The growing police car and taxi fleets of 3 and Y will end that image.Tesla has a luxury branding to it, a connotation of it being a toy for the 1%. Doesn't go very well with this union loving administration.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Sounds like Q2 will be good!

Artful Dodger

"Neko no me"

What’s with the AH low? Do we know the volume at that price?

Most likely is somebody executing a Call option (given the time of day). Another possibility is a 'stuck' order from earlier in the day reported late. Brokers have some hours grace period to do that. Unless you have a paid data source for trades, I'm afraid that's all we can know. NASDAQ stopped reporting per-minute data in Jan '21 for both the Pre-Market and After-hrs sessions.

Arguably, the expectation of Starlink IPO access adds extrinsic value to Tesla shares, like a warrant. I don't know if there is even a legal basis for it, but if it starts looking more likely as time goes on, the "volatility" will go up and add value.

Time to start hoarding some dry powder.

Wicket

Member

Arguably, the expectation of Starlink IPO access adds extrinsic value to Tesla shares, like a warrant. I don't know if there is even a legal basis for it, but if it starts looking more likely as time goes on, the "volatility" will go up and add value.

Heh it's like putting down a deposit on Cybertrucks with a fixed FSD price as a gamble for FSD going to 20k$+ (and similar). Makes sense.

What is the mechanical way to reward *long-term* shareholders? I find it unlikely they look at how old your position is.

This is so frustrating to read.Was this shared?

Elon tweeted ?? about it. (Edit: added tweet directly)

can’t imagine how infuriated must be the investors and board team of Revel that out all the effort to assemble a fleet with well paid job for the taxi industry, seeing that administrative political backstabbing from anti-EV lobbying.

Wicket

Member

Heh it's like putting down a deposit on Cybertrucks with a fixed FSD price as a gamble for FSD going to 20k$+ (and similar). Makes sense.

What is the mechanical way to reward *long-term* shareholders? I find it unlikely they look at how old your position is.

Looks like Starlink raised money in February at a 74B$ valuation. I'm much more fond of these two coming together in scenarios where Starlink is a relatively small % of the total.

This seems roundabout but just putting it out there. Could the strategy evolve to being a Starlink IPO with favor to TSLA shareholders followed by a kind of 'well we seem to have a lot of overlapping shareholders let's go for a merger shareholder vote?'. This is the kind of mechanical M&A logic I have no idea how to process. Post IPO it seems Starlink would likely be more expensive than pre-IPO however while that makes it less optimal for Tesla shareholders to then acquire it, it also helps ensure Starlink shareholders got full value. I can see plenty of reasons the two might benefit tied together. Not super strong ones but reasonable. Definitely would underline the fact Tesla is not just a car company.

Wicket

Member

Model 3 looks to be sold out in China, now 6-8 weeks delivery. Model Y is still 1-3 weeks.

And model S plaid is still available for June delivery! Come on wealthy shareholders.. just how high does it have to be to convince you to drive away in this beauty?!

gabeincal

Active Member

Based on what I see and based on the lack of videos and pics of delivered Plaids, I'm not sure how many deliveries we can reasonably expect in June. Not saying that it should materialize in a share price drop though, 3 & Y deliveries are going well AFAIK.And model S plaid is still available for June delivery! Come on wealthy shareholders.. just how high does it have to be to convince you to drive away in this beauty?!

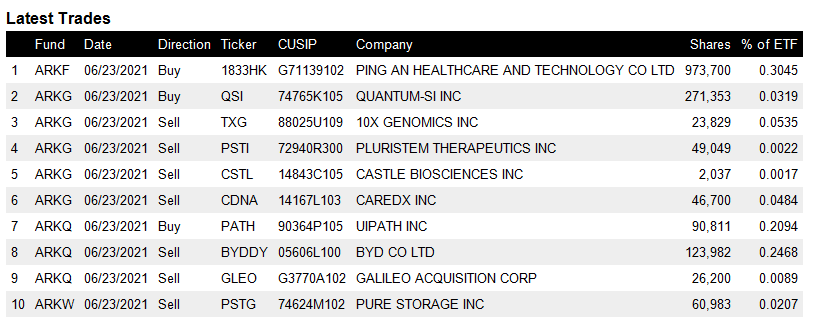

Well, it wasn't ARK buying today.

Not a lot of trading - a popcorn day.

Not a lot of trading - a popcorn day.

That's just a glitch. Not a real price. It happens regularly.What’s with the AH low? Do we know the volume at that price?

UnknownSoldier

Unknown Member

It is extremely unlikely that the rank and file on both sides will accept or vote for this. Just making sure you guys are aware.

Interesting and not entirely surprising if true...

Wicket

Member

Copied from SA (no link for them!):

That's a plausible hypothesis for a bounce assuming the report actually had reliable info in it. My theory about the weak YTD performance is it was a mini-bubble in EV that popped followed by rotation into legacy names. If this was a reversal of that I wouldn't have expected GM and F to also be participating in a rally. But it makes perfect sense if the above is the cause.

- UBS is cautiously optimistic that the worst may be over in terms of the negative impact for the automobile sector from the global chip shortage.

- Analyst Patrick Hummel notes that General Motors (GM +0.6%), Ford (F +2.4%) and Volkswagen (OTCPK:VLKAF) have all suggested the outlook for production is improving as chip supply improves incrementally.

That's a plausible hypothesis for a bounce assuming the report actually had reliable info in it. My theory about the weak YTD performance is it was a mini-bubble in EV that popped followed by rotation into legacy names. If this was a reversal of that I wouldn't have expected GM and F to also be participating in a rally. But it makes perfect sense if the above is the cause.

Wicket

Member

It is extremely unlikely that the rank and file on both sides will accept or vote for this. Just making sure you guys are aware.

It appears it doesn't have the EV credit in it anyway though which seems important.

FTFYIt is extremely unlikely that the rank andfilevile on both sides will accept or vote for this. Just making sure you guys are aware.

Once profits are booked, are you saying price usually goes down? Or all bets are off sort of thing? Delta hedging is fascinating, and do they have their own algos for this? You mentioned weak market makers…. What do the strong market makers do?Nice day and a good after-hours pop after a long time. And predictable too. This AH pop happened many times in the past.

So, the move today of ~33 points was on light volume of ~30 million shares. Just the delta hedging need from market makers requires them to buy ~20 million shares per my calculations. This requires ~3-4x trading volume, and today's volume was definitely not enough to delta hedge their books.

So the weak (perhaps smart) market makers are buying to go home a bit flatter and a get a tad more sleep. This may continue another day before the 650 call buyers decide to book profits.

Either way, interesting week ahead.

Wicket

Member

Is it weird that calls seem to be centered on a reasonable price within the 600s but puts seem to be centered down at a rather bonkers 450? Stock Option Max Pain

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M