That's exactly why it's funny. Milton talks big game but it seems subconsciously he wanted to be Elon.Kinda like what Elon said (about TSLA being volatile and if you can’t handle it you shouldn’t own the stock). Only what Elon said actually made sense.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Sudre

Active Member

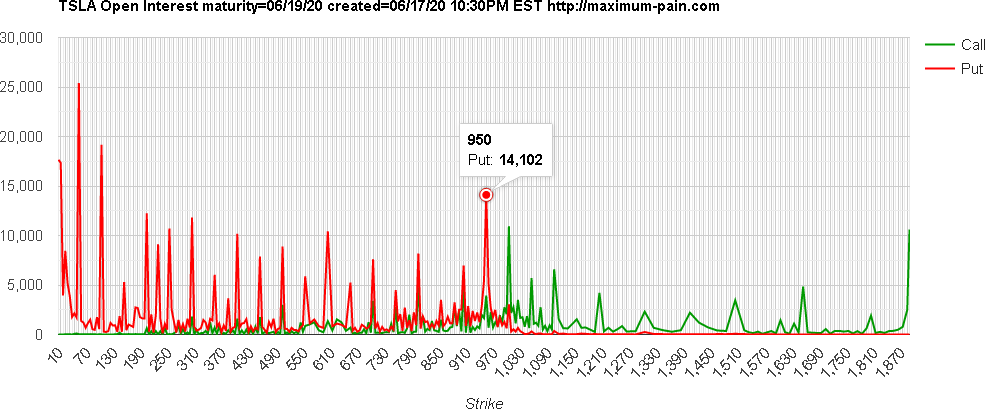

Next week is shaping up to be interesting. Somebodies are expecting news by next Friday. Some pretty high CALL strike prices out there.

I find it perfectly normal. Just like when people have cheat meal. It keeps the spirit going. To me the question is "If you're gonna trade, should you trade a stock you're familiar with or something else completely foreign?", not "Should you trade a stock you're holding a long position in?"I get a kick out of the concept of "trading shares". It is nothing more than a justification to succumb to one's gambling instinct and/or the belief that one can time his/her trades in and out of a good long-term investment and "gild the lily", so to speak. I.e., outsmart the market. Losers' game.

Last edited:

Probably explains why when i try to short NKLA...it has the 'hard to borrow' message, same thing for Boeing.This article I came across yesterday helps explain wth is going on with NKLA and NKLA options.

Apparently <10% of all shares outstanding are currently tradable, and within the next month or so the float will increase in size by 200-300%.

A lot of the people who are not able to sell their stock yet, but will be able to in a month or so, are willing to pay HUGE premiums to lock in a profit now. They're willing to buy ridiculously expensive PUT options and pay ridiculous premiums for shorting to effectively lock in a selling price of ~$30, which is still much higher than what they invested at.

Artful Dodger

"Neko no me"

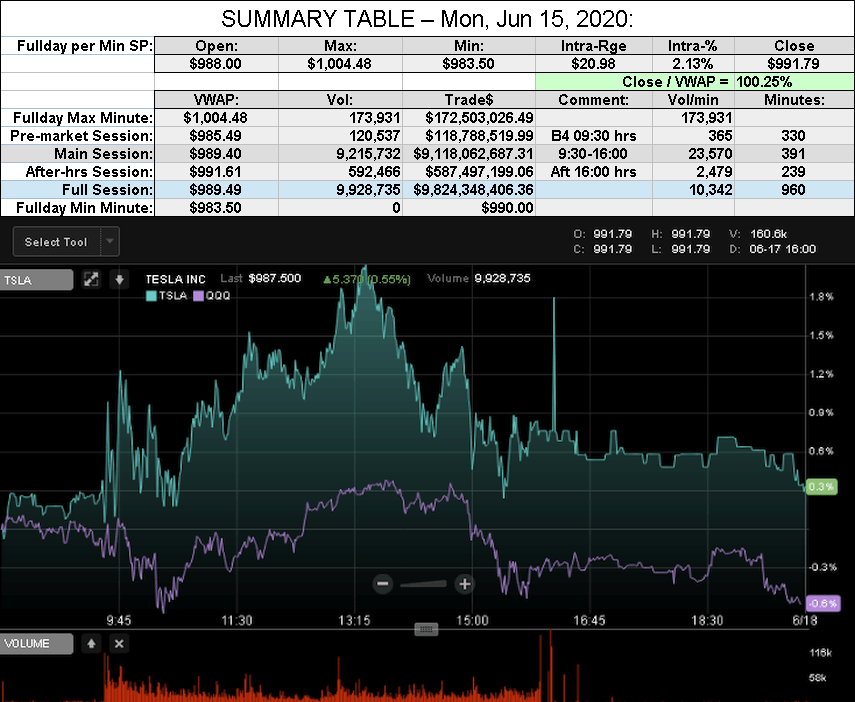

After-action Report: Wed, Jun 17, 2020: (Full-Day's Trading)

Headline: "TSLA in a tight trading range as macros drift sideways"

FINRA Short/Total Volume = 56.6% (52nd Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 57.7% (58th Percentile rank FINRA Reporting)

FINRA Short Exempt Volume was 0.65% of Short Volume (46th Percentile rank)

Headline: "TSLA in a tight trading range as macros drift sideways"

Traded: $9,824,348,406.36 ($9.82 B)

Volume: 9,928,735

VWAP: $989.49

Closing SP / VWAP: 100.25%

(TSLA closed ABOVE today's Avg SP)

Mkt Cap: TSLA / TM = 183.952B / 179.688B = 102.37%

Volume: 9,928,735

VWAP: $989.49

Closing SP / VWAP: 100.25%

(TSLA closed ABOVE today's Avg SP)

Mkt Cap: TSLA / TM = 183.952B / 179.688B = 102.37%

FINRA Short/Total Volume = 56.6% (52nd Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 57.7% (58th Percentile rank FINRA Reporting)

FINRA Short Exempt Volume was 0.65% of Short Volume (46th Percentile rank)

Kinda like what Elon said (about TSLA being volatile and if you can’t handle it you shouldn’t own the stock). Only what Elon said actually made sense.

Making sense and being short TSLA ARE mutually exclusive.

View attachment 552810

I’ve had customers build pergolas:

View attachment 552808

I’ve had customers hide their panels behind parapet walls

When it comes to solar less is more. In my opinion.

Here's what I built as my first DIY solar project. After the pergola project, I did a few other systems for family members and recently just built a pole building primarily for the reason of putting panels on it. Now that I find that my future cybertruck probably won't fit in my house garage, it may just have to live in the "power garage". And to think, this is all as a result of Tesla, or better yet, Elon.

Attachments

Last edited:

JohnSnowNW

Active Member

That's exactly why it's funny. Milton talks big game but it seems subconsciously he wanted to be Elon.

It's a shame he's already been pushed out as CEO...now he no longer has a chance to be Elon

MartinAustin

Active Member

On the same day as the WSJ hit piece, Phil LeBeau tweeted "Down 4% vs. J.D. Power sales estimate set before the COVID-19 pandemic. That estimate was for retail sales to be down 2% vs. last year. Bottom line: retail auto sales have rebounded substantially and are much closer to last years pace."

https://twitter.com/Lebeaucarnews/status/1273342681150824453

https://twitter.com/Lebeaucarnews/status/1273342681150824453

Artful Dodger

"Neko no me"

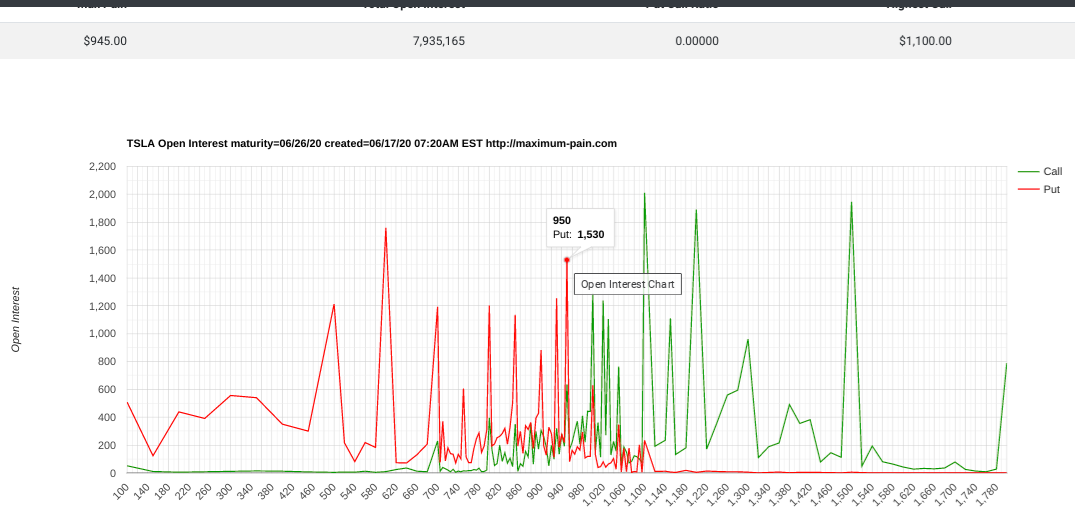

Max Pain for TSLA Options jumped to $890 after today's session. Here's a Chart of the Open Interest:

Not shown (visit the site linked above), Options Volume at the $1K Strike was over 29.4K contracts.

Cheers!

Not shown (visit the site linked above), Options Volume at the $1K Strike was over 29.4K contracts.

Cheers!

Krugerrand

Meow

But when does the enchanted broomstick take effect? Does the SP have to shoot the moon within a certain time period for the witch’s vehicle to be activated? Or is this just another fairytale?

dc_h

Active Member

Back when many of us started here a wise member created the blind faith price target. People would sell when the stock hit the upper quartile and buy when it hit the lower quartile. You could double your stock in a few months on the volatility back then. I think it would be harder today, but others may still be using the algorithm.I find it perfectly normal. Just like when people have cheat meal. It keeps the spirit going. To me the question is "If you're gonna trade, should you trade a stock you're familiar with or something else completely foreign?", not "Should you trade a stock you're holding a long position in?"

That's hilarious!

Analysts are concerned sales and deliveries this quarter could be lower than they were a year ago, before Coronavirus had any impact or was even discovered.

First of all, I think they might be wrong. Secondly, how many companies can say their sales in Q2 this year won't be lower than last year?

If Tesla can beat their performance of a year ago in the middle of a pandemic, it will be a signal of incredible strength, growth and resiliency. And I think they will beat it, shutdowns and all.

Yes, obvious truth. Yet, the tools-"analysts" will not admit/write that as their tool designation is to write crap about Tessla.

Your explanation is very clear, maybe particularly to someone like me who is normally suspicious of most economic pronouncements / inferences.This is based on the loan-to-equity ratio, which is total liabilities divided by equity (assets minus liabilities). Leverage is about how much debt is boosting equity so that a company can get the assets it needs. A low leverage company is using proportionately less debt than its industry peers.

For example,

Tesla $37.25B assets, $28.08B liabilities, $9.17B equity, 3.06 D/E.

GM $246.6B assets, $206.5B liabilities, $40.1B equity, 5.15 D/E.

Ford $258.5B assets, $225.4B liabilities, $33.2B equity, 6.79 D/E.

Tesla has substantially less leverage than Ford or GM. Corporations often like to use greater leverage to improve the return on equity. That is, the cost of capital from debt is typically less than for equity, so higher leverage allows a smaller equity investment to yield higher returns. Companies with thin margins and little growth, like Ford and GM, are only able to deliver an attractive return on equity through leveraging. The downside, of course, is that more debt means more risk for shareholders.

Tesla, OTOH, has been using positive free cash flow to delever, reduce the D/E ratio. So far, the market seems to appreciate the reduction in liquidity risk that this implies, while the opportunity to grow equity remains very high for Tesla. So Tesla does not need to use lots of debt either to grow fast or to spice up ROE. Indeed, the equity only $2.3B capital raise a few months ago seems to be a substantial part to supporting the current high valuation around $1000/sh. That one raise improved D/E from 4.09 to 3.06. Shareholders are more confident that Tesla has both plenty of liquidity and capital for expansion. Had Tesla issued $2.3B in debt instead, the D/E ratio would have been 4.42 instead of 3.06. Either way, liquidity and capital available for expansion would have improved, but Tesla would have substantially more leverage had it borrowed. Likely, investors would have worried more about the ability to pay back $2.3B in incremental debt than an concern about dilution.

I think part of this issue here is that that Tesla has been so traumatized by shorts attacking the stock as a potential bankruptcy case that it is simply a relief to have low leverage. Lower leverage destroys the TSLAQ case. Total debt (excluding non-recourse product financing) is just $8.3B while cash is $8.1B. For a company with market cap over $180B, this is really quite a trivial debt load. That is, Tesla is in a very strong position to be able to raise more capital from equity and delever even more. It doesn't need to, and further deleveraging might not be as well received by shareholders. But for now, I think the last equity offer was a really savvy move.

Edit. Note that there are different variants of D/E ratios floating around. Some focus only on the long-term portion of debt while others include all liabilities in the numerator. I am following the latter, most inclusive definition, per Debt-To-Equity Ratio – D/E.

As I followed your explanation closely, I realized that without having known those relationships in detail, they nonetheless completely support my intuition about the strength of Tesla.

At the time, I thought that B2.3 equity raise was brilliant. Entering the pandemic facing likely production obstacles, the horizon was wide open for building production capacity, as is happening now.

When Tesla has $B 8.1 in cash, I feel very positive about the future.

Last edited:

StealthP3D

Well-Known Member

https://twitter.com/nikolatrevor/status/1273354121664360449

"Im sticking up for you the shareholder. If you don't like that, you shouldn't invest in Nikola."

This guy is a trip

That's a little different than telling existing shareholders to sell. He's saying only invest if you like what you see. That's actually good advice.

Which is why I'm not investing!

ZeApelido

Active Member

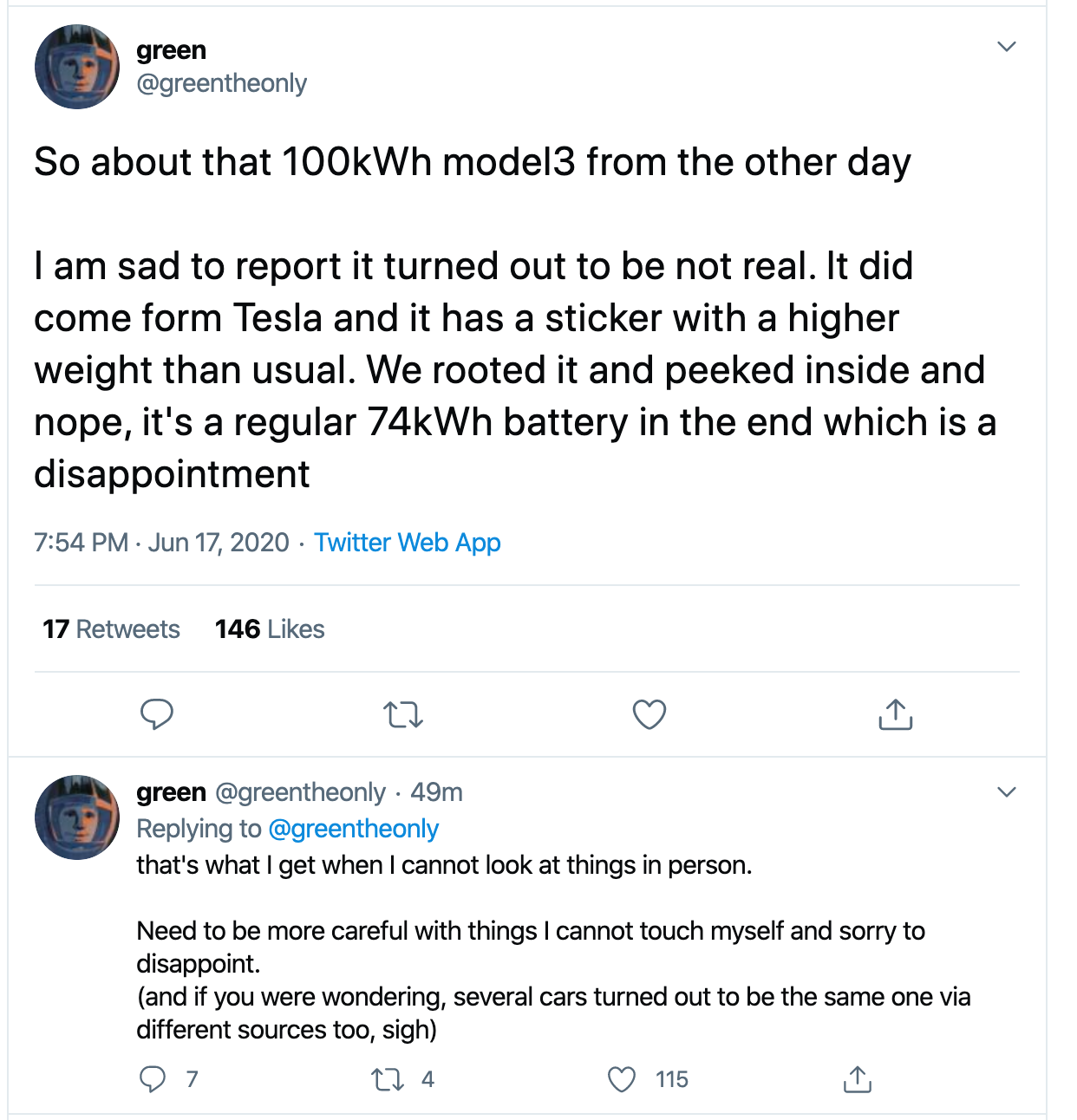

https://twitter.com/greentheonly/status/1273449089838067714

Much like the price discounts he didn't get, Fuderic Lambert @FredLambert demands his money back for the erroneous 100kWh Model 3 pack information from @verygreen .

Oh wait he still made a bunch of money generating ad revenue clicks by quickly posting an article based on a rumor without 2nd sources.

Not a real journalist, but a blogger like the most of them. Stuff them in Oscar the Grouch's trash can and be done with it.

Much like the price discounts he didn't get, Fuderic Lambert @FredLambert demands his money back for the erroneous 100kWh Model 3 pack information from @verygreen .

Oh wait he still made a bunch of money generating ad revenue clicks by quickly posting an article based on a rumor without 2nd sources.

Not a real journalist, but a blogger like the most of them. Stuff them in Oscar the Grouch's trash can and be done with it.

StealthP3D

Well-Known Member

I'm also not entirely surprised to see the usual suspects (Montana Skeptic for those on the block list), cheering Milton on in those replies: https://twitter.com/montana_skeptic/status/1273388162039963648?s=19

As far as I can tell MS doesn't think NKLA is a good investment either. But he avoids saying it because he wants the bubble to get big in the hope it will reflect poorly on TSLA when it pops. But when the NKLA bubble pops, I think it will help TSLA. It might have an immediate very short-term negative impact at best.

MC3OZ

Active Member

https://twitter.com/greentheonly/status/1273449089838067714

Much like the price discounts he didn't get, Fuderic Lambert @FredLambert demands his money back for the erroneous 100kWh Model 3 pack information from @verygreen .

Oh wait he still made a bunch of money generating ad revenue clicks by quickly posting an article based on a rumor without 2nd sources.

Not a real journalist, but a blogger like the most of them. Stuff them in Oscar the Grouch's trash can and be done with it.

View attachment 552986

Even if hypothetically Tesla did have test mules running around with development packs, I find it hard to believe they would be sloppy enough to sell the car with the development pack inside, that is something a competitor would want to get their hands on..

Artful Dodger

"Neko no me"

https://twitter.com/greentheonly/status/1273449089838067714

<snip> ... erroneous 100kWh Model 3 pack information from (Ed. note: detected by) @verygreen .

View attachment 552986

Are you on twitter? Could you ask @verygreen if he weighed the car to see if the GVWR printed on the Sticker was false, too? TIA.

I find it hard to believe they would be sloppy enough to sell the car with the development pack inside

Oh for sure, it's that new LFP bty, doncha no? Because its on a BLOG. /s

Cheers!

Last edited:

ZeApelido

Active Member

Are you on twitter? Could you ask @verygreen if he weighed the car to see if the GVWR printed on the Sticker was false, too? TIA.

Oh for sure, it's that new LFP bty, doncha no? Because its on a BLOG. /s

Cheers!

Asked

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K