I was not an early Tesla investor, but Andrea James seem to be the only few who fought the good fight. First time seeing these clips and I can just hear her frustration, and how the entire street treats her analysis as trash.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Artful Dodger

"Neko no me"

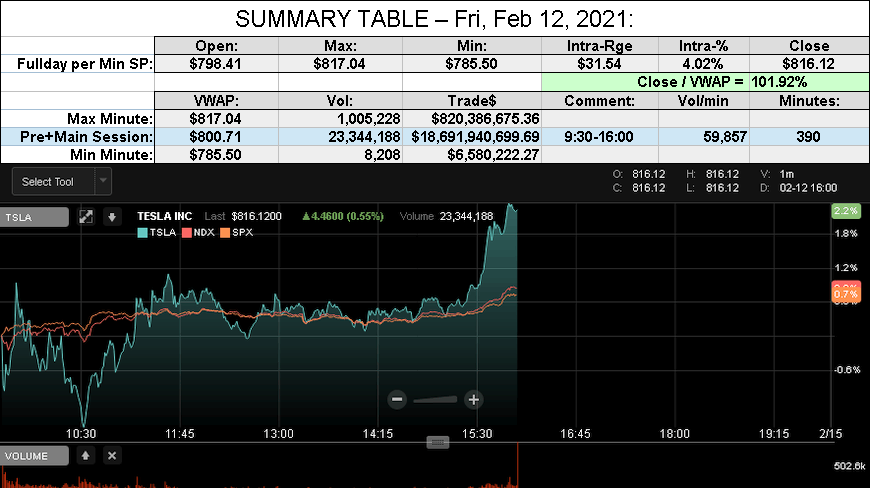

After-action Report: Fri, Feb 12, 2021: (Pre+Main Session Trading)

Headline: "TSLA Late Rally at Close"

Pre-Market:

Main Session:

TSLA S&P 500 Weight: TSLA/FB = 1.8614% (Feb 11)

Mkt Cap: TSLA / FB $783.356B / $770.295B = 101.70%

NB: Yahoo & Google have updated Mkt Cap re 10-K shares (Feb 10, 2021)

CEO Comp. Status: (est'd Mkt Cap including 10-K (Feb 01) shares)

QOTD: @lklundin "Source, please."

Comment: "FUD peaks and ebbs"

View all Lodger's After-Action Reports

Cheers!

Headline: "TSLA Late Rally at Close"

Pre-Market:

Volume: 466,394

SP High $810.00

SP Low $800.00

SP High $810.00

SP Low $800.00

Main Session:

Traded: $18,691,940,699.69 ($18.69B)

Volume: 23,344,188

VWAP: $800.71

Close: $816.12 / VWAP: 101.92%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $830 (-$7.50 from Thu)

Volume: 23,344,188

VWAP: $800.71

Close: $816.12 / VWAP: 101.92%

TSLA closed ABOVE today's Avg SP

TSLA MaxPain (7:00 A.M.): $830 (-$7.50 from Thu)

TSLA S&P 500 Weight: TSLA/FB = 1.8614% (Feb 11)

Mkt Cap: TSLA / FB $783.356B / $770.295B = 101.70%

NB: Yahoo & Google have updated Mkt Cap re 10-K shares (Feb 10, 2021)

CEO Comp. Status: (est'd Mkt Cap including 10-K (Feb 01) shares)

TSLA 30-day Closing Avg Market Cap: $808.96B

TSLA 6-mth Closing Avg Market Cap: $530.07B

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Mkt Cap req'd for 9th tranche ($500B) likely achieved Wed, Feb 03, 2021

Nota Bene: Operational milestones req'd (chart at link).

'Short' Report:TSLA 6-mth Closing Avg Market Cap: $530.07B

Mkt Cap req'd for 8th tranche ($450B) likely achieved Tue, Jan 19, 2021

Mkt Cap req'd for 9th tranche ($500B) likely achieved Wed, Feb 03, 2021

Nota Bene: Operational milestones req'd (chart at link).

FINRA Volume / Total NASDAQ Vol = 43.1% (42nd Percentile rank FINRA Reporting)

FINRA Short / Total Volume = 58.3% (55th Percentile rank Shorting)

FINRA Short Exempt ratio was 0.89% of Short Volume (49th Percentile Rank Exempt)

FINRA Short / Total Volume = 58.3% (55th Percentile rank Shorting)

FINRA Short Exempt ratio was 0.89% of Short Volume (49th Percentile Rank Exempt)

QOTD: @lklundin "Source, please."

Comment: "FUD peaks and ebbs"

View all Lodger's After-Action Reports

Cheers!

RobStark

Well-Known Member

18-11? Pfft, this is not even a playoff team.

Time to rebuild and trade Elon for draft picks.

agastya

Member

I was not an early Tesla investor, but Andrea James seem to be the only few who fought the good fight. First time seeing these clips and I can just hear her frustration, and how the entire street treats her analysis as trash.

DaveT also had an interview with her a few years ago - after she left her job being an analyst.

I can assure you she is still fighting the good fight! What an amazing force she is.DaveT also had an interview with her a few years ago - after she left her job being an analyst.

I know one liners should not be included in posts of merit, but maybe an exception...Coincidentally the SPAC is managed by Kathie Would

Artful Dodger

"Neko no me"

7. Very likely to get a new factory or two announced this year.

This has been superceded by recent guidance, as recently as the 2020 10-K

"We are currently focused on increasing vehicle production and capacity, developing and ramping our battery cell technology, increasing the affordability of our vehicles, expanding our global infrastructure and introducing our next vehicles."

Both Elon and Tesla have been consistent at least since the 2020 Q2 conference call in stating that Tesla now intends to build fewer, larger Gigafactories (first mentioned prior to the announcement of the site selection for Giga Texas).

The rationale is that Tesla's scarcest resource is engineeering talent, and having fewer but larger factories is the best way to leverage Engineering HR to maximize production growth.

So I see Tesla 2025 Production from these two views: (~7M total)

- Per Model:

- Model S/X/R2: 100K

- Semi: 100K

- Cybertruck: 800K

- Model 3/Y: 3M

- Model 2: 3M

- Per Site:

- Fremont+NV: 1M

- Giga Texas: 2M

- Giga Shanghai: 2M

- Giga Berlin: 2M

RoboTaxi / Model 1.

Personally, I think the next 'Giga' location will be for Model 1 / Robotax sometime after 2025, possibly in India. Meanwhile Model 1 lines will be added at Giga Texas, Shanghai, and possibly Berlin (if EU Regulators permitting autonomy).

But basically Tesla will need to add prod. capacity for 14M robotaxis around the world. With all-in-one die-cast chasis and paintless stainless steel bodywork, it might be possible to double prod. at the existing sites, or just buy more land in the vicinity. As always, the bty (and raw materials) supply will be the limiting factor.

More facitlities? Sure, there'll be some Semi prod in NV, the new Li0H mill (either N. Texas or OK), a Li mine in N. NV, maybe a Ni mine w. some manufacturing in Indonesia (to satisfy local prod. req), and hopefully T.E. products in W. Australia (solar, megapack). But these are NOT automotive plants in the traditional sense of the term 'Gigafactory'.

Either way, I don't think we see more 'Giga' sites before India get's a factory to produce affordable locally made EVs. By then, maybe we get Models 1 produced on 4 continents.

Cheers!

Last edited:

Mo City

Active Member

The magnitude of the issue isn't remotely close to TSLA being added to the S&P 500.For the record, the consensus is whether or not Berkshire got into Tesla we should have a definitive answer by market open Tuesday or is it possible this will drag on like the s and p 500 fiasco

Also, what's done has already been done (or not). Either way, the impact on TSLA when revealed will be close to nil.

Ameliorate

Member

The magnitude of the issue isn't remotely close to TSLA being added to the S&P 500.

Also, what's done has already been done (or not). Either way, the impact on TSLA when revealed will be close to nil.

Mmm.... if people thought some outflow this week was due to Gary Black..... Pretty sure the legacy of Berkshire would reverse that and then some. It just is more influential and you know what, it took Elon buying BTC for me to buy some, so for the hardcore BRK followers out there, I'll be curious to see if it's true.

StarFoxisDown!

Well-Known Member

The magnitude of the issue isn't remotely close to TSLA being added to the S&P 500.

Also, what's done has already been done (or not). Either way, the impact on TSLA when revealed will be close to nil.

If the Berkshire news is actually real, it will definitely cause a rally in the share price. Anytime Berkshire reveals a stake in a company, that stock rallies just off of that news alone

Mo City

Active Member

People that believe there was impactful outflow from TSLA due to Gary Black are delusional and need help (or should stop doing drugs).Mmm.... if people thought some outflow this week was due to Gary Black..... Pretty sure the legacy of Berkshire would reverse that and then some. It just is more influential and you know what, it took Elon buying BTC for me to buy some, so for the hardcore BRK followers out there, I'll be curious to see if it's true.

Interesting. Probably a moot point in this case.If the Berkshire news is actually real, it will definitely cause a rally in the share price. Anytime Berkshire reveals a stake in a company, that stock relies just off of that news alone

For the record, the consensus is whether or not Berkshire got into Tesla we should have a definitive answer by market open Tuesday or is it possible this will drag on like the s and p 500 fiasco

So, will we know for sure by Tuesday? I understand that they have 45 days to report. Are the caveats or other circumstances that I don’t know about or is the moment of truth here?

Mmm.... if people thought some outflow this week was due to Gary Black..... Pretty sure the legacy of Berkshire would reverse that and then some. It just is more influential and you know what, it took Elon buying BTC for me to buy some, so for the hardcore BRK followers out there, I'll be curious to see if it's true.

GB = Irrelevant

Artful Dodger

"Neko no me"

OT:He also said you don't need computers to make nuclear weapons, which is true, because we didn't have much in the form of computers in 1945...

The hydrocodes for the first PU gadget were computed via "T-6 IBM computations" beginning in 1943 (when human 'computer' staff could no longer keep up the pace).

Nuclear Weapons Computational Physics (Technical Report) | OSTI.GOV

Nuclear Weapons Computational Physics (Technical Report) | OSTI.GOV

Last edited:

I think that beer would still be safe in the couch whereas it is likely that Lycanthrope got up in the middle in the night and take it to waste.I think Lycanthrope found them them hiding in his coach cushions when looking for money to buy shares... can't let cervesa like that go to waste!

remember folks, beer is not an option (even if you think it calls you. Don’t put it in the fridge (depending on the type of beer, of course)).

UkNorthampton

TSLA - 12+ startups in 1

Wait the stock market can go down?

I just started investing, my grandparents let me put all their retirement money into TSLA.

Tell Stan & Phyl it's in safer hands than before.

UkNorthampton

TSLA - 12+ startups in 1

No... I'm not saying that. I'm saying being vague and saying 'we expect 50% growth yearly with 2021 having the potential for more than that' is vague enough they can't attribute a solid number to it. 750 is too low for what Tesla is clearly expecting, but the difference between 750k and 900k are big enough to create a short term issue. They wanted a small range guidance. Not a percentage growth that they plan to exceed this year.

Then analysts have been given a wonderful opportunity to add value by using their deep understanding to advise their clients.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K