Elon & Herbert having a bromance

Herbert Diess on LinkedIn: We are ready for take off! | 77 comments

Herbert Diess on LinkedIn: We are ready for take off! | 77 comments

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Oh yeah man, come to GermanyGermany is buying the dip $393.24.

I'm taking the wife to Germany for our next vacation have to support the economy after helping us buy the dip

In that case, the price target is too lowThat is correct.

I am not familiar with how MPGe ratings are worked out so wondered if any of you guys could help clarify if this means that there has been a 20% increase in range in Model 3s produced now vs 2020H1? There is a similar bump for Model Y

Sorry for posting about this again, but on page 20-22 of this report there's a really good rebuttal of solid-state batteries. I was aware that solid state batteries work in small lab batteries and had trouble with mass-fabrication, but I didn't know any details. This makes it much more clear why Tesla's strategy of focusing on getting li-ion $/kWh costs down is the right path forward.

The graph below is taken from a teslarati article yesterday Tesla Model Y efficiency exceeds early-production Model 3, data shows.

View attachment 585313

I am not familiar with how MPGe ratings are worked out so wondered if any of you guys could help clarify if this means that there has been a 20% increase in range in Model 3s produced now vs 2020H1? There is a similar bump for Model Y

If this is correct am I right to infer that a significant part of this range increase will be due to battery improvements. Weight reduction seems unlikely to provide this improvement, especially as the 3 has been around for 2 years now. Efficiency from the other parts of the drivetrain (motor etc) also seem less likely for an improvement of this magnitude.

Not enough info in the article to know how software improvements are taken into account (is the data the current MPGe being reported by the vehicles - hence including the impact of software improvements - or the figures when the vehicle was new. I lean towards the first option as this info has been collected by an app).

Which brings me back to how MPGe is calculated. According to Google ' The EPA calculates that 33.7 kilowatt-hours of electricity is the equivalent to one gallon of gas, so an electric or hybrid vehicle that uses 29 kWh per 100 miles would get a combined 115 MPGe rating.' Is this based on a measured battery capacity? Just wondering what happens when Tesla improve battery chemistry and hence capacity. Is the new battery capacity taken into account in the calculation or is it still based on the original battery capacity (as originally measured by EPA).

Thoughts/feedback really welcome as this is not clear to me. I think this is positive news but want to understand exactly how it is positive

I believe Energy could be similar to Auto with FSD. The battery and solar market will grow fast, but eventually will be surpassed by the software grid market solution. TE will become a software grid, on top of the physical grid. It is possible they won't get to scale, but they seem best positioned to take an early lead. The software grid will allow car owners to share burst energy during premium demand and delay charging, commercial buildings to charge at night cheaply and run batteries during peak demand, consumer solar\battery customers to share their power during peak demand and for large scale utility providers to leverage peak demand solutions. If Tesla can capture some microtranasction payments by providing the market, it will provide tremendous value and profit for all of these participants and create a more resilient grid that will grow faster then the economy. The electricity market should grow faster then the overall energy market as fossil fuels decline, even as the cost per KWh falls over the next decade. This could be a trillion dollar market, with 10's of billions of profits annually by 2030.

I would expect Tesla to be forced to spin off energy from auto, as the scale of the company grows more powerful than governments will be comfortable to accept. From a value perspective that would be a rounding error once this business is at scale and could be more valuable to spin off.

Interesting, looks like 3 operational milestones (4 quarter totals)are also met to enable the 3rd tranche award.Am I the only one that noticed that Elon likely earned the 3rd tranche of his 2018 CEO compensation plan on Friday?

I think macro-wise we have some room to go down (NASDAQ future - 1%) although the chart says another run is imminent. If we look at the last 2 monster runs in TSLA, some similarities can be drawn.Gamma squeeze: To what degree is TSLA affected?

There has been a lot of talk on high volume OTM call buying leading to share price gains.

Whether it the influence of call buying by retail is more of was buying by institutions more is a different question.

The volume of options, at least the numbers quoted (if true) imply this theory as credible.

From what I read, TSLA if anything has more vulnerability to Gamma squeeze.

How much of this do you guys think contributed to the TSLA price gain in the last couple of months?

If significant, I see a significant downside risk.

I do think upcoming events can help mitigate a significant downside risk.

But if the unwinding of this Gamma Squeeze happens across tech stocks, I would think TSLA would get significantly impacted not withstanding the upcoming positive events.

@FrankSG @generalenthu @dl003 @StealthP3D Tagging you guys based on my perception of your knowledge on this from your earlier comments on this thread

Edit: I would add that, the Gamma Squeeze impacting share price movement up can also be seen from an organic growth point of view.

In other words, one can say, retail started buying TSLA options once they started seeing the strong growth potential of TSLA since Q3, Q4 2019. More retails coming in, perhaps coinciding with more retail getting into options in general (how true?) amplifies the call buying and thus Gamma squeeze.

Prior to Q3, Q4 the call buying (and buying common) wasn't significant enough to cause the squeeze.

Rookie question re S&P 500. If Tesla doesn’t show a profit this quarter do they have to start over with four consecutive quarters of profit before being considered again?

Is there a likelihood they will show a profit again this quarter?

cheers.

Some misinformation just won’t die. There is no requirement for four consecutive quarters of profit. We’ve been over this literally a hundred times on this very thread. Might be more, I sometimes skip ahead.Rookie question re S&P 500. If Tesla doesn’t show a profit this quarter do they have to start over with four consecutive quarters of profit before being considered again?

Is there a likelihood they will show a profit again this quarter?

cheers.

Rookie question re S&P 500. If Tesla doesn’t show a profit this quarter do they have to start over with four consecutive quarters of profit before being considered again?

Is there a likelihood they will show a profit again this quarter?

cheers.

Indeed, most people are getting this wrong. It is not full quarters of profit, it is the sum of the trailing four quarters should be GAAP profitable (along with the most recent). If Q3 were not, they could still be eligible if Q4 were profitable and Q3's loss were less than the sum of Q1, Q2, and Q4.If they don’t post a profit they would no longer qualify for inclusion (criteria is cumulative 12 month profit AND most recent quarter profit), and would only requalify once both criteria are satisfied.

Odds of not posting a profit is near zero. Tesla’s breakeven (point where it makes no profit) floats around 90k units a quarter (inclusive of regulatory credits, which will at least continue through rest of this year). It will crush that number. The fact that it’s financials now clearly show that breakeven point is one of the largest catalysts to Tesla’s rise in stock price, as it’s finally showing off what kind of long term profitability that it is able to achieve.

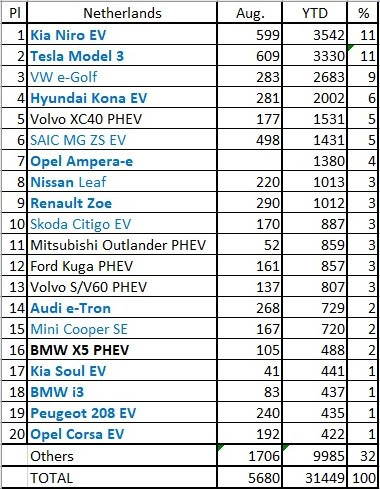

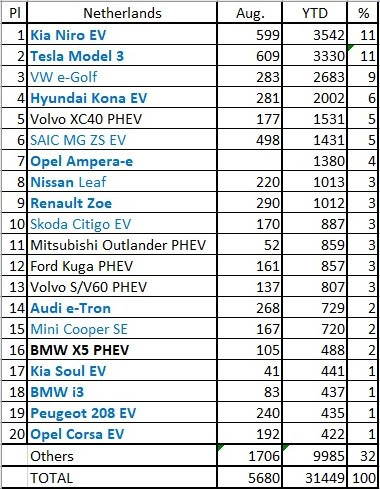

September so far

In the manufacturers ranking, Kia (14%) is in the leadership, followed by Tesla (11%), with Volkswagen (10%) and Volvo (also 10%) are running for the Bronze medal.

EV Sales: Netherlands August 2020

I think the data they are looking at is misleading. I think it‘s summer / winter related. It start seeing higher consumption at 10dgrees C and less. There might be some gains in efficiency but nothing near the suggested 20%.

Remeber, in this case only the early bird gets the worm. If there someone shaving off peak usage and using the nightly dips to charge, well there is no peak and nightly dip anymore. No?

Yes, the rest of us relied upon you to tell us, you slacker... ;-)Am I the only one that noticed that Elon likely earned the 3rd tranche of his 2018 CEO compensation plan on Friday?