Problem is that child seats wouldn’t likely have saved them in a typical SUV or sedan. Normally there are no survivors.Based on automotive experts, I think it’s fair to say that the child seats definitely were a major factor. Problem?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I saw a couple references to the horrific crash where a Tesla plunged down a cliff and all occupants survived. There was speculation about whether FSD was enabled or not. Turns out the driver did it intentionally and has been arrested for attempted murder.

abc7news.com

abc7news.com

CHP says Tesla plunge at Devil's Slide was intentional, driver arrested for attempted murder

The driver has been placed under arrest for attempted murder and child abuse after intentionally driving off the cliff in his car with one adult and two kids inside, the CHP said.

Wow.I saw a couple references to the horrific crash where a Tesla plunged down a cliff and all occupants survived. There was speculation about whether FSD was enabled or not. Turns out the driver did it intentionally and has been arrested for attempted murder.

CHP says Tesla plunge at Devil's Slide was intentional, driver arrested for attempted murder

The driver has been placed under arrest for attempted murder and child abuse after intentionally driving off the cliff in his car with one adult and two kids inside, the CHP said.abc7news.com

One thing is certain: He didn’t see that coming.

Todd Burch

14-Year Member

Ok.

I’m feeling confident that the earnings call will be good for TSLA as long as Elon is not on the call or at least doesn’t go all worst-case scenario apocalyptic mode as he usually does.

(Planning for worse case is great. Talking about it like it’s expected is not).

I’m of the belief that much of the undelivered cars in Q4 were logistics issues out of Tesla’s control and not cars that weren’t purchased. We’ve seen:

1. Cars stuck at the port in Shanghai.

2. A RoRo destined for Europe stuck in Australia due to fumigation and other port issues.

3. A shipment of cars stuck at the airport in Berlin awaiting a ship bound for Taiwan.

4. Massive COVID issues in China.

5. A ship delayed getting into Zeebrugge toward the end of the quarter due to other ship traffic.

6. A massive snowstorm/extremely cold temps in North America in the last 2 weeks of the quarter.

Sorry, I just don’t believe that Tesla built many tens of thousands of cars with no customer in mind. Has demand dropped some? Sure. Economy’s not doing well. Has it plummeted to the extent that bears want you to believe? No. Tesla hasn’t even permanently lowered prices yet—something which will probably be necessary but won’t scare me.

I think the earnings call will clarify these issues and calm investors quite a bit.

Regardless, Tesla still should have adjusted guidance as all of these events unfolded to better prepare investors and analysts. This gaffe’s on Tesla, not Elon.

I’m feeling confident that the earnings call will be good for TSLA as long as Elon is not on the call or at least doesn’t go all worst-case scenario apocalyptic mode as he usually does.

(Planning for worse case is great. Talking about it like it’s expected is not).

I’m of the belief that much of the undelivered cars in Q4 were logistics issues out of Tesla’s control and not cars that weren’t purchased. We’ve seen:

1. Cars stuck at the port in Shanghai.

2. A RoRo destined for Europe stuck in Australia due to fumigation and other port issues.

3. A shipment of cars stuck at the airport in Berlin awaiting a ship bound for Taiwan.

4. Massive COVID issues in China.

5. A ship delayed getting into Zeebrugge toward the end of the quarter due to other ship traffic.

6. A massive snowstorm/extremely cold temps in North America in the last 2 weeks of the quarter.

Sorry, I just don’t believe that Tesla built many tens of thousands of cars with no customer in mind. Has demand dropped some? Sure. Economy’s not doing well. Has it plummeted to the extent that bears want you to believe? No. Tesla hasn’t even permanently lowered prices yet—something which will probably be necessary but won’t scare me.

I think the earnings call will clarify these issues and calm investors quite a bit.

Regardless, Tesla still should have adjusted guidance as all of these events unfolded to better prepare investors and analysts. This gaffe’s on Tesla, not Elon.

bigsmooth125

Member

This is some seriously weak sauce.Well written, pseudo insightful hogwash, pure malarkey.

GJ, you here?

JRP3

Hyperactive Member

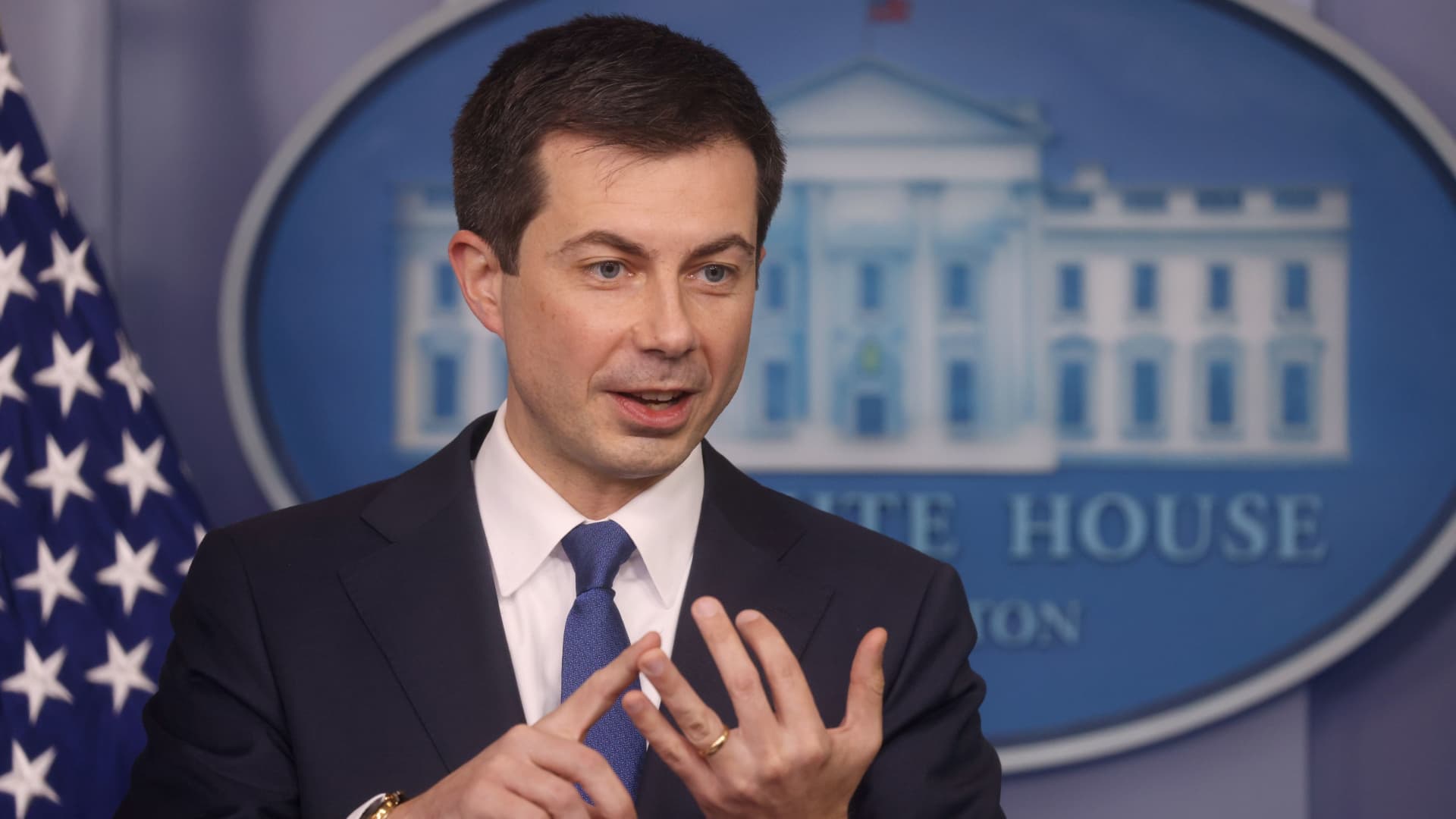

“We admire the range of American companies that have innovated, including Tesla, which did so much to make EVs possible in America,” Buttigieg said in an interview on CNBC’s “Squawk Box.”particularly since Pete was one of the folks in the administration that absolutely refused to say the word 'Tesla' out loud, even when the media would press him on it because they knew their audience was already aware of the conflict that presented for Pete.

Transportation chief Pete Buttigieg credits Musk's Tesla for helping make EVs 'possible in America'

"We admire the range of American companies that have innovated, including Tesla, which did so much to make EVs possible in America," Buttigieg said.

"Tesla is the largest producer of EVs in the country. They’ve played a remarkable role in propelling EV revolution."

Pete Buttigieg: "Tesla is the largest producer of EVs in the country"

In an interview with Yahoo! Finance, U.S. Transportation Sec. Pete Buttigieg said that Tesla is the largest producer of EVs in this country

"And then you have the newer companies, the Teslas, Rivians, and so on that had been set up for this the whole time, but are themselves going through the evolution that would be required for them to hit the next level in terms of scale."

Pete Buttigieg gets real about the EV revolution

Recode spoke with the secretary of transportation about winning over rural drivers and surmounting other roadblocks to the EV transition.

www.vox.com

www.vox.com

It's a little bit skewed here since the person is comparing listed base prices against actual average selling priceInteresting thread about Tesla M3 pricing and how it closely followed the average US selling price for all new cars

This person used another data set with Model 3 ASP and the real Model 3 transactions are significantly higher

And hauling Shanghai-Germany-Taiwan is almost a perfect round-trip!Honda had -33% yoy (growth), perhaps wall street prefers that,.

Lots of ROROs shipping cars out of Japan that will soon be looking for a new gig.

JRP3

Hyperactive Member

You better assume both will happen.I’m feeling confident that the earnings call will be good for TSLA as long as Elon is not on the call or at least doesn’t go all worst-case scenario apocalyptic mode as he usually does.

This does indeed sound like Gordon Johnson. The fact is a smaller slice of a much bigger pie is more pie....I realise it is not popular to say this, but a corresponding story is so far playing out in the BEV market. The data shows that Tesla is year-on-year losing market share by volume, by GWh, and by revenue.

What on Earth are you talking about? Tesla has other engineers besides Elon.Tesla needs to decide whether it is predator or prey, rather than distractedly fiddling with blue feathery baubles in another room.

TSLA_Hopeful

Member

I have an idea for the tax credit. Tesla still sells the Model Y at the standard price. If the Model Y 5 seater qualifies later for the tax credit, the consumer is whole. If the tax credit does not apply to the Model Y 5 seater later, Tesla will provide enhanced autopilot + 20000 supercharging miles for free to the consumer. It's a win-win.

ShareLofty

Member

Tesla is buying Bitcoin again!Thoughts on Investor Day? "capital allocation" could be referring to the buyback.

Maybe @Curt Renz can help craft some language we might be able to use as a template for the emailIRS is inviting feedback for IRA. Please consider sending your thoughts to IRS.

"For those submitting by email, you need to include OMB Control No. 1545-2137 in the subject line and send it to [email protected]."

Source: IRS invites consumers to comment on EV tax credit qualifications

Thank you for sharing!I haven't posted in almost a year. Not since after a couple of my concerns about Elon were taken down. This was around the time of comparing Trudeau to Hitler and supporting the Canadian 'convoy'.

At the risk of being deleted again, in good conscience I feel the need to share this from the perspective of an Investor, in an Investor's thread.

I would first like to say that our family are owners of 4 Model X's, 1 Y, 1 Model 3, and multiple orders for the Cybertruck. We believe in the products and the future of the company, and will always support the inevitability of the EV industry.

However, the progression of recent events and actions, today being no less, of the company's leadership, make me feel that a significant structural change is required for the benefit of both the company and it main owner.

I would like to encourage more of a dialogue of how the leadership can be restructured to channel the skills of Elon while also breaking the perception that Elon = Tesla, and Tesla = Elon. I believe this would be good for Elon, for Tesla, and society in general.

Anyone that has not seen an continuing escalation in his behavior the last couple of years is fooling themselves. Thank you for listening.

Paracelsus

Active Member

Ok - who reached out to Elon?That's awesome @EVNow - I am still rolling at the concept of that:

View attachment 892009

A bit more fitting of a ring to it for Pete as compared to Better Call Saul, particularly since Pete was one of the folks in the administration that absolutely refused to say the word 'Tesla' out loud, even when the media would press him on it because they knew their audience was already aware of the conflict that presented for Pete. Do you really believe that Pete would even consider answering Elon on Twitter regarding anything to do with Tesla? If your answer wasn't just another knock on Elon/Twitter and you were being completely sincere then I would encourage everyone on TMC to constructively get your message to Elon to do just that, and let's get this Model Y exclusion fixed ASAP.

deshkart

Member

The price action reminds me early 2019 when Tesla missed deliveries due to bad logistics to Europe. Everyone and their mom declared that no one will ever buy an EV and Tesla will go bankrupt any moment. During this madness we had AI day - Listening to sheer ambition of the Tesla team and genius behind the autopilot architecture was Jaw dropping. Everyone thought it was the one last stock pump by Elon but it was obvious for me that this company is going to change the world forever.

Stock bottomed after a couple months at $180 - pre pre split. Rest is history.

We are now trading at 20ish PE and nearly 10X from that bottom in approx 3.5 years.

We should 10X again in next 3 to 4 years.

Stock bottomed after a couple months at $180 - pre pre split. Rest is history.

We are now trading at 20ish PE and nearly 10X from that bottom in approx 3.5 years.

We should 10X again in next 3 to 4 years.

About a decade ago I/we pulled our business out of being a storage designer/manufacturer. One of the reasons I did so was because I knew we did not have the depth of capital to go head-to-head with Musk/Tesla in the space, and nor could we compensate with low labour costs. So we focussed in other places. I/we were very right to be concerned as Tesla's offering was attractive: they simply had more firepower and it showed.

so the poster tries to appeal as an authority for space they used to work in

Collectively the Chinese on the other hand did not step back. They have comparable depth of capital to Tesla/Musk (or far more, depending on how you view things) and they pushed ahead with moving LFP from concept to reality, reaching (now) a price/performance point that is globally relevant to the mass market for storage. (and related stuff) They primarily did that because they were motivated by the vehicle market. The term I have used for 15+ years is that there is a mobility-premium for wrapping a battery in a vehicle shell, and the market simply does not - for many very understandable reasons - want to grant that premium margin to stationary storage. So LFP was aimed at vehicles. But it is also en passant solving the storage problem which is now scaling fast.

The size of that rapidly growing mass market from year-to-year is a closely held secret, if indeed anyone knows all the puzzle pieces. I try to track it through different approaches, but it is nigh-on impossible to quantify. I'm not sure many other people have a much better understanding, however much they sell their research reports for (they used to come to me, trying to blag me to get my data for their report). As you probably know I suss out the vehicle/battery splits each year to try and keep tabs on that, enough to do some basic public domain analysis. Quantifying storage with an equivalent precision was tough. From the limited poor quality signals I could assess, until last year I thought Tesla had overwhelming dominance in the utility segment, but was less obviously dominant in the domestic segment, and there were signs that the commercial segment was a fizzle for everyone.

In the course of the last year it has become clearer from the qualitative public domain info that Tesla is no longer competitive in the domestic market. That is why apart from some special niche markets (such as the USA ..... which is why a lot of US-ians aren't reading the tea leaves well ....) Tesla has largely pulled out of attempts to grow their presence in domestic. Instead Tesla has focussed its efforts on the larger utility-scale products and projects. Now does this mean that Tesla can't sell every (domestic) Powerwall it produces: no. Does this mean the price for Powerwall's is reducing : no. So But go look in the market beyond the USA and the Tesla Powerwall is practically a dead product, swamped under a tidal wave of Chinese clones. Overall the Chinese are growing their absolute market size faster than Tesla is, and hence Tesla's market share is reducing.

commercial, utility, qualitative seem overly complicated words used as opinions absent supporting evidence.

shuld Tesla goal to beat Chinese or to execute their own plans?

worrying about Tsla energy is kind of a non starter to me. They have been making cars, not storage solutions. Now (if) they have enough batteries they can move forward more.

Anyone who has ever read Christensen's "Innovators Dilemma" can tell you what is most likely to come next. I've spoilt things by giving my opinion. Tesla will sell every utility scale Megapack they can make for the next few years and will command a premium price for them. None of them will sell into China. Many will sell into USA or to clients in the wider western alliance who are allergic to China. But increasingly the Chinese will move upscale into the utility segment and take what in the longer term will likely become the commanding position. And then Tesla utility-scale storage margins will wither year-by-year with no path back, no matter how many turnaround plans are attempted. The projected scenario in the graphs I gave earlier are very much the high-case; the low-case is far less attractive.

really seems to throw Clayton in here as an appeal absent understanding. whatever the poster is trying to say has not been my read of those books.

it is not Tsla vs Chinese as a good example, it is Tsla v US autos.

AWOL? Perhaps leave your non usians space and visit Austin TX, latrhop ca, Shanghai, Berlin and then justify how they are not deploying capital for growth?Is this a logical harvesting strategy for Tesla, yes. Is it a sign of weaknesses inside Tesla, also yes. Ultimately we know that pathway is terminal in the hardware space. (Tesla keeps on saying that is has not got a capital problem, but it has been AWOL on deploying it aggressively in this space. So that means Tesla has had a leadership talent problem in this space. I'd have though that much was patently obvious given the history of what we now call Tesla Energy). Does it mean investors should worry, absolutely, because by the time storage sales revenues are that significant then also the stuffing will have been beaten out of margins.

I realise it is not popular to say this, but a corresponding story is so far playing out in the BEV market. The data shows that Tesla is year-on-year losing market share by volume, by GWh, and by revenue. I last posted this graph about 11-months ago. Clearly Tesla has put its first team into bat in the vehicle market, and the seconds are playing in the storage market (and crikey knows who are in the solar market). The first team are playing an excellent game. The second team may be about to get a second wind for a while. And the third team are playing in some 0.1% league.

the graphs are meaningless in a 0 to 1 market. Tsla sales, earnings, and run rates all growing. If others are growing also, so be it, Tsla is not losing. Here in usian land, there are scant other evs available…

The analysts who are asking questions on the quarterly call are about as dangerous as a newborn baby deer. The better-armed hunters in the market have shot off a lot of ammunition recently, and some of it has hit home - that was because they can detect a valid scent, even if they don't yet fully understand it. Tesla needs to decide whether it is predator or prey, rather than distractedly fiddling with blue feathery baubles in another room.

View attachment 891986

Bullish: Teslas save lives

Bearish: Tesla drivers are attempted murderers

Bearish: Tesla drivers are attempted murderers

It’s a lose-lose situation.I’m feeling confident that the earnings call will be good for TSLA as long as Elon is not on the call or at least doesn’t go all worst-case scenario apocalyptic mode as he usually does.

Musk is not on the call: “See Musk has truly abandoned Tesla“

Musk is on the call: “Musk blathering about droids when Tesla Auto is failing!“

Headlines write themselves.

I almost guarantee Musk will be on this call.

Just pour concrete in the extra cargo space that the 5 seater has … name part #IRAI would say add $7500 and Tesla will includes some "OFFROAD edition" package that includes backup power station to adding weight? (Something that detechable from the car) I'm pretty sure lots of people will be interested to have one of these if $7500 incentive are available?

View attachment 892040

enslaved robot

Member

Stock bottomed after a couple months at $180 - pre pre split. Rest is history.

Put both my daughters' entire college fund into Tesla at 190 just after AI day. I have a feeling they will be in school for a long time.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M