lafrisbee

Active Member

source?Nikola in re-entry back down to earth - Seems they needed more hydrogen and the battery needed charging… again

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

source?Nikola in re-entry back down to earth - Seems they needed more hydrogen and the battery needed charging… again

I’ve seen Waymo w/o driver as far back as 2 years ago in Az. So this law is clearly different by State.In Washington State there needs to be a licensed driver behind the wheel (who is also sober). I imagine this is true in most US states, so I don't know why you continue to spread this nonsense. The fact that Florida and maybe a handful of other states may have more permissive laws does not change this basic fact.

Symbolic based on NKLA SP today. The story…source?

I would test FSD in a blizzard too. How fun is that! Proud of anyone trying; thank you for your service!Good info, but now I need to mop the sweat off my forehead. Snow people lead a different life...

Paging @LN1_Casey

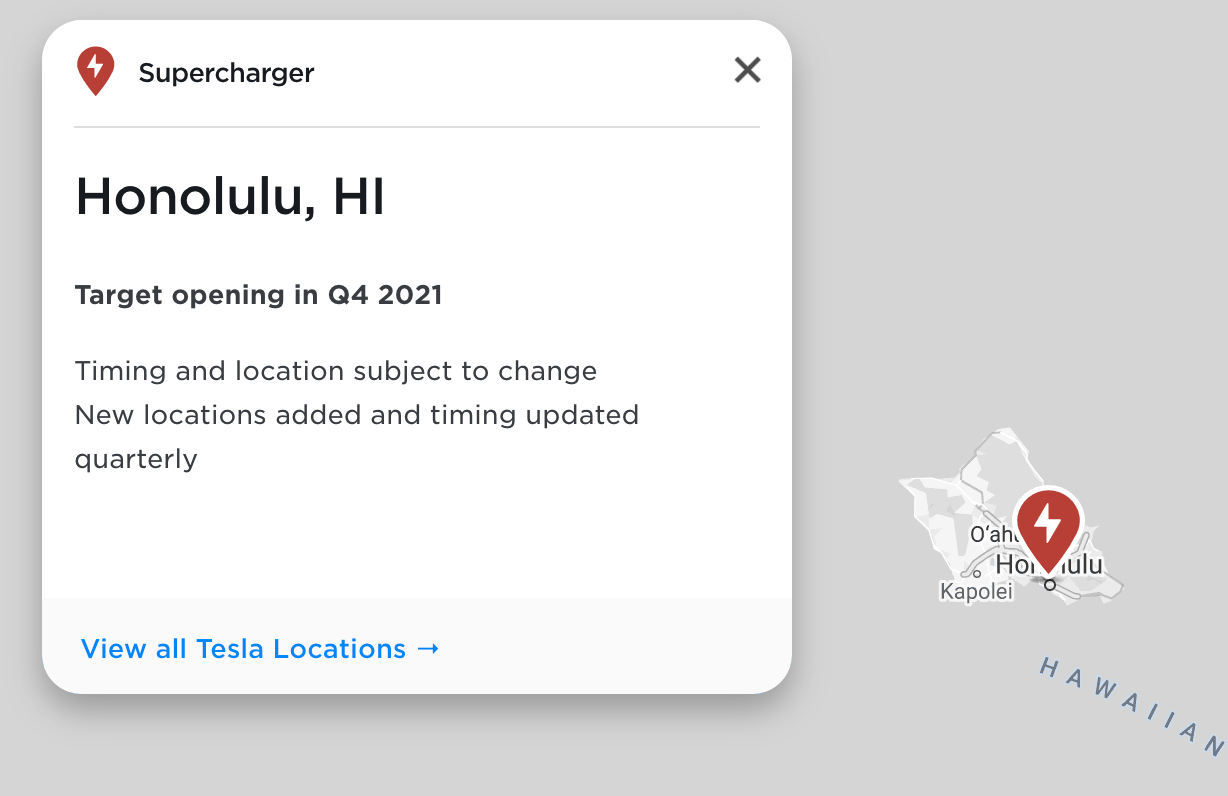

Congrats on your new 'work' Supercharger:

First Tesla Supercharger in Hawaii opens on the island of Oahu

Tesla owners in Hawaii finally have their first Supercharger. A new V3 Supercharger is now open in Pearlridge Center in Aiea, about 10 miles from downtown Honolulu on the island of Oahu. Permits for this […]driveteslacanada.ca

Cheers!

Out of the game? What is this 'game' you speak of?All right everyone I’m back out of the game. Just sold at $1,113

I realize there are different strategies and all, and in no way mean to dismiss them out of hand. So take this at face value.All right everyone I’m back out of the game. Just sold at $1,113

Interesting. I thinks odds are very high that we will be higher than this a month from now.All right everyone I’m back out of the game. Just sold at $1,113

Does anyone have an educated guess when HW4 may replace HW3?I expect both HW4 in-car computer, and Dojo, will be needed before it gets massively better based on my personal experiences with it plus those of most of the other beta testers I've seen.

the fun part about options is that when you feel like selling shares to take profit then it’s time to sell covered calls and when you feel like buying shares because they look cheap it’s time to sell puts closer OTM. Options are interesting because you can be active in the market without affecting the main position average cost basis. I greatly prefer that than to day trade or swing trade a whole position and stay out of the market when the stock FOMOing makes it go higher and higher.Interesting. I thinks odds are very high that we will be higher than this a month from now.

I put the Funny for "Of course I will be wrong" and then you edited that bit out. Sneaky of you.the fun part about options is that when you feel like selling shares to take profit then it’s time to sell covered calls and when you feel like buying shares because they look cheap it’s time to sell puts closer OTM. Options are interesting because you can be active in the market without affecting the main position average cost basis. I greatly prefer that than to day trade or swing trade a whole position and stay out of the market when the stock FOMOing makes it go higher and higher.

Tesla is facing an investor lawsuit over Elon Musk's tweets on 10% stock sales and his recent feud with Elizabeth Warren

"It is unclear who at Tesla, if anyone, is currently reviewing Musk's tweets," investor David Wagner said in a lawsuit filed Thursday.markets.businessinsider.com

Is there going to be a lawsuit for every Tweet Elon writes? Instead of spending money to sue Musk, that Investor should have spent that money to buy in the 900s before it runs back in the 1300s before he even realizes what is happening.

It doesn’t look like it to me so farAny thoughts whether today looks like Elon may have sold the remaining last bit?

Why don't you allow me to view your profile?All right everyone I’m back out of the game. Just sold at $1,113

I’m not selling but you do you and don’t worry about what people are saying. They mocked others for selling at $1200 a few weeks ago….All right everyone I’m back out of the game. Just sold at $1,113

Absolutely no one should be scolded for selling when they want to sell......By the same token though, ya can't complain or wish for dips if you sell and the stock never looks back.I’m not selling but you do you and don’t worry about what people are saying. They mocked others for selling at $1200 a few weeks ago….

Counter suits are usually net useless but Tesla should file counter suits at least for legal costs which may make some think twice before filing and reduce these.the fun part about options is that when you feel like selling shares to take profit then it’s time to sell covered calls and when you feel like buying shares because they look cheap it’s time to sell puts closer OTM. Options are interesting because you can be active in the market without affecting the main position average cost basis. I greatly prefer that than to day trade or swing trade a whole position and stay out of the market when the stock FOMOing makes it go higher and higher.

Tesla is facing an investor lawsuit over Elon Musk's tweets on 10% stock sales and his recent feud with Elizabeth Warren

"It is unclear who at Tesla, if anyone, is currently reviewing Musk's tweets," investor David Wagner said in a lawsuit filed Thursday.markets.businessinsider.com

Is there going to be a lawsuit for every Tweet Elon writes? Instead of spending money to sue Musk, that Investor should have spent that money to buy in the 900s before it runs back in the 1300s before he even realizes what is happening.

All sorts of legitimate reasons for selling. That's a personal decision for everyone.All right everyone I’m back out of the game. Just sold at $1,113