I'd assume that's because of the line size that Tesla has had traditionally and assumes only one line (which might be the case the first year of production).Maybe I missed it, but why exactly are people assuming only 150k trucks per year? That's a nonsensically tiny estimate for a F150-class pickup. Ford alone sells a million full-size pickup trucks per year.

Musk's past statements have indicated that the pickup has as large of a potential market as Model Y. We're looking at ultimately ~700k+/yr.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

ReflexFunds

Active Member

And the model S is Elon's "$45k car" (master plan I) and the model 3 is his "$35k" car (2017 reveal). I don't put much stock in Elon's timelines or early development price targets. After a few more cost reductions they'll get to a $35k model 3. It'll probably be similar with the truck cost. $50k is not the likely starting base price nor does it say much about likely ASP imo. Tesla, rightfully for their growth strategy, prioritizes making a fantastic product over hitting Elon's initial price targets.

Now Tesla has a track record of mass production and already has its powertrain/battery costs at the right level. There is no reason why they cannot hit their $50k price point target for Pickup. And they did hit $35k for Model 3 by the way.

They also hit the price point for the S (albeit with some difficulty). I have a Monroney sticker that says they did.Now Tesla has a track record of mass production and already has its powertrain/battery costs at the right level. There is no reason why they cannot hit their $50k price point target for Pickup. And they did hit $35k for Model 3 by the way.

davepsilon

Member

Now Tesla has a track record of mass production and already has its powertrain/battery costs at the right level. There is no reason why they cannot hit their $50k price point target for Pickup. And they did hit $35k for Model 3 by the way.

On the $35k, yes, sort of. But they haven't hit $35k with a variant they actually wanted to sell. I expect they will sooner rather than later.

I will wait to see the size and utility of the truck they have in mind before speculating further on the price. $50k is possible. I personally am not weighting that pre-release info very highly.

Fact Checking

Well-Known Member

The 10Q is out:

Skimmed it quickly and haven't seen anything that changes the picture painted by the Q3 update letter: 'other income' was FX fluctuations, regulatory credit income was in the normal range - NL+NO and 'rest of the world' revenue is showing a nice uptick while there's a -10% drop in the U.S. compared to Q2. Rest of the world ticked up from 1.52b to 1.83b, +20%.

"China loan agreement" is interesting: $219m used and $924m unused. A lot more room to spend on the factory and ramp up deliveries in China.

Also, amazing conditions:

We knew most of this, but it's worth repeating: 90% of the central bank interest rate for a non-course loan ...

Skimmed it quickly and haven't seen anything that changes the picture painted by the Q3 update letter: 'other income' was FX fluctuations, regulatory credit income was in the normal range - NL+NO and 'rest of the world' revenue is showing a nice uptick while there's a -10% drop in the U.S. compared to Q2. Rest of the world ticked up from 1.52b to 1.83b, +20%.

"China loan agreement" is interesting: $219m used and $924m unused. A lot more room to spend on the factory and ramp up deliveries in China.

Also, amazing conditions:

China Loan Agreements:

In March 2019, one of our subsidiaries entered into a loan agreement with a syndicate of lenders in China for an unsecured facility of up to RMB 3.50billion (or the equivalent amount drawn in U.S. dollars), to be used for expenditures related to the construction of and production at our Gigafactory Shanghai.

Borrowed funds bear interest at an annual rate of: (i) for RMB-denominated loans, 90% of the one-year rate published by the People’s Bank of China, and (ii) for U.S. dollar-denominated loans, the sum of one-year LIBOR plus 1.0%.

The loan facility is non-recourse to our assets.

In September 2019, one of our subsidiaries entered into a loan agreement with a lender in China for an unsecured 12-month revolving facility of up to RMB5.00 billion (or the equivalent drawn in U.S. dollars), to finance vehicles in-transit to China.

Borrowed funds bear interest at an annual rate no greater than 90% of the one-year rate published by the People’s Bank of China.

The loan facility is non-recourse to our assets.

In March 2019, one of our subsidiaries entered into a loan agreement with a syndicate of lenders in China for an unsecured facility of up to RMB 3.50billion (or the equivalent amount drawn in U.S. dollars), to be used for expenditures related to the construction of and production at our Gigafactory Shanghai.

Borrowed funds bear interest at an annual rate of: (i) for RMB-denominated loans, 90% of the one-year rate published by the People’s Bank of China, and (ii) for U.S. dollar-denominated loans, the sum of one-year LIBOR plus 1.0%.

The loan facility is non-recourse to our assets.

In September 2019, one of our subsidiaries entered into a loan agreement with a lender in China for an unsecured 12-month revolving facility of up to RMB5.00 billion (or the equivalent drawn in U.S. dollars), to finance vehicles in-transit to China.

Borrowed funds bear interest at an annual rate no greater than 90% of the one-year rate published by the People’s Bank of China.

The loan facility is non-recourse to our assets.

We knew most of this, but it's worth repeating: 90% of the central bank interest rate for a non-course loan ...

Last edited:

LN1_Casey

Draco dormiens nunquam titillandus

The 10Q is out:

Skimmed it quickly and haven't seen anything that changes the picture painted by the Q3 update letter: 'other income' was FX fluctuations, regulatory credit income was in the normal range - NL+NO and 'rest of the world' revenue is showing a nice uptick while there's a -10% drop in the U.S. compared to Q2. Rest of the world ticked up from 1.52b to 1.83b, +20%.

Breaking news!

TESLA DOWN 10% in America

Shortsville Times

OT/Macro (notice only):

* Labour (incl. Corbyn) is finally onboard with backing a new election in the UK. So it's almost certainly going to happen, either on 9 or 12 December. The outcome should have a big impact on European market sentiment. I'm not sure if it'll impact the UK's EV incentives.

Thread for discussion (e.g. not here):

Brexit

* Labour (incl. Corbyn) is finally onboard with backing a new election in the UK. So it's almost certainly going to happen, either on 9 or 12 December. The outcome should have a big impact on European market sentiment. I'm not sure if it'll impact the UK's EV incentives.

Thread for discussion (e.g. not here):

Brexit

Last edited:

sweter

Member

And they did hit $35k for Model 3 by the way.

Really? Where can I buy it?

At tesla.com.Really? Where can I buy it?

Assuming, you are able to comprehend what is written.

The 10Q is out:

Skimmed it quickly and haven't seen anything that changes the picture painted by the Q3 update letter: 'other income' was FX fluctuations, regulatory credit income was in the normal range - NL+NO and 'rest of the world' revenue is showing a nice uptick while there's a -10% drop in the U.S. compared to Q2. Rest of the world ticked up from 1.52b to 1.83b, +20%.

"China loan agreement" is interesting: $219m used and $924m unused. A lot more room to spend on the factory and ramp up deliveries in China.

Also, amazing conditions:

China Loan Agreements:

In March 2019, one of our subsidiaries entered into a loan agreement with a syndicate of lenders in China for an unsecured facility of up to RMB 3.50billion (or the equivalent amount drawn in U.S. dollars), to be used for expenditures related to the construction of and production at our Gigafactory Shanghai.

Borrowed funds bear interest at an annual rate of: (i) for RMB-denominated loans, 90% of the one-year rate published by the People’s Bank of China, and (ii) for U.S. dollar-denominated loans, the sum of one-year LIBOR plus 1.0%.

The loan facility is non-recourse to our assets.

In September 2019, one of our subsidiaries entered into a loan agreement with a lender in China for an unsecured 12-month revolving facility of up to RMB5.00 billion (or the equivalent drawn in U.S. dollars), to finance vehicles in-transit to China.

Borrowed funds bear interest at an annual rate no greater than 90% of the one-year rate published by the People’s Bank of China.

The loan facility is non-recourse to our assets.

We knew most of this, but it's worth repeating: 90% of the central bank interest rate for a non-course loan ...

And remember the 'tooling depreciation is being lowered via extending tooling life!' short conspiracy theory? Another CT goes up in smoke:

Q2: "Depreciation expense during the three and six months ended June 30, 2019 was $334.6 million and $634.0 million , respectively."

Q3: "Depreciation expense during the three and nine months ended September 30, 2019 was $353 million and $987 million, respectively."

Tooling depreciation is up +$18,4M.

ReflexFunds

Active Member

Not much of note in a quick read of the 10Q.

Capex guidance now for slightly below $1.5bn in 2019. (Down from $1.5-2bn range last Q and $2-2.5bn initial projection, despite Tesla being ahead of schedule on key projects).

$1.9bn unused credit lines available.

Also confirmation that Model 3 gross margin was up slightly yoy in Q3 (despite much lower reg credits, lower prices, weaker mix, introduction of lower trims etc). In 3Q18 they had noted Model 3 GAAP gross margins were >20% on both a GAAP and non GAAP basis.

Capex guidance now for slightly below $1.5bn in 2019. (Down from $1.5-2bn range last Q and $2-2.5bn initial projection, despite Tesla being ahead of schedule on key projects).

$1.9bn unused credit lines available.

Also confirmation that Model 3 gross margin was up slightly yoy in Q3 (despite much lower reg credits, lower prices, weaker mix, introduction of lower trims etc). In 3Q18 they had noted Model 3 GAAP gross margins were >20% on both a GAAP and non GAAP basis.

Last edited:

The Accountant

Active Member

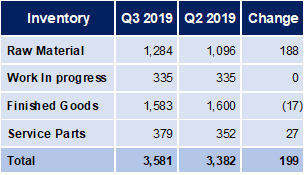

The Inventory Conspiracy Solved !!

The Post-ER FUD included the "Inventory Conspiracy". If Tesla sold all the cars they produced in the period how did inventory go up by $200m. Hmmm.....maybe they're hiding costs in inventory?

Well the brainless FUDsters did not account for the possibility of Raw Materials and Service Parts increasing. Finished Goods actually went down:

The Post-ER FUD included the "Inventory Conspiracy". If Tesla sold all the cars they produced in the period how did inventory go up by $200m. Hmmm.....maybe they're hiding costs in inventory?

Well the brainless FUDsters did not account for the possibility of Raw Materials and Service Parts increasing. Finished Goods actually went down:

Nuclear Fusion

Banned

He also said M3 would get SASElon has already said Cybertruck will start below $50k.

The Inventory Conspiracy Solved !!

The Post-ER FUD included the "Inventory Conspiracy". If Tesla sold all the cars they produced in the period how did inventory go up by $200m. Hmmm.....maybe they're hiding costs in inventory?

Well the brainless FUDsters did not account for the possibility of Raw Materials and Service Parts increasing. Finished Goods actually went down:

View attachment 471071

Could it be that the battery packs sent to GF3 in preparation for the start of Model 3 production are one of the causes of the increase in raw materials? Since they are not attached to cars yet, I suppose they do not count as finished goods.

sweter

Member

At tesla.com.

Assuming, you are able to comprehend what is written.

It seems I'm not, why don't you point me in the direction?

I was curious about having a setup where, in addition to the standard battery pack in the vehicle, you could drop in some additional battery modules in an easy to reach part of the vehicle. E.g. where Rivian has a gear tunnel that they have stashed a kitchen in, Tesla could create a bracket which could hold additional battery modules. If you knew you had a heavy workload you could rent battery modules and place them in the bracket to increase overall capacity for the day.I'm confused. AFAIK "module" in the context of Rivian is something like a type of bed that you can swap out. But it sounds like you're talking about adding or removing batteries. IMHO, that's never going to happen.

Kind of a hybrid of battery ownership and battery swapping where you buy the vehicle with a battery sized to meet your daily needs but have the option to plug in addition battery modules to increase capacity on high usage days.

The Accountant

Active Member

Could it be that the battery packs sent to GF3 in preparation for the start of Model 3 production are one of the causes of the increase in raw materials? Since they are not attached to cars yet, I suppose they do not count as finished goods.

Correct - until a completed car rolls of the line, costs are either in raw materials or work in progress. It's not unusual for raw materials to increase as capacity increases. Once GF3 is on-line, we will see Work In Progress increase as well as there will be more mfg lines at quarter end with cars being assembled.

Really? Where can I buy it?

In US in the showroom, only available to purchase in showrooms

bhtooefr

Active Member

At tesla.com.

Assuming, you are able to comprehend what is written.

It seems I'm not, why don't you point me in the direction?

An Update to Our Vehicle Lineup

But that's pretty well buried, considering you won't find it from the Model 3 ordering pages. And, you can't actually buy it at tesla.com. (At least in the US, you can call or go into a store though to buy it.)

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M