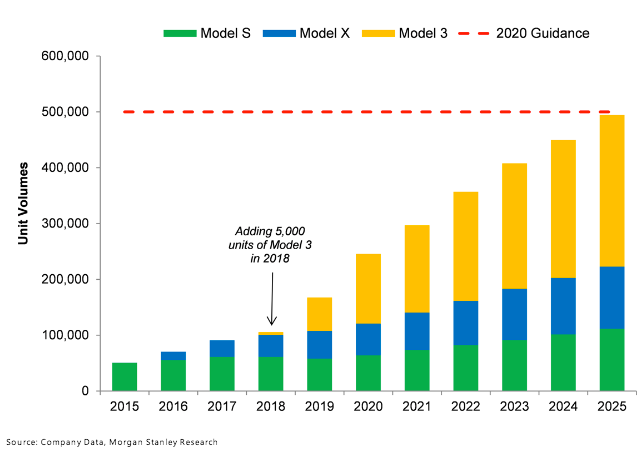

I know I keep talking about Adam Jonas but I finally found the story I read about Jonas forecast for 2020 Tesla deliveries he made in early 2016. In his research report he published on Feb 1, 2016, Jonas said he expected Tesla total unit deliveries to be 246,000 by 2020. This was in contrast to 500,000 company own guidance for 2020. Jonas didn't believe Tesla would hit 500,000 units until 2025. So he lowered his price target at the time from $450 to $333. This was on Feb 1, 2016.

Tesla Projected To Hit 2020 Unit Guidance...By 2025

We're now in 2020. We can now look back and see how accurate Adam Jonas forecast model was back in 2016. Tesla delivered 245,240 vehicles in 2018, two years ahead of Adam Jonas schedule. Tesla will likely deliver 500,000 vehicles this year in 2020, five years ahead of Adam Jonas projection for 2025. Tesla is doing what they said they would do. Adam Jonas, not so much.

So let me get this straight. Adam Jonas had $333 price target on Tesla back in Feb 2016 after Tesla barely delivered 50,000 cars in 2015. Now in Jan 2020, he has $360 price target after raising it from $250 after Tesla delivered 367,200 cars in 2019. Could this dude be anymore wrong? Why is anyone listening to this bozo? Why should we trust his new forecast to 2030 when he was so wrong before? It's not like the old days before the internet where people couldn't search what you said and your history. Internet knows and records all. Bozo analysts can no longer hide after making stupid wrong calls.

(I found your wording to be a bit confusing at first, so I'm going to first restate what I understand.)

I, inexperienced trader, had a contract for $500 strike call options at close on Friday. You said "deep in the money" but the worst case is actually near closing price, because I now buy 100 shares of TSLA for $500 each. If I don't have $50,000 liquid in my account then yes, margin call hits over the weekend. But you always have some time to arrange to satisfy the margin call. My broker (ETrade) usually gives me three trading days to figure it out. One of the ways to meet the margin call is to wire funds from somewhere else, and this always takes a couple of days, and settlement of trades takes time too (although the margin account ignores this and assumes trades are going to work). So they won't do anything on Monday (or Tuesday in this case since Monday is a holiday). That's me I'm talking about, they know I'm good for it, because it has happened a number of times, and I have plenty of capital to meet the call by liquidating other stock, not to mention liquidating the actual TSLA stock I just bought. Now if I had an account worth only a couple of thousand, including that call, they might react differently, and I can't speak for other brokers. In my case, if I have spare cash somewhere else I would try to bring it in. Otherwise I'd just sell (some of) the stock on the first trading day. I guess it is a magnitude thing, if I had 100 contracts ($5M!) they might react differently to me too... but I would definitely have reduced that before close.

You mentioned "Deep in the money" and the incentive to exercise (or hold until automatically exercised) those calls is to get a lower cost basis in the account. This implies that you intend to keep them, so presumably you have the money to do that and won't get a margin call. Or maybe you sell half and keep half. Selling the stock at the next opportunity has the same US tax consequence as selling the option on Friday would have had. Note that recently, the stock has always opened higher after the weekend; if I had $510 calls last week I'd have definitely held them rather than take the $0.50 around closing time, hoping to sell the stock for $520 on Tuesday. (I'd probably put in a limit order over the weekend in case I accidentally slept in, but my aim would be to wake early for market open to evaluate what I thought would happen. I know I have to sell, but I still want it to be to my best advantage. This might be TMI.)

A gap up is not going to be a problem. A sufficiently large gap up would actually nullify the margin call, as the value of the stock would eventually be enough to cover the margin maintenance requirement. The real worry is that the stock goes back down, and you end up owing more than you can cover, when the options would have just expired if it happened on Friday.

This is getting out of hand, and I am hoping a moderator (@ggr) would help.@Electroman

Read science fiction for the last 60 years

“What if this then that”

Imagine the future

Whom else best mirrors _your_ vision of the future

Watch a lot of different technologies

(Federal Labs Consortium gives awards to what they see are best for instance)

Be active in biotech for 50 years and learn to sequence by hand for one

(3-4 years can be done in a lazy few hours)

Realize singularities are punctuated and not evenly distributed

Look at uptake curves of technologies

It’s like we are walking on an exponential curve, flat behind us, vertical ahead, yet it keeps going

Got it, thanks. I was missing the backstory... too focused on moderator skimming.Yeah, so I said deep in the money because last week there were a lot of deep in the money calls from LEAP lottery tickets gone right, and DITM calls have one big problem: they are rather illiquid. The more in the money, the more illiquid.

So it's quite plausible that someone less experienced had 50-100 contracts open yesterday, in the $300-$400 range and couldn't roll them over reasonably. If they misunderstood how their broker handles options expiry.

For example Robinhood auto liquidates the contracts themselves 1-2 hours before the close on Fridays, if the account doesn't have enough margin to exercise - and the client might have moved to Schwab or any other bigger broker, they might not realize that they could face a margin call.

Does this explain why I said DITM? Whether $400 or $500 doesn't matter to the magnitude of the margin call if you have 100 contracts, it's 10,000 shares and $4m-$5m of a jump in margin requirements.

And if this happens in an account with say $100k funds, the broker faces a big overnight risk by holding $4m-$5m in securities that will wipe out $100k in assets with just a -2.5% drop after the weekend.

This is the scenario where I think brokers might feel forced to net out the exposure on a Friday already - and selling a few ten thousand TSLA shares is exactly what created that small spike down this Friday.

I raised the "Buffett scenario" as a hypothetical where the client loses a big chunk of money due to the broker selling on a Friday. I asked whether the broker can legally net out the position on a Friday already, robbing the client of a $4m-$5m "Buffett gap-up in TSLA".

I.e. I was probing whether the original observation by @JBRR that these are options assignment hedges were done due to a margin shortfall, or by the holders of the call options themselves.

Mod: we know the difference. --ggr.This is getting out of hand, and I am hoping a moderator would help.

There is Electroman the wise - that is me

And then there is <lightning symbol>ELECTROMAN<lightning symbol>. People often don't realize that and I get tagged incorrectly. Worse, I got banned once mistakenly.

I don't even know how this forum software allows one to create handles with some crazy symbols like that?. Not sure if I should change my handle, or if the moderator would remove such crazy characters in the handle and force the other person to change..

More than I was expecting for deliveries from Fremont.

If registrations in China are a good proxy for deliveries, then Tesla delivered 6.6k vehicles in Q4 2019 (all from Fremont except 15 to employess).

Exceeding these Q4 numbers with 7.7k vehicles from Fremont in Q1 2020 would be quite impressive....now that GF3 is up and running.

Demand now exceeds prod in Q1 for Made in China Model 3 Standard Range. Tesla says new orders will be delivered in Q2. Assuming 8-13K prod in Shanghai, Q1 China deliveries would look like this:

2400 Model S/X (US)

5300 Model 3 LR/P (US)

8-13K Model 3 SR (MIC)

Total: 15700-20700

Yeah, so I said deep in the money because last week there were a lot of deep in the money calls from LEAP lottery tickets gone right, and DITM calls have one big problem: they are rather illiquid. The more in the money, the more illiquid.

So it's quite plausible that someone less experienced had 50-100 contracts open yesterday, in the $300-$400 range and couldn't roll them over reasonably. If they misunderstood how their broker handles options expiry they could have gotten margin called.

For example Robinhood auto liquidates the contracts themselves 1-2 hours before the close on Fridays, if the account doesn't have enough margin to exercise - and the client might have moved to Schwab or any other bigger broker recently, and they might not realize that they could face a margin call.

Does this explain why I said DITM? Whether $400 or $500 doesn't matter to the magnitude of the margin call if you have 100 contracts, it's 10,000 shares and $4m-$5m of a jump in margin requirements.

And if this happens in an account with say $100k funds, the broker faces a big overnight risk by holding $4m-$5m in securities that will wipe out $100k in assets with just a -2.5% drop after the weekend.

This is the scenario where I think brokers might feel forced to net out the exposure on a Friday already - and selling a few ten thousand TSLA shares is exactly what created that small spike down this Friday.

I raised the "Buffett scenario" as a hypothetical where the client loses a big chunk of money due to the broker selling on a Friday. I asked whether the broker can legally net out the position on a Friday already, robbing the client of a $4m-$5m "Buffett gap-up in TSLA".

I.e. I was probing whether the original observation by @JBRR that these are options assignment hedges were done due to a margin shortfall, or by the holders of the call options themselves.

To make it easier for others to follow, this is related to my estimates HERE where I said this:

@The Accountant, you are mixing up Dec 2019 with Q4 2019. 6643 reported by Bloomberg HERE is the Dec number. Q4 China is 13,000 units. Model S/X was around 2900 units. Model S/X has been consistently between 2600-3000 units in the last 4 quarters. Therefore 2400 is actually a conservative estimate.

As for 5300 Model 3 LR AWD and Performance versions delivered from Fremont to China, here is my calculation: In my Model 3 Survey here, 69% of deliveries reported in Q4 2019 were Model 3 LR AWD or Performance version. These are Model 3 sales numbers in China:

7,750 in Q1 2019

8,500 in Q2 2019

7,600 in Q3 2019

10,100 in Q4 2019

If there was no Shanghai factory, a good estimate for Model 3 deliveries in China in Q1 would be 7700 units. Assuming 69% of those would be LR AWD/P, that means 7700*0.69= 5300 would be Model 3 LR AWD or P. The price of LR AWD/ P has not changed in Q1 compared to Q4 and these models don't qualify for government incentives and Tesla's China website shows that only the SR version will be made in China (at least for now). Therefore there is no reason to think that LR AWD/P sales will be any different than it was in the last few quarters. Therefore 5300 LR AWD/P looks like a good estimate to me.

To make this easier, the second table below shows what we know so far about Q4.

The motivation was that Buffet has (had?) a large stake in BYD motors, a potential Tesla competitor).

I vividly remember the interview right after the byd investment news and their investment thesis is that byd is a battery tech leader with great potential in energy storage and EVs.

None of those are true anymore.

And buffet didn't invest in Apple when it was really on the explosive expansion. He invested in IBM.

He still believe in moats, where old brand can easily raise price and get oversized profit. And that was the reason he bought IBM. Because "nobody got fired buying IBM".

With the internet, it's getting harder for the buffet brand to do that.

Happily report my personal portfolio handily beats berkshire in the past 5 years. And I can see I am not a successful investor comparing to many others here.

My friends, don't sell yourself short. In the past year you showed great insight into the technology and social trend, much better than buffet. I would trust you guys much more than buffet. The day buffet begin to invest in Tesla, is the day I seriously consider taking profit and slowly getting out.

Jordan John Szeliga was arrested on Jan 8 for reckless driving while test-driving a Tesla in Troy (Photo: Oakland County Jail)

"A Lake Orion man is facing multiple charges after allegedly going 130 mph while test-driving a Tesla."

"As they searched for the vehicle, police received more calls that the Tesla was racing down Big Beaver Road in Troy and doing doughnuts in a parking lot located at 755 W. Big Beaver Road, according to WDIV."

Lake Orion man arrested after taking Tesla on 130-mph test drive on I-75

Posted just because the picture is funny.

While Buffet buying Tesla shares is technically possible, Buffet put in legislation that would have prevented Tesla from having Service Centres in Texas. That clause got removed from the legislation, but certainly Buffet is no Tesla fan.

This could be a dark gray swan event with the new year travel planes.

Coronavirus cases could be grossly underestimated, study says - CNN

Three U.S. Airports to Check Passengers for a Deadly Chinese Coronavirus

Not too sure I'm abreast of all that terminology, but I like!Lol, Shortzes don't need the right STANKIN' investigatation. Poor shortzes stayin' after work on a Holiday Friday and readin' this forum blew $561K after 18:45 hrs shorting TSLA into the close of the After-hrs session (notice no change in the macros? QQQ)

View attachment 501642

Don't worry about it. Volume in their 'short' spree was HALF what it was before 18:45 hrs. ROFLMAO. Nobody cares. VWAP b4 18:45 hrs $510.63 18:45 and $505 afterward. What a waste of money.

They're jus' tryin' to piss you off and ruin you long weekend. Don't let 'em. They're nothings, pissants*. Water buoys while the bozz is off at a fancy NYC restauant. Sad losers, ho!

Cheers!

*Advice for Shortzes: When you're in a hole, first rule is 'stop digging'. The other rules, well you're gonna learn the hard way...

Aha! That must be the Stellar Cellar Seller Notwork hard at work. QED. Or TSLAQ-ed maybe?The weird thing is it was 500,000 cars suddenly accelerating at the same time.