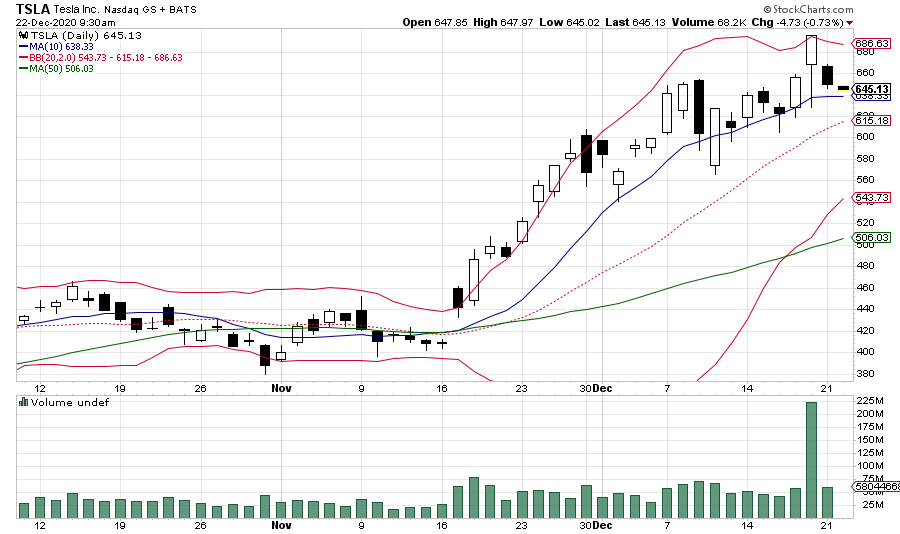

I.....can't.....look....at....your....avatar.Nice to see @FrankSG get some love from Chicken Genius - some technical analysis here pointing to $640 support level, which I didn't really need a chart to work-out myself, but what the hell

P.S. big love for my Short Shorts post on Twitter - never take yourselves too seriously, folks!

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Can anyone explain to me why many of us are so fascinated with this A-hole? Many otherwise apparent longs here inexplicably keep aiding and abetting by (and doing the same with every new troll who pops up) by reposting "giving them the platform", feeding them more clicks, thereby repeating the same old talking points for them! Even my late 94-Y.O. -tech insavvy dad knew not to keep talking about bad people. Many of us like @SoulPedal, are not helping him "fade into the light". Out of practical necessity, I've ignored many good folks here whom I'd otherwise gladly sit down and have a beer with, but whose endless distracting posts provide little value, even if this does this make me a bad person.Gordon Johnson on CNBC this morning, repeating the same old talking points. Nice to see the host calling on it. Of course, they keep giving him the platform, so... Looking forward to Q4 results.

Artful Dodger

"Neko no me"

Clever engineering in the Model 3 SRPM motor (also used in the front drive unit of 2019+ "Raven" S/X)

"Tesla Model 3's motor - The Brilliant Engineering behind it" | (12:08)

Uploaded by Learn Engineering 4 days ago

HIghly recommended Channel.

Cheers!

"Tesla Model 3's motor - The Brilliant Engineering behind it" | (12:08)

Uploaded by Learn Engineering 4 days ago

HIghly recommended Channel.

Cheers!

Causalien

Prime 8 ball Oracle

Can anyone explain to me why many of us are so fascinated with this A-hole? Many otherwise apparent longs here inexplicably keep aiding and abetting by (and doing the same with every new troll who pops up) by reposting "giving them the platform", feeding them more clicks, thereby repeating the same old talking points for them! Even my late 94-Y.O. -tech insavvy dad knew not to keep talking about bad people. Many of us like @SoulPedal, are not helping him "fade into the light". Out of practical necessity, I've ignored many good folks here whom I'd otherwise gladly sit down and have a beer with, but whose endless distracting posts provide little value, even if this does this make me a bad person.

Cause Smeagle is broke. So we a new one to lash out against.

Every couple of month. The MSM bring out a new nobody to rage against tsla. They all have these made up credentials that sounds fancy.

Last edited:

So I think I got it....just like this...right?Clever engineering in the Model 3 SRPM motor (also used in the front drive unit of 2019+ "Raven" S/X)

"Tesla Model 3's motor - The Brilliant Engineering behind it" | (12:08)

Uploaded by Learn Engineering 4 days ago

HIghly recommended Channel.

Cheers!

New MarketWatch article about potential Biden administration EV policy's.

5 ways Joe Biden can accelerate America’s shift to electric vehicles

5 ways Joe Biden can accelerate America’s shift to electric vehicles

Artful Dodger

"Neko no me"

I expect the share price to trade sideways over the next couple of weeks. Then we will have the deliveries figure, and later in January, Q4 earnings. These events could reignite the price. I said on friday morning before opening, that I thought investors should be prepared for a damp squib rather than fireworks on the day, and other than the final minute of trading, that proved to be correct. Most of us on here have enjoyed a 60% rise since the S&P announcement, so a period of consolidation is natural.

One of the reasons I have stopped posting here as much is it takes too much time to make sure I am not reposting something someone else has already posted. However, I will just post every once in while stuff I find particularly valuable and if its a repeat at least its a good one. This morning I read FrankGS's blog post about Friday's trading. It's an interesting in depth read. I recommend it. A nice tidbit toward the end for those that don't read the whole thing is about near term price action:

"There are a lot of reasons to be bullish on TSLA in the near-term:

Here a link to his blog: Tesla's S&P 500 Inclusion Part 3: The Final Chapter

"There are a lot of reasons to be bullish on TSLA in the near-term:

- There shouldn't be too many investors left looking to divest near-term. I think just about everybody who wanted to do so, got the chance to do so at $695.

- TSLA settled at a price and valuation that really isn't all that unreasonable. Financials and growth in a year from now, and continued FSD development could easily provide 50% upside over the next 12 or so months. Unlike if we had settled at $1,000+, I think TSLA can continue to go up slowly but surely.

- There could still be S&P buying left. I think probably most of it has finished, but even if just 10M shares are left, that's still a lot of buying pressure.

- Benchmarked funds might buy dips below $695, because it's an easy way to outperform the S&P 500.

- Year-end window dressing."

Here a link to his blog: Tesla's S&P 500 Inclusion Part 3: The Final Chapter

bkp_duke

Well-Known Member

For the sake of public health, I would like to request @Lycanthrope change his avatar.

Driver Dave

Member

Actually the other way around, TSLA is coming for AAPL and others.

In fact, TSLA is Apple's only real competitor.

No other company besides AAPL and TSLA have top assets all in one place:

Design

Manufacturing

Chips

Batteries

Software

Network

Data

AI

Brand

Global Reach

Visionary CEO (sorry Tim, you aren't this)

The cars are just rolling platforms filled with many seeds that will head in many many directions.

Comparing TSLA to other car companies is stupid. Like comparing Apple to Nokia.

Comparing TSLA to the whole car industry also misses the reach of the opportunity.

Tesla is in a very very strong growth position.

Others should be worried...

Artful Dodger

"Neko no me"

Here is today's TSLA Tech chart as of 09:30 EST: (Note: 10-d Moving Avg at Market Opening was $638.33)

Cheers!

Cheers!

ZeApelido

Active Member

Today is one of those blessed norwegian days.

Tesla Registration Stats

We have 100 cars delivered at 9.30 in the morning.

56,571 Teslas.

Amazing, since its more than the number people there.

1. TSLA is owned by more entities.

2. Much of the investment world invests in such entities.

3. Much of investing is set on automatic pilot now (new employees have to default out of contributing).

Therefore, there will be new buyers of TSLA stock every day as funds get added!

2. Much of the investment world invests in such entities.

3. Much of investing is set on automatic pilot now (new employees have to default out of contributing).

Therefore, there will be new buyers of TSLA stock every day as funds get added!

Knightshade

Well-Known Member

Wait, Lana'i??? There's nothing on Lana'i but a golf course!

You forgot the really awesome cat sanctuary!

The only thing they have right now is the M1 chip and some battery experience.

But even then they don't build any of that. TSMC makes the M1, not Apple.

Apple has no basically 0 manufacturing capability or manufacturing knowledge (apart from that needed to spec to other companies to build their designs).

dc_h

Active Member

That’s about 80% of my humor.Nah. People who are trying to be funny don't usually post things indistinguishable from stupid. And if they do they are usually careful to indicate they are trying to be funny. But I admit, anything is possible given the level of ignorance around here regarding Apple.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M