Sudre

Active Member

How many times can you burn toast before it is simply no longer toast and just a charcoal briquette?we're starting to hit short burn of the century territory again. lol

776.00 +30.79 (4.13%)

After hours: 6:19PM EDT

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

How many times can you burn toast before it is simply no longer toast and just a charcoal briquette?we're starting to hit short burn of the century territory again. lol

776.00 +30.79 (4.13%)

After hours: 6:19PM EDT

Wasn't there a point last time when we just skipped an entire $100s section in a day?Smells like 800+ tomorrow guys... be ready for lift off

We skipped 800. It went from 790 to 900 or something insane. Then went to 969 and plummeted to 880’s in the last 15 min of trading.Wasn't there a point last time when we just skipped an entire $100s section in a day?

I'd say be ready for one of those contact the SEC moments to see how useless they are. You know one of those headlines at 5 minutes before close that quickly gets taken down after the signal has been sent.

That's nothing. My neighbourhood GM, Ford, Chrysler, BMW, Volvo, Mercedes and VW dealers have far more on their lots, each.

paging @FrankSG I like your description of how delta hedging by MMs of large swings in Options contracts affects the no. of shares bought/sold by those same MMs. (while claiming no understand of the process)

Yeah, it's $1.2 Million bucks worth (vs SP @ $676):

View attachment 532096

Options can be executed After-hrs, upon instruction of the broker by the Options owner. This is a good move if TSLA's SP continues back to its fair value price (currently around $750 according to Wall.St)

Somebody's sorry they sold those Calls...

Ford starting to experiment with high-tech manufacturing techniques in the age of Coronavirus:

Ford Tests Buzzing Wristbands to Keep Workers at Safe Distances

Yeah, did you see the Call Options volume at the $800 Strike today? There were 14K open contracts at 12:45 pm (that's a million shares of trading power)I wouldn't be surprised though to see them intensify any move up beyond $800 tomorrow if macros hold and if the stock breaks through. However, because they expire tomorrow, they're also likely to put a damper on any run up at some point when the owners take profits on them and MMs unload the shares they held as a delta hedge.

What makes this mechanism so powerful in TSLA right now is that not enough people are willing to sell TSLA when it goes up by $10, $50, or even $100. Too many shares are locked up in the hands of long term super bulls, and the TSLA options market is enormous (relative to market cap far and away biggest out of any large company).

So what happens is:

This is why TSLA can move up $100 in a day two days in a row on Feb 3rd and 4th on almost no news, and now again at the start of this week.

- Every $10 move up requires MMs to buy a ton of shares in order to hedge risk.

- Because often too few people are willing to sell TSLA for a $10 move up, these shares bought by MMs drive up the price even further.

- The further price increase forces MMs to buy even more shares to hedge risk, and the loop starts all over again.

I don't know exactly when and to what extent each option forces MMs to delta hedge, we'd have to get @ReflexFunds 's input for that. So I don't know whether these $800 call contracts influence the SP as soon as the trades are executed, or upon the first $10 move up, or not until SP gets close to $800, or not at all until MMs decide the battle to hold $800 is lost.

I wouldn't be surprised though to see them intensify any move up beyond $800 tomorrow if macros hold and if the stock breaks through. However, because they expire tomorrow, they're also likely to put a damper on any run up at some point when the owners take profits on them and MMs unload the shares they held as a delta hedge.

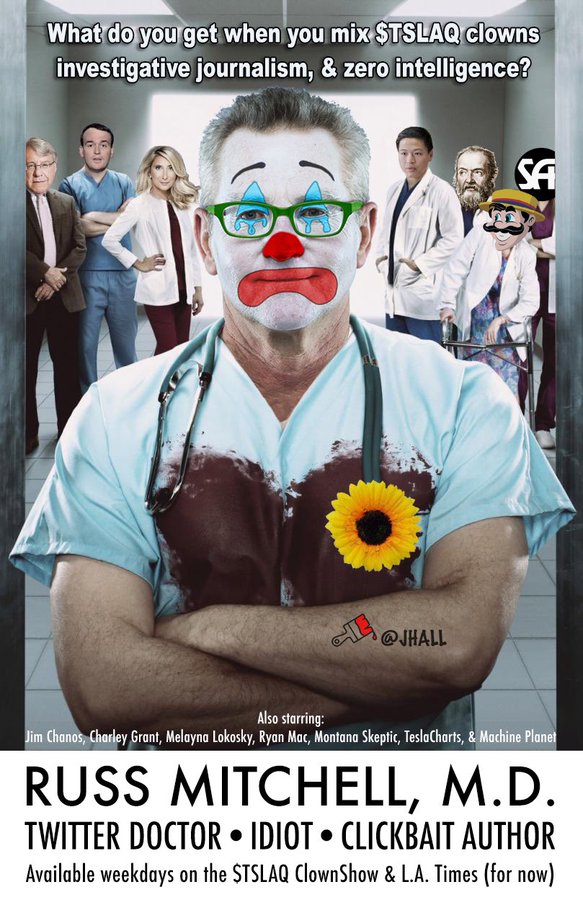

The fact that a LA Times auto reporter went to a hospital to ask employees about ventilators during a pandemic for the sole purpose of believing that Musk’s donation was not in good faith makes Russ a despicable person.

There’s no reason to do this outside of trying to create a bad story out of a good one. Then for a CNN employee to attack Musk on twitter for not doing their job for them (investigating a claim) is unreal.

I’m glad he’s defending himself on this one. There wasn’t anything negative about what Musk did, he’s done his homework, he checked with the hospitals and told them what he could get them. Didn’t even ask for a dime.

Anytime one thinks Tesla fans are crazy just look at the depths people go to make the company seem incompetent and fraudulent. Luckily the current stock price indicates people see the nonsense others create.

Yeah, did you see the Call Options volume at the $800 Strike today? There were 14K open contracts at 12:45 pm (that's a million shares of trading power)

EDIT: There were still 7.65K open contracts at the $800 Strike at end-of-day. There's also 7.5K at the $1,000 Strike, and another 11.5K call contracts open at $1,880

So I don't see the MM buying interest due to delta hedging going away when we break $800 tomorrow. That may happen at the Open, followed by a zoom climb as Options holders try to 'buy themselves into the money'...

Question is, how is NEXT weeks options market going to affect the SP, so we know how to position ourselves at the Close on Friday.

GLTA.

View attachment 533101

So the most common translation of "fastor" is:Ford keeps trolling Tesla. Charging network to be called "fastor charge" is fastor faster than super?Ford Supercharger Network Named in Trademark Filing

Each option has available, in pretty much every trading platform / website, the delta associated with that option. Delta is the size of the change in the option price for a $1 change in the underlying (TSLA in this case).

So an option with a .40 delta, that covers 100 shares, will move $0.40 / share ($40 per contract) for a $1 move in the underlying. At least in theory, a market maker will need 40 shares to stay balanced. But they probably already have 39 shares from when that same option had a .39 delta, so they really only need 1 incremental share.

This is all dynamic, and market makers have a lot of moving pieces (new short positions to balance, new long positions, options that balance other options, and probably more stuff I don't know about). My understanding is that the market maker(s) are the primary counterpart to most option buys and sells (they're making a market), so it's the net position they need to delta hedge, and the net delta of their position on either side.

My image on this is a seriously sophisticated program running at each market maker, analyzing each available trade on the market maker's overall portfolio in that underlying, for every underlying (hurts or helps the delta position), and what change needs to be made to maintain neutrality with every change in the share price. Because if you don't adjust for an hour and the share price moves $25, you could lose a lot of money. Or every half hour, or every 15 minutes - the natural limit on that is to be continuously updating as the market maker.

I think you're fundamentally right about the dynamic. More and more shares ending up in the hands of people with a very high sell price, and willing to wait to get it. Some will be happy to sell at $1000; some at $1200; some at $1500, etc.. And some of us might not sell even at $5000 (I can readily admit that while I think the stock is going way beyond, at $5000 we have a dramatically better retirement than we've been planning on, and not selling starts getting hard). The point being, as you identified, that the number of shares that can be acquired for delta hedging is much smaller than the ~180M total shares would suggest, even after you reduce that for Elon and other institutional holding.

Does that mean you noted it twice?

Dan

LoL, their cars are not cheaper or lighter. He should have just talked about "drives like a Porsche and the quality expected from Porsche". I mean I give them that, the materials they use inside the cabin is more higher end because they don't have PETA harassing them yearly at investor meetings...