I think the Shaker is broken. Bigger fish prevail now.That was it? It was just typical MMD.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

That was it? It was just typical MMD.

Yup. Same *sugar* nearly every day. Easy money.

This is the BEST company to buy and hold while also being the BEST stock to trade.

woodisgood

Optimustic Pessimist

I hold several Jul-31, Aug, and Sep calls.

Are options expected to move upward if the stock moves upward in the next few days?

Or, is IV expected to still stay low even if stock moves upward?

You can think of “events”, eg ERs, investor days, P&D announcements, etc as adding the most volatility. Once those are crossed and become “known,” IV drops. If you don’t have a big rise in share price to offset the IV drop, your option contract depreciates significantly.

Criscmt

Member

You can think of “events”, eg ERs, investor days, P&D announcements, etc as adding the most volatility. Once those are crossed and become “known,” IV drops. If you don’t have a big rise in share price to offset the IV drop, your option contract depreciates significantly.

Thank you. What does it take for the IV to go back up in the coming week/weeks, realistically, if at all? A very significant rise in the SP?

Jack6591

Active Member

A dash of perspective — GM and Ford earnings draw nigh.

Bah, Ha, Ha, Ha...

Bah, Ha, Ha, Ha...

Todd Burch

14-Year Member

Speaking of MMD - Has anyone done any analysis into the timing of the intraday low? Seems to be consistent.

Nothing formal, but when we do have MMDs they're almost always finished around 10:00-10:30. Like clockwork. Like, to the point of being stupid.

Or, in other words, Elon wants Tesla to be a high growth stock. Sheesh. I guess we can infer from that headline that their readership knows almost nothing about stock investing?

We all know you just wanted another Roadster II down the road. Fun my butts!I bought another 25, just for fun

I’m jealousI bought another 25, just for fun

I'm sitting on a $1350 call expiring tomorrow, I'm hoping we have another good run up this afternoon or tomorrow. We were getting beat up a bit by the macros earlier in addition to the usual shenanigans. Worse case I let it exercise and throw another 100 shares on the HODL pile.

Todd Burch

14-Year Member

I'm not greedy. 1 will doWe all know you just wanted another Roadster II down the road. Fun my butts!

Criscmt

Member

I meant, back up to the level it was till yesterday.Thank you. What does it take for the IV to go back up in the coming week/weeks, realistically, if at all? A very significant rise in the SP?

How big a rise in SP does it take?

Todd Burch

14-Year Member

My gut tells me the MMs are using their ammunition trying to keep a drop going, and the rest of the market is scooping up those shares. When the MM's clip runs dry, we shoot back up.

Zach:

Regulatory credit revenue increased sequentially to $428 million. While difficult to forecast precisely, our best estimate of 2020 credit revenue is roughly double that of 2019. Services and other margin improved yet again, marking the fifth sequential quarter of improvement.

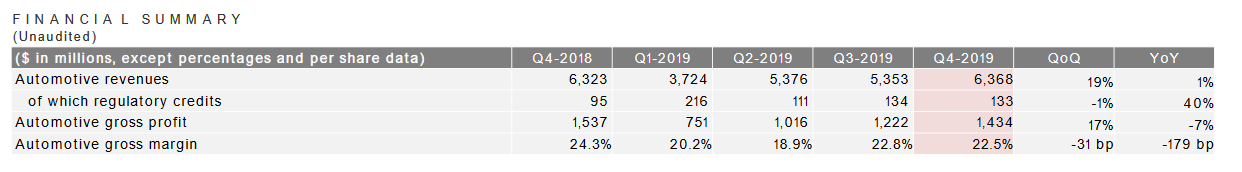

2019 was:

216+111+134+133 = 594

Estimated for 2020 double that, so 1188m. Tracks roughly well with 350m$ pr quarter from FCA.

Nice to know, so that means there will be similar tax credit revenue in the next two quarters. Very nice indeed.

But I've also seen the fake MMD recover a bit so they catch a few more fish.

They want my shares so bad, makes me clinch harder. I reviewed Hyper Change EC summary this morning. Ya 1% of everything is a lot considering R&D and growth are on full throttle. It's actually perfect.

One possible headwind short term is that the next big news (Battery day) is a ways out. So don't be surprised by bear "attempts" for weeks now. Ongoing news on innovation keeps it afloat until then.

They want my shares so bad, makes me clinch harder. I reviewed Hyper Change EC summary this morning. Ya 1% of everything is a lot considering R&D and growth are on full throttle. It's actually perfect.

One possible headwind short term is that the next big news (Battery day) is a ways out. So don't be surprised by bear "attempts" for weeks now. Ongoing news on innovation keeps it afloat until then.

I meant, back up to the level it was till yesterday.

How big a rise in SP does it take?

There is usually an IV drop after earnings. Yesterday I was seeing like 110%, right now at like 89%.

Look at BB, there is a big divergence since 6/30 with big jump in SP, but past few days prices are around 1600 range so there is BB convergence. A steep change in price will once again show as BB divergence, and we will also get higher IV. cheers!!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K