Do you think they build bigger Roadrunner line just for R/D + lols and giggles? Thy need vehicle for them, it can't be 3 or Y, because size of the volume. Line is not ready and refresh is nether. When they both are ready, then you get what you want...Whatever the reasons, Tesla is NOT demand constrained on Models S&X, not even close.

A Model S/X refresh will help demand for those high margin vehicles. I would have bought an interior refreshed Model X. Now it looks like a Model Y for us.

YARD.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I think Elon's tweet yesterday was very prudent.

I wish he had done that sooner though..

HG Wells

Martian Embassy

dqd88

Member

Probably when he said "it's not like Tesla is minting money, which you wouldn't guess from our stock price" [sic] like seriously man... could he just not say *sugar* like that. why.Tesla was at one point 6% up after hours. Anyone know what the catalyst for the drop was?

Great presentation overall though.

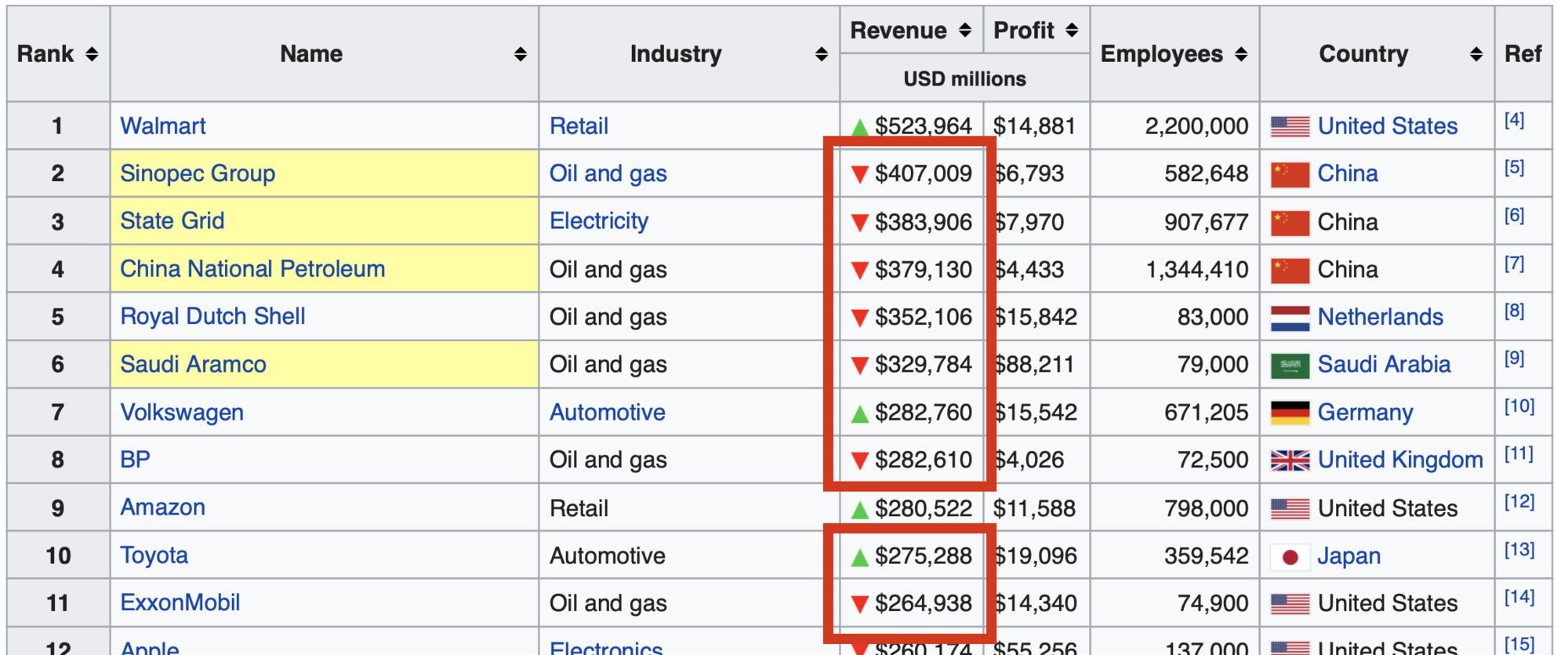

Below is an image with the 10 largest companies in the world in terms of revenue. The main point that I understood from this presentation is that Tesla is aiming to get a lion share of the generated revenues I marked in red... already by 2030...let thank sink in. If they succeed, holy hell

Thekiwi

Active Member

Tesla was at one point 6% up after hours. Anyone know what the catalyst for the drop was?

When Musk said the new battery anode tech isn't quite working (yet) - the yield was low - and that the Pilot production line will take 12 months to get up to full 10GW speed.

Tes La Ferrari

Active Member

Cant wait until tomorrow's hopeful MMD.

Sherlocking the couch cushions for some dry powder now.

Sherlocking the couch cushions for some dry powder now.

juanmedina

Active Member

The announced MS Plaid seems to be osborning the new Roadster. Extra room, comparable specs at 2/3 the cost is about as compelling as it gets.

Anyone cancelling their roadster reservation - or even the founder's edition?

the Roadster top speed is 250 miles+ and 620+ mile of range

This is a great point. Most of those in person are die hard fans so they are probably fine with this. I wonder if things changed in the last couple of days or over the weekend. Maybe they were planning to demo some things but did not because of some weird reasons, possibly related to end of quarter osbourning? Or they were afraid to reveal too much?

It was still a great presentation essentially cementing Tesla's position as the only innovation leader for sustainable transportation and energy. I'm also surprised there was no mention of the million mile battery. I mean I understand why it's not important in the grand scheme of things but to the casual investor it seemed like it was very important to address that.

People will say Elon's comment about valuation was not needed but it's clear that the whole company is fully appreciative of the challenge to move the world to clean energy. I thought it was refreshing to hear honest words from some of his managers and you could tell they really enjoy working for him. Proud to be invested in this company

I was going to say we might drop significantly and/or trade in a range but Q3 P&D will be on us before we absorb all of the battery day stuff.

What is the analyst consensus on the Q3 P&D?

gtrplyr1

Member

Wait .... you mean after all that there is no new iPod in the store tomorrow???

I’m out

WS .... Las Vegas with suits

cheers to the longs !

I’m out

WS .... Las Vegas with suits

cheers to the longs !

woodisgood

Optimustic Pessimist

Those who are disappointed by the AH price action: I'm curious to know what you think the market was expecting to see today vs what we actually saw.

Market wanted shiny things that will be available to purchase very soon.

Not a plan to save the world.

Buy the rumor, sell the news.

As a longtime shareholder (since 2011!) I heard nothing but good news today. For the first time I have a clear picture of the endgame, of how big a company Tesla intends to become: 20M vehicles and 3TWh of batteries by 2030. They showed a roadmap of how to actually get there.

And, basically a roadmap for every other car manufacturer that wants to survive. "Here is the way to the future, follow us!"

Have to agree. I've spent enough time here now to understand just how much this forum hypes itself up. I love the excitement, but I've learned to temper expectations against some of the wilder speculations (and trade accordingly).

I think Elon's tweet yesterday was very prudent.

I think Elon used the words "very insane" and "big" in response to some of the questions on twitter. As a long term investor I know why he used those words because some of the numbers mentioned in the presentation were truly mind boggling. Plus the FSD rewrite seems to be going really well too.

So to be fair he did hype it up on twitter and did the prudent thing by tempering the expectations later.

ZeApelido

Active Member

People are funny.

Are you planning on selling shares tomorrow?

If even medium term, I can't see how increasing energy density 50% and reducing cost 50% cannot be bullish for accumulation of shares by long term investors over time.

It may not happen right now, but it will happen.

Are you planning on selling shares tomorrow?

If even medium term, I can't see how increasing energy density 50% and reducing cost 50% cannot be bullish for accumulation of shares by long term investors over time.

It may not happen right now, but it will happen.

What else were you expectingI'm praying there's some actual substance at the end if this thing. Like an encore. I've rarely been so disappointed. Shorts will feast.

The biggest drop started when he mentioned that Maxwell's dry metal process wasn't 100% functional yet. That comment made me nervous.Tesla was at one point 6% up after hours. Anyone know what the catalyst for the drop was?

Knightshade

Well-Known Member

Seems like a lot of people missed the valuation quote, which corresponded to a large drop AH. Elon said (paraphrasing), "We're not THAT massively profitable making gobs of cash, our valuation makes it seem that way but we're not..."

It reinforces the narrative that it has been very difficult to generate the profitability demonstrated thus far (and shorts will say it's accounting tricks...), and since it was said live and honestly unlike the "stock too high" tweet, there isn't another way to spin it.

As I said- overall this was a lot of nerdy tech stuff that is fantastic long term for the company... but there were basically 4 bits I cringed at- the one you cite is one of em.

A second was earlier where they were explaining the dry cell process, and Elon was basically "once we get this to work" and then corrected himself like "I mean, it works now, we just need to improving how to scale it" or something suggesting this wasn't as sure a thing as they were suggesting and that the PILOT production line was a year away from fully ramping.

Third was "Plaid on sale now- delivery by end of 2021"- the one legit over expectation I had at all for today was they were gonna have a Plaid S on stage with delivery either immediately or end of 2020.

And the last was right near the end one of the employees was like "these are real things, they exist right now!" like some kinda bad Trevor Milton impersonation.

I do need to harken back to all the disagrees I got when I kept explaining why "MILLION MILE BATTERY" isn't a big deal and nobody cares about that and everyone pounded me on how it's gonna be YUGE during battery day and OMG V2G ALONG WITH IT.

And not only did MMB not get mentioned, V2G got explicitly dismissed as unimportant by Elon.

Instead I pointed out the two BIG DEALS are:

Cheaper batteries

A lot more batteries made a lot faster.

And those were the major focus of what was presented -as Elons been telling us for years- to anyone who bothered to listen- those were by far the 2 biggest things holding back the mission.

Brian121

Member

It's a presentation that show the true color of Tesla: innovation, forward looking and tackle the problem head on.

And any long term investor can attest it with so many living proofs: Model 3 ramp, Model X falcon wing door.

I am glad they kept this tradition.

And any long term investor can attest it with so many living proofs: Model 3 ramp, Model X falcon wing door.

I am glad they kept this tradition.

As I recall, it took the chip industry a long time to get decent yields. It appears that Tesla will get decent yields much faster. I'd guess about the same time as the Texas factory completes.When Musk said the new battery anode tech isn't quite working (yet) - the yield was low - and that the Pilot production line will take 12 months to get up to full 10GW speed.

jhm

Well-Known Member

Thekiwi

Active Member

Below is an image with the 10 largest companies in the world in terms of revenue. The main point that I understood from this presentation is that Tesla is aiming to get a lion share of the generated revenues I marked in red... already by 2030...let thank sink in. If they succeed, holy hell

View attachment 591065

not quite - EVs/batteries removes the ongoing money spent on some oil based products - its mostly an elimination rather than a transfer of revenue. Someone buying a Tesla instead of an ICE doesn't then spend the same amount of money with Tesla that they spent on the ongoing cost of refuelling their car with gasoline.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M