In this market nobody cares about PE or PS ratios anymore. Everybody sell, sell, and sellNO! God help me Father, for I have had murderous thoughts against those who repeatedly say stupid things.

For a company that is growing at 3-5% per year, a 20 PE is acceptable. For a company that is growing at 50% per year, with no end in sight of that growth, a PE of 20 would be ludicrously low. Indeed most growth companies (the ones that are smaller and can grow at even 70% growth YoY), they have infinite PEs since they don't make any profit (negative earnings). Amazon was like that as an early public company, so was Apple, Microsoft, Google, etc. Investors invest in these companies, even though they are losing money every year because they expect them to grow really fast and eventually start making huge profits, like Apple.

When a company has basically taken over its market (like Apple and Microsoft), there is much less growth ahead of it and what then matters is how much profit it is making and thus PE is a good measure.

Tesla is still in hyper growth mode. It could very well be a bargain at a PE of 120 still.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

SebastienBonny

Member

I'd rather look at the PEG-value (which should be 1 or lower).I believe a 60 P/E ratio is quite normal on a business expecting to show 50% year over year growth for several coming years

At current P/E ratio of 60, we're at a PEG-value of 1.25 (P/E divided by growth = 50).

That's the way a growth stock should be valued IMO.

With a FY22 EPS (Q1 + Q2 + Q3 + estimated EPS for Q4 of 1.26) of 4.14 we are currently at a P/E ratio of approximately 44 and a PEG-value of 0.88.

I won't even look at the estimated EPS and P/E for 23, that would take us to the conclusion we are way undervalued at this time.

So, yeah, P/E of 60 is quite ok for 50% growth.

If he can fix this dumbster fire than he can truly fix anything and is the greatest engineer of all time.

Was that misspelling intended? If so congratulations, I love it.

JusRelax

Active Member

I'd rather look at the PEG-value (which should be 1 or lower).

At current P/E ratio of 60, we're at a PEG-value of 1.25 (P/E divided by growth = 50).

That's the way a growth stock should be valued IMO.

With a FY22 EPS (Q1 + Q2 + Q3 + estimated EPS for Q4 of 1.26) of 4.14 we are currently at a P/E ratio of approximately 44 and a PEG-value of 0.88.

I won't even look at the estimated EPS and P/E for 23, that would take us to the conclusion we are way undervalued at this time.

So, yeah, P/E of 60 is quite ok for 50% growth.

The "G" in the PEG ratio represents projected earnings growth, not "vehicle deliveries growth" or "revenue growth". For now (and for at least a couple years), earnings should grow much quicker than revenue and/or vehicle deliveries. I don't know Tesla's earnings growth rate off the top of my head (I think it's currently much closer to 300%, not 50%!), but I believe @Gigapress may have a usable earnings growth rate in one of his posts on his substack.

EDIT: I just pulled up Net Income for Q3 2021 compared to Q3 2022, here are the numbers:

Q32021: $1.62 Billion

Q32022: $3.29 Billion

Thus, the current earnings growth rate is 3.29/1.62 - 100% = 103%. Normally, I wouldn't expect such a high growth to continue into the future; however, Tesla's past year's difficulties with chip shortage, covid shutdowns, etc make it possible for Tesla to continue with such a high earnings rate for the next four quarters (i.e. - 3.29 * 2.03 = $6.67 Billion net income in Q3 2023).

Last edited:

On a side note, I have been watching the Electrified videos over the last few months. Dillon does an excellent job chatting through the daily goings on around Tesla and TSLA. I'd put his channel at #2 behind Robs.To put into perspective how ridiculous the current SP is:

There's a fair amount of overlap between the two, but Rob's videos have trended towards being more focused on the long term performance/outlook for Tesla first and the current events discussed each day usually are set in the context of how that plays into the long term narrative - While Dillons videos have a wider range of daily events covered in less detail.

Robs become a bit of an "elder statesman" (for lack of a better term) for Tesla IMO while Dillon is still in the young buck stage.

Anyway - I highly recommend both if you're short on time and don't have hours to spend trawling through TMC or other tesla news. Between the two you'll be covered for both the daily events and the longer term outlook.

cricketman

Member

Yes I look at PEG ratios tooI'd rather look at the PEG-value (which should be 1 or lower).

At current P/E ratio of 60, we're at a PEG-value of 1.25 (P/E divided by growth = 50).

That's the way a growth stock should be valued IMO.

With a FY22 EPS (Q1 + Q2 + Q3 + estimated EPS for Q4 of 1.26) of 4.14 we are currently at a P/E ratio of approximately 44 and a PEG-value of 0.88.

I won't even look at the estimated EPS and P/E for 23, that would take us to the conclusion we are way undervalued at this time.

So, yeah, P/E of 60 is quite ok for 50% growth.

PEGs in good times "always" return to 1 (at least 1, maybe much higher), especially for companies with little debt

I predict $5bn profit for Q4 22, meaning $20bn annually. Divided by market cap of $580bn and 50% growth rate, this is a PEG ratio of 0.58 so Tesla is trading at a 42% discount of sensible levels, as long as you are prepared to hold until the economy and stock market is in better shape, and nothing happens during this period to negatively affect the PEG ratios (i.e. reduction in profits or growth rates).

From fundamentals, I expect $1,000 share price within 3 years, but this is a bullish perspective, and so the PEG ratio analysis is a good one to do on very sensible Warren Buffet-like terms to give some balance. Either way, the analysis says BUY BUY BUY

SebastienBonny

Member

Conclusion: 50 is conservative so we shouldn't go any lowerThe "G" in the PEG ratio represents projected earnings growth, not "vehicle deliveries growth" or "revenue growth". For now (and for at least a couple years), earnings should grow much quicker than revenue and/or vehicle deliveries. I don't know Tesla's earnings growth rate off the top of my head (I think it's currently much closer to 300%, not 50%!), but I believe @Gigapress may have a usable earnings growth rate in one of his posts on his substack.

EDIT: I just pulled up Net Income for Q3 2021 compared to Q3 2022, here are the numbers:

Q32021: $1.62 Billion

Q32022: $3.29 Billion

Thus, the current earnings growth rate is 3.29/1.62 - 100% = 103%. Normally, I wouldn't expect such a high growth to continue into the future; however, Tesla's past year's difficulties with chip shortage, covid shutdowns, etc make it possible for Tesla to continue with such a high earnings rate for the next four quarters (i.e. - 3.29 * 2.03 = $6.67 Billion net income in Q3 2023).

Thekiwi

Active Member

An interesting episode.Tesla Daily coming through corroborating the 87.7K Shanghai production figure, saying that the CPCA gave the same number Reuters reported earlier today.

- Rob spends a fair bit of time specualting on possible lower profit margins in the short term (2023) from possible demand softness in China (which he thinks is one possibility given the two recent price cuts in quick succession, combined with higher production rate).

- Then he covers in detail a new bill that has popped up in congress that changes the EV tax credit bill significantly (Possibly to fix the issues the EU is complaing about): EV credit will be open to foreign made cars until 2026, and the made-in-US battery content requirement also disappears for a few years. Potentially opens the door for chinese made teslas being sold in USA if that option ends up making sense for Tesla.

This is my thinking also. I'm really close to buying TSLA again. I just need to see it stop falling first.I'd rather look at the PEG-value (which should be 1 or lower).

At current P/E ratio of 60, we're at a PEG-value of 1.25 (P/E divided by growth = 50).

That's the way a growth stock should be valued IMO.

With a FY22 EPS (Q1 + Q2 + Q3 + estimated EPS for Q4 of 1.26) of 4.14 we are currently at a P/E ratio of approximately 44 and a PEG-value of 0.88.

I won't even look at the estimated EPS and P/E for 23, that would take us to the conclusion we are way undervalued at this time.

So, yeah, P/E of 60 is quite ok for 50% growth.

I sold my TSLA after first split at approximately current price.

Todesbuckler

Member

PEG around 1 seems also to me like a fair (or even low) valuation of Tesla.

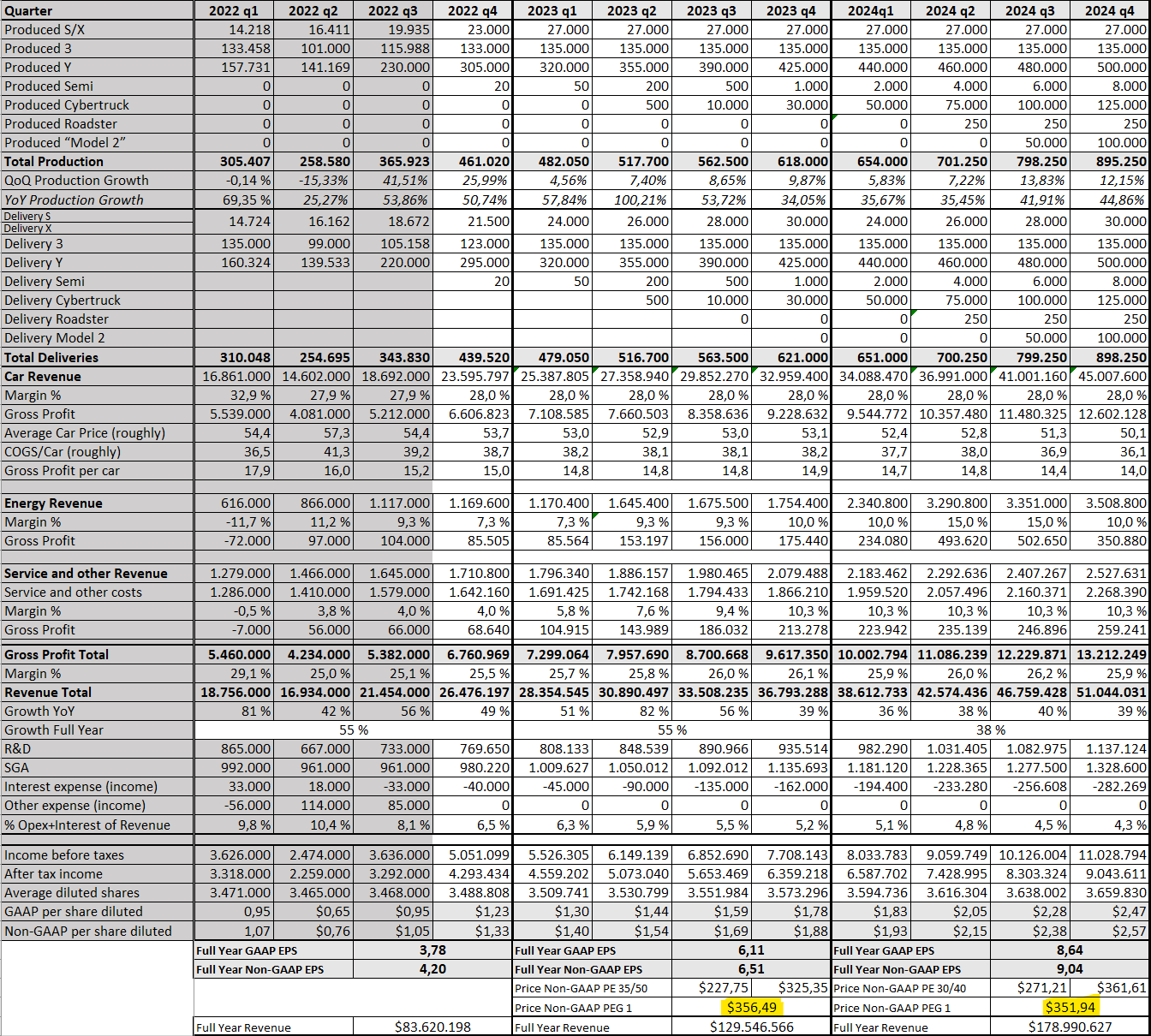

In my near-term financial model, I include PEG valuations based on YoY earnings growth and full-year non-GAAP EPS estimates.

This yields a share price of around 350$ with a rather cautious margin and growth assumption for 2023&2024.

Full model:

In my near-term financial model, I include PEG valuations based on YoY earnings growth and full-year non-GAAP EPS estimates.

This yields a share price of around 350$ with a rather cautious margin and growth assumption for 2023&2024.

Full model:

nativewolf

Active Member

For now a mysteryRoss also admitted that he has no idea why Elon is/was selling in that podcast(assuming it's the one from today w Farzad, Alexandra, and Gary Black). He's as exasperated/exacerbatedas the rest of us.

So basically if one has to put out content just make some shheeet up and stir the pot?An interesting episode.

- Rob spends a fair bit of time specualting on possible lower profit margins in the short term (2023) from possible demand softness in China (which he thinks is one possibility given the two recent price cuts in quick succession, combined with higher production rate).

- Then he covers in detail a new bill that has popped up in congress that changes the EV tax credit bill significantly (Possibly to fix the issues the EU is complaing about): EV credit will be open to foreign made cars until 2026, and the made-in-US battery content requirement also disappears for a few years. Potentially opens the door for chinese made teslas being sold in USA if that option ends up making sense for Tesla.

one Could really start a dudetube channel covering just the tsla specula lations

Relevant die to Elon selling.Tesla Daily coming through corroborating the 87.7K Shanghai production figure, saying that the CPCA gave the same number Reuters reported earlier today.

Rob had a big error in the Twitter funding math.

The $7.1B 3rd party equity number already included the Saudi shares. So his estimate on Elon's potential shortfall is off by $1.9B .

https://www.sec.gov/Archives/edgar/data/1418091/000110465922056055/tm2214608d1_ex-m.htm

Equity Investor Aggregate Equity Commitment A.M. Management & Consulting $25,000,000 AH Capital Management, L.L.C. (a16z) $400,000,000 Aliya Capital Partners LLC $360,000,000 BAMCO, Inc. (Baron) $100,000,000 Binance $500,000,000 Brookfield $250,000,000 DFJ Growth IV Partners, LLC $100,000,000 Fidelity Management & Research Company LLC $316,139,386 Honeycomb Asset Management LP $5,000,000 Key Wealth Advisors LLC $30,000,000 Lawrence J. Ellison Revocable Trust $1,000,000,000 Litani Ventures $25,000,000 Qatar Holding LLC $375,000,000 Sequoia Capital Fund, L.P. $800,000,000 Strauss Capital LLC $150,000,000 Tresser Blvd 402 LLC (Cartenna) $8,500,000 VyCapital $700,000,000 Witkoff Capital $100,000,000 $5,244,639,386 Equity Investor Aggregate Equity Commitment HRH Prince Alwaleed Bin Talal Bin Abdulaziz Alsaud (Kingdom) 34,948,975 shares @$54.20 $1,894,234,445 Total $7,138,873,831 plus Jack $1,000,000,000 $8,138,873,831

Do you take reservations for test rides? Tesla will initially have only 2 demo cars in Belgium (for 5 service centers).

Same here (incoming EU MX Plaid). Apparently I will get the Model X meant for Elon (VIN X69420).As @The Accountant set a precedent, I'll share my tweet rather than retyping... Incoming EU MXP!!

Artful Dodger

"Neko no me"

So why did he sell? He's not done either it looks like ..it's a lot of coin.

To me TSLA looks like a screaming buy and I never got the fascination with Twatter so....I guess I don't know a lot. I'm curious as to the motives for selling.

If you were looking at ~$50B in income taxes, and could get ~57% off your tax bill assisted by 5:1 selling leverage by shortzes/hedgies, what would you do? Then, include share buybacks on the cheap. Enough treasury shares in Tesla's larder to cover all employee and Officer SBC (ex-CEO) for the rest of the decade.

Funny thing about Retail investors, they're fed a constant stream of dogdoo: "any SP spike is a bubble that has to burst", but "any SP trough is an abysmal bottom" from which there can be no return (and pay no nevermind to the fundamentals behind the curtain). Solution? Apply critical thinking skills to the main stream narrative. Surprising results emerge. That's how you run with the big dawgs.

For long investors, be aware: "This too shall pass". Tesla will be in a stronger place afterward. Few players in this market are as well positioned to benefit from the current setup. I trust Tesla's management team to do well for the company, and the mission.

When product demand truly “softens” they will pull new product levers (next gen) or offer new options (y suspension) to ratchet demand some more. they also alter pr

Did you put out such wariness and serenity when the price was MUCh higher?If you were looking at ~$50B in income taxes, and could get ~57% off your tax bill assisted by 5:1 selling leverage by shortzes/hedgies, what would you do? Then, include share buybacks on the cheap. Enough treasury shares in Tesla's larder to cover all employee and Officer SBC (ex-CEO) for the rest of the decade.

Funny thing about Retail investors, they're fed a constant stream of dogdoo: "any SP spike is a bubble that has to burst", but "any SP trough is an abysmal bottom" from which there can be no return (and pay no nevermind to the fundamentals behind the curtain). Solution? Apply critical thinking skills to the main stream narrative. Surprising results emerge. That's how you run with the big dawgs.

For long investors, be aware: "This too shall pass". Tesla will be in a stronger place afterward. Few players in this market are as well positioned to benefit from the current setup. I trust Tesla's management team to do well for the company, and the mission.

StarFoxisDown!

Well-Known Member

The new bill has zero chance of being successful now that Republicans will control the House. There's zero Congress can do.An interesting episode.

- Rob spends a fair bit of time specualting on possible lower profit margins in the short term (2023) from possible demand softness in China (which he thinks is one possibility given the two recent price cuts in quick succession, combined with higher production rate).

- Then he covers in detail a new bill that has popped up in congress that changes the EV tax credit bill significantly (Possibly to fix the issues the EU is complaing about): EV credit will be open to foreign made cars until 2026, and the made-in-US battery content requirement also disappears for a few years. Potentially opens the door for chinese made teslas being sold in USA if that option ends up making sense for Tesla.

As for margins, Shanghai running at actual full production for an entire quarter would make up the difference even if they have to drop prices again. That's because of depreciation/amortization in the factory. The factory essentially running at half of it's capacity for the quarter, like it did in Q2 and Q3, drops gross margin considerably.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K