The used car cost has been more than new on carmax for a long time. Most also say they are in a pending sale. Something incredibly fishy going on there.A friend of mine might be getting a tesla. I was looking on their CPO site and was amazed at the prices of the CPO cars. They are as much as a new one. There also were not many cars available either.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Time for rave cave to be built so party people don´t have to hang out in the forest  !

!

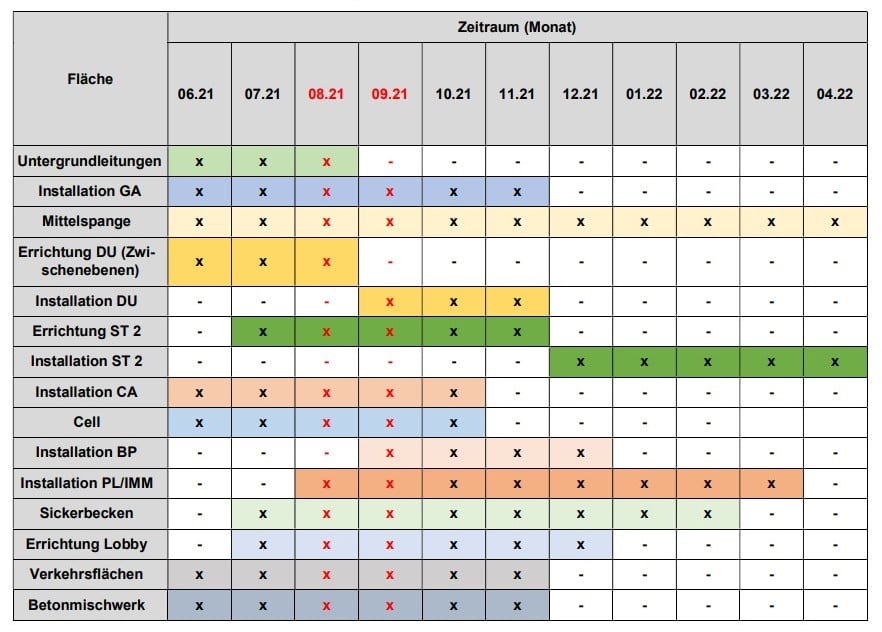

German bureaucracy slows down the progress of GF Berlin construction, but on the positive side we have more transparency - tobilindh found a time line for construction in the plans that had to be made public again:

From top to bottom:

If they want to start production in the end of November as previously reported by @avoigt, according to this they´ll have to do with imported battery packs.

From top to bottom:

- Untergrundleitungen = Underground lines (could be either electric or for liquids)

- Installation GA = Installation of General Assembly

- Mittelspange = Center ... (not sure about this myself, might refer to the central area between main building an Drive unit building)

- Errichtung DU (Zwischenebenen) = Construction of Drive Unit (intermediate levels)

- Installation DU = Installation of Drive Unit (most lkely equipment installation in the building)

- Errichtung ST 2 = Construction of ST 2 (second stamping press?)

- Installation ST 2 = Installation of ST 2

- Installation CA = Installation of Casting Machines

- Cell (that is the english word already...- don´t know if it only refers to the building for cell production or also includes equipment installation (seems unlikely as they are only doing the foundation at the moment)

- Installation BP = Installation BP (likely battery pack)

- Installation PL/IMM (no idea)

- Sickerbecken = Infiltraion Basin

- Errichtung Lobby = Construction of the entrance lobby (with rave cave

??)

- Verkehrsflächen = Traffic areas

- Betonmischwerk = Cement mixing facility

If they want to start production in the end of November as previously reported by @avoigt, according to this they´ll have to do with imported battery packs.

gabeincal

Active Member

Have you noticed if the number of Model S sitting around the factory and storage lot have increased or decreased since deliveries started. I'm curious to know if there's a likelihood of a revenue bump this quarter from S deliveries. Elon said at the delivery event they're only making a couple of hundred a week at the moment, but if the few thousand already made can be delivered this quarter it would add a nice chunk of change to the quarterly results.

From my rough eyeballing it doesn't look like the number stored has diminished much so far.

View attachment 675455

I think the temp lot has about the same number of cars. Likely the very same cars. For some reason, the refresh S' are piling up with few leaving the factory on trucks. Some people on Twitter spotted Plaid S' waiting for delivery at service centers, but that's all I've got so far.

I think Tesla hopes that they can get their hands on the missing part (or software, though I doubt it) before the EOQ - I'm not going to bet with call options that they will. IMHO S&X deliveries will be a few hundred at most this quarter. My realistic guess is much less than a hundred.

ByeByeJohnny

Active Member

The plan has been to start with imported batteries from Kato since forever. If they can stick to this looks like they'll be producing cars at around the same time as Austin. Not bad even with three months headstart considering all the permit delays and Austin using five times the personnel for constructionIf they want to start production in the end of November as previously reported by @avoigt, according to this they´ll have to do with imported battery packs.

Given the, IMO, disaster that has been the S and X refresh, I seriously am in fear if Tesla EVER tries that for 3/Y.I think the temp lot has about the same number of cars. Likely the very same cars. For some reason, the refresh S' are piling up with few leaving the factory on trucks. Some people on Twitter spotted Plaid S' waiting for delivery at service centers, but that's all I've got so far.

I think Tesla hopes that they can get their hands on the missing part (or software, though I doubt it) before the EOQ - I'm not going to bet with call options that they will. IMHO S&X deliveries will be a few hundred at most this quarter. My realistic guess is much less than a hundred.

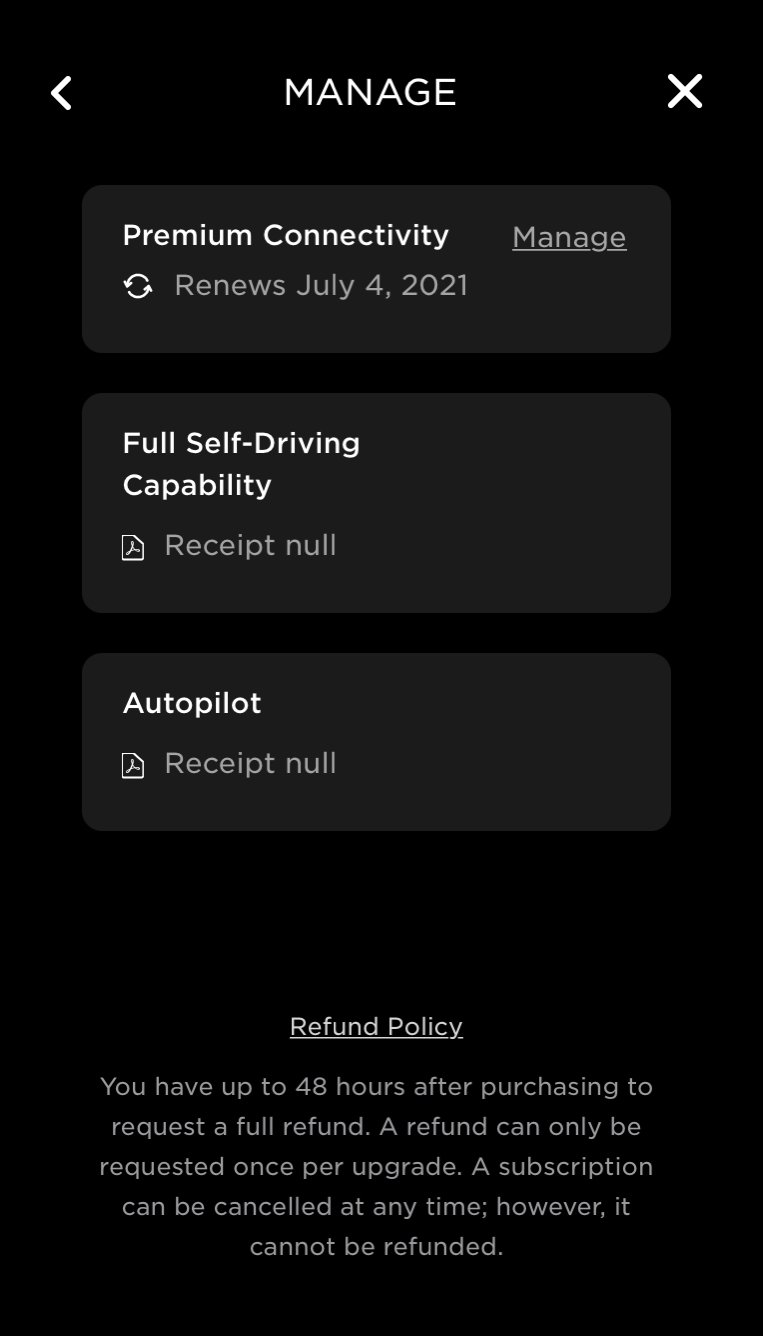

Don’t think I’ve seen this before? Tesla app under Upgrades>Manage Upgrades I’m seeing this:

(I already have AP and FSD).

Sorry if this isn’t new.

edit: typo

(I already have AP and FSD).

Sorry if this isn’t new.

edit: typo

Last edited:

Wicket

Member

Anyone has updates on the Infra Bill?

When could we see it finalized and what’s the current planned effective date for rebate/credit for 2021 cars?

I looked into this for someone and didn't get any response but it looks certain that it *starts* after 12/31/2021. Unclear to me when the bill hits full senate reconciliation but is unlikely to pass through the regular means because Republicans are block voting against it (and so can filibuster). I don't think I really found any news that was particularly recent. The last event being that it did pass through a bipartisan senate committee (14-14 tie) May 26th. U.S. Senate panel advances EV tax credit of up to $12,500.

edit: the most humorous thing I found was the budget they had planned which expected ~13%/year increase in outlays. Let that sink in before you believe any numbers they ever tell you about how much plans are gonna cost.

Last edited:

hacer

Active Member

... There is no rule that says Tesla must accommodate every standard. It will be up to other manufacturers to agree to Tesla's (probably reasonable) requirements. ...

Not every standard, but in Europe there is a law that all EV chargers (including Tesla superchargers) must accommodate the CCS standard which includes the "charging communications". Tesla also supports its own communications (which is not prohibited), but I'm pretty sure the intent is to strong-arm Tesla into allowing all CCS vehicles to charge using the CCS connector, communications, etc. Combined Charging System - Wikipedia

Last edited:

hacer

Active Member

These are employee incentive stock options. They are non-transferable and thus they cannot be sold. They can only be exercised or allowed to expire. Of course there is no obligation to sell all (or any) of the stock acquired by exercising them although most people sell at least enough to cover all of the exercise price cost + tax bill for whatever part is sold immediately.... selling some of your options directly would result in lower taxes (since some of those options are long term cap gains).

...

Right, that’s exactly the point, so I guess you didn’t read very carefully. The order fee has increased by $900. It was an additional $100 on the final purchase, now it’s $1000. It’s clearly stated; it’s just 10x more than it was for MS, or currently is for M3 or MY.

The deposit doesn’t enter into it. This is just about the final purchase price.

Here‘s the MVOA from my MY:

View attachment 675499

And the one referenced above from SarahsDad:

View attachment 675500

If you still can’t do the math, I’m afraid I can’t help you further.

Looks like my MVOA wasn't exactly accurate. This is a further breakdown I found under "Payment Method -> Show Details". Car price is now $137,290, not $138,190. And my $1,000 deposit is getting refunded.

More details on the Clean Energy for America Act here...I looked into this for someone and didn't get any response but it looks certain that it *starts* after 12/31/2021. Unclear to me when the bill hits full senate reconciliation but is unlikely to pass through the regular means because Republicans are block voting against it (and so can filibuster). I don't think I really found any news that was particularly recent. The last event being that it did pass through a bipartisan senate committee (14-14 tie) May 26th. U.S. Senate panel advances EV tax credit of up to $12,500.

edit: the most humorous thing I found was the budget they had planned which expected ~13%/year increase in outlays. Let that sink in before you believe any numbers they ever tell you about how much plans are gonna cost.

US Senate to consider tax credit legislation under clean energy for America act

The Clean Energy for America Act (the “CEAA” or the “bill”), which would consolidate more than 40 existing energy incentives into three…

Artful Dodger

"Neko no me"

Wicket

Member

More details on the Clean Energy for America Act here...

US Senate to consider tax credit legislation under clean energy for America act

The Clean Energy for America Act (the “CEAA” or the “bill”), which would consolidate more than 40 existing energy incentives into three…www.lexology.com

The proposal extends and modifies the Section 30D credit for new qualified plug-in electric-drive motor vehicles (the “EV Credit”) and eliminates the EV Credit’s limitation on the number of credit-eligible EVs a manufacturer can sell. In addition, beginning January 1, 2022, the proposal makes the EV Credit a refundable personal income tax credit for vehicles acquired on or after such date.

This suggests a nuance I might have missed. That there are two stages here. One is the relief of the cap on the old $7,500 tax rebate that Tesla, GM passed which possibly starts immediately (I'm unclear)? The second phase is the full $12,500 direct tax refund (straight off the top regardless of your tax burden) and other features like 80k$ cap which starts after 12/31/21. It's always been a bit of a mystery why they wouldn't have it execute immediately since that's contrary to any common sense (not that this is too surprising in itself).

Wicket

Member

What does a 600B$ market cap say about the minimum performance of Tesla's future financials? It seems productive to think about it from that perspective not just 'how high could it go?' (which may be hard to measure and a very wide range and certainly difficult to put a clear multiple on).

Most people would pay minimum of 1.5 PEG (I hate this construction but it does generally give some idea) so 600B$ could be for instance 200B$ in revenue, 10% net margin, and 30x P/E (from at least 20% forward EPS growth and 1.5x). What are the odds Tesla fails to achieve these numbers?

1) 200B$ in revenue is circa the era of ~4m units. With model 3/Y likely pulling down 2m combined eventually and CT and model 2 this seems an easy to hit number. It also ignores that other LOBs like energy, insurance and improving service economics will contribute increasingly.

2) 10% net margin is already what many project for Q4 2021. They would only have to maintain this in face of competition despite showing dramatic scaling advantages and far more revenue upside (as well as FSD not yet counted fully or fully baked). If the market price of vehicles exists such that other players have to achieve 5% then it seems easy to claim that Tesla can achieve 5% higher given structural advantages in direct sales and other brand/technology/advertising/debt factors.

3) 20% EPS growth seems a cinch so long as revenue growth remains upwards of 10% (roughly 20% marginal revenue goes to net profit which would be like 25% GM - 5% expanded op.ex) which seems like something that comes circa 2030+.

Any comments on the usefulness of this analysis or ways to improve it? Important to repeat I'm not trying to locate the fair price here only clarify the downside risk at current prices.

Most people would pay minimum of 1.5 PEG (I hate this construction but it does generally give some idea) so 600B$ could be for instance 200B$ in revenue, 10% net margin, and 30x P/E (from at least 20% forward EPS growth and 1.5x). What are the odds Tesla fails to achieve these numbers?

1) 200B$ in revenue is circa the era of ~4m units. With model 3/Y likely pulling down 2m combined eventually and CT and model 2 this seems an easy to hit number. It also ignores that other LOBs like energy, insurance and improving service economics will contribute increasingly.

2) 10% net margin is already what many project for Q4 2021. They would only have to maintain this in face of competition despite showing dramatic scaling advantages and far more revenue upside (as well as FSD not yet counted fully or fully baked). If the market price of vehicles exists such that other players have to achieve 5% then it seems easy to claim that Tesla can achieve 5% higher given structural advantages in direct sales and other brand/technology/advertising/debt factors.

3) 20% EPS growth seems a cinch so long as revenue growth remains upwards of 10% (roughly 20% marginal revenue goes to net profit which would be like 25% GM - 5% expanded op.ex) which seems like something that comes circa 2030+.

Any comments on the usefulness of this analysis or ways to improve it? Important to repeat I'm not trying to locate the fair price here only clarify the downside risk at current prices.

I actually don't expect the yoke to be problematic either, but for your F1 example don't those cars go lock-to-lock in <1 yoke revolution, however?Seems the only thing TSLAQ could complain about Plaid is the steering yoke, and they often brought up Randy preferred round wheel after tried Unplugged Performance Plaid in Laguna Seca to make their point.

If you look at Randy’s previous runs, you would understand why, he is so familiar with the track that he often slide his hands up or down the wheel in anticipation of a turn, so his arms would be more level mid turn to do fine adjustments with less effort.

This is a personal preference of a pro driver on his home track.

Anyone who drives a Tesla that hard on public road shouldn’t own a Tesla.(Miata would be a good option to do that without breaking the law)

Even on tracks, F1 drivers lives with their yokes just fine, and plenty of other racers who always lock their hands on 3 and 9 o’clock no matter the wheel shape, so not every racer would need/want a round wheel.

Not that I think there would be anyone not buying the new S&X because of the yoke, just want to point out it’s just personal preferences when it comes to racing.

For everyday driving the yoke seems perfect, great visibility to instrument cluster, and when cruising the flat bottom would be a nice place to rest your hands on.

MC3OZ

Active Member

Given the, IMO, disaster that has been the S and X refresh, I seriously am in fear if Tesla EVER tries that for 3/Y.

By that stage, we will have Model 2, Cybertruck etc, and there is no real reason to do 3/Y at the same time.

For the 3/Y there are multiple factories, they would probably ramp a Refresh version at Fremont, while other factories churn out the existing version.

Or maybe Austin will start making a new version of the Model 3, while Fremont churns out the existing version.

Multiple factories helps... and the new tech will be probably proven in Model S/X before moving to Model 3/Y.

For Model S my hunch is they are short some part, all of that part is going into Plaid versions this quarter, a pile of LR Model S are waiting on the part.

Some time in Q3, they will source the part, and all of those LR Model S cars will ship.

I do wonder when we will get the Rizen CPU, the rear screen and V11 software in Model 3/Y. The cost of the new CPU may be a factor..

Whether or not V11 needs the new chip, I bet some games need it to play well.

Well that puts an end to the great price fixing, bait and switching, illegal unethical pricing practice scandal of June 2021. Thank goodness!Looks like my MVOA wasn't exactly accurate. This is a further breakdown I found under "Payment Method -> Show Details". Car price is now $137,290, not $138,190. And my $1,000 deposit is getting refunded.

View attachment 675655

I smell more transitioning happening tomorrow. Another bloody day for the dow. 10 year continues to drop. Asian market getting killed. Nasdaq holding and will most likely outperform. Last Friday dejavu.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K