That means it is worth a solid $2800Credit Suisse raises price target from 700 to 1400

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

List of current PTs for TSLA:

Piper Sandler: $2,322

JMP: $1,500

Credit Suisse: $1.400

Goldman Sachs: $1,300

Wedbush: $1,250

Jefferies: $1,200

Deutsche Bank: $900

Roth Capital: $750

Morgan Stanley: $740

Baird: $700

Royal Bank of Canada: $615

Bank of America: $485

Citi: $450

Cowen: $300

Barclays: $300

J.P. Morgan: $295

GLJ Research: $87

Haven't heard from Baird and Deutsche Bank in a while. About time.

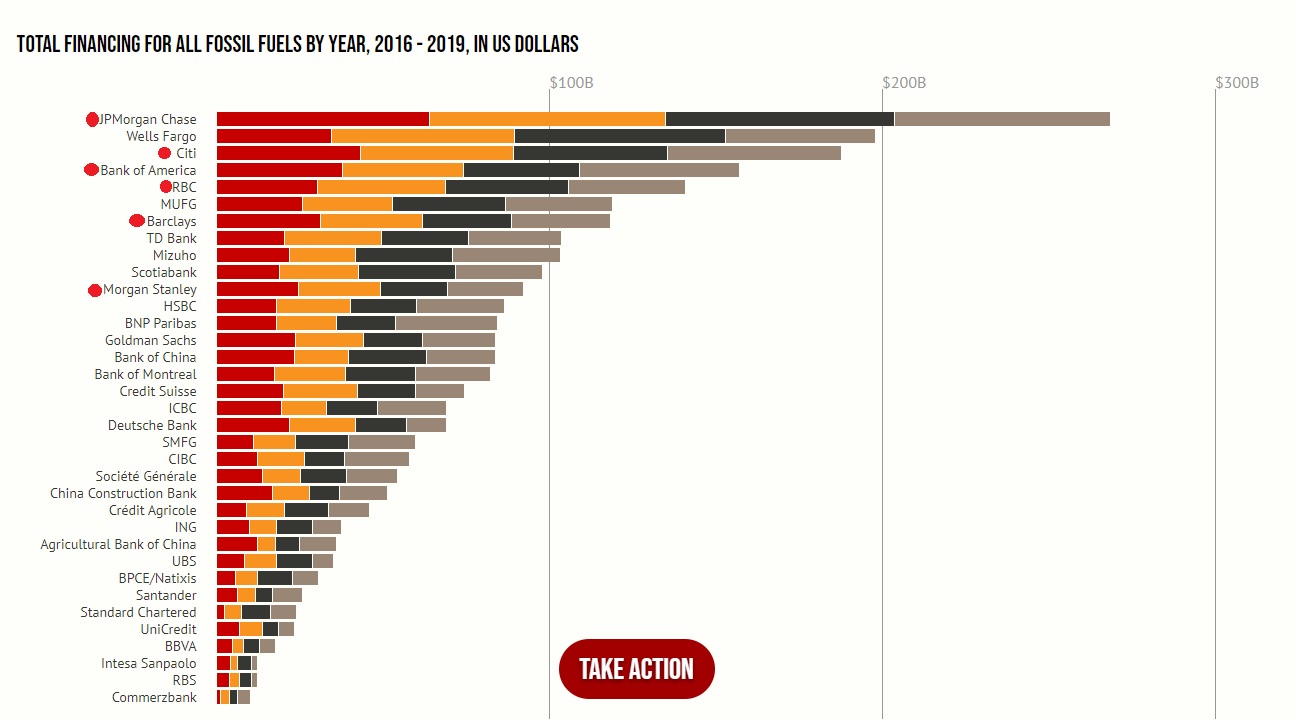

Also, Fossil Fuel Bank infographics

Piper Sandler: $2,322

JMP: $1,500

Credit Suisse: $1.400

Goldman Sachs: $1,300

Wedbush: $1,250

Jefferies: $1,200

Deutsche Bank: $900

Roth Capital: $750

Morgan Stanley: $740

Baird: $700

Royal Bank of Canada: $615

Bank of America: $485

Citi: $450

Cowen: $300

Barclays: $300

J.P. Morgan: $295

GLJ Research: $87

Haven't heard from Baird and Deutsche Bank in a while. About time.

Also, Fossil Fuel Bank infographics

Last edited:

ZeApelido

Active Member

Isn't GF New York near your location? You'd think they'd have more installation bodies that close to the "mothership" for solar panels.

I actually reached out and called Tesla to ask about my service area; they do not service it at this time. I'll probably check back in a few months. It's going on my rental, so not dire for my own use.

To be fair, if @JRP3 is in central NY, he's probably still trapped in 10 feet of snow.

CyberDutchie

Active Member

That reminds me of the old joke, "What to they call the person who finishes last in a medical school class?"

EDIT: How do I get "spoiler" to work?

@Curt Renz

By using ‘open bracket’ spoiler ‘close bracket’ ... ‘open bracket’ ‘forward slash’ spoiler ‘close bracket’

Artful Dodger

"Neko no me"

I remain convinced, that we can achieve a startling turnaround; once we reach the innovation tipping point with sustainable transportation and renewable energy.

These 8 maps show the massive drop in smog caused by the coronavirus - Keep America Beautiful

This is a worthy goal in itself, but the issue of urban smog is separate from green house gas emissions.

As we saw in Los Angeles, a month after we stop running fossil cars and truck, the atmosphere has largely cleaned itself from the sulfer dixoxide (SO2), oxides of nitrogen (NOx), and ozone (O3).

But the major long-term resident compound creating the green house effect is carbon dioxide (CO2).

It's resident time in the atmosphere is measured in thousand of years, not a few months.

We have dug ourselves a deep hole, and right now the first thing we need to do is STOP DIGGING.

Cheers!

The Martian

Member

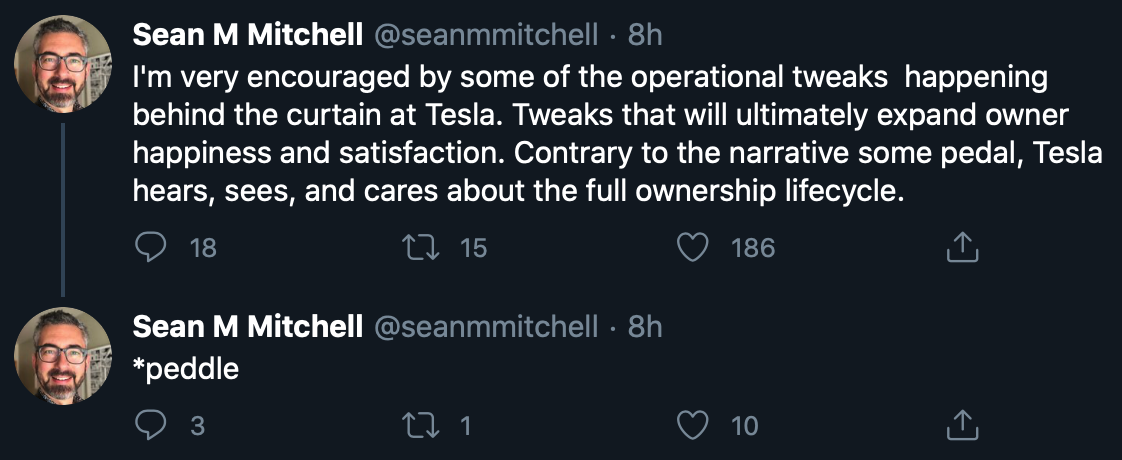

I know we talked about Tesla service problems here a lot like beating a dead horse. Hopefully they're addressing it this time "behind the curtain" for real.

MC3OZ

Active Member

A solar shield with the main purpose to shield the polar regions would fail.

Most of our planets incoming energy is centered around the equator. The earth uses wind and ocean currents to transport that energy to the polar regions.

One way we could cool off the planet is a lot of low level nuclear explosions that would put a lot of dust high into the atmosphere. How ever getting people to agree to creating a nuclear winter seems problematic.

I agree the space shield seems like a real long shot..

This is a link to a twitter post where a guy suggests it:-

https://twitter.com/polareclipse1/status/1188856248583753735

My main point is that clean energy and transport are the easier part of the problem to solve which Tesla is addressing.

After that is done things get a bit harder, but humanity will be glad it has done the easy bit.

List of current PTs for TSLA:

Piper Sandler: $2,322

JMP: $1,500

Credit Suisse: $1.400

Goldman Sachs: $1,300

Wedbush: $1,250

Jefferies: $1,200

Deutsche Bank: $900

Roth Capital: $750

Morgan Stanley: $740

Baird: $700

Royal Bank of Canada: $615

Bank of America: $485

Citi: $450

Cowen: $300

Barclays: $300

J.P. Morgan: $295

GLJ Research: $87

Haven't heard from Baird and Deutsche Bank in a while. About time.

Seriously? Someone actually has a $87 price target on TSLA??

This guySeriously? Someone actually has a $87 price target on TSLA??

kengchang

Active Member

Funny thing that 87 is pronounced as idiot/moron in Taiwanese....This guy

List of current PTs for TSLA:

Piper Sandler: $2,322

JMP: $1,500

Credit Suisse: $1.400

Goldman Sachs: $1,300

Wedbush: $1,250

Jefferies: $1,200

Deutsche Bank: $900

Roth Capital: $750

Morgan Stanley: $740

Baird: $700

Royal Bank of Canada: $615

Bank of America: $485

Citi: $450

Cowen: $300

Barclays: $300

J.P. Morgan: $295

GLJ Research: $87

Haven't heard from Baird and Deutsche Bank in a while. About time.

Also, Fossil Fuel Bank infographicsView attachment 565375

Deutsche Bank: $900 - shows $1000

Interesting observation on Tiprank: 24 of the top 25 analysts are in the Technology sector. Which would mean that the Technology sector has had the best returns in the last year.

Last edited:

trix

Member

This guy

you never know... he might be right after the stock split.

List of current PTs for TSLA:

Piper Sandler: $2,322

JMP: $1,500

Credit Suisse: $1.400

Goldman Sachs: $1,300

Wedbush: $1,250

Jefferies: $1,200

Deutsche Bank: $900

Roth Capital: $750

Morgan Stanley: $740

Baird: $700

Royal Bank of Canada: $615

Bank of America: $485

Citi: $450

Cowen: $300

Barclays: $300

J.P. Morgan: $295

GLJ Research: $87

Haven't heard from Baird and Deutsche Bank in a while. About time.

Also, Fossil Fuel Bank infographicsView attachment 565375

I can give you a few updates and additions.

Additions:

Elazar Advisors (very small firm but hits FactSet and Refinitiv) has a price target of $1,525.

New Street Research has a price target of $1,100.

Oppenheimer's price target is $968.

UBS's price target is $800.

Canaccord's is $650.

Evercore ISI's is $625.

Wolfe Research's is $615.

Updates:

Deutsche Bank raised their price target to $1,000 last week.

RBC went up to $765 this week.

Something we're not expecting...Battery Day question:

All I see from the non-retail investment experts is the “Million-mile Battery”. Do we really think THAT is the Battery Day big announcement?

<snip>

What are we really expecting from Battery Day?

Predicting between 50 and 5000 opening, between 40 and 6000 closing.Well what’s everything thinking open and close prices tomorrow?

(But I could still be wrong).

Guess my name.

Well what’s everything thinking open and close prices tomorrow?

The standard MS range $10 - infinity and beyond.

RobStark

Well-Known Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M