Sec/q1 behind, I grabbed a bit more tsla just now. Here’s to ‘19!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

EVNow

Well-Known Member

Why would you see the need to excuse Mark's statement - in some form or the other ? Reminds me of all the excuses certain politicians make about an undesirable politician.homophobic jokes about federal judges = "and Mark makes some bad (and cringe-worthy) jokes...."

Certainly cringe-worthy, and not something I would have said...

Singer3000

Member

Lots of people keep saying this, implying that Tesla could have produced more Model 3s if only they had more cash on hand for working capital.So you think Tesla should have, instead of producing 77k vehicles and delivering 63k, they should have instead produced 90-100k and delivered 63k, and thus tacked another 1B loss to FCF? Great plan there.

But we’re always being told that Model 3 production growth has a positive impact on working capital cashflow (I.e. payables days are longer than raw materials plus WIP plus days to deliver).

I’m confused why more people don’t see this situation at the least, as a misstep? If you have the demand and the working capital flexibility, you don’t care whether on the 31st of the month those cars have been delivered or else are in transit to customers that have paid a non-refundable deposit. Sales are sales.

Q1 results will hopefully shed some light on all this.

EVNow

Well-Known Member

I'd be surprised if this is the actual motivation. But, they should actually disclose this conflict of interest.Let's again remember that the LA Times is owned by a direct competitor of Tesla, which is developing zinc-air battery technology:

EVNow

Well-Known Member

Is it still the case for EU/China cars ?But we’re always being told that Model 3 production growth has a positive impact on working capital cashflow (I.e. payables days are longer than raw materials plus WIP plus days to deliver).

Pras

Member

How does a short get a seat on the roundtable for investors? I assume the criteria should be that one is a Tesla shareholder. Maybe the investor definition include shorts, but not from a conventional understanding.As moderator, I should remember not to mix roles. I have removed the temporary ban on @Smokey4141 so that he can rebut my rebuttal. Or try to anyway.

Edit: wow, so many disagrees! Tells me something...

Hock1

Member

Ok I guess I am using the Robert Mueller technical definition. I do not believe there is an agreement or plan between the SEC and the big investment houses. I think there is an acceptance of mutual objectives based upon working relationships and common goals. But again you could be right. I just do not see the SEC making an agreement with GS for example to attack Tesla. For the same reason it is unlikely that Trump had an agreement necessary to constitute a legal conspiracy even though he clearly encouraged and welcomed Russian involvement.

TDS===Tesla Derangement Syndrome.Hmm, I got to wonder if these shorts are so good at sniffing out fraud, why haven't they been shorting and exposing all these automakers colluding on emissions fraud and more? You'd think shorts could basically do some emissions testing of their own to determine who's cheating and then target the cheaters.

Instead $tslaq is a doomsday cult fixated on a single target. You can see in this reporting how members have gone through a sort of conversion experience as they bond with the $tslaq community. They become indoctrinated into seeing Musk as a liar who cannot be trusted as as source of information about Tesla. This creates an intellectual filter where any information contrary to the view of the cult is rejected as an obvious deception by Musk. Also to reinforce this script, their is cultivation of a persecution complex. As long as Musk and Tesla acolytes are seen as persecuting the $tslaq truth speaker, it validates the cults view and radically rejects any information contrary to that view. The cult member feels himself fighting a righteous cause simply by hating and contradicting any who are "persecuting" the cult. The fixation on Tesla's in parking lots reveals this sort of distortive framing. Consider that the average dealership sells only about 10 cars per week, but they've got scores even hundreds of cars on their lots at any point in time. This is just a logistical reality. There is nothing nefarious about that. Now look at the Tesla delivery lot, they are stuffed to the gills just to handle the logistics of delivery. Naturally there needs to be some overflow. Now because the $tslaq cult has framed this all as some great deception, they are predisposed to interpret the observations of Tesla in lots as some sort of deception, rather than simply the logistics of a company that is bursting at the seems more than doubling their deliveries in a single year. The cannot take in such an alternative interpretation because they perceive that they are actively being lied to and personally threatened by Tesla. Growth and logistics, those are exactly the sort of lies they would expect a fraudster like Musk to try to deceive them with!

Philosophically this is why falsifuability criterion of Karl Popper is so important for delineating between empirical though and cultic thinking. The question is, what sort of empirical data would a $tslaq member accept as falsifying or invalidating his investment thesis? The intellectual filters of the cultic mind make it nearly impossible for anything to register as fact that should threaten the cultic view. So we see this over and over again, some information comes out that is consistent with a Tesla grow narrative, and the doomsday cult quickly radically reinterprets as some sort of bad thing or further evidence of fraud or doom. The basic facts that Tesla grew unit sales by 150% last year and finished the second half profitable and cash positive does not register in their think as facts which potentially invalidates their short thesis. Instead they become obsessed with snooping around parking lots hoping to find evidence to buttress their rejection of facts about growth. So many of them do not hold a short thesis that can reasonably be falsified by basic facts. And this is precisely what it means to be caught up in a cultic thinking as a radical departure from empirical thought.

Yes, $TslaQ is a cult.

One should also ask themselves what empirical outcome would cause me to reject my current investment thesis. For me personally, I am looking to see 50% annual growth in revenue through 2025. If Tesla were to struggle to sustain this level of growth, I would become very concerned. As a really basic empirical test, I check to see if y/y reported revenue has actually grown more than 50%. Moreover, I question whether this growth can be sustained over the next year or two. So I need to see that Tesla is continuing to position itself for growth. This outlook is quite open to information which can falsify my thesis. So to the best of my abilities, I am engaged in empirical thinking and not lost in cultic brain rot.

Smokey4141

Banned

As moderator, I should remember not to mix roles. I have removed the temporary ban on @Smokey4141 so that he can rebut my rebuttal. Or try to anyway.

Edit: wow, so many disagrees! Tells me something...

Thank you for this opportunity... I won't take too much more of your time, but I ~do~ appreciate this moment....

It's at least the "fair" thing to do, right?

<<<<<Hmmm suspiciously, JB has a total of $21M, not $55M as your other graph seems to say.

And another lie: you can see in the table on the right that JB is pretty constant at a bit more than $4m/month, even in the estimates. But in the original graph you posted, the column for JB on 4/24 shows about $70M according to the scale on the right. That's an extra $15M over the previous month. Where did that sudden non-linear rise in the graph come from? It isn't justified by the table.>>>>>

The table below that you're referencing, is ~cumulative~, for ALL insiders...

That's why the title is "Total Tesla Insider Sales".... NOT just JB...as your "suspicious" comment infers...

And you said "JB on 4/24"... I presume you meant 4/28...

But yes, as you see, the ~cumulative~ sales (for ALL board members) are now ramping up....

The columns in red are the "scheduled sales" in April/May.... If they don't occur, THEN you can question the chart, but that's what's scheduled for now, according to their individual sales plans... Thru 3/26, that's already happened....

And I understand that people make mistakes, or mis-read things sometimes, but I don't appreciate being accused of "lies" and "tricks", when none are evident or intended, and then just banned... Respectfully, that was really crappy, Sir, but I ~do~ appreciate the opportunity to clarify.......

Singer3000

Member

I don’t know. Tesla’s management would have known that when they decided not to raise capital though.Is it still the case for EU/China cars ?

A history lesson on production from the Q2 2018 letter:

“During the month of July, we have repeated weekly production of approximately 5,000 Model 3 cars multiple times while also producing 2,000 Model S and X per week. Having achieved our 5,000 per week milestone, we will now continue to increase that further, with our aim being to produce 6,000 Model 3 vehicles per week by late August. We then expect to increase production over the next few quarters beyond 6,000 per week, while keeping additional capex limited.”

I dont mean to sound like a troll. But we’re still not hitting an average of 5k per week over a 13 week quarter. People that are expecting some miracle dust to lead to a GAAP profit in Q1 or 500k total deliveries in 2019 need a reality check.

So is the problem demand, production or cash on hand for working capital?

Doggydogworld

Active Member

The speed vs. speed limit histograms show AP was used mostly in congested highway traffic (e.g. rush hour), not free flowing. They excluded very slow traffic from their detailed analysis.

- there are also certain patterns in which drivers choose to employ Autopilot, mainly high-speed road sections with free-flowing traffic (highways)

- there were no accidents recorded during the study, either caused by a poor Autopilot decision or by slow reaction of the drivers in dangerous situations

- most situations in which drivers chose to disengage Autopilot in an anticipatory manner involved curves in the road, while most situations for reactive disengagements involved the car getting to close to lane lines, walls or other cars

- interestingly, drivers in the study tended to constantly explore the limits of the system, which allowed them to better understand its limitations (where things are likely to not work or go wrong)

- there is also an acknowledgement by the authors that, statistically, there will be a number of individuals in the greater population that will tend to over-rely on the performance of the autonomous system and show decreased vigilance, although they didn't see this behaviour in the studied group

They only had 800 reactive disengagements. Median time on AP was around 2 minutes. Attentiveness decrement tends to happen around 30-40 minutes.

After teaching my teenagers to drive in recent years, I can relate! I was hyper-vigilant early on when they made lots of mistakes, much less so as they improved.Paradoxically, the authors suggest that the imperfect functionality of the Autopilot system is what keeps vigilance levels high for drivers and helps avoid serious consequences; a closer-to-perfect system may actually increase complacency and prove itself more dangerous when supervision is still necessary.

Attention decrement is very real, and will show up more as AP/FSD improve to handle more situations competently and run for longer times without disengagement. That's why Waymo, GM/Cruise, Ford and others ditched the "gradually improve through the SAE levels" approach in favor of jumping straight to Level 4. Waymo was running 100 mile loops without intervention in 2010 and already seeing severe attention decrement even though the cars were nowhere near safe. A self-driving car that causes a severe wreck every few thousand miles is horrifically unsafe, but if it drives smoothly it will "feel" completely safe. Waymo had to go to trained, 2-person teams and give them specific monitoring/logging tasks to keep them engaged. They still have problems, such as the safety driver who ended up in a ditch last summer after inadvertently disabling the system while dozing off.

Smokey4141

Banned

Why would you see the need to excuse Mark's statement - in some form or the other ? Reminds me of all the excuses certain politicians make about an undesirable politician.

I'm not making an excuse, I'm agreeing with you, dude....

He's often a jack-@#%.... JFC....

Doggydogworld

Active Member

It's a mix. They were limited by logistics in Europe and demand in the US. The 2/28 SR+ launch (and price cuts) boosted US demand, but probably slowed production.I dont mean to sound like a troll. But we’re still not hitting an average of 5k per week over a 13 week quarter. People that are expecting some miracle dust to lead to a GAAP profit in Q1 or 500k total deliveries in 2019 need a reality check.

So is the problem demand, production or cash on hand for working capital?

Tesla ended Q1 with 20k Model 3s in inventory. I'd guess 8k in transit, 12k unsold new inventory. There was no reason to run production all-out and increase unsold inventory from 12k to 15k or 20k.

Heck, I would think the FCC would have something to say about that even. Imagine if Bezos used the Washington Post to badmouth Wal Mart or Netflix.Let's again remember that the LA Times is owned by a direct competitor of Tesla, which is developing zinc-air battery technology:

The only surprising thing about this is that the LA Times writing hit pieces about the owner's competition does not count as market manipulation aiding and abetting an illegal 'short and distort' scheme in the SEC's book.

EVNow

Well-Known Member

I'm not that worried about production. Infact, there were so many changes in Q1 - I'm surprised they still managed to make so many 3s in Q1 !I dont mean to sound like a troll. But we’re still not hitting an average of 5k per week over a 13 week quarter. People that are expecting some miracle dust to lead to a GAAP profit in Q1 or 500k total deliveries in 2019 need a reality check.

Elon Musk on Twitter

Replying to:Time flies

#Etron came. A diff one. And it can't even compete with #Tesla's lower models.

2009- 'watch out, Tesla, Audi's E-tron is coming'

Haha.

Last edited:

Causalien

Prime 8 ball Oracle

To be fair, Fly is in Europe, and tracked deliveries in that area on practically a daily basis...

NO ONE on the "Q" side of the ledger was ~surprised~ by the disappointing Q1 sales....

Yet many ~here~ were...

So, drink whatever flavor Kool-aid you want, but on the "Q" side, it tasted pretty good...

(that wasn't meant specifically to you, Creekstalker, but more the collective board here)

And yes, many have been wrong about some things at some times, but there's been a lot right too....

And many times see things before they are common knowledge....

And some have been pounding that drum for years, others have come along more recently...

To lump ~all~ TSLA bears into one single camp.....is just simply wrong...

This might be an interesting thread along those lines as well... Never mess with the "el gato"... hahahaha

el gato malo on Twitter

I'll wrap this up with...... Achieved some pretty amazing things, yes....

But at what cost?

Rhetorical question, no need to answer, but....when the books and movie comes out a few years from now.....please....think of this note...

Regardless, thanks, man... Always appreciate honest, thoughtful debate among reasonable adults....

To be fair, you guys have your shares of myopic fixation. Things like officers exercising options and selling. Almost every year, you shorts come back and show these figures as insider selling, spinning the narratives of officers getting out of the stock.

One of these dates when tesla is running in bull's favor, I am going to sign up to a short forum and gloat. (because this year, you guys finally have a few places that are persistent). It goes both way.

You guys see the glass as empty, we see it as full. The truth is half empty. Marketing is deceiving for all manufacturers, Elon is just autistic and transparent so it is easy to pick on. If he is a normal lying SOB CEO, you'd get industry wide diselgate.

PS. Don't you have better and more pressing shorts like BA to kill for intentionally designing a shitty plane and killing 2 plane load of people because their autopilot relies on ONE camera?

Last edited:

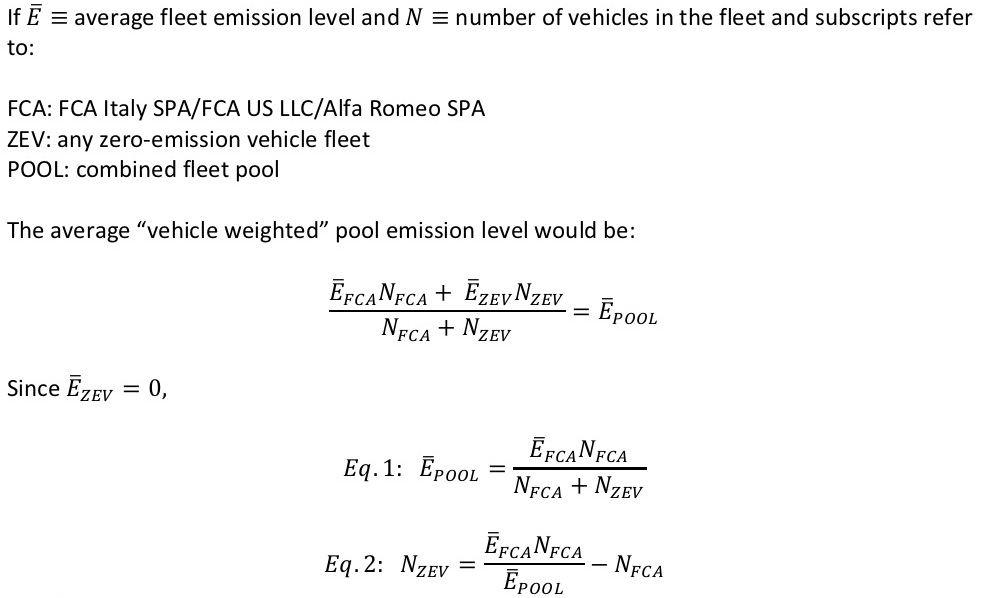

I’m still interested in trying to crunch some of the numbers involved with the FCA/Tesla pooling deal. I’ve found most of the info I was looking for in this post:

Tesla, TSLA & the Investment World: the 2019 Investors' Roundtable

Reference 1 had:

The FCA 2017 fleet total vehicles = 727,201 (p. 13)

The FCA 2017 fleet average CO2 emissions = 120 g/km (Table 3-1)

The FCA CO2 emission targets (2020/2021) = 91 g/km (Table 3-1)

(Reference 1 already combined all the Fiat components that I listed separately in the linked post.)

The one obvious missing piece is the calculation for the pool average CO2 emission. The post I linked to above assumed it was a “vehicle weighted” average, and I still think that would be right. In fact, Reference 2 specifies the information that pool members are allowed to share and it’s the exact above parameters (Article 7 Paragraph 5). There’s not much more you can do with those than “vehicle weighted”.

Reference 2 (Article 9 Paragraph 2b) gives the post-2018 penalty (“premium”) for missing the emission target: 95 € per g/km per new vehicle. Paragraph 4 states that that penalty goes into the “general budget” of the EU. (!!)

Given that data and assumptions, if FCA pools with a ZEV provider we can compute the pool average emissions given the number of ZEVs, or conversely the number of ZEVs needed to reach a certain emission limit. The equations are given below.

Interesting results:

First the easy one. How much trouble is FCA in? Their 2017 numbers are 29 g/km out of compliance with the 2020/21 limits (120-91).

(29 g/km)( 95 € per g/km per vehicle)(727,201 vehicles) = €2.00 B penalty. Per year.

Ouch, but that’s the number we’ve been hearing. So far, so good.

Second, how many ZEVs would it take to get an FCA/ZEV Pool into complete compliance (91 g/cc)? Plug the numbers into Equation 2 below:

(120)(727,201)/(91)-727,201 = 231,745 ZEVs. Per year.

Ouch again. Obviously, Tesla is not going to get FCA into compliance and eliminate the whole penalty. It can only reduce the pain.

OK, what if Tesla supplies 70,000 ZEVs to the pool every year? How much help is that? From Equation 1:

(120)(727,201)/(727,201+70,000)=109.5 g/km. That’s a reduction of 10.5 g/km which is equivalent to a penalty reduction of (10.5)(95)(727,201) = €725 M.

So how much is that worth to FCA? Suppose they give Tesla a 50% “bounty” (half of the yearly penalty reduction) to join the pool. That’s:

(0.5)( €725 M) = €362.5 M. Per year. Not out of line with “low 100’s of millions of euros” and each ZEV is worth about €5,200 additional profit to Tesla.

In this scenario, FCA would pay the EU €1.275 B penalty, pay Tesla €362.5 M bounty and save €362.5 M over not pooling. Per year. Still really bad, but realistically probably the best scenario they’ve got. All they can do is negotiate the bounty.

Does FCA have any other options? Well, they could try to lower their darn emissions, but Reference 1 Figure 3.8 shows they have made essentially zero progress since 2011. But suppose miraculously they got half way to their target (105 g/km). Then their best option would only pay the EU €648.5 M, but would still pay Tesla €318.5 M bounty for the 70,000 ZEVs (€4550 additional Tesla profit per ZEV).

Those that understand the pooling logic better than me, feel free to correct. I’m still not clear on the 2019 pooling vs. the 2020/2021 targets. It seems like the 2019 numbers are subject to the 2020/2021 targets in some way.

References:

1) https://www.theicct.org/sites/default/files/publications/ICCT_Pocketbook_2018_Final_20181205.pdf

2) https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:140:0001:0015:EN:PDF

Tesla, TSLA & the Investment World: the 2019 Investors' Roundtable

Reference 1 had:

The FCA 2017 fleet total vehicles = 727,201 (p. 13)

The FCA 2017 fleet average CO2 emissions = 120 g/km (Table 3-1)

The FCA CO2 emission targets (2020/2021) = 91 g/km (Table 3-1)

(Reference 1 already combined all the Fiat components that I listed separately in the linked post.)

The one obvious missing piece is the calculation for the pool average CO2 emission. The post I linked to above assumed it was a “vehicle weighted” average, and I still think that would be right. In fact, Reference 2 specifies the information that pool members are allowed to share and it’s the exact above parameters (Article 7 Paragraph 5). There’s not much more you can do with those than “vehicle weighted”.

Reference 2 (Article 9 Paragraph 2b) gives the post-2018 penalty (“premium”) for missing the emission target: 95 € per g/km per new vehicle. Paragraph 4 states that that penalty goes into the “general budget” of the EU. (!!)

Given that data and assumptions, if FCA pools with a ZEV provider we can compute the pool average emissions given the number of ZEVs, or conversely the number of ZEVs needed to reach a certain emission limit. The equations are given below.

Interesting results:

First the easy one. How much trouble is FCA in? Their 2017 numbers are 29 g/km out of compliance with the 2020/21 limits (120-91).

(29 g/km)( 95 € per g/km per vehicle)(727,201 vehicles) = €2.00 B penalty. Per year.

Ouch, but that’s the number we’ve been hearing. So far, so good.

Second, how many ZEVs would it take to get an FCA/ZEV Pool into complete compliance (91 g/cc)? Plug the numbers into Equation 2 below:

(120)(727,201)/(91)-727,201 = 231,745 ZEVs. Per year.

Ouch again. Obviously, Tesla is not going to get FCA into compliance and eliminate the whole penalty. It can only reduce the pain.

OK, what if Tesla supplies 70,000 ZEVs to the pool every year? How much help is that? From Equation 1:

(120)(727,201)/(727,201+70,000)=109.5 g/km. That’s a reduction of 10.5 g/km which is equivalent to a penalty reduction of (10.5)(95)(727,201) = €725 M.

So how much is that worth to FCA? Suppose they give Tesla a 50% “bounty” (half of the yearly penalty reduction) to join the pool. That’s:

(0.5)( €725 M) = €362.5 M. Per year. Not out of line with “low 100’s of millions of euros” and each ZEV is worth about €5,200 additional profit to Tesla.

In this scenario, FCA would pay the EU €1.275 B penalty, pay Tesla €362.5 M bounty and save €362.5 M over not pooling. Per year. Still really bad, but realistically probably the best scenario they’ve got. All they can do is negotiate the bounty.

Does FCA have any other options? Well, they could try to lower their darn emissions, but Reference 1 Figure 3.8 shows they have made essentially zero progress since 2011. But suppose miraculously they got half way to their target (105 g/km). Then their best option would only pay the EU €648.5 M, but would still pay Tesla €318.5 M bounty for the 70,000 ZEVs (€4550 additional Tesla profit per ZEV).

Those that understand the pooling logic better than me, feel free to correct. I’m still not clear on the 2019 pooling vs. the 2020/2021 targets. It seems like the 2019 numbers are subject to the 2020/2021 targets in some way.

References:

1) https://www.theicct.org/sites/default/files/publications/ICCT_Pocketbook_2018_Final_20181205.pdf

2) https://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=OJ:L:2009:140:0001:0015:EN:PDF

shrspeedblade

Rideshare Monkey

Well, 3 more into the Roth IRA at $275. Lets see what they'll do for me in 20 years!

Doggydogworld

Active Member

Tesla says GF3 battery module production will be online this year, concurrent with stamping, joining, paint and final assembly. In theory they could send GF1 cells to Shanghai, but there's no reason to send packs. Unless they've changed plans again, of course.It's not mutually exclusive. Tesla could have been accumulating battery packs for anticipated needs later in the year (e.g. to have enough stock to feed GF3, since local battery production won't be online until next year.....

Instead of theorizing a huge stash of packs somewhere, common sense says the 6k/week reports were simply wrong.

Doggydogworld

Active Member

TE is ~0% gross margin, an improvement from most/all of 2018 when it was negative.If TE produces a few hundred million in expected profit,...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M