UnknownSoldier

Unknown Member

Today is going to be wild. I want to see how the big whales react, they don't trade AH.Don’t waste your time track Frankfurt price, especially premarket. Even NYSE premarket doesn’t matter.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Today is going to be wild. I want to see how the big whales react, they don't trade AH.Don’t waste your time track Frankfurt price, especially premarket. Even NYSE premarket doesn’t matter.

With all love and respect to my Serbian friends, but Sljivovic is pretty vile...Tesla was denied right to Teslaquila trademark because of this

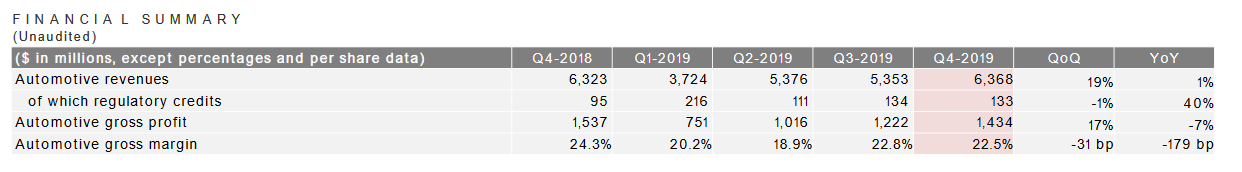

Also I like how unflappable he is on the earnings call.Zach is an amazing CFO. I think that a large part of TSLA's current stock price can be attributed to Tesla's new IR stance and the fancy new earnings reports.

TSLA has gone from $200 to $1,600 since:

Of course Tesla has also delivered strong results over the same time period, but I think the effect of the way in which these results have been communicated to investors should not be underestimated.

- Tesla started to disclose less public information

- Under promise and over delivering became the norm

- The earnings letter revamp in Q3'19

- Zach has started to provide better information around naysayer talking points like the AR.

If supply is 0 does that mean demand is negative?Our good buddy Cramer:

Cramer’s lightning round: ‘You should stay away’ from Nikola

Nikola Corporation: “Supply overwhelmed demand, which is not a good sign. Most of the good stocks are like Tesla where demand is overwhelming supply. I think that you should stay away. There is much better places for you to put your money.”

I heard "high capacity passenger vehicle" -- presumably van or bus.

That did sound a little difficult to follow - As the analyst pointed out, there appears to be conflicting goals of highest margins and also accelerating affordability. Manufacturing cost improvements can help with both, but by definition you cant have the highest margins in the industry and be making the vehicles as affordable as they could possibly be. I might have to listen to that question again.Do you have the exact quote? I don’t recall the 1% figure, but may have misheard.

In the end its a chicken and egg situation, the higher the volume of cars, the better the economies of scale and the more margin can be achieved, but if you use that margin to lower prices and increase volume, you can generate even larger economies of scale and even higher margins. It’s basically what Amazon did - at any point you can choose to slow down and take the profits from massive margins (Amazon started to do that in the last few years), but the incentive is to keep going for scale and increasing your potential future margins. At any point they could stop the growth and reap massive reward.

The alternative to the Amazon route is the Apple one, where you maintain your high margins and profits but the growth is managed over a longer period (eg slower). In my opinion Tesla share price is currently valued for the Amazon high growth model, so it is probably the best route to take.

Surely they're at least C cups - He's a husky boy.Elon behind you in the kitchen with double A's. Ahhh he's a witch!

I just have a hard time thinking of use cases for large high capacity passenger vehicles in the autonomous future outside the loop/hyperloop. Can anyone else think of how they could be useful?

That did sound a little difficult to follow - As the analyst pointed out, there appears to be conflicting goals of highest margins and also accelerating affordability. Manufacturing cost improvements can help with both, but by definition you cant have the highest margins in the industry and be making the vehicles as affordable as they could possibly be. I might have to listen to that question again.

That did sound a little difficult to follow - As the analyst pointed out, there appears to be conflicting goals of highest margins and also accelerating affordability. Manufacturing cost improvements can help with both, but by definition you cant have the highest margins in the industry and be making the vehicles as affordable as they could possibly be. I might have to listen to that question again.

Tesla (TSLA) PT Raised to $1,475 at Goldman Sachs

Tesla (TSLA) PT Raised to $1,475 at Goldman Sachs