Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Causalien

Prime 8 ball Oracle

All great points ... but i am still waiting for TSLA to go on sale before adding to my long position... time will tell if this is a smart move...

no one on this board has convinced me otherwise ... i do need to increase my purchase price points on my limit orders to reflect last couple months ... still kicking myself for not going all in back in March /early April .. we will probably never see those prices again

my SP Model for YE 2020 is $650-$750 range so I will hold fast till we see this range again

Going all in at this point is pretty unwise. Even the pie in the sky scenario at $3000 only brings you about 3x (or 6x at the low of this year) return. That is not enough, in my opinion, as a risk/reward ratio to go all in. It was good enough to risk 25% of your net worth to gain 25% though. I've just tallied all my trades recently as I am doing taxes and realized that even through very conservative trades and cost averaging down (then up along the V). PPL should be able to increase their net worth by 25%.

assuming taxes are not a concern, what would you say is the difference between not going in and selling at this moment? Are you saying the current risk:reward isn't worth it? Wanted to see what you think, not trying to argue.Going all in at this point is pretty unwise. Even the pie in the sky scenario at $3000 only brings you about 3x (or 6x at the low of this year) return. That is not enough, in my opinion, as a risk/reward ratio to go all in. It was good enough to risk 25% of your net worth to gain 25% though. I've just tallied all my trades recently as I am doing taxes and realized that even through very conservative trades and cost averaging down (then up along the V). PPL should be able to increase their net worth by 25%.

This spat with Bezos again looks very bad for Elon. The last thing we need is more evidence that he’s being taken in by Coronavirus conspiracy theories. Undoubtedly Amazon had very good reasons for suppressing dangerous disinformation during a Global Pandemic, and it is incredibly disturbing to see more evidence of Elon being taken in by these anti-Science conspiracy theories, and criticizing a public service by Amazon in quelling the disinformation.

please do not reply here. If anything, please reply in the coronavirus thread. We do not need to go down a rat hole, but it is very important for investors to be aware of something this important.

please do not reply here. If anything, please reply in the coronavirus thread. We do not need to go down a rat hole, but it is very important for investors to be aware of something this important.

RobStark

Well-Known Member

This spat with Bezos again looks very bad for Elon. The last thing we need is more evidence that he’s being taken in by Coronavirus conspiracy theories. Undoubtedly Amazon had very good reasons for suppressing dangerous disinformation during a Global Pandemic, and it is incredibly disturbing to see more evidence of Elon being taken in by these anti-Science conspiracy theories, and criticizing a public service by Amazon in quelling the disinformation.

please do not reply here. If anything, please reply in the coronavirus thread. We do not need to go down a rat hole, but it is very important for investors to be aware of something this important.

Debunking and exposing incorrect information is much more effective than supression.

"Suppression" just adds fuel to the "conspiracy theory" fire.

Causalien

Prime 8 ball Oracle

assuming taxes are not a concern, what would you say is the difference between not going in and selling at this moment? Are you saying the current risk:reward isn't worth it? Wanted to see what you think, not trying to argue.

Not understanding the bolded part completely

But if it is what I think it is. Selling means getting out of potential future earnings. Which is about 3x. While the downside is probably a loss of 50%. Which, when it comes to mature tech stock is still a good deal... provided you categorize tsla stock in your holdings as matured tech, not risk play. But holding or selling at this point has a lot to do with tax. Because if you needed to access the capital, you can just ask the bank to provide a loan based off the asset. I am assuming that ppl who hold this and debate about selling have been invested for at least a decade and hence there are significant asset value to do this and significant cap gains.

For an all in risk play... Ya, the risk reward ratio is not good enough. But at the same time, going all in should only be a viable strategy when your net worth is below a certain point. I am conservative, so going all in should only be done at below 200k. There are ppl who manages to still go all in and win at million+ net worth, I am not that person. The variable is that my definition of going all in is when you risk the value going to 0. And for a chance that you lose it all, a 3x reward is not worth it as it can be easily achieved by starting a business.

Simply put, I am in long for the majority of my Tesla stake, but play the short term patterns with a smaller percentage for operating expenses. Working well so far and plan to continue.

Hock1

Member

That will not continue to be a good strategy. If you are counting on winning the short term game to live, you probably should not be in the market, IMOSimply put, I am in long for the majority of my Tesla stake, but play the short term patterns with a smaller percentage for operating expenses. Working well so far and plan to continue.

Giga Britain looks to be a possibility Elon Musk jets to UK amid Somerset Tesla factory plans - reports

Thekiwi

Active Member

For an all in risk play... Ya, the risk reward ratio is not good enough. But at the same time, going all in should only be a viable strategy when your net worth is below a certain point. I am conservative, so going all in should only be done at below 200k. There are ppl who manages to still go all in and win at million+ net worth, I am not that person. The variable is that my definition of going all in is when you risk the value going to 0. And for a chance that you lose it all, a 3x reward is not worth it as it can be easily achieved by starting a business.

Agree with this, once past a certain point where the potential loss would impact the quality of the rest of your life in a major way, the odds just don’t stack up for an “all in” investment (especially when the “easy” 10x-20x appreciation has already been experienced). Everyone reaches that point at a different stage depending on age, dependents, life expectations and future earning power.

That will not continue to be a good strategy. If you are counting on winning the short term game to live, you probably should not be in the market, IMO

Not to live, just taking advantage of the current patterns for short term. I realize they change, that’s why most of my Tesla stake is long.

tinm

2020 Model S LR+ Owner

Some concrete progress in GigaBerlin:

I know it’s only a one-time thing (stretched over about a year) but, given it’s well-known that the making of concrete is a huge contributor to greenhouse gases, I’m curious how much CO2 etc is being generated in order to build GigaBerlin. Has Tesla said anything?

Artful Dodger

"Neko no me"

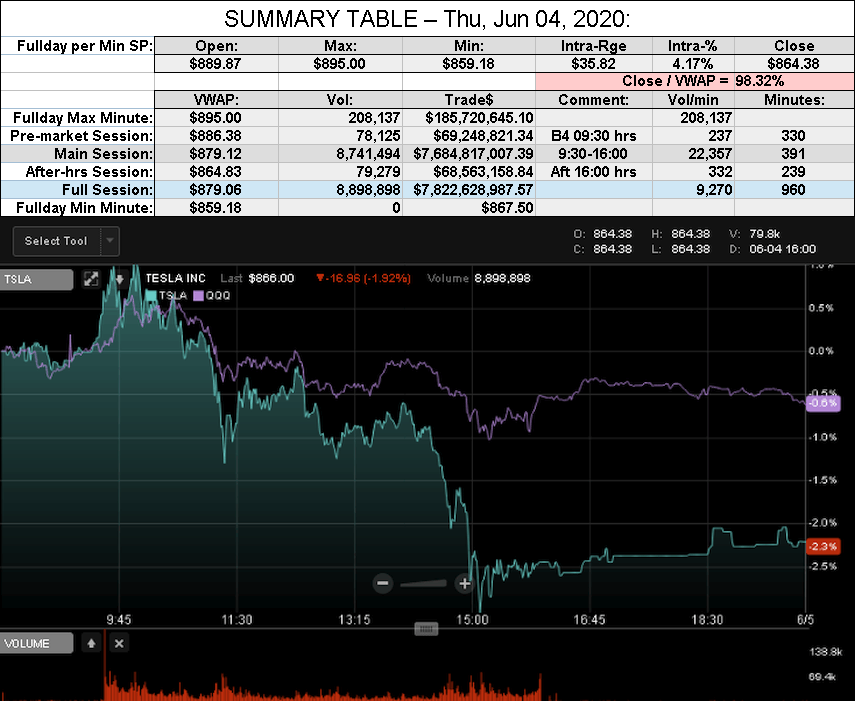

After-action Report: Thu, Jun 04, 2020: (Full-Day's Trading)

FINRA Short/Total Volume = 53.9% (51st Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 51.3% (52nd Percentile rank FINRA Reporting)

FINRA Short Exempt Volume was 0.80% of Short Volume (47th Percentile rank).

Comment: "Macro-assisted slump shoves TSLA to Max Pain"

VWAP: $879.06

Volume: 8,898,898

Traded: $7,822,628,987.57 ($7.82 B)

Closing SP / VWAP: 98.32%

(TSLA closed BELOW today's Avg SP)

Volume: 8,898,898

Traded: $7,822,628,987.57 ($7.82 B)

Closing SP / VWAP: 98.32%

(TSLA closed BELOW today's Avg SP)

FINRA Short/Total Volume = 53.9% (51st Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 51.3% (52nd Percentile rank FINRA Reporting)

FINRA Short Exempt Volume was 0.80% of Short Volume (47th Percentile rank).

Comment: "Macro-assisted slump shoves TSLA to Max Pain"

oh well i am conservative in my models i guess.. you need to have a realistic model for your own estimates we don't have to agree ... there is a lot of uncertainty but this is where i am at right now ... i dont try to time the market per se ... i try to buy at bargain prices ... which the market irrationally gives us from time to time ...So to get to those numbers, which I think Tesla will hit it in terms of vehicle P/D for 2020, Tesla will need to make and sell around 175k-200k in Q4. That's likely a quarter of revenue that will be 10-11 billion. Nearly double the revenue of Q1 with very likely higher margins in the same year.......Q1 in which the share price was higher than your 650-750 range for EOY 2020 share price.

Definitely everyone should have their own strategy for when they buy and such, but the logic doesn't add up there.

i use my crude model to tell when the stock is on sale ... i am not always right ... but it is better than guessing

to clarify ...when i say all in I mean available cash on hand ... ~20% TSLA todayGoing all in at this point is pretty unwise. Even the pie in the sky scenario at $3000 only brings you about 3x (or 6x at the low of this year) return. That is not enough, in my opinion, as a risk/reward ratio to go all in. It was good enough to risk 25% of your net worth to gain 25% though. I've just tallied all my trades recently as I am doing taxes and realized that even through very conservative trades and cost averaging down (then up along the V). PPL should be able to increase their net worth by 25%.

nope .. never done options ... taking some classes now to refresh the strategies i learned in college ... possibly when i retire...i think you need to spend a lot of time on options .. not sure i want to spend my time that wayAre you selling slightly OTM weekly puts while you wait?

tinm

2020 Model S LR+ Owner

I know it’s only a one-time thing (stretched over about a year) but, given it’s well-known that the making of concrete is a huge contributor to greenhouse gases, I’m curious how much CO2 etc is being generated in order to build GigaBerlin. Has Tesla said anything?

Good grief. To the people rating this “funny” or “disagree”, I just gotta know what part of that post triggered that, especially the disagrees:

- I know it’s only a one-time thing (stretched over about a year)

- but, given it’s well-known that the making of concrete is a huge contributor to greenhouse gases,

- I’m curious how much CO2 etc is being generated in order to build GigaBerlin.

- Has Tesla said anything?

Environmental impact of concrete - Wikipedia

Causalien

Prime 8 ball Oracle

to clarify ...when i say all in I mean available cash on hand ... ~20% TSLA today

Right. Then it is a different matter.

However, if you consider the recovery. TSLA has completely recovered while some other stock has not. I will take a playbook from what I did in 2008.

Assuming the economy eventually recover, which businesses can survive this and how much return will their recovery give me.

It is best to Assume that there is a second wave (because which pandemic doesn't have a 2nd wave?) , which business is being reckless and which business is not. I've already done this in March and most of the survivable business have 6 month of cashburn leeway the ones deemed non survivable by me had 3 months. In July, we'll get an update of their real cash burn under real pandemic settings and ppl will have a better idea on which business can survive and which cannot.

MC3OZ

Active Member

I’m curious how much CO2 etc is being generated in order to build GigaBerlin.

While it is unfortunate, it is necessary to build Giga Berlin...

Telsa is planting a forest, which will help offset those emissions..

I hope we can find better ways of making concrete, if "Flash Graphene" scales as hoped, we can add Graphene to all kinds of things including concrete to make them stronger... meaning we need to use less.

All sorts of things can be done to make construction more sustainable, sustainable energy and transport is a good first step.

Electrek - half hour ago: Tesla quietly acquired automated manufacturing firm to design factories - Electrek

Only 10 miles from where I live.

Interesting that this has been kept quiet for 2.5 years.

Is this where Tesla designs "the machines that make the machines that make the machines"?

If so, it all starts here.

Here's the Linked-in description of the guy who runs the operation for Tesla, as he did before it was bought by Tesla in 2017: https://www.linkedin.com/in/brian-greviskes-b01842b

I suppose that if the unit were in Silicon Valley, it would've been hard to hide. Instead it's tucked away in a relatively secluded spot in a far western Chicago suburb. Apparently the engineers employed there have been pretty good at not bragging about their work.

Below is a 2020 overhead view from Google Maps, which describes Compass Automation as being "closed".

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K