I put in a $945 buy order. Let's see if we play with that gap today. I'm off to get my wisdom teeth pulled. Probably rather be watching the ticker today. lol

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

...or only buy LEAPS with whatever you consider your "play money". I thinks LEAPS are mostly a good calculated risk. I'm all about buying shares and HODLING. But it's just so much FUN playing in front of the steamroller...Way, way too tempting to take more risk than I want to expose my portfolio to. I've built my position in TSLA by catching falling knives and lucking out more than once. So; only leap once you've considered the amount of sleep you may lose.

Oh it is, it is.....or only buy LEAPS with whatever you consider your "play money". I thinks LEAPS are mostly a good calculated risk. I'm all about buying shares and HODLING. But it's just so much FUN playing in front of the steamroller...

okay, in for 2 more at 981...

Edit: Luck was with me today

Edit: Luck was with me today

Last edited:

Artful Dodger

"Neko no me"

Fifth consecutive day of declines, this is likely fresh money now betting against TSLA. And with Tesla about to report record-shattering earnings, I suspect the current high price of oil tells us exactly who is doing the betting. The fact that JPMorgan Chase updated their price target to $295 after the record P&D report tells us all we need to know about who's organizing this bear raid.

And its ultimately futile. TESLA does not depend upon TSLA (or the Market) to raise the cash it needs to continue its exponential (soon to be legendary) growth. Tesla is SELF-FUNDING (just as Elon said they would be 4 years ago). FCF is King, and Elon is Grand-Poobah...

I'm HODL'ing.

Cheers!

P.S. Paging @Unpilot

Agree. When we got guys like Gary Black twittering, "Ignore the macros, I'm raising my price target to $1600," I feel a big dump coming too.That means they’re abt to dump heavy.

Last week's price action was yet another great example of just how brutally rigged the market is. With the 200 day moving average at about $800, and Jan '21 max pain at $740 according to Papafox, I wouldn't be surprised to see THEM, with the help of strategically planted news stories, manipulate the SP down a couple hundred more dollars, and keep it down while the usual suspects get in position for the next leg up.

I don't doubt we could see $1600 (or higher) in the next 12 months. But I could also see us trading mostly in the 700s-900s over the next few months, then suddenly, in the span of a month, jump to $1500-$1600. It's how the MMs make their money.

Don't make bets you can't afford to lose and you'll be ok.

2daMoon

Mostly Harmless

A little reality check for those whose faith is being tested.

Look at the dotted yellow line that marks the bottom of the trend for the past two years and consider its relationship to the current SP.

Then, consider the fundamentals at play and how there is nothing about Tesla's operation that indicates anything but growth.

Lastly, Don't worry, HODL & Be happy

Look at the dotted yellow line that marks the bottom of the trend for the past two years and consider its relationship to the current SP.

Then, consider the fundamentals at play and how there is nothing about Tesla's operation that indicates anything but growth.

Lastly, Don't worry, HODL & Be happy

Accident

Member

I blame Goldman Sachs.Hmmmm....

Yes, they upgraded Tesla, but at the same time GS upped their rate hike forecast to 4 hikes this year (from 3), and they're expecting Fed to start selling down the balance sheet starting in the summer.

But But...I had to rescind my bid on a yacht.

And forget about the private jet!

My short term option score is now 2-9....heading to 2-11

Long term shares locked away from my trembling gambling fingers.

And forget about the private jet!

My short term option score is now 2-9....heading to 2-11

Long term shares locked away from my trembling gambling fingers.

Fred42

Active Member

An alternative to fretting over the stock price is to read this lengthy informative and entertaining post by Mr. Miserable.

teslamotorsclub.com

teslamotorsclub.com

30 hour wait for recovery. Lessons learnt.

My Model 3 broke down on Thursday evening. The dreaded 12v failure. Indications were messages like "Vehicle may not restart","Electrical system is unable to support all features" followed shortly afterwards by red warnings to pull over as the vehicle was about to shut down, which it did. The...

Last edited:

The Accountant

Active Member

Why the Impact of Treasury Yields on TSLA is a Head Fake

The pending Fed Rate hikes are driving up Treasury Yields putting pressure on Growth stocks like Tesla.

This will be temporary as Wall Street Analysts realize that their Valuation Models have grossly underestimated Tesla's future cash flows.

Let me explain.

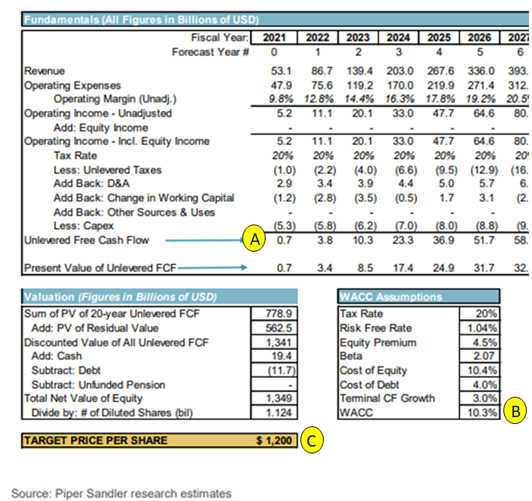

Below is Piper Sandler's Valuation for Tesla computed in January 2021 (a year ago).

Their valuation takes 20 years of cash flow (see A below) and discounts it with a Weighted Average Cost of Capital (WACC) - (see B below) to arrive at a price target of $1,200 (see C below). In October 2021, Piper took it's price target for Tesla up to $1,300 based on the strong Q3 results.

The reason Growth Stocks are taking a beating is that as Treasury Yields go up, the WACC goes up so the 10.3% discount rate (in B below) may go up to 11% in 2022. This would have the impact of reducing Tesla's valuation in the model below from $1,200 to I estimate $1,100 (an 8% reduction).

That's fair but one other item in the model has to change . . . .look at Piper Sandler's cash flows in line A below; they are grossly underestimated.

For 2021, Piper has $0.7B in Cash Flow, Tesla will deliver over $4.3B.

For 2022, Piper has $3.8B in Cash Flow, I estimate tesla will deliver over $11.0B.

Subsequent years area also grossly underestimated as they build on the wrong numbers from the year prior.

So the higher treasury yields will cut the stock valuation down 8% but the higher Cash Flow will take the valuation up. . . .way up.

I see $1,800 by year-end once Analysts realize Tesla is a money printing machine. It may take some time as my estimate has $7B of $11B CF for 2022 coming in the back half of the year.

The pending Fed Rate hikes are driving up Treasury Yields putting pressure on Growth stocks like Tesla.

This will be temporary as Wall Street Analysts realize that their Valuation Models have grossly underestimated Tesla's future cash flows.

Let me explain.

Below is Piper Sandler's Valuation for Tesla computed in January 2021 (a year ago).

Their valuation takes 20 years of cash flow (see A below) and discounts it with a Weighted Average Cost of Capital (WACC) - (see B below) to arrive at a price target of $1,200 (see C below). In October 2021, Piper took it's price target for Tesla up to $1,300 based on the strong Q3 results.

The reason Growth Stocks are taking a beating is that as Treasury Yields go up, the WACC goes up so the 10.3% discount rate (in B below) may go up to 11% in 2022. This would have the impact of reducing Tesla's valuation in the model below from $1,200 to I estimate $1,100 (an 8% reduction).

That's fair but one other item in the model has to change . . . .look at Piper Sandler's cash flows in line A below; they are grossly underestimated.

For 2021, Piper has $0.7B in Cash Flow, Tesla will deliver over $4.3B.

For 2022, Piper has $3.8B in Cash Flow, I estimate tesla will deliver over $11.0B.

Subsequent years area also grossly underestimated as they build on the wrong numbers from the year prior.

So the higher treasury yields will cut the stock valuation down 8% but the higher Cash Flow will take the valuation up. . . .way up.

I see $1,800 by year-end once Analysts realize Tesla is a money printing machine. It may take some time as my estimate has $7B of $11B CF for 2022 coming in the back half of the year.

Xd85

Member

If you were a Strong Guy you wouldn't be so upset.Super lucky the musk Brothers sold at the top. Total coincidence.

Phobi

Member

Artful Dodger

"Neko no me"

Jan '21 max pain at $740 according to Papafox

That's an extremely misleading figure. Most LEAPS of this expiry date were hedged by Market Makers months or even years ago and DO NOT influence their motivation and decision making to buy or sell shares. Paging @Papafox

Further, the highest open interest PUT strike is $1, which mainly indicates that there exists somewhere a matching long CALL option purchased on margin, and the PUT was opened simply to reduce the margin requirement, and/or increase leverage on the long call.

The reality is that neither NASDAQ, the CBOE (options market), nor your broker provides an accurate assessment of "Max Pain", and if they did that would still be only one of five large disparate groups in a perpetual game of tug-of-war over the daily SP.

This may come as a surprise, but for most retail investors, the best strategy is often to pick a company with strong fundamentals in a growing market, and focus on the long game. I believe that @StealthP3D may have mentioned that this is how he's prospered for 30 years.

Cheers to the Longs!

Last edited:

Right now TSLA shares are down less than almost all of the other American automakers. This may have been helpful.

Dig deeper

Member

Its a total coincidence that you forgot to mention that Elon owns more of the company than he did before his "sales". Try harder, troll.Super lucky the musk Brothers sold at the top. Total coincidence.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M