That took longer than expected...............These stock moves on companies that are posting laughable growth compared to Tesla just add to my annoyance

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Nah. Optimus isn't about sports and physical agility. It's about repetitive boring labor.Frisbee

And it throws it back.

Have it pass out swag bags to all attendees when they arrive.

Last edited:

dhanson865

Well-Known Member

Nah. Optimus isn't about spots and physical agility. It's about repetitive boring labor.

Have it pass out swag bags to all attendees when they arrive.

Have it say "Would you like some swag?" and if they say Yes it grabs a bag and hands it to them. If they say No it says "It's good stuff, are you sure?" and at that point it grabs a bag but doesn't hand it to them unless they reach for it.

Simple decision tree and only needs to know how to say two things and do two general motions + the grab and release concepts.

If you want to polish the routine you can add a "Have a nice day" or "Enjoy the presentation" after the bag release on the handoff. But even if it was a wordless handoff and it got the first statement(s) right I'd call it a win.

edit: Oh and to really show this off, have several of them standing behind a table, all the swag on another table behind them. A ballet of Optimus SubPrimes going back and forth to grab a bag for people going by.

And when I say ballet, it's totally boring normal movement you'd expect from a bored teenager, just quietly efficiently doing the job. The only thing that makes it remotely ballet like is the line of them doing the same motions.

Last edited:

Sure, if you allow for pulling in outside cash, early exercise is better because that effectively negates/ ignores the short term taxes.I think I understand what you are getting at.

When I compute the 2 scenarios, it is better to exercise now and get capital gains later when you sell.

If Kimbal exercises now and sells the shares later at $3k per share he nets about $49.9m (see first yellow cell below).

If we waits until $3,000 to exercise and sells, then he nets only $42,7m (the 2nd yellow cell).

However, he has an opportunity loss on the 7.8m in taxes he pays now (see orange cell). That money could be earning something.

It is possible he could be forgoing gains on this $7.8m that would exceed the tax benefit of exercising now.

However, I do know of several senior executives who have exercised early to get the long term cap gains on the eventual sale.

View attachment 833928

If one includes opportunity cost and allows that cash to be put into TSLA, delayed exercise is better. That $8 million would return an additional $20+ million post tax with TSLA at $3k, making the delayed scenario favorable by $10 million.

I ran through this in regards to Elon's 2012 exercise, I expect his 2018 plan to also be executed as late as possible.

Yeah, that would be perfect.Have it say "Would you like some swag?" and if they say Yes it grabs a back and hands it to them. If they say No it says "it's good stuff, are you sure?" and at that point it grabs a bag but doesn't hand it to them unless they reach for it.

Simple decision tree and only needs to know how to say two things and do two general motions + the grab and release concepts.

Another good one would be having attendees on folding chairs and having Optimus setting up folding chairs in rows as people arrive. Avoiding people, unfolding the chairs, setting them up in rows with aisles.

I genuinely doubt we'll get anything like this. But those are the sorts of tasks which I suspect Optimus will excel at and be scooped up for. Maybe that'll be part of AI Day 3

MountainRatMat

Member

When Elon revealed the Tesla Semi he used the example of climbing uphill with a full load. An electric truck can maintain full speed while a diesel can't always. Elon said that is a big deal with driver hours.Once in a while they do care about acceleration. I recall a case where the additional speed allowed the truck to unloaded before quitting time the same day. Previously they would arrive a few minutes too late and so the truck had to stay overnight and be unloaded in the morning. Yes, this is kind of an edge case, but when it happens, it's a big deal.

I implore you to not egg him on.With the 850 wall, we're likely to be capped short of our deserved beta, again.

StarFoxisDown!

Well-Known Member

At this point, putting my annoyance aside, I'm kinda fascinated to see what happens over the next 5 months.That took longer than expected...............

Are a number of stocks due for a major correction or is TSLA going to at least 1200 by Q4 earnings? Because you can't have both.

UnknownSoldier

Unknown Member

Apple's market is extremely inelastic, because if you want an iPhone there is only one supplier and Apple's ecosystem lock-in is by far the strongest of any platform. Even gasoline seems to be a more elastic demand market than Apple product is judging from recent events.US is in a severe recession. US consumers continue to spend $500 to $1000 on new iPhones. Something doesnt add up.

These have to be for Austin as well? Maybe even Berlin?

Freemont was at 1666 cars per day months ago. Those castings will be gone in no time just there. I think.

I think we all know TSLA is going to 1200 eventually....whether the market lets it is a different story.....till it decides to let it run, i am perfectly fine with accumulating more chairs at discounted levels.At this point, putting my annoyance aside, I'm kinda fascinated to see what happens over the next 5 months.

Are a number of stocks due for a major correction or is TSLA going to at least 1200 by Q4 earnings? Because you can't have both.

Words of HABIT

Active Member

Today ARKK is trading at levels they first reached May 2018 (four years, two months ago) and this is including a substantial position in TSLA which rocketed from $55 to $850 during the same time frame). They got one time lucky with Tesla. Plain and simple. Anyone still holding ARK funds should seriously think about cutting your losses and buying TSLA before the big run up.Arkk keeps swinging and missing. Tdoc was down 17% from earnings yesterday and Roku down 25% today. Should have just stuck with Tesla.

Like all investment decisions, it's also possible to lose money. It's not only the opportunity cost of the exercise taxes, but if the stock actually loses value (shock, horror, but we're talking about TSLA!) the taxes paid become unrecoverable because they can't be offset against capital losses.I think I understand what you are getting at.

When I compute the 2 scenarios, it is better to exercise now and get capital gains later when you sell.

If Kimbal exercises now and sells the shares later at $3k per share he nets about $49.9m (see first yellow cell below).

If we waits until $3,000 to exercise and sells, then he nets only $42,7m (the 2nd yellow cell).

However, he has an opportunity loss on the 7.8m in taxes he pays now (see orange cell). That money could be earning something.

It is possible he could be forgoing gains on this $7.8m that would exceed the tax benefit of exercising now.

However, I do know of several senior executives who have exercised early to get the long term cap gains on the eventual sale.

View attachment 833928

Back when QCOM was the darling of NASDAQ, 1999-2000, I had a friend who borrowed against his house to exercise and hold options. He was in real trouble when the price plummeted again. This despite the fact that if he hadn't exercised, the options would have still been above water, just not as much.

Last edited:

Imagine if Cathie sold all her picks near the top. Could have been a legendary investor. Instead she doubled down at the top.....Today ARKK is trading at levels they first reached May 2018 (four years, two months ago) and this is including a substantial position in TSLA which rocketed from $55 to $850 during the same time frame). They got one time lucky with Tesla. Plain and simple. Anyone still holding ARK funds should seriously think about cutting your losses and buying TSLA before the big run up.

insaneoctane

Well-Known Member

I just wish they'd tie the air vent directional settings to the driver. My wife always splits the flow and away from her face. Me, the exact opposite. We battle with the settings often because of this. The good news is that because it's a Tesla, I know this enhancement is merely an OTA away....someday....

Tesla launches Cloud Profiles in update 2022.24

The long-rumored 'cloud profiles' are finally arriving in Tesla update 2022.24. Tesla is officially calling the feature 'Tesla Profiles.' With this latewww.notateslaapp.com

This could work on Hertz rentals if we can add the rental car to our tesla app.

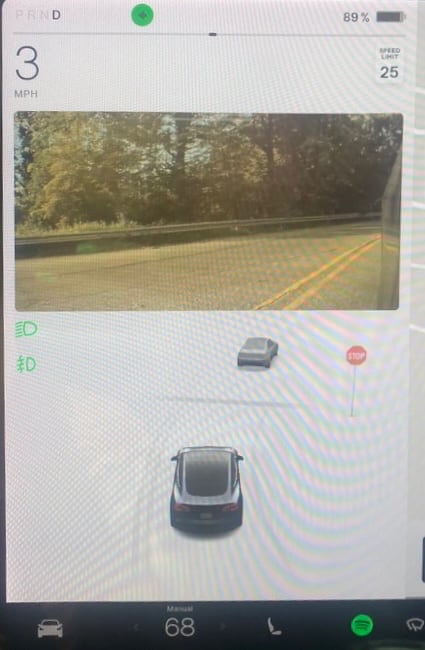

2022.24 allows you reposition the Blind Spot Camera display [Video]

Tesla's newest update 2022.24 is now in the beginning stages of rolling out. While it's still early and it may be several weeks before your vehicle recwww.notateslaapp.com

You can move the blind spot camera display to any of the 4 corners.

Bet TSLA

Active Member

I doubt very much we'll any sort of direct interaction with attendees. That would require enormous effort go into making sure Optimus couldn't harm anybody no matter what they chose to do ("Let's see what happens if I get in its way and put my finger in this joint..."). Way too dangerous.Yeah, that would be perfect.

Another good one would be having attendees on folding chairs and having Optimus setting up folding chairs in rows as people arrive. Avoiding people, unfolding the chairs, setting them up in rows with aisles.

I genuinely doubt we'll get anything like this. But those are the sorts of tasks which I suspect Optimus will excel at and be scooped up for. Maybe that'll be part of AI Day 3

henchman24

Active Member

insaneoctane

Well-Known Member

Since Tesla isn't a "dealer", are they excluded? The price is so low, not sure Tesla would have much to offer with the low cap anyways... Again, I feel like this subsidy just lines the pocket of the dealerships vs end consumer.Reviewing the Tax Inflation Reduction Act document. Think the used car part of it is stupid. Must be used car bought from a dealer. So private person to person sale doesnt qualify. Can only be the 1st transfer. So you go to a used car dealer and 2 of the exact same car on lot. One gets a tax credit and one doesnt. Because one was sold to dealer by original owner and another by 2nd owner.

Bet TSLA

Active Member

No, no, we don't want to know what Elon thinks about anything political. Remember? "Will try my best to be heads down focused on doing useful things for civilization." Unless by "learn Elon's opinion" you mean he should whisper it in your ear.It might be interesting to learn Elon's opinion of this new political party.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K