Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Renault Can’t Expect a Tesla-Style Helping Hand

'This juxtaposition sends a crystal clear message: Carmakers that grew fat and happy producing combustion engine vehicles won’t get any help from the stock market now that they’ve decided to embrace an electric future. Instead the gasoline gang are going to fund these changes themselves and it’s going to be painful.'

I'm surprised that Renault is having such troubles now, because it's one of the best performing automakers in terms of CO2 (source), idem for its Nissan partner.

This is sad because it seems that companies who made the best efforts to electrify their lineup (Nissan + Renault) are paying higher cost than laggards (like PSA + FCA).

Other EU manufacturers like BMW and Daimler are in pretty bad position too, although they may have bigger margins for the moment. Daimler has to work the hardest (cf. their recent dividend cut, and the lack of battery supply for the EQC) but they at least realize that they will have to fully switch to BEV at some point. BMW now say they want to offer all kind of vehicles for decades: ICE, hybrids, etc.

VW appears to really try to catch up with Tesla, with the right strategy. IMO, they have the best chances to survive the upcoming recession.

Japan: Except Toyota, all manufacturers might face big troubles in the next few years. Toyota won't have to pay big fines soon, but their lack of commitment (to say the least) is astonishing. They seem to wait for other manufactures to go bankrupt before deciding to go electric, at the risk of letting Tesla taking an unsurpassed lead.

Volvo will certainly be saved by the Geely merger.

We'll know the fate of GM and Ford when they'll reveal their EV trucks, and when Cybertrucks will be running the streets. Ford seems to be working on a standard F-150-like truck but they'll probably disappoint in terms of features, range and price (like the Mach E vs Mode Y). GM is just having fun with their PR team, dreaming about a comeback of the Hummer brand. They also believe their Cruise tech will save them…

This is my ill-informed musings. Feel free to correct me or share your thoughts.

I'm looking at the chart right now and I don't see anything out of the ordinary happening...?Interesting price action in pre-market. I guess this is not just max pain. I thought the events yesterday would provide a little stability, plus the rumors on demand in China.

Maybe I should always do the opposite trade of what I expect to happen

Edit- removed inadvertently stacked quote my big fat fingers quoted by themselves that I never meant to quote. When it comes to those stinking way-too-close-together rating icons on the right and my big fat fingers... I could scream.

Last edited:

gerebgraus

Member

It is a fair guess that many legacy car companies will fail in the transition to BEV. Some will survive. It is an even fairer guess that the vast majority of BEV startups will fail. (I consider Tesla, BYD, etc. in this category too.) Tesla is in the best position due to its processes. Rivian has a chance because they have Amazon's financial support and large order of delivery vans. Bezos is one of the greatest entrepreneurs of our time. His record of success against Musk is not great. But Blue Origin in the space business is happily chugging along without being able to compete with Spacex. The same thing might happen with Rivian. I doubt that Lucid, Faraday will make it. The vast majority of the several hundreds of Chinese companies will fail. And 2-3 might survive.And Nissan's former CEO also warned that the company could go bankrupt in the next 2 years:

But it's Tesla's corporate debt that is rated by both Moody's and S&P as "junk debt" (B3/B-), while Nissan's corporate debt is rated as "investment grade" NINE full notches higher at A3/A-:

Hello Moody's and S&P credit rating staff, ... tap, tap ... is this thing on?

The Accountant

Active Member

Shouldn't it be a percentage of fleet size still under warranty?

I imagine warranty costs as a percentage of the fleet size is dropping even faster.

I see your logic but the way warranty expense accrual works is that the entire estimated lifetime warranty cost for a vehicle (sloar panel, etc) is recorded at the time of sale. The $152m of warranty expense in Q4 only relates to vehicles, energy products sold in Q4.

Internally, Tsla does the analysis you are referring to...so that they can determine if their estimates are reasonable. We're unalble to do this analysis as we don't have enough detail in the 10K.

Neither guy is very good at stating their case. The poor host were making their points for them. That was tough to watch hahaFrom CNBC:

Loup Ventures' Gene Munster and Roth Capital's Craig Irwin debate Tesla's bear and bull cases

I'm looking at the chart right now and I don't see anything out of the ordinary happening...?

It was down 3.5% for a moment. I know the day is long, I was just thinking whether there was any news I missed, or simple shenanigans pre-market on a Friday..

Edit: clearly the latter

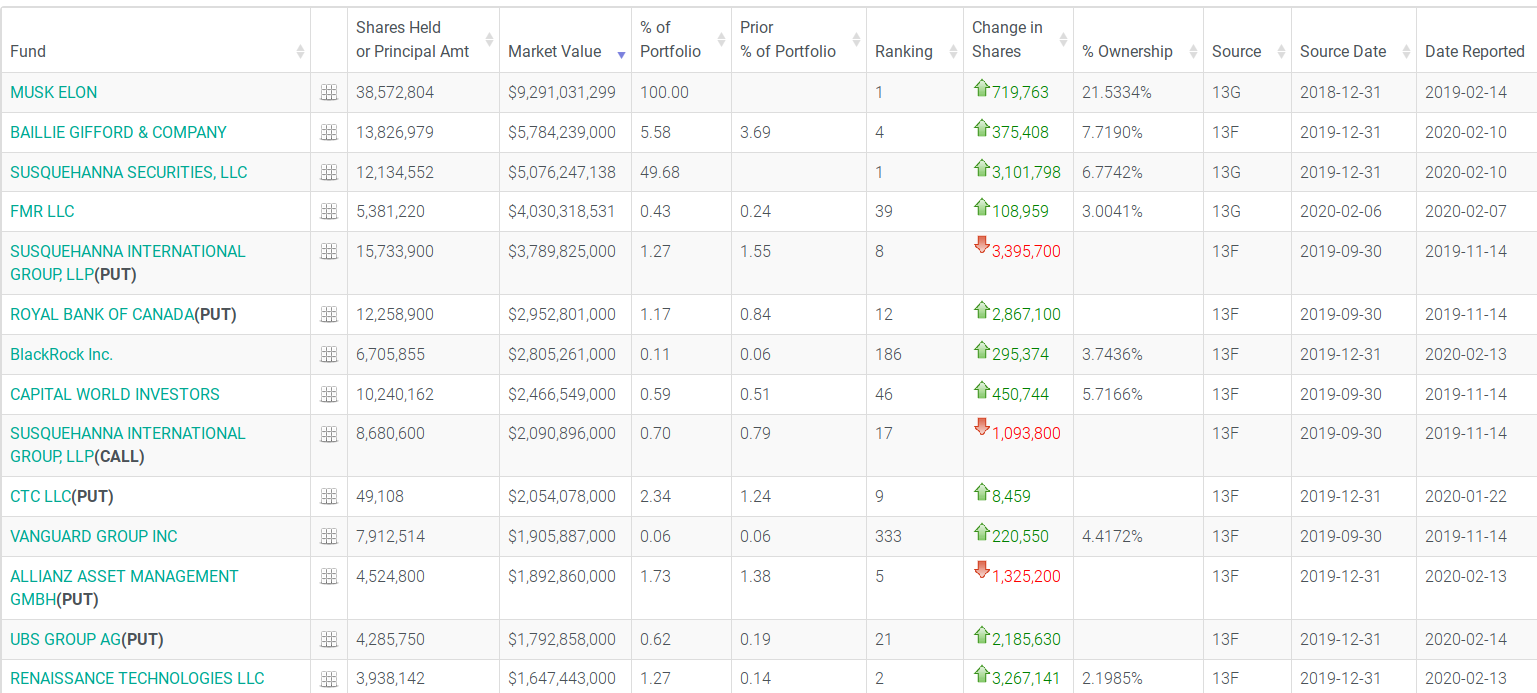

About 2 weeks ago I was wondering who were the big whales that triggered the rally from mid-December:

This post by FC mentions Capital World Investors filed a 13F about crossing the 5% threshold:

So I went and looked if they were the triggering whale, but it seems they have only increased by a relatively small amount, so they probably have been slowly gathering their shares over time and just happened to cross the threshold recently.

On the other hand, I do see some big moves in the table at the link:

We keep hearing that short covering is only a small fraction of whats driving this rally, and more of a reaction to margin calls rather than the driving force. This means the main driving force is longs accumulating, probably some huge investor, institution. If its a new one they need to report it when they reach 5%, AFAIK. On the other hand if its an existing large shareholder adding more, they still need to periodically report an amendment to declare their new position, right ?

When do we find out who is it if that is the case ?

This post by FC mentions Capital World Investors filed a 13F about crossing the 5% threshold:

Capital World Investors just disclosed a 10.6 million shares (5.0%) stake in Tesla:

I believe they are long term investors who were increasing and decreasing their Tesla stake over the years, and they now increased their stake.

So I went and looked if they were the triggering whale, but it seems they have only increased by a relatively small amount, so they probably have been slowly gathering their shares over time and just happened to cross the threshold recently.

On the other hand, I do see some big moves in the table at the link:

- Susquehanna Securities (+3.1 million shares),

- Royal Bank OF Canada (+2.8 million shares) and

- UBS Group AG (+2.1 million shares)

seems to be the biggest changes.

Swampgator

Active Member

Craig says that TSLA has no structural or strategic advantages.Neither guy is very good at stating their case. The poor host were making their points for them. That was tough to watch haha

humbaba

sleeping until $7000

Doesn't that cap the price at $767? This is out of my area, but that seemed to me to cap how much Tesla could make. That is, they could be bought for less than $767, and the only way I can think that would be rational is if the market price went lower.So with the offering now priced at $767 does that mean we should see the price run towards that today? Or does that just mean that they get to buy shares at a significant discount?

Which could explain the downward pressure if interested parties wanted to cut how much money Tesla actually obtained from the capital raise.

But I really have no idea how this works. Happy to be corrected as I'm sure I've misunderstood something.

Neither guy is very good at stating their case. The poor host were making their points for them. That was tough to watch haha

Agreed! I was surprised that the CNBC host was making some better points. I think Gene Munster is just not very good at making an argument. Craig Irwin doesn't even seem to believe his own thesis (maybe he doesn't).

Craig says that TSLA has no structural or strategic advantages.

Reminds me of Bob Lutz and the things he used to say.....which didn't age well!

Krugerrand

Meow

. Evaluating the assumptions related to the nature and frequency of future claims and the related costs to repair or replace items under warranty involved evaluating whether the assumptions used were reasonable considering current and past performance, including a lookback analysis comparing prior period forecasted claims to actual claims incurred.

So, that’s one of the best run-on sentences I’ve read in a while that sounds super intellectual, but registered as blah, blah, blah.

Late2theGame

Member

Hmm, data from CNN seem very different - am I missing something?About 2 weeks ago I was wondering who were the big whales that triggered the rally from mid-December:

This post by FC mentions Capital World Investors filed a 13F about crossing the 5% threshold:

So I went and looked if they were the triggering whale, but it seems they have only increased by a relatively small amount, so they probably have been slowly gathering their shares over time and just happened to cross the threshold recently.

On the other hand, I do see some big moves in the table at the link:

View attachment 511063

- Susquehanna Securities (+3.1 million shares),

- Royal Bank OF Canada (+2.8 million shares) and

- UBS Group AG (+2.1 million shares)

seems to be the biggest changes.

Edit: Never mind, they seem to use different names for some funds and firms, otherwise they are actually close.

Last edited:

TradingInvest

Active Member

About 2 weeks ago I was wondering who were the big whales that triggered the rally from mid-December:

This post by FC mentions Capital World Investors filed a 13F about crossing the 5% threshold:

So I went and looked if they were the triggering whale, but it seems they have only increased by a relatively small amount, so they probably have been slowly gathering their shares over time and just happened to cross the threshold recently.

On the other hand, I do see some big moves in the table at the link:

View attachment 511063

- Susquehanna Securities (+3.1 million shares),

- Royal Bank OF Canada (+2.8 million shares) and

- UBS Group AG (+2.1 million shares)

seems to be the biggest changes.

I think the real news is Renaissance Technologies added 3.26 million shares. Probably that's the main reason why the stock went up yesterday. Their Medallion fund does quantitative trading, which has a long term track record of ~70% gain per year before fees. Their larger fund runs like a normal fund.

We should stop legitimizing what Craig Irwin says. He, and many others, are simply the remnant of an era on Wall Street when there was still a lot of slack in term of qualification and merits. I like how Elon gave them the middle finger. He straight up told them no cap raise, then turn around and did a cap raise and shorts got crushed. Their short sighted orientation is so toxic.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K