Plug Power is local to me. They make fuel cells used in equipment like forklifts.Without looking these up, I am guessing they all make batteries or battery components?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TSLA popped up on WSJ's money flow tracker today for buying on weakness. For what it's worth, it was also on the "selling on strength" page yesterday.

Money Flows: Buying on Weakness - Markets Data Center - WSJ.com

Money Flows: Buying on Weakness - Markets Data Center - WSJ.com

Some new FUD ? Why the big drop now (and from 10:30 ?)

At CNBC around that time Melissa Lee repeated the misunderstanding about ARK's portfolio rebalancing policy, which had resulted in net Tesla sales by ARK in the fourth quarter, despite it remaining the top holding among their ETFs. Then earlier this hour TSLA slid when Phil LeBeau reported on CNBC about the lawyer departure. Although he did it again a little later (along with an edited clip of Gene Munster's comments focusing only on the negative portion) which corresponded with another slide. Phil and others at CNBC have in recent weeks commented about Elon not agreeing to an interview with them, which seems to have led to their regularly repeating Tesla FUD.

EDIT: I don't mean to particularly pick on Phil LeBeau, since he tends to temper any seeming negatives with rational explanations. He also presents the positives. He's a pro. However, it's the CNBC anchors who try to bait him toward FUD. Having been a TV financial news anchor myself, I know that suggested words are often transmitted to an anchor's earpiece from the microphone of a producer.

Last edited:

TSLA popped up on WSJ's money flow tracker today for buying on weakness. For what it's worth, it was also on the "selling on strength" page yesterday.

Money Flows: Buying on Weakness - Markets Data Center - WSJ.com

Sounds a bit schizophrenic.

EVNow

Well-Known Member

No - they don't dump shares (since it lowers the price).Probably a large holder derisking since Elon hasn’t learned his lesson

Outside price manipulation - high volume signifies either fear of price going down (so they want to sell quickly) or fear of price going up (so, buy quickly). This happens because of some news.

Large holder wanting to sell or buy - will do so using bots in small chunks over a period of time (hours or days) - so as to not move the price.

Yeah that whole market timing thing has tripped up....um...a few people over the years.And lucky me, I took off my bear suit yesterday. Over the first half of the day :Þ

(did save a small amount of my rollover money for better buying opportunities, and I'm glad I did that... but geez, I could have made a small fortune had I waited until today :Þ)

Model 3 VINs on Twitter

#Tesla registered 2,751 new #Model3 VINs. ~7% estimated to be dual motor. ~27% estimated to be International. Highest VIN is 294869.

#Tesla registered 2,751 new #Model3 VINs. ~7% estimated to be dual motor. ~27% estimated to be International. Highest VIN is 294869.

kangarookid

Member

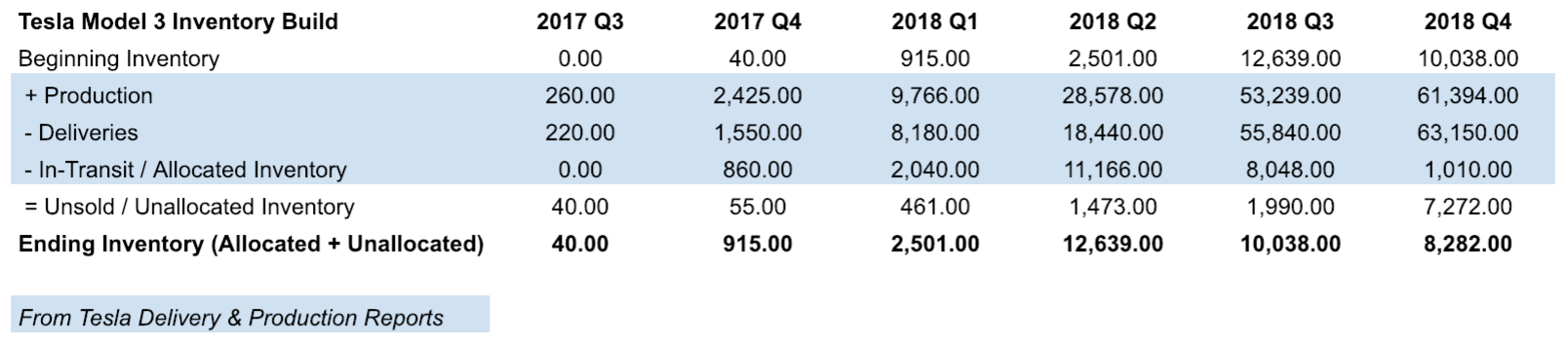

Was thinking more about the model 3 inventory hack that was going around yesterday which suggested about 7k Model 3s were currently in inventory. If you go back through all of the quarterly Delivery & Production reports, I think you can basically calculate what inventory levels were up through last quarter. Up until this most recent quarter, I'd say remaining inventory were cars that were built in the final week and were unallocated to buyers. Based on my calculations, Tesla had 8,282 cars in inventory (in transit or 1010 + unallocated of 7,272) at the end of Q4. Less than 2 weeks of production is not bad at all. More or less jives with the inventory list that was going around yesterday also.

kangarookid

Member

Also interesting.. a strong sign for US demand

Tesla Delivered More Vehicles in January than Reports Suggest

Tesla Delivered More Vehicles in January than Reports Suggest

anthonyj

Stonks

Just bought a couple puts. Thank me later

$280p for 3/1. Can TSLA really bounce off $300 for the tenth time in 2 months? We shall see!

$280p for 3/1. Can TSLA really bounce off $300 for the tenth time in 2 months? We shall see!

Last edited:

It is clear Tesla is operating on an exponential growth curve.

The predictability of 400k or 3 million on a timeline is difficult at best. Market players understand this and manipulate daily on this premise.

The reality is Tesla will produce and sell more cars by 50% or triple digits every year for many years to come. This is where the long term investors will come out significantly higher, especially if they don’t buy into the FUD of day traders wanting you euphoric or terrorized into pressing sell or buy at their time and choosing.

We live in the internet age. You can go directly to the source to understand this. Listen to the ARC interview Elon has done. We don’t need middle men on the street telling us what to think.

The predictability of 400k or 3 million on a timeline is difficult at best. Market players understand this and manipulate daily on this premise.

The reality is Tesla will produce and sell more cars by 50% or triple digits every year for many years to come. This is where the long term investors will come out significantly higher, especially if they don’t buy into the FUD of day traders wanting you euphoric or terrorized into pressing sell or buy at their time and choosing.

We live in the internet age. You can go directly to the source to understand this. Listen to the ARC interview Elon has done. We don’t need middle men on the street telling us what to think.

EVNow

Well-Known Member

Yes, thanks to macros. Nasdaq rapidly lost 20 points.300 seems like it will get tested again today.

ps : Broken on volume of 140k.

Elon's compensation plan that was approved last year had milestones in terms of market capital. The first one would require somewhere around $600 SP if I remember correctly ($100 Billion market cap?). Does he have a deadline associated with that milestone ?

Or is the plan simply that he gets nothing until the milestone is reached ?

Or is the plan simply that he gets nothing until the milestone is reached ?

ZeApelido

Active Member

How does Elon get to 1.5 million vehicles in 2021? Ok let's assume he meant annualized rate at the end of 2021... that means producing ~ 30,000 vehicles / week!

2,000 S+X

12,000 M3

15,000 MY

1,000 Semi

???

2,000 S+X

12,000 M3

15,000 MY

1,000 Semi

???

anthonyj

Stonks

Elon lives in the future, so you have to add a yearHow does Elon get to 1.5 million vehicles in 2021? Ok let's assume he meant annualized rate at the end of 2021... that means producing ~ 30,000 vehicles / week!

2,000 S+X

12,000 M3

15,000 MY

1,000 Semi

???

Then don't give him any more ideasElon must not disparage the SEC

tivoboy

Active Member

Greetings. Been a while for me. Off doing the actual work and spending more time with currencies volatility and overall portfolios re-balancing and re-allocating. Still short some TSLA with the mar 245$ puts (probably go to 0$ at this point, but i essentially paid nothing for them).

That said I've been meaning to come back and post some comments but the narrative is back to getting so out of scope here. not even going to mention the weekend threads.

I don't like this price action at all and haven't for a while. So much odd buying in the markets, a bit overbought in many growth areas (from what was clearly oversold back in Dec) but almost everything has rallied over the 50 day at least (the majority of stocks) if not also their 200 day - and yet TSLA has gone nowhere.

I don't like that so many funds sold large positions last Q4/18, and I don't like the looks of opening up leasing in the USA soon. MAYBE it's just employees at the moment, but if it broadens its a negative.

From past experience, the company will have to finance this directly - and then finance that out externally at a cost of capital (much higher than debt). OR, they will have to put in a guarantee on residuals to whomever is the external lender. Either way, it's a balance sheet and or operating capital hit as well as and income statement hit.

My opinion, it would also APPEAR to be negative on USA and possibly CA demand (I mean why put a lease option together if the demand is enough to get full boat from every buyer. Coupled with our previous understanding of the price reduction on the 3 (and we still don't know what the deliveries were last year first of this year where the company guaranteed the full Fed Tax Credit amount DELTA if the cars delivery were delayed. We'll see that first in Q119 reporting. Not till early May probably.

So, I don't like this price action and am pretty certain we're going under $300 soon and probably lower (and now as I type this we're now ticking under 300$).

I know the haters will say I'm trying to press the short, I'm not. While my current only open position is that short put, I'm long the company in spirit (owner, fan) and will certainly re-enter at some point in the future. For the moment, it's sell OTM calls (or ITM if you're in a long position) or be ready for a lower entry for the short term. Personally, I probably wouldn't enter at anything higher than $270 for a short play (or really long play) and I'm not going to expect to see my true re-entry again till Late April 19, or early May 19.

That said I've been meaning to come back and post some comments but the narrative is back to getting so out of scope here. not even going to mention the weekend threads.

I don't like this price action at all and haven't for a while. So much odd buying in the markets, a bit overbought in many growth areas (from what was clearly oversold back in Dec) but almost everything has rallied over the 50 day at least (the majority of stocks) if not also their 200 day - and yet TSLA has gone nowhere.

I don't like that so many funds sold large positions last Q4/18, and I don't like the looks of opening up leasing in the USA soon. MAYBE it's just employees at the moment, but if it broadens its a negative.

From past experience, the company will have to finance this directly - and then finance that out externally at a cost of capital (much higher than debt). OR, they will have to put in a guarantee on residuals to whomever is the external lender. Either way, it's a balance sheet and or operating capital hit as well as and income statement hit.

My opinion, it would also APPEAR to be negative on USA and possibly CA demand (I mean why put a lease option together if the demand is enough to get full boat from every buyer. Coupled with our previous understanding of the price reduction on the 3 (and we still don't know what the deliveries were last year first of this year where the company guaranteed the full Fed Tax Credit amount DELTA if the cars delivery were delayed. We'll see that first in Q119 reporting. Not till early May probably.

So, I don't like this price action and am pretty certain we're going under $300 soon and probably lower (and now as I type this we're now ticking under 300$).

I know the haters will say I'm trying to press the short, I'm not. While my current only open position is that short put, I'm long the company in spirit (owner, fan) and will certainly re-enter at some point in the future. For the moment, it's sell OTM calls (or ITM if you're in a long position) or be ready for a lower entry for the short term. Personally, I probably wouldn't enter at anything higher than $270 for a short play (or really long play) and I'm not going to expect to see my true re-entry again till Late April 19, or early May 19.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K