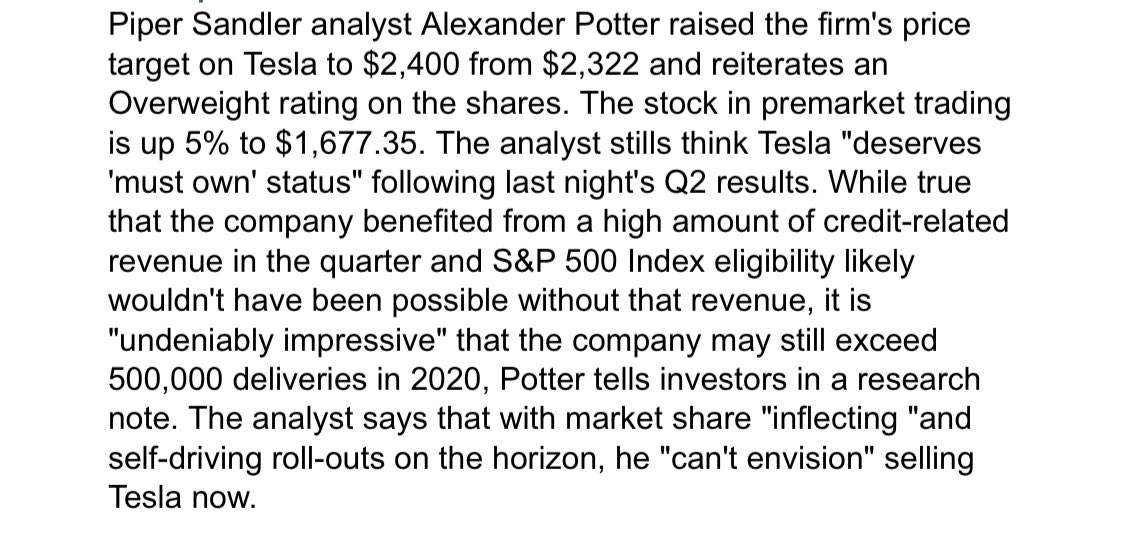

Piper Sandler says TSLA is “must own”

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ZachF

Active Member

So what's with Zach saying they should achieve "industry-leading" double-digit margin and Elon saying they're targeting maximal sales growth while preserving a 1% margin? Is there really that much of a gap between Elon's personal opinion and the company's position?

That was the one odd thing that really stood out to me on the call.

High margins fund fast growth.

They're just going to take their money and make new factories/etc with it instead of doing stock buybacks like 90% of current companies do.

Very low volume yesterday after hours and in pre-market so far. Looks like every one who is short or structurally short (index funds, etc) is having a deer-in-the-headlights moment.

Yea I’m wondering if liquidity is already becoming an issue with most long term investors just HODLing. Plus short interest has gone down considerably.

I like the new consolidate and run TSLA better than the wild TSLA we saw the previous Monday when it shot up to 1794.99 like it was drunk.

Who’s buying today?

Runarbt

Active Member

Very low volume yesterday after hours and in pre-market so far. Looks like every one who is short or structurally short (index funds, etc) is having a deer-in-the-headlights moment.

They: "If we just wait - maybe it will all go away!"

Interesting that Auto Nation (AN) is reporting (CNBC) a good quarter due to consumer interest in avoiding public transportation. More interest in used cars for private travel. Trucks still very popular. Still slamming Tesla for the business model but with more respect

Tslynk67

Well-Known Member

MM's going bigly to control the narrative here by spooking pre-market, because they're under real threat of an absolute rout this week...

This is where all those shares Citadel bought come in really handy.

This is where all those shares Citadel bought come in really handy.

Pezpunk

Active Member

in case you missed it during last night's posting flurry:

public service announcement for everyone: the last two quarters, both major beats like this one, have followed a similar pattern -- huge after-hours spike, then it gets completely eliminated the next day, then the stock goes bananas over the following few weeks as the information is absorbed and the misinformation and FUD are gradually dismissed by the general market.

MM's going bigly to control the narrative here by spooking pre-market, because they're under real threat of an absolute rout this week...

This is where all those shares Citadel bought come in really handy.

They've got to be very careful though with S&P 500 inclusion ahead. Not being fully delta hedged in the coming weeks/months is extremely risky for them.

Runarbt

Active Member

And back up $16431618!

Don't worry, be happy.. this is just noise.

Next week - SP will be a LOT higher.

Edit: 1648

I keep telling myself not to look at the ticker, that I need to overcome my obsessive watching of meaningless random walks and manipulations of the market.

But I am weak. Pathetic and feeble.

(wealthier, though)

But I am weak. Pathetic and feeble.

(wealthier, though)

The Accountant

Active Member

$125m to $250m Upside Coming in Q3

In my estimation, Tesla took a $125 to $250m charge in Q3 for Idle Capacity charges.

Expect to see margins and profits increase by that amount in Q3.

I posted details in the financial projections thread as to not clutter this thread with accounting talk (don't want to upset the future island owner)

See link here:

Near-future quarterly financial projections

In my estimation, Tesla took a $125 to $250m charge in Q3 for Idle Capacity charges.

Expect to see margins and profits increase by that amount in Q3.

I posted details in the financial projections thread as to not clutter this thread with accounting talk (don't want to upset the future island owner)

See link here:

Near-future quarterly financial projections

This quote from Musk is why I will always be long tesla and just bought more shares,.....

“I think just we want to be like slightly profitable and maximize growth and make the cars as affordable as possible,” he concluded.

“I think just we want to be like slightly profitable and maximize growth and make the cars as affordable as possible,” he concluded.

LN1_Casey

Draco dormiens nunquam titillandus

Who’s buying today?

Hopefully a lot of people.

Except that Tesla won't (or at least shouldn't) be threatened by the legislators every session. Remember that last session there was a big push to close Tesla service centres and raise the registration to $200 per year extra. So, there is a practical side.I live in Austin, and there are *a lot* of Teslas driving around the city right now. You can buy Teslas when you live in Texas, and there are service centers here. You just have to put the order in on the website rather than at the Tesla showroom.

To be clear I think the law will absolutely be changed once Tesla has thousands of employees represented by state legislators, but this whole thing is really a non-issue as a practical matter.

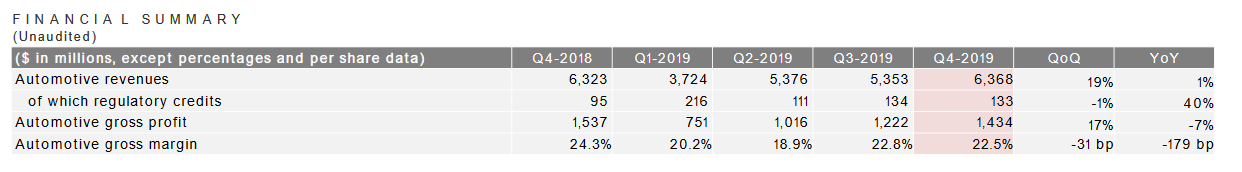

I think the doubling expectation implies the addition of PSA into the EU pool. That would increase the number of petrol/diesel cars by x4! And PSA's are just as dirty as FCA's.Zach:

Regulatory credit revenue increased sequentially to $428 million. While difficult to forecast precisely, our best estimate of 2020 credit revenue is roughly double that of 2019. Services and other margin improved yet again, marking the fifth sequential quarter of improvement.

2019 was:

216+111+134+133 = 594

Estimated for 2020 double that, so 1188m. Tracks roughly well with 350m$ pr quarter from FCA.

Going to work on Tesla energy...finally!Chamath on CNBC right now, absolutely destroying the bear thesis.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K