The pandemic is mostly in the rear view in most parts of the world now. How quickly we forget, and that is great.

Without the vaccines, I suspect we could be still discussing how many thousands of peoples dying today.

But, here is an example of what it could be like and it’s still a unfathomabe reality in some part of the world:

As China continues to implement its "zero-Covid" policy, CNN's Selina Wang looks at the effects on ordinary Chinese citizens.

www.cnn.com

Well it’s only in the “rear view mirror” from the perspective that we all have gotten used to living with covid as an everyday risk. Thousands of people are still dying every day from covid in the western world - each death a horrible experience for all involved, but its now viewed by most as a new item on the list of accepted society risks - like deaths from influenza or car crashes - a risk that can now be minimized by vaccines, treatments & sensible behavior.

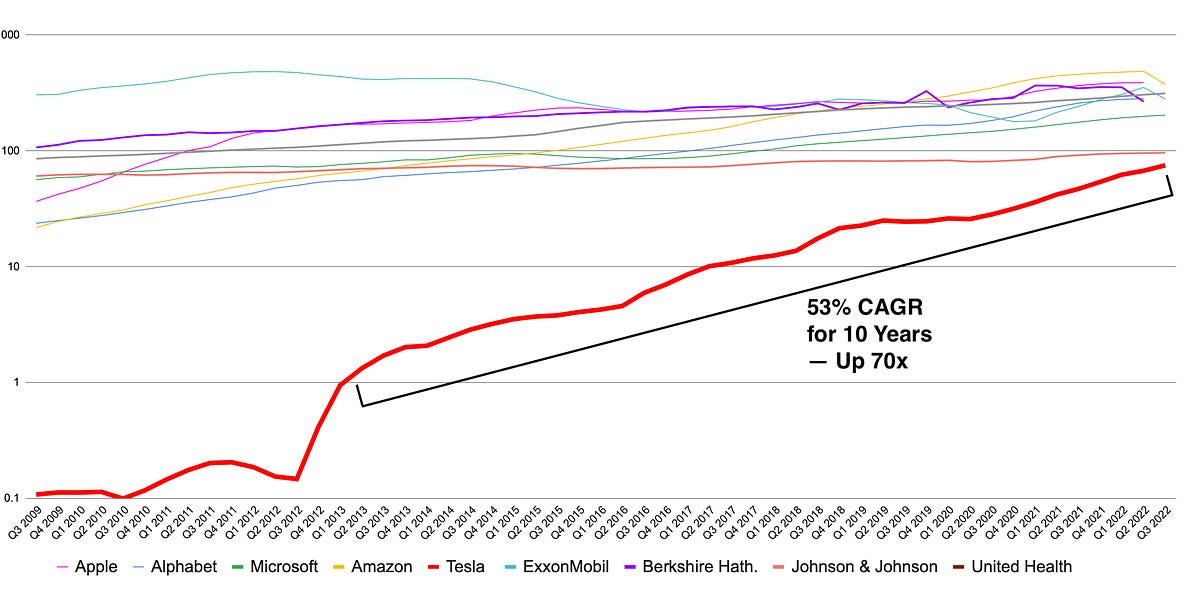

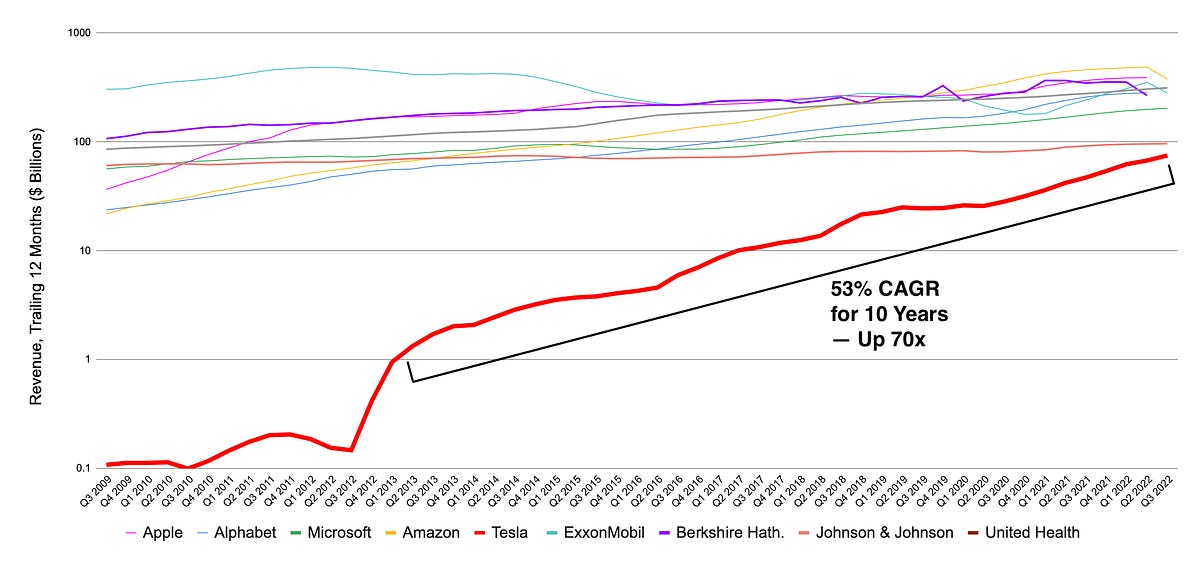

China is a completely different position (for now), much to the detriment of Tesla. Not only is Tesla harmed from potential factory shutdowns, but also from temporary demand softness due to It’s economy being severely impacted by the covid policy. It’s so hard for the chinese leadership to change without first changing their vaccination strategy, and vast investment in logistics of the health system to cope with relaxed covid restrictions (eg letting covid wash over the country of 1.4 billion people).

Even in a best case scenario, relaxing covid restrictions in china will lead to hundreds of thousands of excess deaths.

This will sound morbid, but for the chinese government, they are probably hoping that the decision to relax covid restrictions - thereby becoming responsible for the deaths - is one they don’t actually have to make, with the current covid outbreak ending up escaping containment measures and spreading far and wide.

This is what happened here in New Zealand, thankfully after we had achieved very high vaccination rates. We were essentially covid free for 18 months until the 2nd half of 2021, but meant our borders were effectively closed (only open to residents/citizens/VIPs with mandatory 2 weeks in quarantine facilities) - and no government wants to be responsible for intentionally letting covid in and killing thousands of people. In the end the decision to open borders back up without quarantine was only done after the Delta variant escaped the quarantine system - after which the closed borders were redundant. Covid deaths in New Zealand is at 2,100 - virtually all from the more mild Delta & Omicron variants, which is approaching 0.05% of the population so far.

0.05% of a highly vaccinated population. That would be ~700,000 dead in China IF they were highly vaccinated with pfizer or similar and had a health care system set up to cope with the huge wave of ICU patients.

More likely with a low vaccination rate, and a crappy vaccine at that, and a health system that can not support a covid wave that Omicron would generate, the death tally would be much higher.

One could argue that for China, keeping the covid zero policy in place until a much better vaccine and/or treatment has been developed is the most politically palatable (but there is no guarantee of course that vaccine or treatment eventuates).