Screw ‘em!

25 more at 426. I really should diversify, but this is a war!!!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

StarFoxisDown!

Well-Known Member

Been watching Max Pain. It was at 440 on Mon (as I recall), now it's only slipped to $437.5.

We're fine.

Stock Option Max Pain

Volume is still light, so I'd imagine they want to drop the share price as efficiently as possible so that if there is a rally after Earnings on Thursday morning, they can try to cap the rise so that they at least have a shot of walking it back down by Friday afternoon to hit max pain.

Really though, I don't think anyone could change my opinion at this point that there will be no S&P inclusion during Q4, no matter what Q3 earnings are. The light volume for weeks now especially since Q3 P/D numbers, to me at least, reaffirms my thought process that there's no fear in Wall St of missing out on the inclusion. They'll get their green light and then volume will suddenly pile in days before the actual inclusion announcement happens.

Before anyone responds with "The entire market is seeing light volume"....that's true but Tesla's volume percentage wise has been a lot lighter and other stocks/companies do not have a impending stock catalyst like S&P inclusion on their doorstep. There's very different dynamics at play when it comes to Tesla's trading action and catalysts verses say Apple or Amazon right now in this time period

Tslynk67

Well-Known Member

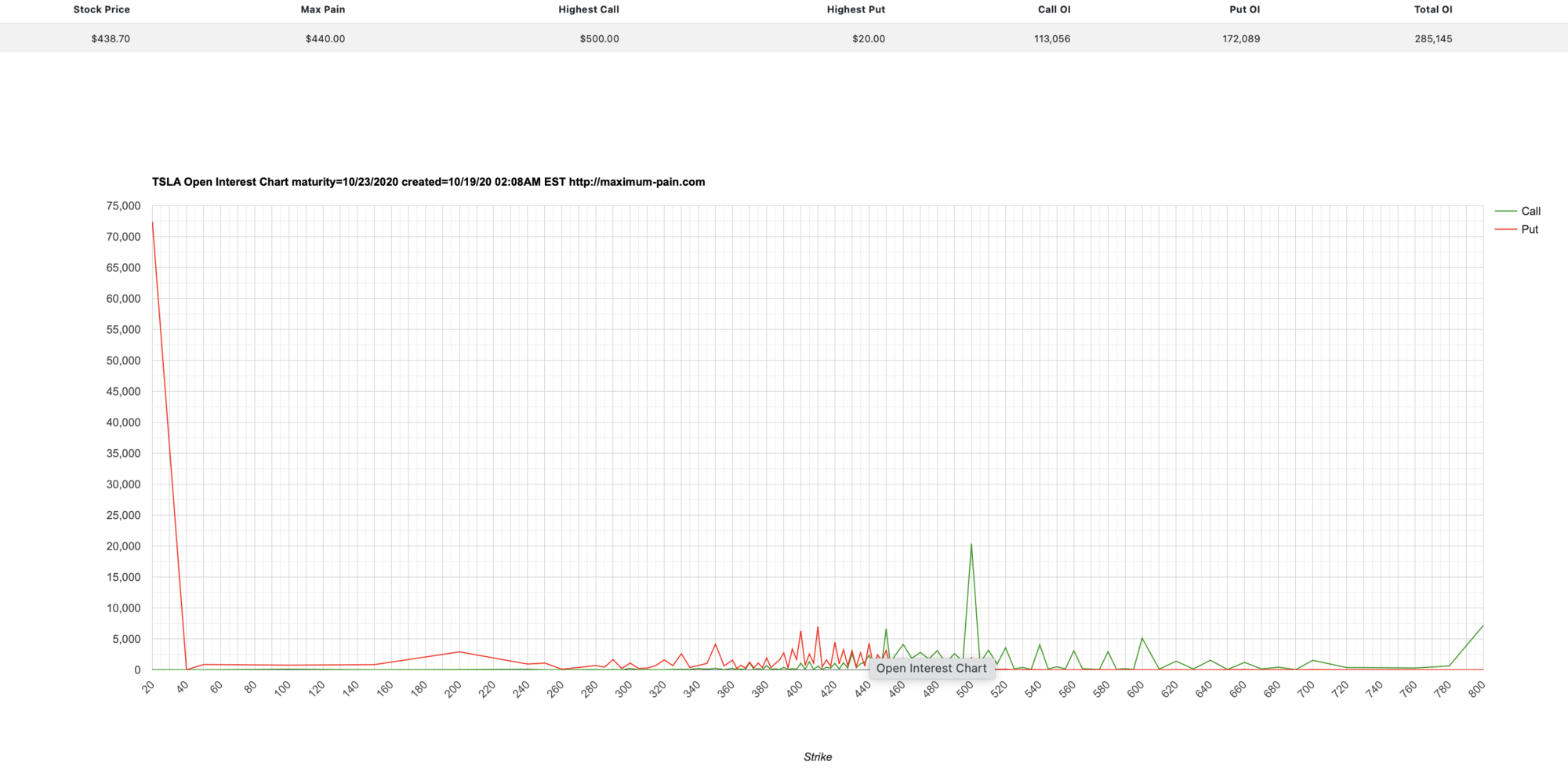

Believe it or not, but MP is at $440 for this week. I suspect the manips are trying to cover a potential pop after earnings as it does them no good being this low - we're deep in put territory

$450 has a modest 6,000 calls, but $500 20,000, so avoiding a run up to that and the delta-hedging it would invoke.

Chart looks weird because of the 72,500 shitputs at $20

$450 has a modest 6,000 calls, but $500 20,000, so avoiding a run up to that and the delta-hedging it would invoke.

Chart looks weird because of the 72,500 shitputs at $20

Jack6591

Active Member

I have often used the knife fight metaphor in describing TSLA share price action. I remain as convinced today as I have ever been, the fossil fuel industry will not go quietly into the night.

Billions of people and companies are vested in the fossil fuel and automotive industries. The endowment effect will drive their animosity toward sustainable transportation until electric vehicles reach a tipping point.

Tesla and those vested in it must become battle-hardened. In the end technology will evolve — the fittest shall survive.

Billions of people and companies are vested in the fossil fuel and automotive industries. The endowment effect will drive their animosity toward sustainable transportation until electric vehicles reach a tipping point.

Tesla and those vested in it must become battle-hardened. In the end technology will evolve — the fittest shall survive.

Those are not shitputs. They were the hopes and dreams of TASLQ.Believe it or not, but MP is at $440 for this week. I suspect the manips are trying to cover a potential pop after earnings as it does them no good being this low - we're deep in put territory

$450 has a modest 6,000 calls, but $500 20,000, so avoiding a run up to that and the delta-hedging it would invoke.

Chart looks weird because of the 72,500 shitputs at $20

View attachment 600454

The Accountant

Active Member

My final Q3 2020 earnings estimate posted here:

Near-future quarterly financial projections

My final Q3 2020 Cash Flow & Cash Balance estimate posted here:

Near-future quarterly financial projections

Near-future quarterly financial projections

My final Q3 2020 Cash Flow & Cash Balance estimate posted here:

Near-future quarterly financial projections

Volume is still light, so I'd imagine they want to drop the share price as efficiently as possible so that if there is a rally after Earnings on Thursday morning, they can try to cap the rise so that they at least have a shot of walking it back down by Friday afternoon to hit max pain.

Really though, I don't think anyone could change my opinion at this point that there will be no S&P inclusion during Q4, no matter what Q3 earnings are. The light volume for weeks now especially since Q3 P/D numbers, to me at least, reaffirms my thought process that there's no fear in Wall St of missing out on the inclusion. They'll get their green light and then volume will suddenly pile in days before the actual inclusion announcement happens.

Before anyone responds with "The entire market is seeing light volume"....that's true but Tesla's volume percentage wise has been a lot lighter and other stocks/companies do not have a impending stock catalyst like S&P inclusion on their doorstep. There's very different dynamics at play when it comes to Tesla's trading action and catalysts verses say Apple or Amazon right now in this time period

If “they” had so much insight, wouldn’t they have not bought in after Q2? Why not just drive the price up now, spark a bunch of momentum, and sell off into a big frenzied rise based on S&P speculation? I think the explanation is likely that the players largely positioned themselves after the P&D report, and volume is lighter on uncertainty around the election, economy, etc.

Another Pelosi/Mnuchin talk on stimulus scheduled for 12PM PST/3PM EST.

https://twitter.com/jakesherman/status/1318568822295695360?s=21

Last edited:

This must be super rare for Tesla to cover as warrantee vs a recall. I wonder what the PR group thinks?Electrek had it posted in Scribd, it seems to have been removed, but I can still view it. Here is a snapshot of the details:

View attachment 600451

It will likely show up on NHTSA site eventually.

It lists that it takes 0.8 hours to repair if the most possible parts are damaged from the drive through standing water.

@Singuy note it is only a repair TSB, not preventative. So they wouldn't do anything to your car unless you drive through standing water and have parts damaged.

StarFoxisDown!

Well-Known Member

If “they” had so much insight, wouldn’t they have not bought in after Q2? Why not just drive the price up now, spark a bunch of momentum, and sell off into a big frenzied rise based on S&P speculation? I think the explanation is likely that the players largely positioned themselves after the P&D report, and volume is lighter on uncertainty around the election, economy, etc.

Trading is definitely lighter across the board due to the election, for sure. Definitely not debating that factor has been in play. But again, Tesla's trading has been lighter percentage wise than and such a large catalyst like a potential S&P inclusion announcement that could happen at any time after Q3 earnings...to me...would cause volume to increase, even with the election factor in place.

I think Q2, essentially Wall St was caught off guard by the Q2 P/D numbers which caused a huge buying frenzy because of the potential for inclusion.....since everyone knew Tesla would post a profit at that point. All of the trading action since that Friday where S&P committee snubbed Tesla for Etsy, has been saying "There's no imminent inclusion announcement" for the foreseeable future. In order for Wall St traders to be THAT confident in trading the stock and also for big funds/banks to not be buying since Q3 P/D numbers came out, tells me that there's common knowledge that the inclusion announcement won't be happening anytime soon, regardless of Q3 Earnings numbers.

This is completely my own theory, I don't expect everyone to agree with me and obviously, there is no proof of insider trading knowledge being out there. It's just my logical conclusion to the trading action and volume since beginning of Sept.

AimStellar

Member

Lots of capping going on this a.m. On these relatively light volume days, it does not take much effort to cap. Has been happening at $423.00/$423.50 since the successful drive down after TSLA dared to cross $425 a little after 10:30 a.m. EST. Maybe this all coincidence, but it is pretty easy to see when someone follows the trades closely and sees large trades put in and then pulled when the desired result is achieved.

What's the best way to find this trading / (Time&Sales(?) data -- specifically, filtering trades based on volume equal to or greater than X (I am able to do this with Fidelity) but specifically with regard to the second part you mentioned, "large trades ... pulled" -- what resource do you use to find this data? Thanks!

This sounds like it will not cover the damage of half your car scraping down the freeway. If this is a $150 fix, I'd say yes to that. (Or get some 2-part epoxy and just squirt some in a couple places, and wipe it off?)Electrek had it posted in Scribd, it seems to have been removed, but I can still view it. Here is a snapshot of the details:

View attachment 600451

It will likely show up on NHTSA site eventually.

It lists that it takes 0.8 hours to repair if the most possible parts are damaged from the drive through standing water.

@Singuy note it is only a repair TSB, not preventative. So they wouldn't do anything to your car unless you drive through standing water and have parts damaged.

Since when and where did “Wall St” expect $8.3bn revenue / $0.55 earnings for this Quarter?

That’s what Al Root has put out in Barron’s.....and that’s far higher than the composites, even the outliers, that were anywhere but within the TMC data crunchers’ spreadsheets. Far worse, of course, is that it smells of an Oh Dear Tesla Disappoints With Missing/Barely Beating Expectations heading to theater near you.

That’s what Al Root has put out in Barron’s.....and that’s far higher than the composites, even the outliers, that were anywhere but within the TMC data crunchers’ spreadsheets. Far worse, of course, is that it smells of an Oh Dear Tesla Disappoints With Missing/Barely Beating Expectations heading to theater near you.

I can't believe all those puts so low. Makes no sense other than a source for my future wealth.Believe it or not, but MP is at $440 for this week. I suspect the manips are trying to cover a potential pop after earnings as it does them no good being this low - we're deep in put territory

$450 has a modest 6,000 calls, but $500 20,000, so avoiding a run up to that and the delta-hedging it would invoke.

Chart looks weird because of the 72,500 shitputs at $20

View attachment 600454

Last week showed an even distribution of puts all the way down. It reminded me of someone playing the Roulette Wheel by placing bets on every red number, along with a the 000's that don't exist. NUTS!

AimStellar

Member

Limit order submitted this AM for 100 TSLA shares @ $421.9 executed at 12:32pm EST and another for 100 TSLA @ $421.75 just executed. Just put another buy for 100 @ $419.10

AimStellar

Member

Since when and where did “Wall St” expect $8.3bn revenue / $0.55 earnings for this Quarter?

That’s what Al Root has put out in Barron’s.....and that’s far higher then the composites, even the outliers, that were anywhere but within the TMC data crunchers. Far worse, of course, is that it smells of an Oh Dear Tesla Disappoints With Missing/Barely Beating Expectations heading to theater near you.

FWIW, Al Root has consistently (in my opinion) written *very* favorably articles on TSLA, and furthermore from my obsv. writes the vast majority of TSLA articles on Barron's.

Since when and where did “Wall St” expect $8.3bn revenue / $0.55 earnings for this Quarter?

That’s what Al Root has put out in Barron’s.....and that’s far higher then the composites, even the outliers, that were anywhere but within the TMC data crunchers. Far worse, of course, is that it smells of an Oh Dear Tesla Disappoints With Missing/Barely Beating Expectations heading to theater near you.

The Tesla IR analyst estimate compilation has revenue at 8.4b$, non-GAAP 0.76$/share, GAAP 0.39$/share.

It seems to me that the third party report of Q3 Tesla registrations in California should be taken with a grain of salt. The actual total for Q3 deliveries has already been officially reported. In the Tesla rush of American and especially Californian deliveries late in a quarter, the state paperwork for registrations can be delayed, especially by a pandemic hobbled bureaucracy. And if not, then the demand was made up elsewhere. Meanwhile, with so many Teslas already delivered in California, there could be a lull there until trade-ins start flowing more rapidly.

Regarding GM's electric Hummer commercial tonight: that truck won't be delivered for a year. I doubt older GM loyalists will want an electric pickup truck, at least not in the near future. I'd expect younger electric pickup truck prospects to willingly wait for the Tesla Cybertruck. Perhaps the commercial will spur Elon to move up the production start for the Cybertruck.

Since Tesla Q3 earnings will be released tomorrow afternoon, traders may be cautious. Today's thin trading volume implies that could be true. Hedge funds and market makers might be setting up bargains ahead of a possible jump on Thursday.

Regarding GM's electric Hummer commercial tonight: that truck won't be delivered for a year. I doubt older GM loyalists will want an electric pickup truck, at least not in the near future. I'd expect younger electric pickup truck prospects to willingly wait for the Tesla Cybertruck. Perhaps the commercial will spur Elon to move up the production start for the Cybertruck.

Since Tesla Q3 earnings will be released tomorrow afternoon, traders may be cautious. Today's thin trading volume implies that could be true. Hedge funds and market makers might be setting up bargains ahead of a possible jump on Thursday.

Last edited:

But everyone knows this trick (set expectations higher than realistic). We see it every quarter... so lame.The Tesla IR analyst estimate compilation has revenue at 8.4b$, non-GAAP 0.76$/share, GAAP 0.39$/share.

Tslynk67

Well-Known Member

I can't believe all those puts so low. Makes no sense other than a source for my future wealth.

Last week showed an even distribution of puts all the way down. It reminded me of someone playing the Roulette Wheel by placing bets on every red number, along with a the 000's that don't exist. NUTS!

Can be they're just for increasing margin.

Plus, once upon a time, the $20 strike was really $100 and the SP was trading in the $170's last year, so maybe seemed like a reasonable bet to someone back then.

Last edited:

Tslynk67

Well-Known Member

The Tesla IR analyst estimate compilation has revenue at 8.4b$, non-GAAP 0.76$/share, GAAP 0.39$/share.

Well that's conveniently gone up from $0.54 last week...

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M