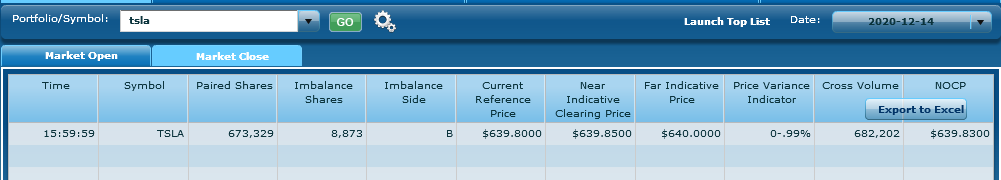

The thing that gets me about him is this statement "We are the biggest bear on wall st and we are projecting 180k deliveries".

That's like saying, "I'm the dumbest kid in my class but at least I have the highest I.Q."

I think it is more about trying to shift the analyst expectations higher, to try to engineer a miss on the P&D report. "We are the biggest bear and think 180k, so everyone else surely needs to have estimates higher than ours."

TeslaCharts on Twitter has tried to pull the same crap, put out really high numbers saying that they have to be the minimum to try to influence the FactSet numbers so that we get a miss even if the numbers are really good.