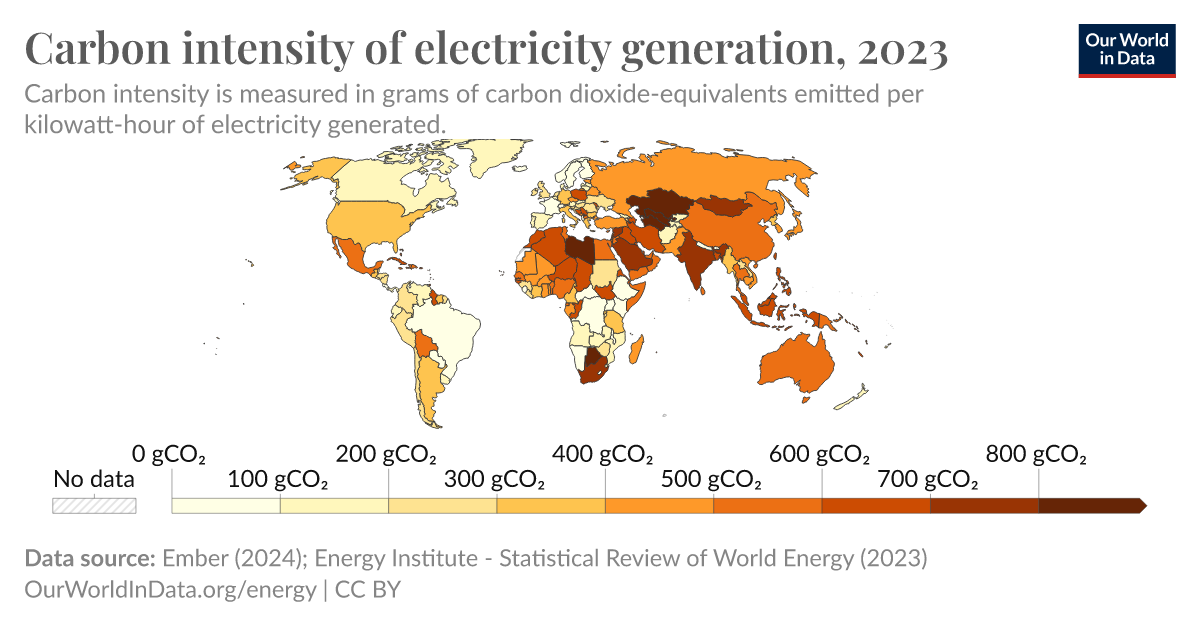

Well.. Energiewende started under Schröder with the SPD & Greens in government. From 1998-2003. In 2004 Merkel came along with neocon (Conservatives of CDU and liberals from FDP) to cancel most of it (i.e. all energy-intensive industry was suddenly exempt the EEG, a fee for subsidizing renewable.. doubling the penalty to the consumer).. the from 2008-2020 we had 3 terms of SPD & CDU under Merkel .. now we have "traffic-light"-government.. SPD + Greens + FDP (the neocons .. yellow)...And the actual record of the energiwende factoring in cost (basically highest electricity prices in the world now) and real world co2 reductions (Germany probably will have the highest co2 per KWh of any Western European country) is mixed at best, and currently they are getting destroyed in actual renewable generation growth by China and the USA.

The course to get us hooked on russian gas was a present from Schröder when he left office in 2003 and headed onto the board of Gazprom.. and all conservatives just strengthened the dependency on russia further ..

Now the Green Minister of Commerce is building the biggest LNG-Terminal in the baltic to get at least rid of the dependency from russia without sacrificing the CO2-reductions from ending coal.. He only is Minister since November and has to clean up 16 years of neocon-mess....

We were leading in renewables in 2004. Then they sacrificed 70k jobs in solar (and everything migrated to china) in 2006/07.. since 2016 they go heavily after wind as well. 30k jobs gone. Last producer of commercial windmills (for electricity) went bankrupt some weeks ago.

And the "coal-exit" compromise saves the 30k jobs in coal extraction & consumption .. getting subsidized on average by 500k € per worker over the next 10-30 years...

So .. it is a bit more complicated than Energiewende caused the high prices, energy mix is still crap.. it was the explicit policy from conservatives in the last 16 years. Your guess how that came to be .. *cough*lobbying*cough*..

BTW: we still do not have the UNO Anti-Lobbying-Law (only one of 5 countries in the world or so) .. As a politician corruption is only outlawed when you explicitly buy a concrete vote on a concrete law... so go figure