Thanks! That is too cool and makes perfect sense. Much better than trucking them.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

TheTalkingMule

Distributed Energy Enthusiast

No real choice. Oil market price gouging(and inflation) need to be stamped out.I think somebody in the administration is going to have to have a talk with Powell. Sending the stock market into a tailspin right before the midterms definitely isn't in their interests.

I think they're pretty sure we're in the clear, but wanted to send a message. Worked too. Oil was trying for a comeback, but tanked to a new recent low. Hopefully we can get WTI back down to $75-80, where it was when all this nonsense started.

That plus good CPI numbers and we're all set.

A lot of what the Fed does it does by just talking and getting the market reaction they want. We'll see how much higher they actually go with rates. They seem to have tanked housing starts/purchases with what they have done so far. Food prices should mediate a bit with grain shipments from Ukraine and Russia restarted. I still think oil/gas will remain high as long as Putin is still breathing.No real choice. Oil market price gouging(and inflation) need to be stamped out.

I think they're pretty sure we're in the clear, but wanted to send a message. Worked too. Oil was trying for a comeback, but tanked to a new recent low. Hopefully we can get WTI back down to $75-80, where it was when all this nonsense started.

That plus good CPI numbers and we're all set.

tinyrodent

Member

Interesting article on Tesla's moves in Canada

electricautonomy.ca

electricautonomy.ca

EXCLUSIVE: Tesla files more documents about potential Canadian factory

New Tesla lobbyist documents reveal formal talk with the federal government about Canadian factory, as clues emerge about what it might make

Carl Raymond

Active Member

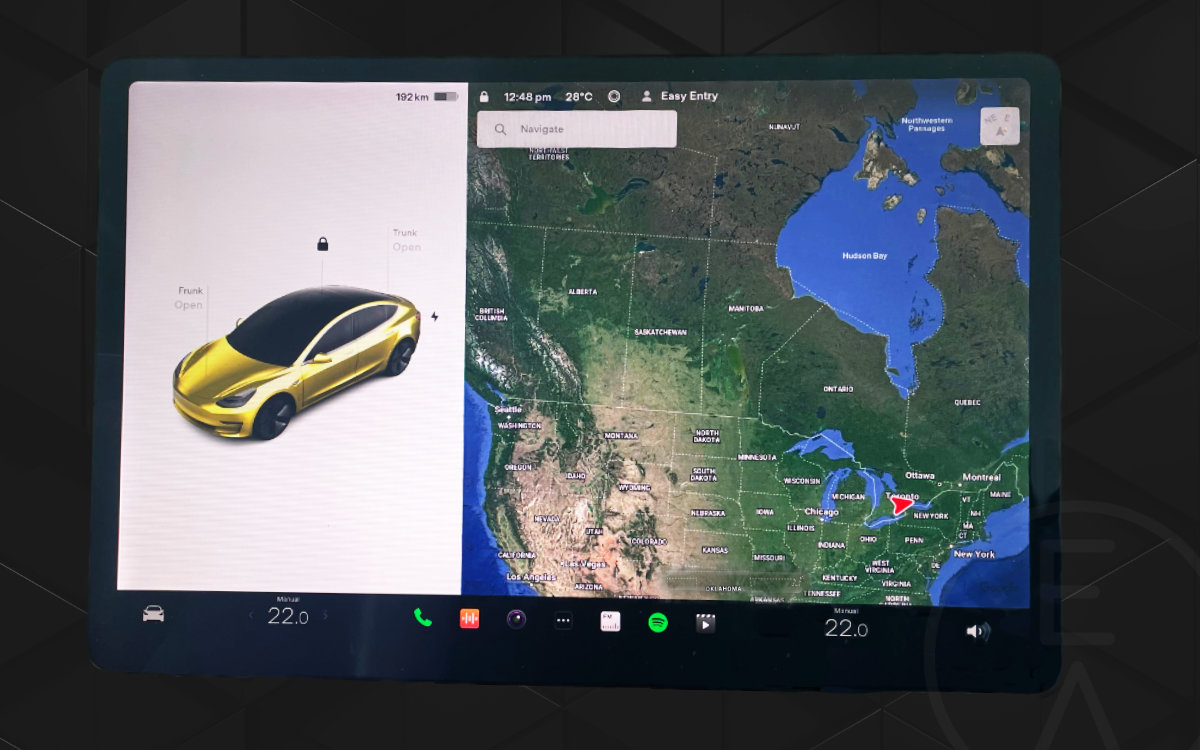

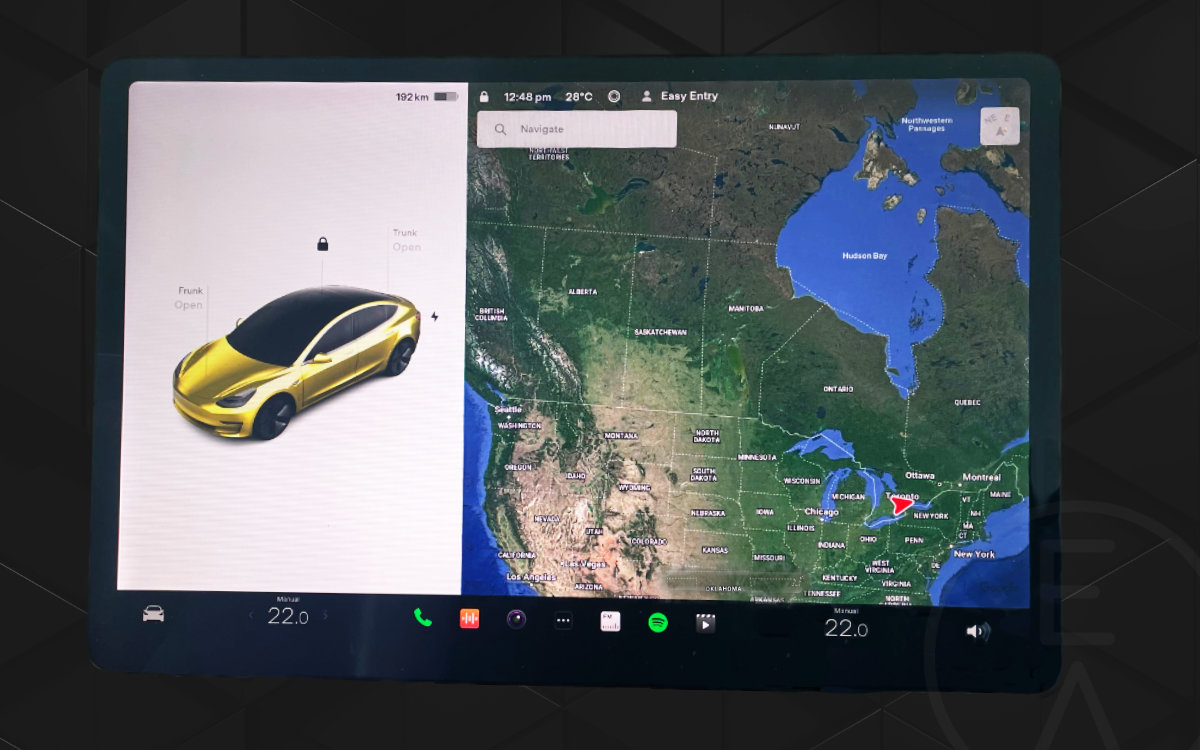

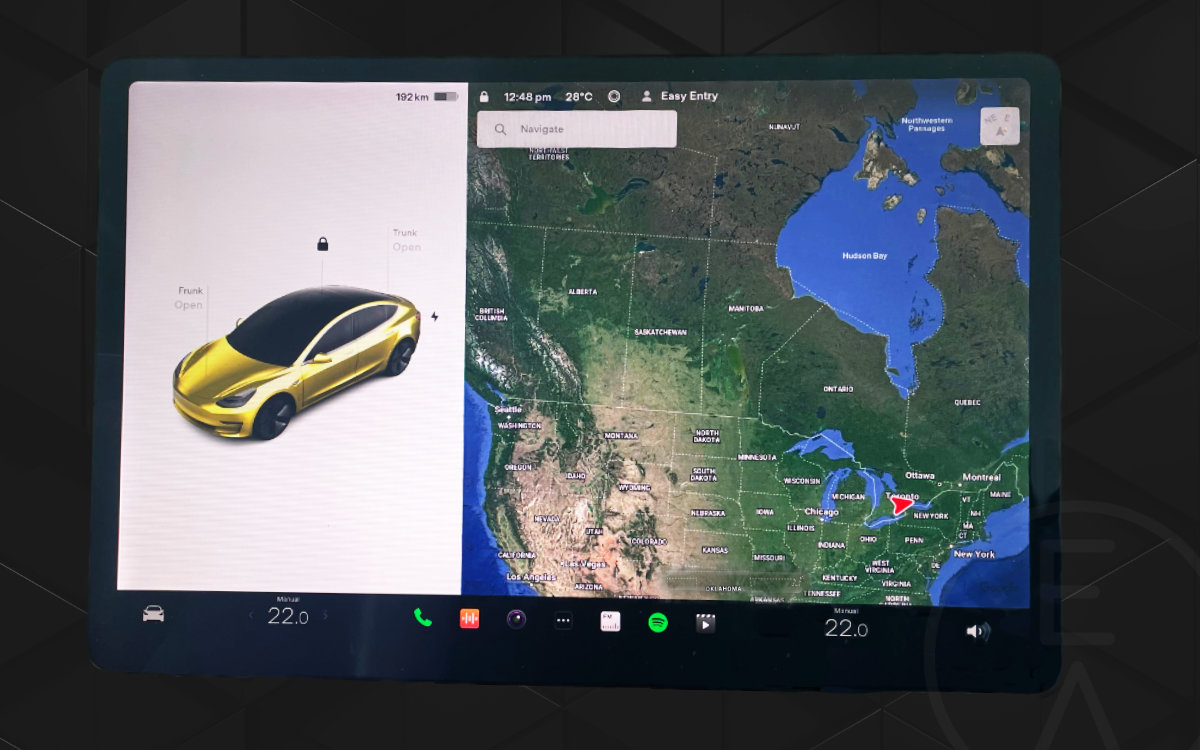

The train yard is visible here: Google Maps

So if you’re Elon are you thinking:

Line extension

or

Boring tunnel

or

FSD convoy in the dead of night?

larmor

Active Member

Buffalo GF is pretty close to Ontario CanadaInteresting article on Tesla's moves in Canada

EXCLUSIVE: Tesla files more documents about potential Canadian factory

New Tesla lobbyist documents reveal formal talk with the federal government about Canadian factory, as clues emerge about what it might makeelectricautonomy.ca

StealthP3D

Well-Known Member

Two or three quarters is a flash in the pan to an investor with conviction. I would wait more than 2 or 3 years for TSLA to start appreciating again (as long as the fundamental reasons I bought the stock remain intact) but that's not going to be necessary. I can't say that as a fact, but I can say it with conviction. Conviction should never be blind; it should always be based on real things.To be fair, I think many in this thread have felt that the spring was approaching it's absolute limit for 2 or 3 quarters now....only to still be waiting...

In 1997 I started buying QCOM with the conviction they held the keys to high-bandwidth cellular data. Cellular data was, at the time, slower than molasses and as expensive as caviar. People actually thought the common person didn't need high-bandwidth cellular data. I knew they wanted high bandwidth cellular data; they just didn't know it yet.

In 1998 QCOM went down, not up. It made no sense as Qualcomm was profitable and growing. So, I bought more. It got cheaper still! It was about 30-35% cheaper than the very low price I had already Identified as a bargain even though adoption of Qualcomm's technology was growing rapidly and proving its abilities in the real world with millions of users. I even sold highly appreciated MSFT stock that still had a bright future to buy more QCOM. It was our biggest position of just a handful, by far. Then we moved into our tiny uninsulated summer vacation cabin in the neighboring County, sold our real house (that we owned outright) and put 90% of the proceeds into more QCOM which showed no signs of life if all you looked at was the market price. In the spring of 1999 Ericsson settled out of court with Qualcomm and the stock quickly doubled. I watched with mild amusement as greedy people, not wanting to lose their unrealized profits, sold for two, three or four times what they had originally paid. They thought payday had finally come! Over the next 9 months QCOM continued to appreciate until it was worth 36 times the doldrums of 1998. Every $100,000 invested had turned into $3.6 million. I didn't sell a single share until the day before it peaked, the last trading day of 1999. This is what I had waited 3 years for, and it was worth the wait! Investing is not for the impatient or those quick to take profits. That said, I am not expecting TSLA to perform just like that! But the longer the price is held down, the more it will resemble a rocket ship again. If markets were not so spastic, TSLA would more closely resemble a locomotive of the kind that steam-rolls your way to great wealth. Instead, it goes in unpredictable and irrational fits and spurts that have little to do with the actual value of the company.

Always judge the value of a company by your own analysis, not the current share price or recent share price movements! That's how you lose. And remember that 2 or 3 quarters in the investment world is like 5 minutes to a day trader. Don't invest with impatience - that's not how you become wealthy Manipulators rely on other's impatience to finally get their way. And never sell a stock simply because it doubled or tripled quickly, only sell because it has become abundantly clear the future of the company is not bright enough to justify the price. Even then I would caution against selling too soon as momentum and market FOMO will typically push the price far higher than it has any right to be. If the company is as good as your analysis showed, it will likely be OK to hold through a multi-year period of doldrums if you get caught in the downdraft that stagnates for a multi-year period. Ideally, you would sell before such an event but it's almost always better to hold too long than to sell too early (unless the company has no substance or staying power).

I would argue that TSLA, as a long-term, core holding, is undervalued at more than triple the current price even if I assume FSD will never work. And that's an assumption I'm not willing to make.

Last edited:

DoE (pronounced "Doh!") is the abbreviation for the US Ministry of Oil. Once you know that, it explains a lot.Disappointed to read the following Tesla Semi comments on LinkedIn from Jigar Shah, director of loan products at the DoE and renewables pioneer:

Operating costs are most certainly lower. But this doesn't accurately count the extra Infrastructure costs for Superchargers which will be closer to $0.43/kwh. Also doesn't address the weight versus payload trade-off math. Are these awesomely engineered trucks only good when delivering lighter loads or equally awesome when loaded up?

The reality is that most of these first fleets going EV are ones that return to a central place to charge. Unlikely to work today on routes going across the country.

(post link)

Referenced article....

The Staggering Economics of the Tesla Semi

The economics of the Tesla semi show that it is about 83% cheaper to drive and haul goods than a standard diesel truck. Not to mention the reduction in cost due to less maintenance. The Tesla semi will truly disrupt the trucking industry.www.torquenews.com

What is the deal with this DoE? I understand pandering to Michigan voters, but why tear down and borderline lie about those on the front lines of the transition?

Perhaps I'll give him the benefit of the doubt and assume he's misinformed.

(note: Shah does all his own LinkedIn posting)

2daMoon

Mostly Harmless

Okay, this cracked me up...

"Tesla lobbyist registry documents in Canada hint that the EV automaker has initiated talks with CN’s federal government. The public records suggest Tesla has been talking with feral government officials in Canada over the last six months."

From this Teslarati article

Screenshot

I just hope they got their shots after such an encounter.

"Tesla lobbyist registry documents in Canada hint that the EV automaker has initiated talks with CN’s federal government. The public records suggest Tesla has been talking with feral government officials in Canada over the last six months."

From this Teslarati article

Screenshot

I just hope they got their shots after such an encounter.

StealthP3D

Well-Known Member

So does the market front-running amazing Q3 results mean one only losses $1Million/day instead of two...?

(asking for a friend).

I'm not sure what your point is here as we are not even to Q3 Production and Delivery numbers, let alone close to Q3 results which aren't due for almost 2 more months.

Second+Third.So if you’re Elon are you thinking:

Line extension

or

Boring tunnel

or

FSD convoy in the dead of night?

Thekiwi

Active Member

Chengdu in lockdown. City of 21 million, home to a lot of factories (Foxconn/Apple, Toyota etc) - I have no idea if this impacts Tesla supply chain, but be prepared.

(You may be finished with Covid, but COVID is not finished with your portfolio)

Don’t count your Q3 results before they have hatched etc.

(You may be finished with Covid, but COVID is not finished with your portfolio)

Don’t count your Q3 results before they have hatched etc.

I agree that TSLA is currently undervalued at about triple the price, and any discount to that price I’d normally use to reflect risks that things don’t work out as planned is more than offset by a premium I’d assign in Tesla’s case to things working out better than planned (e.g. FSD and robotaxi coming to fruition, energy revs and margin taking off, bots, etc).Two or three quarters is a flash in the pan to an investor with conviction. I would wait more than 2 or 3 years for TSLA to start appreciating again (as long as the fundamental reasons I bought the stock remain intact) but that's not going to be necessary. I can't say that as a fact, but I can say it with conviction. Conviction should never be blind; it should always be based on real things.

In 1997 I started buying QCOM with the conviction they held the keys to high-bandwidth cellular data. Cellular data was, at the time, slower than molasses and as expensive as caviar. People actually thought the common person didn't need high-bandwidth cellular data. I knew they wanted high bandwidth cellular data; they just didn't know it yet.

In 1998 QCOM went down, not up. It made no sense as Qualcomm was profitable and growing. So, I bought more. It got cheaper still! It was about 30-35% cheaper than the very low price I had already Identified as a bargain even though adoption of Qualcomm's technology was growing rapidly and proving its abilities in the real world with millions of users. I even sold highly appreciated MSFT stock that still had a bright future to buy more QCOM. It was our biggest position of just a handful, by far. Then we moved into our tiny uninsulated summer vacation cabin in the neighboring County, sold our real house (that we owned outright) and put 90% of the proceeds into more QCOM which showed no signs of life if all you looked at was the market price. In the spring of 1999 Ericsson settled out of court with Qualcomm and the stock quickly doubled. I watched with mild amusement as greedy people, not wanting to lose their unrealized profits, sold for two, three or four times what they had originally paid. They thought payday had finally come! Over the next 9 months QCOM continued to appreciate until it was worth 36 times the doldrums of 1998. Every $100,000 invested had turned into $3.6 million. I didn't sell a single share until the day before it peaked, the last trading day of 1999. This is what I had waited 3 years for, and it was worth the wait! Investing is not for the impatient or those quick to take profits. That said, I am not expecting TSLA to perform just like that! But the longer the price is held down, the more it will resemble a rocket ship again. If markets were not so spastic, TSLA would more closely resemble a locomotive of the kind that steam-rolls your way to great wealth. Instead, it goes in unpredictable and irrational fits and spurts that have little to do with the actual value of the company.

Always judge the value of a company by your own analysis, not the current share price or recent share price movements! That's how you lose. And remember that 2 or 3 quarters in the investment world is like 5 minutes to a day trader. Don't invest with impatience - that's not how you become wealthy Manipulators rely on other's impatience to finally get their way. And never sell a stock simply because it doubled or tripled quickly, only sell because it has become abundantly clear the future of the company is not bright enough to justify the price. Even then I would caution against selling too soon as momentum and market FOMO will typically push the price far higher than it has any right to be. If the company is as good as your analysis showed, it will likely be OK to hold through a multi-year period of doldrums if you get caught in the downdraft that stagnates for a multi-year period. Ideally, you would sell before such an event but it's almost always better to hold too long than to sell too early (unless the company has no substance or staying power).

I would argue that TSLA, as a long-term, core holding, is undervalued at more than triple the current price even if I assume FSD will never work. And that's an assumption I'm not willing to make.

I love reading this forum, but it does have a downside of posters trying to tie business changes to short term stock changes. Month-to-month, and even year-to-year, stock prices are determined by the machinations of traders. At some point (that is impossible to predict with precision), the market price is adjusted in a big spurt (up or down) to bring it more in alignment with fundamentals, and then the traders take over again.

I’m very confident that another big adjustment is coming to TSLA. I think that adjustment is coming very soon, but I realize that shorter term timing is just a probabilistic guess, not to gamble serious money on.

For those of us investing with conviction about Tesla’s bright future, patience is the path.

Thekiwi

Active Member

. . .

Maybe we'll have a repeat of the glorious breakout in 2023 again

Cathie explains it like this:

Todd Burch

14-Year Member

And that includes retooling time…

Nolimits

Member

But that’s if the new chengdu lockdown doesn’t affect us right? I can’t see how it won’t. Lockdown of 21million population seems like a lot.

In a country of over 1.4 billion, the question is what supply chains are affected and are factories shut down?But that’s if the new chengdu lockdown doesn’t affect us right? I can’t see how it won’t. Lockdown of 21million population seems like a lot.

China is doing its best to keep Chengdu factories and offices going in “capsules”. While some factories may be down, I would wager most will be operating on some level. This is advertised as a four day shut down to test everyone. They moved based on 167 positives. Because of all the FUDsters, if there was a direct impact on Tesla Shanghai, chances are high it would have been carried in a Reuters headline.

China does seem really intent on causing major economic damage to itself. Wonder if that will change after their elections.

china and electionsIn a country of over 1.4 billion, the question is what supply chains are affected and are factories shut down?

China is doing its best to keep Chengdu factories and offices going in “capsules”. While some factories may be down, I would wager most will be operating on some level. This is advertised as a four day shut down to test everyone. They moved based on 167 positives. Because of all the FUDsters, if there was a direct impact on Tesla Shanghai, chances are high it would have been carried in a Reuters headline.

China does seem really intent on causing major economic damage to itself. Wonder if that will change after their elections.

Hopefully, come Sunday, it is lifted...But that’s if the new chengdu lockdown doesn’t affect us right? I can’t see how it won’t. Lockdown of 21million population seems like a lot.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/JM5N3NGKQFMG5KJ4GSRWIMPS3E.jpg)

Chengdu locks down 21.2 million as Chinese cities battle COVID

The southwestern Chinese metropolis of Chengdu announced a lockdown of its 21.2 million residents as it launched four days of citywide COVID-19 testing, as some of the country's most populous and economically important cities battle outbreaks.

"Chengdu, which reported 157 domestically transmitted infections on Wednesday, is the largest Chinese city to be locked down since Shanghai in April and May. It remained unclear whether the lockdown would be lifted after the mass testing ends on Sunday."

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K