Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

That is just more bad reporting by Electrek. Yes, Model Y prototypes where spotted in Minnesota. Were they cold-weather testing? I doubt it. Tesla has a high quality dedicated cold testing facility, that is where they would do cold weather testing. Not parked in a random parking lot in Minnesota.

And Tesla does its cold weather testing in Alaska: A Look Inside The Tesla Cold Weather Testing Facility | CleanTechnica

Tslynk67

Well-Known Member

Need option “not advice”.

If you own 100sh and think Tesla is going to 1000+ in the next year and you want to double your shares but you don’t have the cash to buy another 100 right now... but will next year.

Would it make sense to sell 1 contract of Jan 2021 700 calls for $64 and buy 2 contracts of Jan 2021 800 calls for $44, costing $1,400 (vs $4,400 for 1 800 call).

Is the worst thing that could happen is the price goes down and you lose on your current holdings plus the $1,400?

Is the second “worse” the price goes to $801, you lose $10k on the 700-800 rise and get margin called for 200sh @ 800?

Personally I'm looking to get enough cash in my play account to see a put, or maybe a put bull spread, one month into the future, rinse-repeat. Worse thing that happens is that you have to buy 100 shares at a lower price than current. Normally you'll get to keep the premium.

Do your own research, I know nothing.

JusRelax

Active Member

Surprised this hasn't been mentioned here yet:

With the increasing concern about the CoronaVirus in China, is it not likely Tesla will see a jump in Chinese sales of cars with Bioweapon Defense Mode A/C equipped? (Model S/X)

They should probably look at making it an option available to the MIC model 3 (if they haven't already), I imagine it would be popular in areas of high pollution anyway.

That's a good point. If Tesla knows bioweapon defense mode protects against it, I feel like Tesla China would definitely tweet something about it...

So if Tesla are conducting cold weather testing of the Model Y presently, how does that square with the February delivery rumor? Hard to imagine they would still be doing testing this close to supposed deliveries. I'm growing increasingly skeptical of the Reddit rumor from the other day.

Tesla Model Y prototypes spotted cold-weather testing in Minnesota snow - Electrek

Model 3 was caught winter testing in New Zealand on July 27, 2017.

The first 30 cars were delivered to customers the next day, July 28.

Tesla Model 3 Caught Cold-Weather Testing in New Zealand Ahead of Handover Event

RobStark

Well-Known Member

The only appropriate modern response to this is:

OK Boomer.

Ralph Nader was born before WWII started, 1934.

OK, G.I. Ralph?

ZachF

Active Member

Renault is down 5% today, 12% this year and 58% over the last two years and the troubles have only just begun. Big ICE sales crash in the making, billions in stranded assets, billions in debt and legacy costs, billions needed for developing EVs, which at first will have negative or virtually no margin.

And this is the prospect for all OEMs!

Which investor in their right mind would put any money in traditional OEM stocks for the next five years? If you want to invest in automotive there is only one viable option at the moment. I expect a lot of smart money to switch to TSLA in the coming years.

I am of the opinion it's going to get brutal, fast, for the Japanese auto industry in the next few years.

Nissan is basically a Zombie waiting to die. Mitsubishi too.

Toyota downright refuses to bother with EV tech... Their conservativism has morphed into laziness. They've also been having weak sales in the US.

Pretty much the same with Subaru. (except the weak US sales part)

Japan is by far the largest net exporter of ICE vehicles (9.7m production vs. 5.2m sales)

Japan is already massively in debt and wont be able to bail out them all.

While much of the focus has been put on Germany, I think cracks will start to show in Japan, and when they do they'll worsen quickly.

Tesla’s can run on coal even if they rarely do. That should be worth lots to Trump.

Somebody already converted a Model 3 to run on gas. I have no idea why! But they did. So a coal burning steam engine Model 3 should be possible too.

The Model 3-Based Obrist Mark II Is A Different Proposition For EVs

mejojo

Active Member

I can grantee you, Bubba here in the NW US will buy out the CyberTruck due to its ability to deflect penetration of a 9-mm. His only problem will be figuring out how to charge it at the local ICE station, and look cool

Prediction: Within 3 months after CT delivers in any volume, there will be a lawsuit "I shot the truck and hit my _____!"

The Martian

Member

I recommend watching this video made by our fellow TMC member. It will keep you calm dealing with crazy TSLA price action no matter it's up or down.Honestly, I think I've been traumatized by TSLA. With my model I (thanks in very very VERY large part to members of this forum at the time) predicted the first quarterly profit against an expected loss. That night I celebrated, danced, had a drink slept like a baby. The next morning the stock shot up ever so briefly and then went straight down and didnt stop. It seems at times you can be right and still be very wrong. Tesla right now has nothing but tailwinds and clear skies ahead as far as I can see. I got my FSD installed in my Model S yesterday, and when I asked them to look into a possible suspension and motor issue, they told me it would cost me $97 dollars if nothing was wrong. If there was indeed an issue it would be free. They are being more and more efficient. I went to CES and got inside the Mercedes EQC. I have no idea why they let us get into it because the dash screen kept flashing "malfunction" and the GPS lagged by 1-2 seconds when trying to hit the keys. Competition is clearly not coming. Tesla keeps moving ahead. I literally cant see a reason I need these puts. But the past has scarred me and I don't want to live through a drop to 380. I've also purchased a smaller number of bullish spreads in the event we move up as we should.

It may not be entirely rational. But its an honest answer.

<iframe width="1124" height="632" src="

Yep. Just had my credit card skimmed at a gas station a couple of weeks ago. That’s a huge theft industry.

It happened to me a year ago. My bank called to tell me that my credit card had been charged $100 that day at a gas station 70 miles from my home and garaged compact car. They suspected theft. I concurred. They immediately cancelled the charge and my credit card number, and mailed a new card with a new number but still considered to be for the old account.

They also advised to never have the card scanned at the pump, and to always go inside the station to pay. They explained that some crooks can scan a pump's card reader and steal credit card information.

I explain to gas station clerks why I have to pay inside, and that that will stop when I get my Model Y.

RobStark

Well-Known Member

I was tuning into CNBC squawk box just earlier and they had the CEO of Nebia on to promote his new fancy shower head. He likened it to the Tesla Model 3 in terms of its improvement over the original. I’m sure those CNBC hosts are sick and tired of talking Tesla so it was great to see it being stealthily mentioned in a positive way!

Ultimate traditional luxury products are the " Rolls Royce of.......

When someone is making a pitch that this product is modern with leading edge tech it is the " Tesla of....."

That's nonsense. The solar on your roof doesn't replace much employment: neither natural gas, coal or nuclear power are labor intensive.

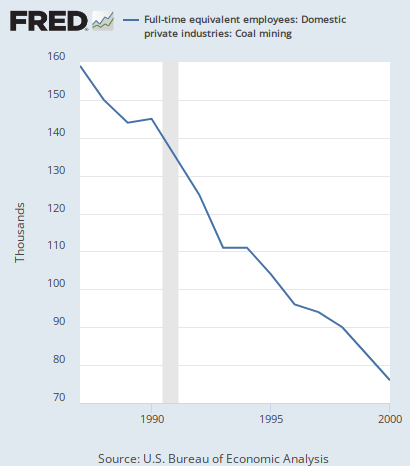

Here's U.S. coal mining employment for example:

Currently below 50,000 people - fossil fuel extraction is very labor efficient.

On the other side, to make 0.4m vehicles a year Tesla needs ~40k employees, most of them in their automotive segment.

Just doubling Tesla's production will create as many jobs in the U.S. as the entire coal industry - and these are vastly higher quality, high-tech jobs.

1,000,000,000 ICE vehicles need to be replaced globally, at an accelerated rate. What does that mean? More employment.

Here's an extensive study about the job creation effects of the "Green New Deal":

Would a Green New Deal Add or Kill Jobs?

"New jobs from energy-efficiency investments would be significant, totaling 1.8 million in 2030 and 4.2 million in 2050."

History also supports this notion: in most past disruption events, almost without exception disruption increased employment.

E2 tracks clean jobs to help US politicians and others understand the tangible benefits of clean tech businesses in the areas of the politicians’ voter bases.

E2 creates a variety of detailed reports by area, which can be handy for investors as well as citizens and politicians. For example, here’s a link to the report for the Midwest: Clean Jobs Midwest 2019 | 737,000 clean energy jobs across Midwest

This data sheet in this image summarizes the US:

Tslynk67

Well-Known Member

Today’s closing:

--0.3% FCAU

--0.2% F

--0.1% GM

+0.5% TSLA (all-time closing high)

Odd price action today. After the big effort to push it down in pre-market and then again mid-session, I didn't at all expect to finish green.

Tomorrow I expect MM's to push it down again, let's see!

They probably don’t have any to sell. All telling people about it would do is make those with an X become a mark for people in fear... I wouldn’t drive a food truck through a famine and expect to get to the other side.That's a good point. If Tesla knows bioweapon defense mode protects against it, I feel like Tesla China would definitely tweet something about it...

UnknownSoldier

Unknown Member

HEPA air filters don't filter particles as small as viruses. Almost nothing does, including those N95 masks which are always so popular during flu season.That's a good point. If Tesla knows bioweapon defense mode protects against it, I feel like Tesla China would definitely tweet something about it...

That's what I also suspected yesterday, until they expended an ungodly amount of ammunition to push it down $25. Any chance they ran themselves dry with that maneuver?Odd price action today. After the big effort to push it down in pre-market and then again mid-session, I didn't at all expect to finish green.

Tomorrow I expect MM's to push it down again, let's see!

They don't need to filter viruses, just proplet nuclei (I think that's the term). Bare viruses are rarely sufficient to transfer disease for a variety of reasons.HEPA air filters don't filter particles as small as viruses. Almost nothing does, including those N95 masks which are always so popular during flu season.

Svetlin

Member

Need option “not advice”.

If you own 100sh and think Tesla is going to 1000+ in the next year and you want to double your shares but you don’t have the cash to buy another 100 right now... but will next year.

Would it make sense to sell 1 contract of Jan 2021 700 calls for $64 and buy 2 contracts of Jan 2021 800 calls for $44, costing $1,400 (vs $4,400 for 1 800 call).

Is the worst thing that could happen is the price goes down and you lose on your current holdings plus the $1,400?

Is the second “worse” the price goes to $801, you lose $10k on the 700-800 rise and get margin called for 200sh @ 800?

My not advice: Sell the 100 shares and buy 2 calls for late 2021 or jan 2022. Should be able to get strikes around 300-350 with the 57k from selling 100 shares. When you have the cash next year, let the calls get exercised and you end up with 200 shares.

Worst case, you lose all your money.

EDIT: also, selling the 100 shares has tax considerations that other strategies may not have. So, not claiming that this is the best approach.

Last edited:

JusRelax

Active Member

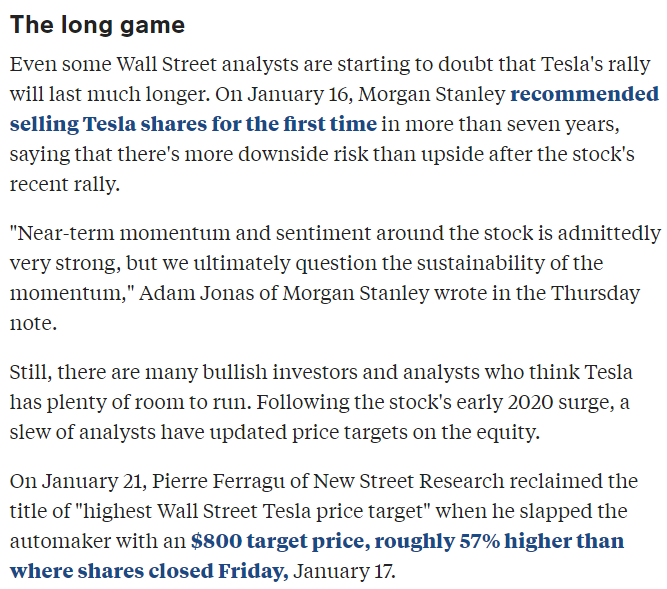

Wait... Adam Jonas of Morgan Stanley has been a bull for the past 7+ years until a week ago?

Traders betting against Tesla have lost $3.3 billion less than a month into 2020. Many are still holding onto their short positions. (TSLA) | Markets Insider

Traders betting against Tesla have lost $3.3 billion less than a month into 2020. Many are still holding onto their short positions. (TSLA) | Markets Insider

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K