Before I address your robotaxi concerns, let's start with this. I don't believe Elon's claim that Tesla Energy has the potential to be bigger than its automotive business because:

[...]

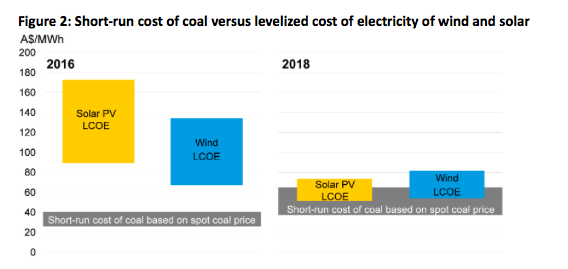

Thanks for sharing your numbers. As the other poster, I feel like the BloombergNEF numbers probably don't take into account the potential of replacing a decent chunk of the current grid power generation capacity with wind/solar/storage. And the 122x number is big but too far in the future. I'd rather look at a more detailed picture of the next 10 years than a fast and loose guesstimate of the next 20. If we're already today at the point where utilities are

closing current coal plants and

natural gas peaker plants in favor of cheaper renewables, I have a hunch we may be at the start of an S-curve of deploying renewable power generation -- it shouldn't take much of a cost benefit to entice operators to switch, and there's only a little more incremental advance in price/efficiency before "borderline cheaper" becomes "obviously you'd be stupid not to do that." One of the articles I read said it won't be economical to replace fossil fuel plants elsewhere in the world until at least 2024... but I read that and hear "those fossil fuel plants are going to be non-economical REALLY SOON."

The wild card is that I don't know how much storage will actually be batteries -- I've heard of a number of alternatives. Though I guess in the real world, something already mass-manufactured like batteries will probably win the next 10 years over something that's currently being demonstrated in a lab/on a small scale.

On a related note, if the

subsidized-home-battery-as-distributed-grid systems take off, I think any estimates of the organic growth of PowerWall systems would prove to be way too low.

This will be a lot easier after the Battery & Powertrain Day -- if they give target dates for 2 TWh, we can split auto/energy and work backward from the battery capacity and see how it lines up with any estimates of future market size of each, and maybe meet in the middle.

I understand your viewpoint which is based on what car ownership is like today. However, car ownership is going to be vastly different from what it is today when full autonomy arrives. When Tesla has an FSD system that is safer than a human and gains regulatory approval, I expect them to bundle this as standard on every single vehicle just like they've done with autopilot. I also expect the price of this FSD system to be significant. Elon has talked about $100k+ in the past, but even if it just costs costs a lot less like $20k, up front costs of vehicle purchases will increase significantly, while at the same time robotaxis will reduce the price of transportation on demand significantly.

As a result, car ownership will change drastically from what it is today. Many more people will simply rely on robotaxis for transportation, because it will be cheaper than private car ownership is today. Private car ownership today is about

$0.60 per mile, but transportation by robotaxi is likely to be similar or cheaper (in my model it's $0.33). If the increased up front costs of cars increases the cost of private car ownership from $0.60 to say $0.70 or $0.75 per mile, while at the same time a robotaxi costs $0.50 per mile, simple economics indicate that most people will no longer own a car without renting it out as a robotaxi. And probably most cars will be bought by fleet operators rather than individuals.

OK, so let's say the average cost of a new car is $60K (up from roughly $40K today) and it includes full autonomy:

- I can't think the market for used cars or cheap non-autonomous cars is going to go away. The quantity of "people who can't afford a $60K car" is vast, and some car manufacturer will see that and address it.

- I don't think the economics of earning money from your car as a Robotaxis outweigh the feeling of (as another poster put it) "I don't even let my wife drive my Model S." Don't forget, your Model S is my Model 3 -- the most expensive car I've ever bought by a huge margin, and not one I want strangers riding around in without me. I mean, let's say 100K miles billed per year and I earn 10 cents a mile (somewhat splitting the difference between $0.33 cost and $0.50 bill with Tesla)... There's no way I would accept $10K/year in return for not loving my ride, but instead constantly worrying about the condition it's in and whether I'd even be ABLE to take it for a drive and needing to clean and maintain it and etc. Just daily washing in the winter when a couple hours of driving makes the outside look like complete crap would be an enormous chore. Today I pick the 50 degree days to do it, and they're not very frequent. The next week the highs are all in the 30s and 40s and this isn't even really the cold part of the country. No thank you!

The model isn't supposed to give a pin-point accurate prediction of the future, but rather to help understand the potential economics of the Tesla Network AMaaS business. Full FSD not being here in 2024 would shift the numbers around a little bit, but not by that much, because it's a simple software update that Tesla has to send out to its vehicles. The biggest impact on these numbers far and away are Tesla's production numbers. If Tesla produces significantly more or less vehicles than the estimations in this model (that is a little aggressive btw), that'll impact the numbers quite a bit.

Well... so that's I guess the root of my issue. I don't disagree that this is a useful exercise to understand the potential economics. Completely true. But if we're going to say "this stock is heading to $2500 on the basis of earnings of $50/share" then I am not willing to base that on understanding the potential economics.

I wrote about this awhile ago

I'm sorry, this quote lost the meaningful part. If I can paraphrase, it was "if you mistreat the Robotaxi, you may get kicked out of using the network. Therefore people won't do it."

I don't find that at all realistic:

- We can't say both "nobody will be able to afford cars and everyone will use Robotaxis" and "the undesirables won't be allowed to use Robotaxis." Talk about post-apocalyptic! The underclass of people who are denied basic transportation.

- Maybe there will be fines or surcharges instead, except it doesn't take very much of that before $0.50 per mile plus charges for a Robotaxi outweighs $0.70 per mile for a personal vehicle.

- There's a park I take my kids to, two miles down the road. There's busy roads and crossroads with no sidewalks or shoulders; for basic safety we have to drive there. It has a muddy creek. My kids like to play in it, whether planned or not. Afterward, we have to get home. Are you saying if we call a Robotaxi to do it, and muddy up the seats, we'll get kicked out of the network? And yet, we have to get home! And yet, we won't have a personal car any more because it's so much cheaper to use Robotaxis? Today, we just clean up our car afterward. We intentionally got one with seats that are easy to clean, because kids. But I wouldn't keep a Robotaxi on the clock just so we can clean it. If we summon a Robotaxi all wet and muddy and the one that shows up has cloth seats, we're not going to keep retrying, we're just going to make them dirty. Sorry. (There's also the park with a sand lot, there's the days we go hiking on dirt trails, there's the times a kid unexpectedly vomits in the car, etc.)

- It's one thing to be in an Uber with the driver/owner right there. It's another thing to be in an anonymous Robotaxi with a camera. I think the potential for misbehavior is much higher when there's no human there. Especially if you think it's just owned by some large anonymous fleet. Worst case, slap some duct tape over the camera. You know how people behave on the Internet vs in person; I think there will be an element of that in the Robotaxi vs the taxi-with-driver.

Also, what about car seats? If my kids and I Robotaxi to the grocery store, we what? Carry a bunch of car seats around in the grocery cart so we can get home in a different Robotaxi? Keep the original one needlessly on the clock for an hour? Besides, have you every tried to actually install a bunch of car seats at once with your kids waiting? Who wants their Robotaxi to show up while they're standing around with cranky kids and melting ice cream and a pile of car seats that need to be installed? And what are the odds that all those hurriedly-installed seats will be fully and correctly attached?

Maybe you can summon a Robotaxi with car seats installed, but with the various combinations of kid ages and seat types (forward, backward, booster, etc.) and he-doesn't-want-to-sit-by-her-today it seems unlikely that just the right configuration will be standing by.

We also keep an empty plastic cup or bin in the car in case we see a kid vomit coming in time, and a cleanup bag with wipes and cleaning spray and paper towels and plastic bags and a minimal clean kid outfit... Not going to be carrying that around for every Robotaxi ride.

Also we have spare tubes for the bikes (several sizes). And puzzle magazines in case instant entertainment is required. And headphones, for those long trips where iPads come out. And a hair band, for my daughter with long hair. (At least we won't need the change for parking meters any more!)

And my kids leave random food/drink containers or individual french fries or peanuts or the occasional chicken nugget behind

all the time. Not to mention toy wrappers and unwanted Pokemon cards and chunks of crayons and favorite sticks and rocks and whatever. I mean, they're kids! We clean the inside of the cars from time to time, because we need to. We use a vacuum. Will Robotaxis come with a vacuum so we can clean it out if it drops us somewhere other than home? Or do we need to carry one of those around too?

If I could take Robotaxis but had to make them spotless after every single trip, that would not be an attractive offer. Yeah, we do that when we take a cab in NYC, but not in everyday life.

All right, sorry, this got a little out of control. Rant over! I just feel... there are so many reasons why major changes to human attitudes and daily life would be required Robotaxis take over the world. It's not like we'll up and make all those changes for $5K. Or $10K. Or whatever. It will take time, and I'm not sure how high the percent-Robotaxi can

actually go. We have this personal ownership model because it works

really well. Not that nothing can be better, just there will be a transition, and I suspect it will take much longer than the transition from ICE to EVs.

Not that I'm necessarily right.