I wrote the post before reading that one, it was a matter of minutes. Sorry.Needing to say 'your bit' is selfish behavior, and disgarding MOD instructions. TAKE IT TO THE PROPER THREAD.

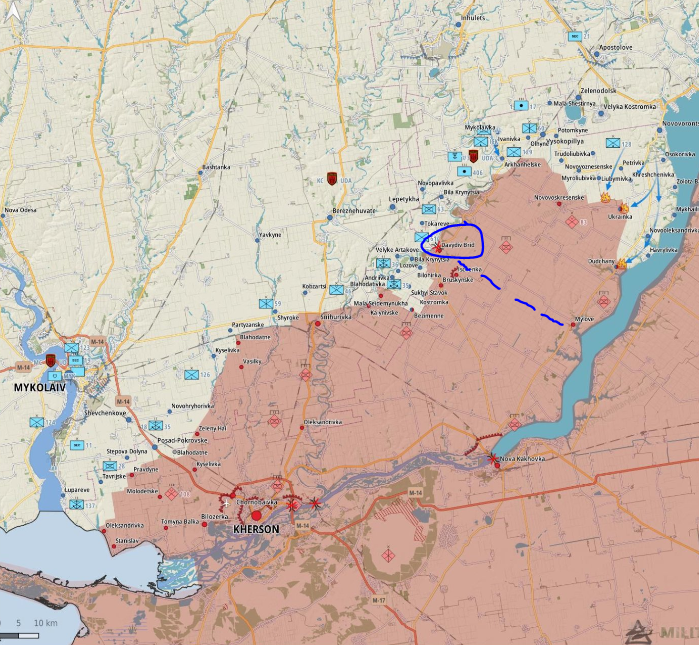

Russia/Ukraine conflict

The hits keep coming. 4 more HIMARS with rocket resupplies, 200 Mine-Resistant Ambush Protected (MRAP) vehicles, ammunition for Howitzers, and mines. These will come from existing inventory so will be delivered soon. This is in addition to the 18 HIMARS and other goodies announced last week...teslamotorsclub.com

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The “non-hedge hedge” practice of trying to balance FX risks through supplier and other expense/revenue balancing reduces FX direct losses, but does not eliminate them because the balance sheet FX rises and falls still remain and it is still impractical, if not impossible, to make such efforts as well matched as FX forwards etc can do. Many large industrial and trading companies use barter deals to help minimize these risks, some of which are multi-party. I believe Tesla would call the barter deals hedging, so they don’t do those.Does anyone know more about the point @Thekiwi brought up about the impact that the drastic shift in US$ exchange rates will have on 2023 vehicle pricing? I'm not even sure how to start researching this one but it's important because it looks like it could materially affect gross margins in Q4 and next year.

What I'm mainly wondering:

- To what extent is Tesla hedged against forex changes, if at all?

- How much of this is mitigated by the fact that most of Tesla's sales outside the US are coming from Berlin and Shanghai and so the costs are in yuan and euros?

- What reasons might Tesla have had for not updating local prices in response to in some cases 20%+ swings in exchange rates in the last six months? I mean if I can actually buy a Tesla in New Zealand for the equivalent of US$38k right now before sales tax, what's stopping people or companies from buying them in bulk and shipping off to resell in the US for a $20k profit? I don't understand.

Tesla's 10-Q says they generally don't hedge forex risk.

I found @unk45's post about this, but I don't know how to attempt to translate this to ASP and COGS forecasts.

Thiese transaction types tend to be disclosed rarely, if ever. The Tesla techniques of balancing, to some extent, sales revenues with purchases is relatively simple and can reduce costs. Without building a local factory some examples likely to be used today probably are things like these:

Revenues from Taiwan balance semiconductor expenses (these usually priced in US$ or CNY anyway); Mexico/Canadian costs balance with revenues from sales.

There are countless variants, none of which are hedging directly.

Tesla also uses the time tested non-hedging techniques used extensively by Apple, borrowing in local currency to balance longer term expenses. For example borrowing CNY to finance some Chinese factory costs. Such financing is cheap (always cheaper when you don’t need the money) and is often locally subsidized to encourage investment.

For this array of techniques German and Austrian banks were the traditional experts. Major investment banks all have groups dedicated to these techniques.

Most of this is quite boring. On the periphery are exciting and colorful stories.

The Accountant

Active Member

Wall Street analysts' Q3 consensus Non-GAAP EPS for $TSLA was $1.07 (Bloomberg) on deliveries of 358k.

If deliveries of 344k are truly a miss, then we should see the WS Bloomberg estimate drop from $1.07 to $0.99.

Yahoo Finance had an estimate of $1.05 and this should drop to $0.97.

If WS EPS does not drop to $0.97-$0.99, then they are playing us.

I’m estimating $1.22 EPS for Q3.

If deliveries of 344k are truly a miss, then we should see the WS Bloomberg estimate drop from $1.07 to $0.99.

Yahoo Finance had an estimate of $1.05 and this should drop to $0.97.

If WS EPS does not drop to $0.97-$0.99, then they are playing us.

I’m estimating $1.22 EPS for Q3.

JusRelax

Active Member

Wall Street analysts' Q3 consensus Non-GAAP EPS for $TSLA was $1.07 (Bloomberg) on deliveries of 358k.

If deliveries of 344k are truly a miss, then we should see the WS Bloomberg estimate drop from $1.07 to $0.99.

Yahoo Finance had an estimate of $1.05 and this should drop to $0.97.

If WS EPS does not drop to $0.97-$0.99, then they are playing us.

I’m estimating $1.22 EPS for Q3.

I just checked and it seems to be at $1.03 now:

Featsbeyond50

Active Member

Great post.We're already off the rails so I'll say my bit.

Elon's brain is great at many things, but my impression is that he's greater *inside the realms of physics*. The more he works in a "factual" universe, where things are clearer and more deterministic, the better he fares.

This is where his First Principles mindset thrives. I'm sure his neuroatypical brain is really happy in those domains, he's like Kal-El from Kripton.

He's really good also in more blurred realms a bit outside that. Economy, communication/marketing, design (link in "make things pretty", engineering is his forte). Socially he's a bit awkward but he can be highly effective as well.

But I would stay away from real, dirty politics. When you have 107M followers on Twitter, is just dangerous to state "facts" about history of a country you probably visited once or twice. History of Soviet Union is literally one of the most complex theme of the planet. You can call every major expert in the world and their statements would be wary and devoid of absolutes. They will know they know a little part of the whole. There are no *literal facts*. It's just too complex: it's billion people fighting each other for a century. There is no easy solution, no silver bullet, no clear definition of boundaries. War is messy, it f**ks with your brains, destroys all rationality. What we see now is the consequence of decades of war, cold and hot.

And weighting with a few tweets, well, it's a recipe for a s**tstorm. I know his heart is in the right place on this one but he's not "speaking truth to power", but damaging an already damaged discourse, IMHO.

My biggest worry about Elon, now that his health seems to be in order, is who has his ear. This has been a concern to me for a couple of years and recently reading those tweets between him and Parag, and seeing how quickly and mysteriously they turned, I'm more convinced my concern is justified. He seems to be friends with Jack Dorsey and I don't trust that effer. Can't put my finger on it, but I don't trust him. He seems to look to Larry Ellison as a mentor. I don't know much about Ellison or have any impression of him, and I don't like not knowing if that guy could be a manipulator.

Elon's relationship with Amber Heard is all the proof I need that Elon has bad judgement with people. I get it, when a woman looks like that, as men we're only human, but, she is so clearly a NPD and all around train wreck, for him to not see that is a huge red flag. And she was married at the time.

People talk about Elon needing to stay off Twitter, needing to stop with the distractions, stop with the drama. What he really needs is someone close to him he trusts, who is level headed and has good intentions. If he had that, the BS and drama would largely go away.

Just as batteries have been the limiting factor for Tesla 1.0, computing power is the limiting factor of Tesla 2.0 (real-world AI).Dojo fast training of NNs - Realize the hardware chip is baked/finalized, the hard part remains of making it stable at nominal and peak power/workloads. The software stack and support tools are the critical path. Timeline looks to be 6 months to 2 years.

So, yeah, HODL

I remember my computer science professors talking about how early in their careers they only had enough computing power to compile and run a program once a day. But developers needed to be able to try out new ideas MUCH more quickly. Computing for the masses could not take off until computing power grew by orders of magnitude.

I believe the same is true of real-world AI. The computing requirements are enormous. This is the primary reason FSD has not improved faster. But Dojo hardware and software cuts NN training time by 75%. That's a huge improvement and I expect Tesla is already trying to figure out how to cut that time by another 75%.

Just as we have been looking at battery supply as the key to Tesla's growth in auto and energy, look at the progress of Dojo as key to Tesla's growth as an AI company.

HODL indeed!So, yeah, HODL

Accident

Member

13F filing is due 45 days after the end of quarter. We’ll only in February who sold today.Does anyone know how up to date these figures are? It looks like there could be up to a 45 day lag.

ZachF

Active Member

If Elon is worried about nuclear war, the biggest thing he could do to help at this point is to use SpaceX to help build a brilliant pebbles ballistic missile shield.

thx1139

Active Member

Its also good for us believers in Tesla and Elon to realize he can be wrong about things. He shouldnt be persecuted for it. Most of the time I think his thoughts come from a good place. He does need to learn that Twitter is a cesspool, yes I participate, and twitter polls are useless. Elon Twitter polls have never done Elon, Tesla and Tesla investors any good.Lots of respect for this guy.

I don’t agree with Musk on Ukraine (some fundamental flaws to the idea of re-opening the vote right now), but the fact that I disagree with him on one topic doesn’t change all the other things which I like and respect about him.

Musk makes cars and rockets, he doesn’t resolve international conflicts.

Quite often I feel like he should just STFU about things outside his bailiwick, but if he did… he wouldn’t be Musk.

I used to think that Musk’s intemperate use of Twitter was a risk factor for Tesla and TSLA, but at this point I believe almost everyone’s opinion of him has hardened. For his millions of admirers, his worst posts are just head scratchers. For his millions of detractors, there’s little he can do right. I no longer believe that any of Musk’s non-Tesla tweets materially impacts demand for Tesla products.

MORNING NOTE TO ALL;

The Twittercane has blown over, through and is gone, although scattered squalls and occasional heavy showers are to be expected.

But not here. We’re done. Any further such posts will be deleted out of hand.

The Twittercane has blown over, through and is gone, although scattered squalls and occasional heavy showers are to be expected.

But not here. We’re done. Any further such posts will be deleted out of hand.

Thekiwi

Active Member

I enjoy your posts. I think you need to revisit your 2023 ASP expectations though. The collapse in global currencies vs the US dollar I think means any large leap in non-US vehicle pricing is unlikely.

The most popular models being churned out of GigaShanghai now are priced under $40K USD.

For example here are the current prices we have down here in New Zealand:

Model Y RWD (SR): $37,768 USD

Model 3 RWD (SR): $37,124 USD

(Model Y: $76,200 NZD incl 15% sales tax. $66,260 NZD less sales tax. US dollar conversion rate 0.57c = $37,768 USD)

(Model 3: $74,900 NZD incl 15% sales tax. $65,130 NZD less sales tax. US dollar conversion rate 0.57c = $37,124 USD)

(note: NZ dollar briefly fell to USD 55c in past week, which meant for a brief moment there was a Model 3 available for ~$35k USD. The prophecy was fulfilled)

Too late to edit, but an error on my part here. Stupidly, the price above I quoted was from the buyers perspective. Forgot to include the fact that this is the price to the buyer after government funded subsidy, which is $4,900 USD.

So the actual money Tesla receives from selling an entry level SR Model 3 & Y in New Zealand is $42k+ USD.

Fun thought. Tesla's margins are so high that they could sell cars to legacy auto at a discount, and then Tesla and legacy auto would still have higher margins than legacy auto has today. (not even talking about EV margins which are close to or below zero for most)

They really should update the name to Factory Handful now that they've ramped up.Factory zero living up to it's name

Hock1

Member

Like what? You mean, like using margin, selling stock to cover a margin call, then buying options?Not going to argue with you. I think most people can envision several scenarios where one would not be able to ride out the current environment. Go Tesla!

Last edited:

Thekiwi

Active Member

And so ends my belief that Axios was a good well edited & balanced news platform.

One sided, slanted, cherry picking of facts to try and portray a high level of risk:

www.axios.com

www.axios.com

One sided, slanted, cherry picking of facts to try and portray a high level of risk:

Elon Musk's empire of risk

He's taken big risks in space, on the roads and now online.

Artful Dodger

"Neko no me"

Gigapress

Trying to be less wrong

I just realized the New Zealand 3/Y SR are coming from Shanghai and probably use an LFP pack, so a pretax base price of $42k for a 3 is actually not that crazy since Tesla probably saves like $2k on the battery.Just in regards to importing from another country:

For NZ/AUS -> North America in particular it wouldn’t work easily as its LHD vs RHD models (and also uses a CCS plug). I have no idea how much a conversion to LHD would be, and I suspect that would invalidate warranty. This protects tesla against grey market export impact from those markets. However China itself being LHD (like North America) would be a candidate for acquiring cheaper teslas to export to USA to try and arbitrage the price difference. I have no idea what Tesla has in place to discourage that.

One other thing to remember is the prices I gave for New Zealand were with sales tax removed to show the amount that tesla receives, one would need to pay that sales tax of course to acquire the vehicle for export. So the price is closer to $44k USD, and then their is the delivery fee locally, plus the cost to export it to USA.

Also I am talking about the SR model here - so its not apples to apples Vs the LR USA model Y.

Still hard to fathom how we're down at $250 ($750 pre split) after record P&D numbers and an almost certain record ATH ER coming in two weeks. Makes me wonder if Q4 expectations are too high to realistically pass Wall Street's presumptions? Is Q4 doomed to be a negative hit no matter how impressive it ends up being?

2daMoon

Mostly Harmless

... and now for something completely different.

Apologies for not perpetuating geopolitics, Twitter, and other discussions, but the NASDAQ ticker has developed prescience. This matters. Even if I don't agree with it's number, providing an Unchanged SP for a future date is still pretty amazing, isn't it?

Is this proof that we ARE living in a simulation?

I've been seeing this sort of anomaly pop up often during the day for the past few months and finally took the time to capture it.

Clearly, it is only a glitch in The Matrix.

/s

Apologies for not perpetuating geopolitics, Twitter, and other discussions, but the NASDAQ ticker has developed prescience. This matters. Even if I don't agree with it's number, providing an Unchanged SP for a future date is still pretty amazing, isn't it?

Is this proof that we ARE living in a simulation?

I've been seeing this sort of anomaly pop up often during the day for the past few months and finally took the time to capture it.

Clearly, it is only a glitch in The Matrix.

/s

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 11K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K