Range for Europe (LR) has also been increased to 560 km (WLTP standard). Maybe we're making progress with homologation....

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

J

jbcarioca

Guest

Mostly your points seem valid to me, but I do not share your conclusions. Why?...And may possibly just kill off the line rather than redesigning it, depending on market needs at the time.

...

They have no interest in sinking more money into S&X. That's not a priority, and it's been quite clear for a long time that it's not a priority. There will be incremental updates (a more "Model-3-like" interior appears to be in the works for mid-2019, for example), but don't expect any expensive, radical changes.

Tesla is rapidly progressing with modular power delivery systems, reduced cost of batteries, continuous improvements in ancillary systems and major improvements in manufacturing simplicity. I think most serious observers agree with those points.

Now they can introduce a wide variety of vehicles using the same building blocks, making major reductions in Capex. Not only does that Model Y, Semi and pickup easier, it also eases the new Roadster and... new Models S and X. Given all this advance that has been made the capex need for those models will be things that will yield increased GM on these and other lower-volume variants.

We might actually think of the equivalent in the ICE world where modular design at VAG yields parts commonality in engine pieces from Polo to Bugatti. Were there not such commonality tiny production runs of exotics would be prohibitive. Of course the performance characteristics have zero comparison. Engineeering costs decline with every reuse.

I think Tesla understands those issues very well indeed. S and X will be around for a long time with major improvements along the way.

S/X are a cash source, and will continue to be used as a cash source - not a sink - until they're no longer useful, wherein they'll be replaced or killed. Don't just take my word for it, take Tesla's. They've made it more than clear that they have no plans to make any significant changes to S&X any time soon, that neither they nor Panasonic have interest in making more 18650s, that S&X won't be built in upcoming GFs (only 3 and Y), that there's no more room at Fremont, that they don't see the S/X limit as changing from 100k, and on and on.

They have no interest in sinking more money into S&X. That's not a priority, and it's been quite clear for a long time that it's not a priority. There will be incremental updates (a more "Model-3-like" interior appears to be in the works for mid-2019, for example), but don't expect any expensive, radical changes.

Seems obvious to me that you significantly underestimate the effect of a long series of incremental updates.

So sure 'replaced', but from the inside out right under the noses of many...

Chartered321

Member

ReflexFunds

Active Member

No, did you read the post you replied to? Because I very clearly spelled out why they're not going to do this until absolutely forced to. And may possibly just kill off the line rather than redesigning it, depending on market needs at the time.

Tesla's capital focus is on much bigger fish: Model Y, new gigafactories for M3 and MY, Pickup, Semi, etc - and as for the high end, Roadster. Plus Tesla Energy expansion, superchargers, megachargers, leasing, and so many other things. They have massive capital needs, and the last thing they need to be doing is throwing away previous capital investments to make new capital investments that are unnecessary.

S/X are a cash source, and will continue to be used as a cash source - not a sink - until they're no longer useful, wherein they'll be replaced or killed. Don't just take my word for it, take Tesla's. They've made it more than clear that they have no plans to make any significant changes to S&X any time soon, that neither they nor Panasonic have interest in making more 18650s, that S&X won't be built in upcoming GFs (only 3 and Y), that there's no more room at Fremont, that they don't see the S/X limit as changing from 100k, and on and on.

They have no interest in sinking more money into S&X. That's not a priority, and it's been quite clear for a long time that it's not a priority. There will be incremental updates (a more "Model-3-like" interior appears to be in the works for mid-2019, for example), but don't expect any expensive, radical changes.

I'm undecided on this issue, but I see a reasonable chance Tesla moves S/X cell & pack production to GF1 in March/April-19 at low capex cost.

A few reasons for this:

- Panasonic aims for 35Gwh/year run rate at GF1 by March 2019. This is too much for Model 3 and Storage alone, particularly since SR battery is likely to come out at a similar time and not all storage cells are from Panasonic.

- Panasonic aims to move battery production to the US in April 2019 (according to Asian Nikkei Review). This is possibly the media misinterpreting a planned change of corporate and business unit structure, rather than physical production, but I don't see a reason for its Japanese factory to be owned by a US based Panasonic entity.

- Supercharger version 3 is coming out in early 2019 according to Elon. There's a reasonable chance this charging capability requires some type of upgrade to Model S/X cells/packs.

- New more automated Grohmann module/pack production lines have started to be installed at GF1 in Q4 and aim to ramp up in late Q1. If model 3 module/pack production is transferred to these new cheaper more highly automated lines, with some modifications the current semi-automated model 3 lines at GF1 may be used for the new S/X packs at limited capex.

- Panasonic cell production is also constrained by its supply chain, and particularly cathode purchases from Sumitomo. Sumitomo is operating at max capacity and doesn't appear to have yet signed off on new capacity. Therefore if Panasonic moves S/X cell production to GF1, it is likely going to have to divert its cathode supply to GF1 and close down its Japanese line - therefore there may not be any 18650s diverted to competition.

- Moving S/X production to GF1 can increase economies of scale and reduce the cell cost for model 3 production, contributing to profitable release of the base model 3.

- With increased competition for S/X in 2019 from I-Pace/E-tron etc, a battery upgrade with increased range and performance would be helpful to take them another level ahead of the competition.

"Earlier this month, Tesla CEO Elon Musk wrote on Twitter that cell production for its so-called Gigafactory in Shanghai "will be sourced locally, most likely from several companies," including Panasonic. While both sides had known this was a possibility, it is nevertheless a blow to Panasonic's battery business, which will now face greater competition from rivals.

Musk's tweet came just after Panasonic's second-quarter earnings announcement late last month, when President and CEO Kazuhiro Tsuga struck an upbeat tone on the partnership. He said Panasonic would "reach 35 gigawatt-hours within fiscal 2018" at U.S. battery facilities jointly operated with Tesla, achieving full output capacity, and would "consider further investments in North America" while continuing to cooperate with the electric-car maker.

Osaka-based Panasonic has been planning to transfer the production of Tesla batteries from an in-house company for automotive and industrial systems to a new U.S.-based unit starting next April. It aims to deepen its relationship with the automaker as Tesla's Model 3 sedan finally gets on track for mass production, after prior delays.

"There's no way a single company could cover all the immense need for auto batteries," Yoshio Ito, the head of Panasonic's automotive and industrial systems company, said in response to Musk's tweet. "We'll discuss the matter with Tesla, but we're envisioning a range of options." "

Fact Checking

Well-Known Member

"Osaka-based Panasonic has been planning to transfer the production of Tesla batteries from an in-house company for automotive and industrial systems to a new U.S.-based unit starting next April. It aims to deepen its relationship with the automaker as Tesla's Model 3 sedan finally gets on track for mass production, after prior delays."

This is something @neroden remarked on in the past as well: Panasonic has been quietly reorganizing their battery business to make it easy for Tesla to purchase. Merging with Japanese companies has risks, as Peugeot found out the hard way, so Panasonic has been working on a U.S. based battery business with many of those risks removed.

The most logical production site for such a company would be GF1.

The problem, I think, is that Panasonic would almost certainly have to be paid in $TSLA shares. I.e. Panasonic doesn't want to sell their battery business in the traditional sense - they want a stake in Tesla, and want to pay with their battery business. Which I'm pretty certain Elon doesn't want, due to dilution and corporate control issues.

Also, as @KarenRei pointed it out before, that Tesla is rather religious about in-sourcing and vertical integration, and the cell production part is a giant wart on that otherwise squeaky clean concept.

How is Tesla and Panasonic going to resolve this? It's pretty unclear to me, but 2019 could become interesting.

ItsNotAboutTheMoney

Well-Known Member

This is something @neroden remarked on in the past as well: Panasonic has been quietly reorganizing their battery business to make it easy for Tesla to purchase. Merging with Japanese companies has risks, as Peugeot found out the hard way, so Panasonic has been working on a U.S. based battery business with many of those risks removed.

The most logical production site for such a company would be GF1.

The problem, I think, is that Panasonic would almost certainly have to be paid in $TSLA shares. I.e. Panasonic doesn't want to sell their battery business in the traditional sense - they want a stake in Tesla, and want to pay with their battery business. Which I'm pretty certain Elon doesn't want, due to dilution and corporate control issues.

Also, as @KarenRei pointed it out before, that Tesla is rather religious about in-sourcing and vertical integration, and the cell production part is a giant wart on that otherwise squeaky clean concept.

How is Tesla and Panasonic going to resolve this? It's pretty unclear to me, but 2019 could become interesting.

I think the idea of a purchase by Tesla or merger is a bit overblown. Maybe it could be a separate vehicle for to attract other investment. But I think it's more likely that Tesla is such a big part of their business that for both risk and operational reasons, separating it out from the main company makes sense.

Black swans I can take. What makes me more worried is this new bright orange variety that keeps coming at us from every direction. So far the attacks have been quite feeble but this swan's unpredictable nature certainly makes it troublesome enough.Beware the macros though and don’t take it personally if the market takes Tesla down with it a bit. There’s a bevy of black swans out there waiting for a place to land.

Fact Checking

Well-Known Member

PS: please have a look on the FY2019E 0.03 USD loss per share that will keep alive the cash burning theory. Words fail me...

BTW., that's the EPS, which is reduced by a number of non-cash items.

An EPS of close to 0 means significantly positive cash flows. So without intending to GS is actually bullish on Tesla, they just don't realize it yet in their self-serving fake forecast.

BTW., Goldman Sachs analysts covering Tesla should be disbarred from working in the securities industry for life, for gross professional misconduct. Clients listening to their 'sell' rating have lost a lot of money in 2018 and I predict that they'll probably lose a lot more in 2019-2020.

"Talking your book" is one thing, but what GS's Tesla analysts are doing here is flirting with outright securities fraud, IMHO.

Last edited:

SebastianR

Active Member

I wouldn’t characterise that as ‘ongoing production porblems’. They’ve ramped their production beyond the break-even point, and can’ take their time to ramp it even further. Solving the remaining bottlenecks in a economical way, instead of a ‘hail Mary’ way.

I think this is the point that Mr. Market doesn't fully get yet:

The game has changed since Tesla reached break-even. There is no longer a race to reach "production numbers at all costs" to demonstrate reckless growth aimed to inspire higher share prices to raise more equity (rinse & repeat).

They are now playing the "let's oil this cash machine" game: with Tesla's focus on cash-flow and self-funding growth by getting cars paid much earlier than they need to pay their suppliers, I expect product margins (especially for the Model 3) to grow faster than the production numbers - it just makes sense. (Technically, I expect Tesla to focus on minimizing production time to optimize cash flow while maximizing "products sold", I guess margin improvements will come as a consequence of that.).

It's actually worse than Tesla throwing away sunk cost: if Tesla decided to not use the 18,650 cells made in Panasonic's factories in Japan, Panasonic could sell the output to another carmaker - for example to some EV startup that would be more than happy with a ~10 GWh/year supply of proven, reliable, high energy density cells...

Aside from the use in TE products: would it be conceivable to use the new cell format only in the Model X (or Model S)? That would immediately allow for growth in both product lines... But might be the instant death to the one that didn't get the update...

Last edited:

Uptick rule clarification please...

If the uptick rule is in force and no one can drive down the stock how long does this last? Could there be a significant drive down once the uptick rule expires? Im curious as i have freed up some cash and am wondering to buy start of play or hold untill it reaches bottem, I'm predicting 300 will be strong support.

It is active the day of the 10% drop (from previous close) and the following day. It does not stop anyone from closing their open positions with real stock shares. It only prevents selling short at the current bid price. This prevents lowering the stock price artificially and and triggering stop loss orders. As such I would not expect any additionally drop tomorrow beyond the re-enabled shorts activity.

Tomorrow may then have a mandatory morning dip (MMD) buying opportunity. Or news could come out and the stock will gap up. Who knows...

At least Wedbush maintained 440 PT and Baird 465 PT, little bit of good news

Bloomberg - Are you a robot?

Bloomberg - Are you a robot?

Fact Checking

Well-Known Member

Panasonic aims for 35Gwh/year run rate at GF1 by March 2019. This is too much for Model 3 and Storage alone, particularly since SR battery is likely to come out at a similar time and not all storage cells are from Panasonic.

BTW., while I agree with most of your post, I don't think that's true:

- Tesla has at least one GWh scale storage contract.

- Adding battery storage that has 10+ years of expected life time is a no-brainer upgrade and investment for wind farms: wind peaks in the night when power use is the lowest, so a lot of that power can only be sold at very low prices. With battery storage that peak nightly energy can be transformed into a peaker plant in essence, selling the energy for 10-20 times as much money ... Also there will be a gold rush effect: the first ones to do this will earn a lot from this.

- If only there was a company selling GWhs worth of battery capacity at reasonable prices.

- Note that Big Oil will have limited ability to run interference: power companies are strategic long term allies of Tesla, not of the Big Oil/Coal price cartel. Tesla will free power companies from Big Oil and give them energy independence and self-determination. That's a well established, several trillion dollars worth industry to transform, right there, available to the first mover.

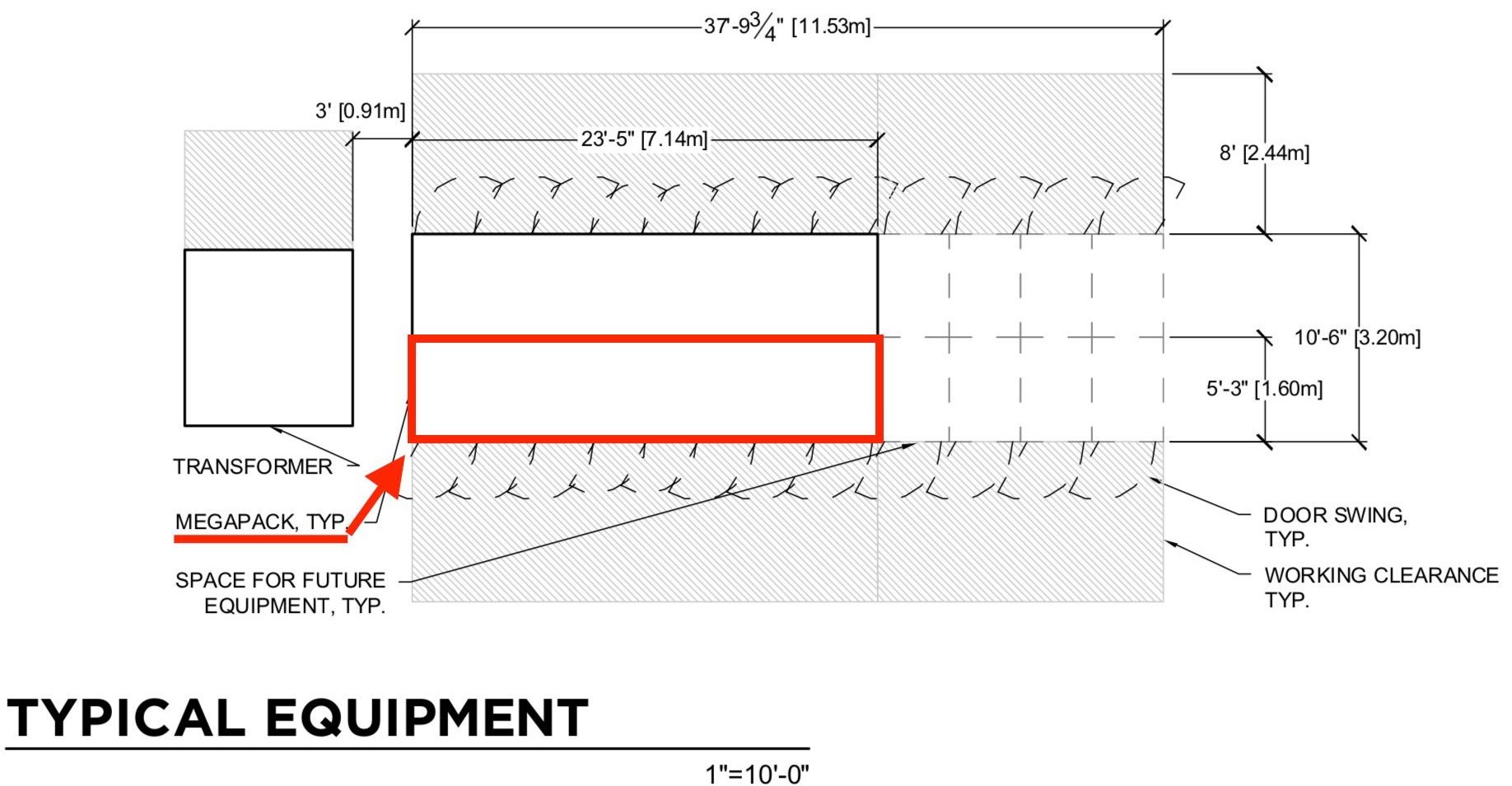

With the containerized "Megapack" Tesla is well positioned to push out as many of them as there's excess cell capacity at the Gigafactory:

But yeah, no way to model this, yet, but I agree with Elon and JB that Tesla Energy is going to outgrow the Tesla automotive side within a couple of years.

Last edited:

Navin

Active Member

Looking ahead - how do we avoid the “fact sheet” analyst scheme when it comes to q4 earnings? Won’t they play the same game again?

There will be 20 million shares traded at 270 soon

Your New Year’s resolution was to give us more care bear hugs?

tivoboy

Active Member

Just remember, uptick does not apply to derivatives. enough option sellers (or put buyers) can produce enough similar pressure to the underlying equity and will simply produce SELLERs of the equity if not shorts.Uptick rule couldn’t have kicked in at a better time.

tivoboy

Active Member

And probably 100% of the profit. I don't think any other manufacturer is producing cars YET at a profit.Musk tweet, tesla captured 50 percent of total plug in electric car sales, with that translating to 2/3 of the market in terms of revenue!! Is this a hint about q4 earnings...

tivoboy

Active Member

I find it hard to believe that the SINGLE digit $ cost of a mobile OS is what enabled third party companies to survive in the low cost smartphone market. (and they don't really get access to any current generation OS at the time). Not having to build an OS from scratch is a thing for sure but not having to have paid a third party for it to license wasn't the difference between starting or not starting, or profit and no profit, etc.An important factor in the iOS versus Android battle is that Google saved all the the (non-apple)phone vendors by providing them a free OS, and at the same time, a common platform for apps. Think of how the mobile phone world would look like today if Google wouldn’t have built Android. That’s how the car world will look like in 10 years time.

ZeApelido

Active Member

Did anyone already give Troy the NateSilverBronze Award for the worst forecast of 2018?

He will blame the polls.

EVNow

Well-Known Member

Google didn't build Android - they bought Android Inc in 2005.An important factor in the iOS versus Android battle is that Google saved all the the (non-apple)phone vendors by providing them a free OS, and at the same time, a common platform for apps. Think of how the mobile phone world would look like today if Google wouldn’t have built Android. That’s how the car world will look like in 10 years time.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M