Featsbeyond50

Active Member

Don't worry about this selloff guys, it's okay. I'm selling an investment house and will soon have lots of cash to put into TSLA so everything is fine.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Yes, the wording is technically "by end of the year" but doesn't change my point that the margin loan won't be taken until the buyout goes through oversight@StarFoxisDown!

Pretty sure it's by the end of the year, not at the end of the year.

It's the velocity of the shift which mostly happened in the last 2 weeks. And also it can still drop more.That's like a 3% shift from the recent high of ~0.158 to 0.153.

Over the last 180 days:

4% down from high to low

1% down from average to low

US Dollar (USD) to Chinese Yuan (CNY) exchange rate history

Yuan to Euro is 8% to 4% though which is more impactful for Tesla China.

He can't do that until he "secures funding" by way of a PE partner for the remaining equity commitment. (17 Billion)Elon should tweet that he is not selling TSLA stock to finance the Twitter purchase. Or would that be a violation of SEC ruling?

Yeah I fail to see the perspective hereLol

Both Ford and Amazon are going to have to take multi billion dollar charges for Rivian stock in both Q1 and Q2…

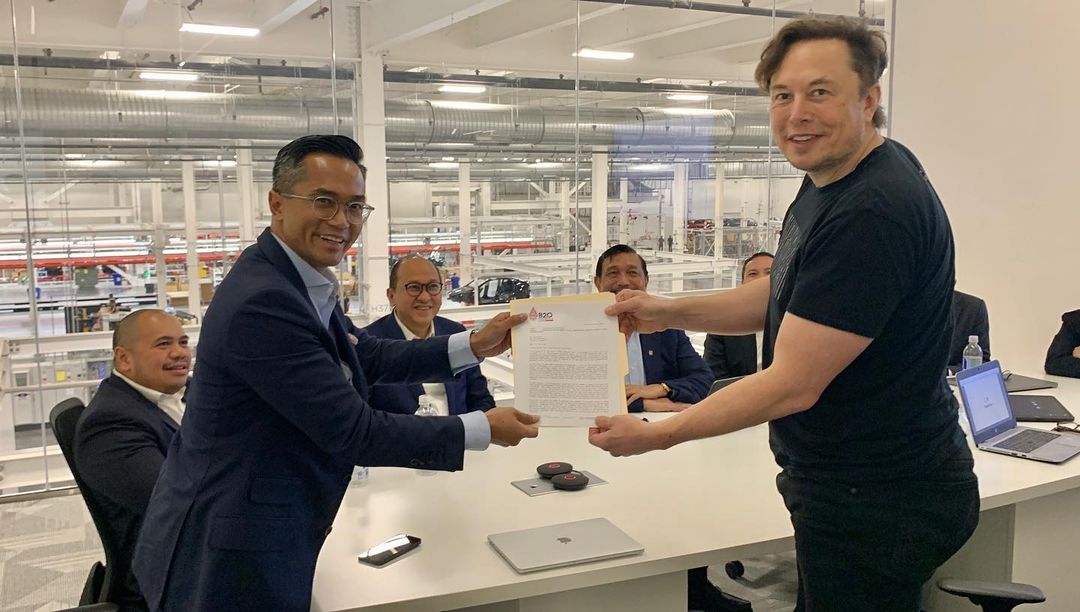

Several officials were part of the delegation. These included Indonesia’s Coordinating Minister for Maritime Affairs and Investment Luhut Binsar Pandjaitan, Indonesian Ambassador to the United States Rosan Roeslani, and Anindya Bakrie, the general chair of the Advisory Council of Chamber of Commerce and Industry.

In a post on Instagram, Bakrie noted that the goal of the meeting was to persuade Tesla to explore the idea of cooperating with Indonesia for its battery supply chain. “Our goal is to convince Tesla to explore cooperation with Indonesia regarding the supply and processing of Nickel as a raw material for making Battery Cells based on good and sustainable ESG (Environment, Social and Governance),” Bakrie wrote.

Just remembered last time I transferred in money it got held up and forced to wait until 3/14. I got it at $768 that day - better to be lucky than good.Just put in for a $35k transfer in my 457 retirement account to the brokerage window. It won't show up until tomorrow (probably after lunch). Hopefully this drop in TSLA will hold until then for me to get in (or maybe I can get lucky and it will drop more?).

Btw the number TSLA would need to go down on that margin loan is about 400-450/share.

The number of 500/share I’ve seen floated around is using incorrect numbers/math

Except that thing that is not being talked about is that Elon has multiple options to pay the margin loan through taking equity loans against SpaceX and guess what other company......yup.....Twitter.It just seems like really bad planning to leverage an asset that one then proceeds to tank through large volume selling in order to raise additional capital. Like, that can't be the plan right?

And yes, I am a little grumpy that I sold my protective 4/29 $900 puts at $5.23 a pop earlier today.