Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Tslynk67

Well-Known Member

Why do you always post with such an arrogant and superior tone?

Funny, I don’t see the poster you’re responding to, but I can deduce which one it is. “No manipulation” theme, I guess?

I see a lot of these ghost posts.

There are ways to stop wasting your time, if you exercise the feature.

Tslynk67

Well-Known Member

Exactly

The share price never moves in a linear relation to the other metrics

The demand supply paradigm takes over here

The front running has led to explosive appreciation of the share price

I believe a significant horde of shares have already been accumulated by the front running entities

The opposite holds true when time comes next week and they start unloading

I won’t be surprised to see only a moderate rise in share price instead of a squeeze as the demand will likely be met by a steady supply of the accumulated shares .

Just want everyone to be cognizant of this possibility and not get hopes too high.

The share price will rise , that’s for sure.

But it is something we cannot predict with accuracy.

Why would front-runners want to sell in a way that limits price-rises? They’re vultures, like the rest and will do everything to maximise their own gains.

Why would front-runners want to sell in a way that limits price-rises? They’re vultures, like the rest and will do everything to maximise their own gains.

Risk management. 10% gains on volume would still be very substantial.

Runarbt

Active Member

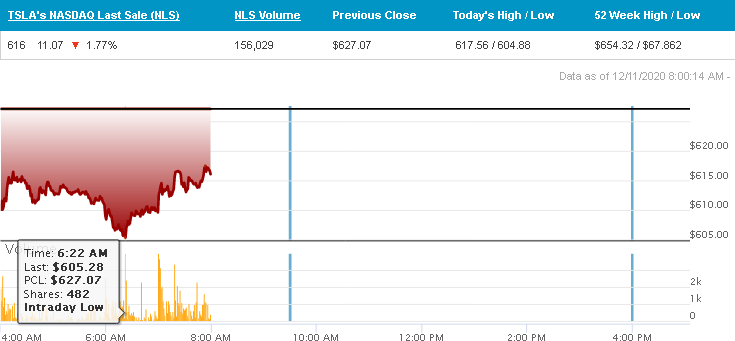

606$, tech futures down 1%.

I think we can assume with a good degree of probability that close SP will be between 600-620.

Last day before inclusion where MM "easy" can peg this to maximum-pain, be sure they will try to.

NExt week however - will be an entire different game - we will still playing "chicken", but buying pressure will be on for sure.

I think we can assume with a good degree of probability that close SP will be between 600-620.

Last day before inclusion where MM "easy" can peg this to maximum-pain, be sure they will try to.

NExt week however - will be an entire different game - we will still playing "chicken", but buying pressure will be on for sure.

Agree on that, unless the macros get really bad

Gene Munster on CNBC now. Showing list of FAANG favorites. AAPL mostly favored and tacking Tesla on the end but unmentioned.

rg121xt567

New Member

Just too much is perfectly aligned for the EV industry going into 2021. Here’s one interesting analysis predicting Tesla’s growth prospects towards $1T & more ->

<iframe width="560" height="315" src="

" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen></iframe>

I do believe a lot of what mentioned in the video could come true or at least get very close to it.

<iframe width="560" height="315" src="

I do believe a lot of what mentioned in the video could come true or at least get very close to it.

With the typical high brow attitudeThey live in Cupertino

Tes La Ferrari

Active Member

Volatile Tesla's entry into S&P 500 may not be a quiet ride for the stock market — CNBC

“...of the 15 stocks that joined the S&P 500 so far this year, most of them have outperformed the S&P since their inclusion. Just four have underperformed the S&P index since they joined it, and only one, DexCom is lower since it was added.

Carrier Global has performed the best of this year's entrants and it is up more than 120%, outperforming the S&P by more than 75% since it was added April 3.”

“...of the 15 stocks that joined the S&P 500 so far this year, most of them have outperformed the S&P since their inclusion. Just four have underperformed the S&P index since they joined it, and only one, DexCom is lower since it was added.

Carrier Global has performed the best of this year's entrants and it is up more than 120%, outperforming the S&P by more than 75% since it was added April 3.”

Last edited:

Artful Dodger

"Neko no me"

08:00 a.m. Whistle: Fri, Dec 11, 2020

TSLA share price: $616.00 -11.07 -1.77%

Volume: 545,586 shares (Moderate)

Max Pain (07:00 ET): $600 (unchanged from yesterday)

Cheers!

TSLA share price: $616.00 -11.07 -1.77%

Volume: 545,586 shares (Moderate)

Max Pain (07:00 ET): $600 (unchanged from yesterday)

Cheers!

Todd Burch

14-Year Member

My gut feel is that today will be one of those steady climb days and we'll close just below $650.

Todd Burch

14-Year Member

I don't remember, was yours the gut with a 0.170 batting average?

Yes. Although my gut about Tuesday and Wednesday's trading being a head fake turned out correctly, so it is now batting .171.

Let me just remind you of what can happen when you bat .171: Kyle Schwarber's Comeback from Batting .171 to Lethal Cubs Slugger

Lol. Nice.Yes. Although my gut about Tuesday and Wednesday's trading being a head fake turned out correctly, so it is now batting .171.

Let me just remind you of what can happen when you bat .171: Kyle Schwarber's Comeback from Batting .171 to Lethal Cubs Slugger

At least cat gut is still useful for stringed instrumentsYes. Although my gut about Tuesday and Wednesday's trading being a head fake turned out correctly, so it is now batting .171.

Let me just remind you of what can happen when you bat .171: Kyle Schwarber's Comeback from Batting .171 to Lethal Cubs Slugger

Artful Dodger

"Neko no me"

Shanghai factory expanding onto new land!

From Wu Wa:

The winter in Shanghai is cold and humid, and the sky is shrouded in mist. The Lingang Tesla factory, which is a kilometer away from downtown Shanghai, is indeed very lively. In addition to the new Model 3s constantly shuttled in the factory, we also Seeing that the fence outside the paint shop on the east side of the second phase of the factory was opened, two excavators were stepping towards the watermelon field in the east, although we did not get any information about the watermelon field in the east. However, according to the signs today (Dec 10), Tesla is likely to rent the watermelon land in the southeast. I was consulting a melon farmer who stayed in this land and learned that the construction staff on the site told him , This land will no longer grow crops, they need to find a piece of farmland to grow watermelon in Lingang. In the near future, a new factory building will be built here. With the expansion of the factory, Tesla has also carried out a large number of recruitment in various cities in China. Next year, Tesla China will be a new era.

Yeah, I called the "watermelon" expansion starting last September: (here's the relevant posts)

- Sep 23, 2020 "Not much room left for another product w/o more land purchases. But those watermelon farms look mighty tasty..."

- Oct 21, 2020 "Tesla will seek another 50 year lease on a conveniently located watermelon farm"

- Oct 21, 2020 "I look for a 1M/yr Model 2 Factory to go up in the former watermelon patch on the East side of Giga Shanghai (where the new road is now being built)"

- Nov 11, 2020 "Chinese construction crews are doing way too much ground work on the East side of Giga Shanghai for it to be just a new road through the former watermelon patch. I think they're starting on another assembly building"

I see a continuous buildout occurring in China based on these advantages:

- inexpensive local non-recourse debt for capital funding

- access to 1st-tier State construction engineering assets

- continued National policies favoring the rapid expansion of EV production

- Tesla's envious technological leadership in design and production technology

The only issue remaining is, does the $15K Model 1 factory get built in China, or in India? Or, why not both? But then which is first? Of course, by 2025 China will have substantial EV credibility, and almost certainly their own Model 1 plant. Their large auto market demands that it be so.

Cheers!

Last edited:

Todd Burch

14-Year Member

Anybody know why macros are red, even though the vaccine news sounds great? Sell the news?

Funds have to sell everything else so they can buy more TSLA?

Honestly, not sure but my best guess is just because of the rising death rate?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M