ElectricIAC

Good-Natured Rascal

Seems like we all have Care Bears in our midst.Just checked and Rivian and Lucid basically in the same boat.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Seems like we all have Care Bears in our midst.Just checked and Rivian and Lucid basically in the same boat.

Thank you AD. I was a shareholder of OSTK in circa, 2003-2006, and followed the travails of Patrick Byrne. Being a broker at the time, I became very familiar with OSTK's tangle with the naked shorts. Not many people in my life, Wall Street or other, understood what I was describing (naked short-selling) and saw me as a tinfoil hat, just as almost everyone on Wall Street did with PB. I became so aware of the NSS issue that I retired from the industry in 2008, sooner than I would have liked to. I could not see putting retail investors' money into that type of market. There isn't a day that goes by that I don't think of this problem. I see it as the greatest financial crime against free-market, investing humanity. As I have opined, several times on this board, TSLA is a target of this crime. Elon needs to, with his team of lawyers, confront the SEC on this issue or, as I have suggested, spin off part of TSLA into a new company, the result of which would put pressure on the short sellers (fake or legit) to cover. Somehow this crime has to be stopped.Musk-see TV: (the story of how one CEO beat the hedge funds, saved his company, and lived to tell about it)

Billion $$$ Fight Against Naked Short Selling | hosted by Roger James Hamilton (11 hrs ago)

Jeers to the shortzes!

P.S. There's some advice on how Tesla could deal with short sellers in the first 5 minutes of the video.

BONUS Reading:

Just checked and Rivian and Lucid basically in the same boat.

It did on the way down!We need 23 in a row to get back to ATH, so should be at a new ATH well before the end of February. That is how this works, right?

Out of all the victims of this NSS nonsense, don't you think Elon would be the right person to tackle it head on? Or did he side step it because it is outside of his control politically, and no longer affects the mission since Tesla is now fully self-funded? The only affect it has remaining is employee retention. So there is hope there still.Thank you AD. I was a shareholder of OSTK in circa, 2003-2006, and followed the travails of Patrick Byrne. Being a broker at the time, I became very familiar with OSTK's tangle with the naked shorts. Not many people in my life, Wall Street or other, understood what I was describing (naked short-selling) and saw me as a tinfoil hat, just as almost everyone on Wall Street did with PB. I became so aware of the NSS issue that I retired from the industry in 2008, sooner than I would have liked to. I could not see putting retail investors' money into that type of market. There isn't a day that goes by that I don't think of this problem. I see it as the greatest financial crime against free-market, investing humanity. As I have opined, several times on this board, TSLA is a target of this crime. Elon needs to, with his team of lawyers, confront the SEC on this issue or, as I have suggested, spin off part of TSLA into a new company, the result of which would put pressure on the short sellers (fake or legit) to cover. Somehow this crime has to be stopped.

Exactly this, for as long as the company is innovating and growing ideas And branching out, which could be forever, even though all companies die eventually. I’ll check out that book. Another good on is Amazon.com: Founders at Work: Stories of Startups' Early Days (Audible Audio Edition): Jessica Livingston, Chelsea Kwoka, full cast, Upfront Books: Books. No direct Elon interview, but Max Levchin about PayPal.The problem as I see it is that the CEO criticisms tend to be for specific events and not the aggregate performance - a lot of the commentary is rating every swing of the bat (or maybe even a bad season) and if there are a few clangers in quick succession he's called a terrible batsman and we need fresh blood in the team - but looking at career stats he's up there with the absolute greats. I give him a lot of latitude for swings I don't agree with precisely because he's achieved things I will never achieve and couldn't hope to.

I'm reading The Founders book about the founders of PayPal at the moment and there's a lot of poor swings by Elon in the X.com era mentioned, yet he adapted and created a giant company (along with other brilliant founders). Even with poor swings he's hit more 6's that nearly anyone else, and tends to do so at the times they are really needed.

Some examples:

So when people want another CEO, who else can we choose that we can rely on to step up to the wicket when the game is on the line and knock it over the fence. Ross Gerber?

- First 100% owned China plant - Who besides Elon could have had the will and skill to have navigated that political environment

- Getting Panasonic to make a big leap into cells at GigaNevada

- Making the world believe EVs are a real option

- The decision to go for Gigacasting - which is acknowledged to be Elon's

- Not being scared to drop vehicle prices by $10k and put the hurt on the competition while driving the mission forward - most other CEOs would probably cut volume to protect margins

Apologies for the cricket analogy.

Unfortunately he is right. i first began to understand this when I read America Alone In 2007. Demographics don’t lie. Look at women only having 1-1.25 children and do the math. If women only have 1 child per woman, the next generation is only 50% of the current. That’s 20 - 30 years! several countries are in this range.

Tesla might be in big trouble in little China if this guy is right? China is totally collapsing this decade apparently? Is this guy credible? never heard of him till recently, I’ve listened to a few podcasts now and I’m ready to throw myself off a bridge lol, basically the good times are over and globalisation is finished? He seems to know what he’s talking about but is it a bit hyperbole? Im not sure but I hope he’s wrong?

Out of all the victims of this NSS nonsense, don't you think Elon would be the right person to tackle it head on? Or did he side step it because it is outside of his control politically, and no longer affects the mission since Tesla is now fully self-funded? The only affect it has remaining is employee retention. So there is hope there still.

My personal belief is that the SEC is allowing NSS so that the US gov't can manipulate the economy and cater to special interest at will. Specifically, they are trying to prevent such a rapid transition to sustainable energy because folks/companies need time to adapt, in theory. Call it the old guard or incumbent, but I'm talking about workers mostly. What are they going to do, and who will pay their pensions that dry up?

Imagine for a second, a world where Tesla truth went viral and nobody in their right mind bought another ICE vehicle. What's that economy look like while it transitions and the entire OEM supply chain collapses? What percentage of actual workers (that make actual products) would be affected by an overnight shift? I don't have a number, but I believe this country still runs on oil.

To your point: Yes, I believe Elon absolutely is the right person to tackle this issue. Who knows? Maybe the legal team that he put together a few months ago (maybe more) is working on it. There is no doubt in my mind that Elon has a very keen view of what is going on in NSS.Out of all the victims of this NSS nonsense, don't you think Elon would be the right person to tackle it head on? Or did he side step it because it is outside of his control politically, and no longer affects the mission since Tesla is now fully self-funded? The only affect it has remaining is employee retention. So there is hope there still.

My personal belief is that the SEC is allowing NSS so that the US gov't can manipulate the economy and cater to special interest at will. Specifically, they are trying to prevent such a rapid transition to sustainable energy because folks/companies need time to adapt, in theory. Call it the old guard or incumbent, but I'm talking about workers mostly. What are they going to do, and who will pay their pensions that dry up?

Imagine for a second, a world where Tesla truth went viral and nobody in their right mind bought another ICE vehicle. What's that economy look like while it transitions and the entire OEM supply chain collapses? What percentage of actual workers (that make actual products) would be affected by an overnight shift? I don't have a number, but I believe this country still runs on oil.

terraformindustries.wordpress.com

terraformindustries.wordpress.com

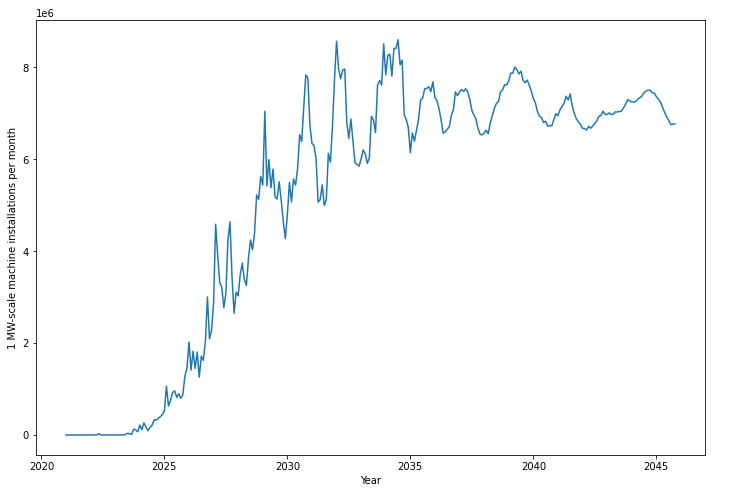

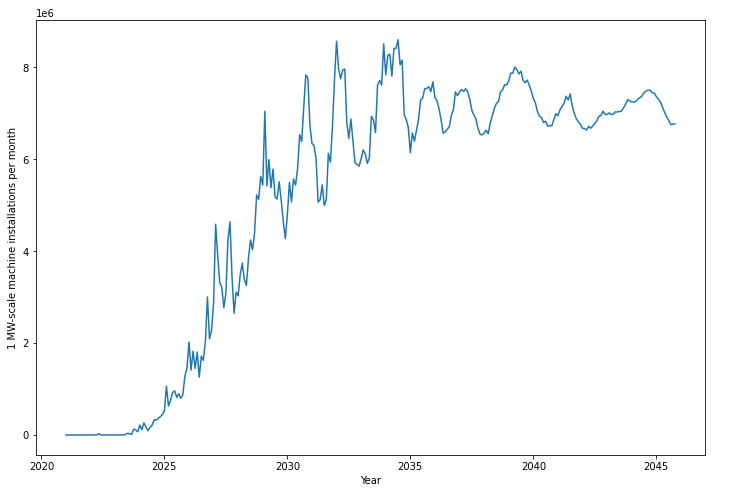

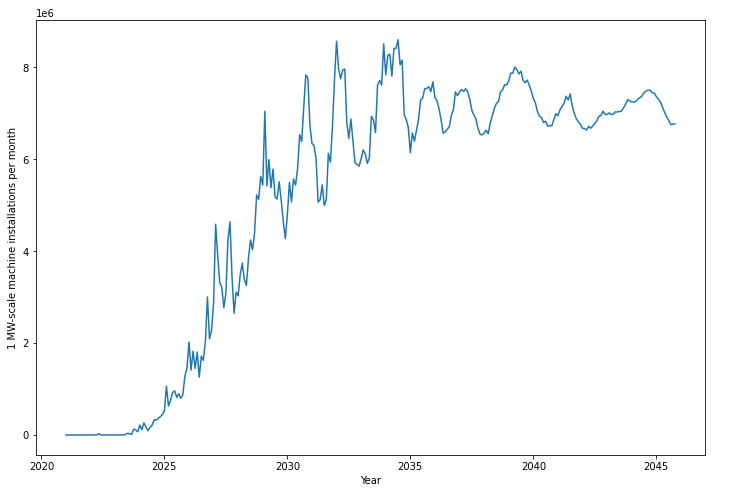

I even think that that last bullet point is probably right on. This industry at scale might use the majority of the world’s electricity in the future. Why is no one talking about this?

- Low electrical efficiency is good.

- Many technical problems are soluble in copious cheap electricity.

- Use of local solar is good, even in relatively cloudy places like Germany or Vermont, because solar decosting is moving very quickly.

- We need a lot of solar panels. Something like 1000x current annual production. This will take 20-30 years, not 1000 years, because production is doubling every 33 months or so, and speeding up.

- CO2 production strongly correlates with economic growth and reduction of poverty so is not a moral failing, per se. Extraction of fossil hydrocarbons to fuel CO2 production is subideal, however.

- While our overall process is chemically similar to photosynthesis->biomass, the per area productivity is 1000x higher.

- Our competition is fracking and other conventional fossil oil and gas extraction.

- A 5 year equipment lifetime is plenty, as a short ROI is good for scale.

- We can make any desired commodity hydrocarbon long term.

- Synthetic fuel will use 80+% of all solar generation long term.

Population collapse is a real national security issue in China and its something the national government is taking very seriously. Elon didn't decide to start building worker bots because he is bored, but to hopefully provide civilization with a soft landing.Unfortunately he is right. i first began to understand this when I read America Alone In 2007. Demographics don’t lie. Look at women only having 1-1.25 children and do the math. If women only have 1 child per woman, the next generation is only 50% of the current. That’s 20 - 30 years! several countries are in this range.

If we can pause endless rehashing of the same old political conversations, here’s something else to ponder.

Tesla Energy’s opportunity is a direct function of the total addressable market for kWh of electricity. We also need to stop, in Elon’s words, “the dumbest experiment in history” of rapidly increasing the CO2 concentration in our atmosphere and oceans, and we need to do this as quickly as possible. Oil and gas are mostly used for burning, but our civilization’s sustainability is also threatened by our utter reliance on mined hydrocarbons for chemical production.

It doesn’t have to be this way much longer. Synthetic hydrocarbon production from CO2 capture and solar power can solve both of these problems and I believe the capital markets have not done the math on the gigantic amount of demand for electricity this will create once solar and battery power reach sufficiently low prices. We already today have the ability to remove CO2 from the atmosphere, but the fundamental reason why all solutions thus far have failed economically is that CO2 at 420 ppm needs a lot of energy to be captured and an order of magnitude more energy to be ripped apart and reassembled into useful products like methane or ethylene. Doing this with renewable energy such that the overall process is carbon-negative has been prohibitively expensive.

Has been. If we extrapolate the solar and battery cost trends another 5-10 years out, in certain markets we will reach a tipping point—a disruption moment—in which synthetic hydrocarbon production will be cheaper than fossil-derived sourcing of the same chemicals. IRA subsidies for clean energy, clean hydrogen production and carbon sequestration suddenly pulled this schedule forward for American production by several years, maybe even by a decade. Likewise did the invasion of Ukraine and boycotting of Russian gas for European production.

But the plot is thicker. Interestingly, there is a single US state endowed with all of the following:

Texas.

- Strong sunshine

- Abundant cheap, flat land

- The fastest rate of solar power development in the nation

- The biggest hydrocarbon chemical sector in the nation

- Eastward-facing coastline that’s nearly at tropical latitudes

- Deepwater ports to the Atlantic Ocean ideal for shipping

- The headquarters of every Musk company including Tesla and SpaceX

Texas and its Gulf Coast neighbor Louisiana account for a whopping 70% of American primary petrochemical production according to the US government in this report.

View attachment 898156

Was this opportunity to advance sustainability and make even more money an unsaid reason in favor of moving Tesla and SpaceX to Texas? I don’t know because Elon has never mentioned this in public to my knowledge. However, I do know that SpaceX is already getting involved in direct air capture of CO2, water electrolysis to produce green hydrogen; and Sabatier reactors in order to produce methane for rocket fuel. This is required for sustainable rocket fuel on Earth, but it will also be required from Day 1 of fuel production on Mars, because Mars has no natural gas. I also would note that the Musk Foundation has offered a $100M prize for carbon capture technology, indicating Elon is thinking about this and believes it’s very important.

The big question in my mind is, will SpaceX just stop at making methalox fuel, or will they (or their sister company Tesla) expand deeper downstream in this vertical by making stuff out of the methane? Methane and hydrogen are commodities and there’s nothing special nor unique about rocket fuel methane or the hydrogen used to synthesize it. With methane and hydrogen as building blocks, any hydrocarbon chemicals can be assembled. In fact this basic chemistry is how biologists believe life on Earth began, in deep-sea thermal vents where photosynthesis was impossible and there was no other source of chemical energy. For human industrial production, it would likely come from Fischer-Tropsch synthesis. The implication for the role it must play in a hypothetical self-sustaining civilization on Mars is obvious, which is why I still think SpaceX has got to be thinking about this for the long-term plans. Their mission requires refinement of this technology to have any practical chance of success. How else could a Martian colony produce its own fuels, plastics, fertilizers, lubricants, pharmaceuticals and everything else an advanced civilization needs to survive and terraform an entire planet?

SpaceX also needs enormous amounts of capital to fund this development. They hope to make big bucks from Starlink and from orbital transportation services, but these markets are tiny in comparison to the opportunity in the chemicals sector. At some point, money might be the limiting factor on making humanity a multiplanetary species.

Terraform Industries is the most credible startup outside SpaceX in my opinion and they are openly pursuing these goals for chemical production for something other than just Starship flights. They released a new white paper today with a lot more numbers and technical detail.

Terraform Industries Whitepaper 2.0

Fuel from the sky: Cheap hydrocarbons from CO2 direct air capture and sunlight. terraformindustries.com At Terraform Industries, we believe our species and civilization should survive climate…terraformindustries.wordpress.com

I hope some of you, especially the scientists and engineers, will read it closely and tell me if it’s as technically and economically feasible as it sounds. I have not seen analysis from any other TSLA investors except me on this topic and it’s such a humongous long-term opportunity if it actually is viable. On the other hand, I’m wondering if batteries will be irrelevant to this industry. Terraform’s white paper indicates that they’ll only be operating the hydrolyzers during daylight hours. If steady 24/7 operation is not the goal then this might not mean much for Megapack demand in the coming decades.

Here is their basic thesis which I currently believe is probably correct:

I even think that that last bullet point is probably right on. This industry at scale might use the majority of the world’s electricity in the future. Why is no one talking about this?

Abundant energy will only bring with it new, yet unforeseen problems with it. Just at a larger scale due to more energy!If we can pause endless rehashing of the same old political conversations, here’s something else to ponder.

Tesla Energy’s opportunity is a direct function of the total addressable market for kWh of electricity. We also need to stop, in Elon’s words, “the dumbest experiment in history” of rapidly increasing the CO2 concentration in our atmosphere and oceans, and we need to do this as quickly as possible. Oil and gas are mostly used for burning, but our civilization’s sustainability is also threatened by our utter reliance on mined hydrocarbons for chemical production.

It doesn’t have to be this way much longer. Synthetic hydrocarbon production from CO2 capture and solar power can solve both of these problems and I believe the capital markets have not done the math on the gigantic amount of demand for electricity this will create once solar and battery power reach sufficiently low prices. We already today have the ability to remove CO2 from the atmosphere, but the fundamental reason why all solutions thus far have failed economically is that CO2 at 420 ppm needs a lot of energy to be captured and an order of magnitude more energy to be ripped apart and reassembled into useful products like methane or ethylene. Doing this with renewable energy such that the overall process is carbon-negative has been prohibitively expensive.

Has been. If we extrapolate the solar and battery cost trends another 5-10 years out, in certain markets we will reach a tipping point—a disruption moment—in which synthetic hydrocarbon production will be cheaper than fossil-derived sourcing of the same chemicals. IRA subsidies for clean energy, clean hydrogen production and carbon sequestration suddenly pulled this schedule forward for American production by several years, maybe even by a decade. Likewise did the invasion of Ukraine and boycotting of Russian gas for European production.

But the plot is thicker. Interestingly, there is a single US state endowed with all of the following:

Texas.

- Strong sunshine

- Abundant cheap, flat land

- The fastest rate of solar power development in the nation

- The biggest hydrocarbon chemical sector in the nation

- Eastward-facing coastline that’s nearly at tropical latitudes

- Deepwater ports to the Atlantic Ocean ideal for shipping

- The headquarters of every Musk company including Tesla and SpaceX

Texas and its Gulf Coast neighbor Louisiana account for a whopping 70% of American primary petrochemical production according to the US government in this report.

View attachment 898156

Was this opportunity to advance sustainability and make even more money an unsaid reason in favor of moving Tesla and SpaceX to Texas? I don’t know because Elon has never mentioned this in public to my knowledge. However, I do know that SpaceX is already getting involved in direct air capture of CO2, water electrolysis to produce green hydrogen; and Sabatier reactors in order to produce methane for rocket fuel. This is required for sustainable rocket fuel on Earth, but it will also be required from Day 1 of fuel production on Mars, because Mars has no natural gas. I also would note that the Musk Foundation has offered a $100M prize for carbon capture technology, indicating Elon is thinking about this and believes it’s very important.

The big question in my mind is, will SpaceX just stop at making methalox fuel, or will they (or their sister company Tesla) expand deeper downstream in this vertical by making stuff out of the methane? Methane and hydrogen are commodities and there’s nothing special nor unique about rocket fuel methane or the hydrogen used to synthesize it. With methane and hydrogen as building blocks, any hydrocarbon chemicals can be assembled. In fact this basic chemistry is how biologists believe life on Earth began, in deep-sea thermal vents where photosynthesis was impossible and there was no other source of chemical energy. For human industrial production, it would likely come from Fischer-Tropsch synthesis. The implication for the role it must play in a hypothetical self-sustaining civilization on Mars is obvious, which is why I still think SpaceX has got to be thinking about this for the long-term plans. Their mission requires refinement of this technology to have any practical chance of success. How else could a Martian colony produce its own fuels, plastics, fertilizers, lubricants, pharmaceuticals and everything else an advanced civilization needs to survive and terraform an entire planet?

SpaceX also needs enormous amounts of capital to fund this development. They hope to make big bucks from Starlink and from orbital transportation services, but these markets are tiny in comparison to the opportunity in the chemicals sector. At some point, money might be the limiting factor on making humanity a multiplanetary species.

Terraform Industries is the most credible startup outside SpaceX in my opinion and they are openly pursuing these goals for chemical production for something other than just Starship flights. They released a new white paper today with a lot more numbers and technical detail.

Terraform Industries Whitepaper 2.0

Fuel from the sky: Cheap hydrocarbons from CO2 direct air capture and sunlight. terraformindustries.com At Terraform Industries, we believe our species and civilization should survive climate…terraformindustries.wordpress.com

I hope some of you, especially the scientists and engineers, will read it closely and tell me if it’s as technically and economically feasible as it sounds. I have not seen analysis from any other TSLA investors except me on this topic and it’s such a humongous long-term opportunity if it actually is viable. On the other hand, I’m wondering if batteries will be irrelevant to this industry. Terraform’s white paper indicates that they’ll only be operating the hydrolyzers during daylight hours. If steady 24/7 operation is not the goal then this might not mean much for Megapack demand in the coming decades.

Here is their basic thesis which I currently believe is probably correct:

I even think that that last bullet point is probably right on. This industry at scale might use the majority of the world’s electricity in the future. Why is no one talking about this?

Take care of climate change and give young people hope for the future and a decent economic environment.Unfortunately he is right. i first began to understand this when I read America Alone In 2007. Demographics don’t lie. Look at women only having 1-1.25 children and do the math. If women only have 1 child per woman, the next generation is only 50% of the current. That’s 20 - 30 years! several countries are in this range.

This really tells the reality that TSLA is an ideal target for the unclothed vendors.Thank you AD. I was a shareholder of OSTK in circa, 2003-2006, and followed the travails of Patrick Byrne. Being a broker at the time, I became very familiar with OSTK's tangle with the naked shorts. Not many people in my life, Wall Street or other, understood what I was describing (naked short-selling) and saw me as a tinfoil hat, just as almost everyone on Wall Street did with PB. I became so aware of the NSS issue that I retired from the industry in 2008, sooner than I would have liked to. I could not see putting retail investors' money into that type of market. There isn't a day that goes by that I don't think of this problem. I see it as the greatest financial crime against free-market, investing humanity. As I have opined, several times on this board, TSLA is a target of this crime. Elon needs to, with his team of lawyers, confront the SEC on this issue or, as I have suggested, spin off part of TSLA into a new company, the result of which would put pressure on the short sellers (fake or legit) to cover. Somehow this crime has to be stopped.