I xerox your sentiment /sGreat news. The mods said we couldn’t talk about Twitter, but never said anything about X.com.

I’m afraid Elon’s shenanigans are going to ruin the demand for the letter X. Soon everyone will refuse to type words that start with X like Xylophone and Xanax. I’m so tired of this.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Great news. The mods said we couldn’t talk about Twitter, but never said anything about X.com.

I’m afraid Elon’s shenanigans are going to ruin the demand for the letter X. Soon everyone will refuse to type words that start with X like Xylophone and Xanax. I’m so tired of this.

Actually it's all good. Elon finally improved the user experience on Twitter.The new site has the best information I've every seen on it.

I very much agree with all but the first sentence, which I used to believe was true but now only consider to be “one of those things I wish were true but sadly isn’t”. Human psychology is always the greater factor at any moment; even long runs are merely collections of short runs and each of those short runs are individually and collectively more a reflection of psychology than a reflection of financials / fundamentals.In the long run regardless of the narrative being spun, the stock is valued on the fundamentals.

Tesla energy starting to contribute to profits in a meaningful way will be a great result.

Others promoting energy storage batteries will be free advertising for Tesla.

Energy companies are going to fight by trying to prevent clean energy and storage being commented to the grid, that will be a political fight, But I suspect many Fossil Fuel generators will simply give up and exit the grid, battery storage will then be essential.

growler23

Member

And solar panels will finally be sold to others after all of the factories are covered. /s?Building Gen3 cars would be a "killer app"

Building more Optimus, building HVAC, making batteries.

IMO Optimus is sold to others after all of the internal "job vacancies" are filled.

Gigapress

Trying to be less wrong

If Tesla continues to earn positive net cash flow, then that cash either will continue building up on the balance sheet or it will be distributed to shareholders as dividend payments. The fundamentals will at least provide a floor, but the valuation above and beyond that floor is based on expectations about the future, other psychological factors, and various kinds of market irrationality. This is why the market is a voting machine in the short run and a weighing machine in the long run. Fundamental investing is best done by accurately predicting the company's future cash flows and calculating a net present value based on your cost of capital. In the final analysis, cash is king and Tesla is piling up cash by the billions quarter after quarter.I very much agree with all but the first sentence, which I used to believe was true but now only consider to be “one of those things I wish were true but sadly isn’t”. Human psychology is always the greater factor at any moment; even long runs are merely collections of short runs and each of those short runs are individually and collectively more a reflection of psychology than a reflection of financials / fundamentals.

I struggle to imagine a realistic hypothetical scenario in which Tesla's market cap ends up being less than Tesla's net cash and cash equivalents (less the value of any debt). Otherwise, there would be an obvious arbitrage opportunity for some investor to gobble up a majority of the equity and then use the voting rights to force a liquidation of the cash, such that the net present value of the dividends from doing so exceeds the capital cost of buying the shares.

In the alternative case, Tesla leadership voluntarily decides to start paying dividends, and thus long-term TSLA holders technically don't even need to care about the market valuation of their equity because they will get a return on investment directly the old-fashioned way. In a realistic version of this scenario, the dividend payments would drive the stock price to some appropriate range where the yields are similar to other similar blue-chip stocks.

This is where the importance of P/E ratios fundamentally comes from. It's a way of looking at actual (or latent potential) dividend yields. If for example TSLA's P/E fell to 5 because of rising earnings, this would mean either cash is piling up so fast that it will equal the market cap in 5 years or it would mean that TSLA is paying out a 1/5 = 20% dividend yield, or some mix between these extremes. As of today, TSLA's trailing twelve month P/E for 2022 was 50. If you can foresee Tesla increasing earnings by 10x then the P/E is headed to 5 in the absence of stock price movement.

(Not investment advice and I'm not a licensed financial advisor.)

Last edited:

Tes La Ferrari

Active Member

Space X shares inspiring video of travel to Mars.

Easter egg : spot the Cybertruck at 0:28

Easter egg : spot the Cybertruck at 0:28

mars_or_bust

Member

Great news. The mods said we couldn’t talk about Twitter, but never said anything about X.com.

I’m afraid Elon’s shenanigans are going to ruin the demand for the letter X. Soon everyone will refuse to type words that start with X like Xylophone and Xanax. I’m so tired of this.

Paracelsus

Active Member

Although somewhat of an odd comparison, TSLA may have just been passed by BTC in the Market Cap race, as BTC pushed up above $30,000 again. At this point TSLA would need to 5x while everyone else stands still to reach the top Market Cap spot, but better to 10x as @Gigapress suggested with the world still in spin and with others on the list moving forward as well. Regardless of how it might happen, I am glad that Elon has put his eye on that prize with enough conviction to openly discuss its possibilities:

Last edited:

Is it the last gasp of BTC before Xcoin arrives?Although somewhat of an odd comparison, TSLA may have just been passed by BTC in the Market Cap race, as BTC pushed up above $30,000 again. At this point TSLA would need to 5x while everyone else stands still to reach the top Market Cap spot, but better to 10x as @Gigapress suggested with the world still in spin and with others on the list moving forward as well. Regardless of how it might happen, I am glad that Elon has put his eye on that prize with enough conviction to openly discuss its possibilities:

Puma2020

Member

A favorite WWDTM audio clipSo a talking bouncing dog that looks about as useful as Clippy seems right on brand.

Clippy must Die!

BioSehnsucht

Model 3 LR

Any mention of Clippy always makes me think of this video (full of nostalgic IT and meme references, this video could be summarized as Clippy's Revenge)A favorite WWDTM audio clip

Clippy must Die!

UkNorthampton

TSLA - 12+ startups in 1

Cybertruck castings? Some comments disagree. I don't know.

In 25 years of living in Western Canada, I've never heard roon-da-boot.Take the third turn on the roon-da-boot eh.

UkNorthampton

TSLA - 12+ startups in 1

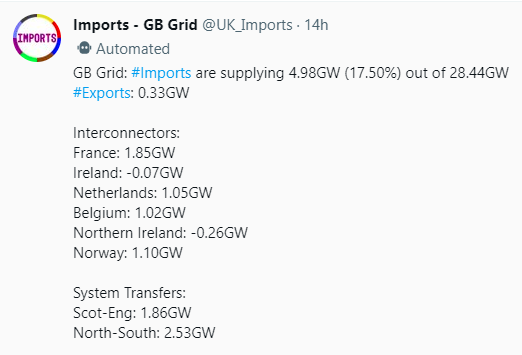

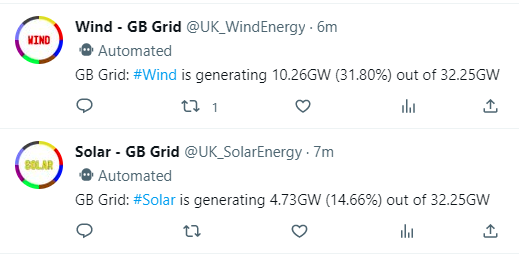

UK/Europe/World needs more Tesla Megapacks. Nearly half of UK electricity from Solar & Wind right now.

Storage contributing over 3% at some points between 7-10PM last night (normally highest-load period is considered to be something like 4-10PM. Peak times from memory, so not exact). More storage would probably reduce expensive imports (over 17% at some point last night). Depending on the economics, Tesla Megapack & other storage demand seems very high to me. I'd expect European Megapack production to be huge if cells/raw materials are available.

Storage contributing over 3% at some points between 7-10PM last night (normally highest-load period is considered to be something like 4-10PM. Peak times from memory, so not exact). More storage would probably reduce expensive imports (over 17% at some point last night). Depending on the economics, Tesla Megapack & other storage demand seems very high to me. I'd expect European Megapack production to be huge if cells/raw materials are available.

I recommend this dynamic website (with real-time data) National Grid: Live instead of tweets, as you can see % by sources over a day, week, year and all time with charts.UK/Europe/World needs more Tesla Megapacks. Nearly half of UK electricity from Solar & Wind right now.

Storage contributing over 3% at some points between 7-10PM last night (normally highest-load period is considered to be something like 4-10PM. Peak times from memory, so not exact). More storage would probably reduce expensive imports (over 17% at some point last night). Depending on the economics, Tesla Megapack & other storage demand seems very high to me. I'd expect European Megapack production to be huge if cells/raw materials are available.

UkNorthampton

TSLA - 12+ startups in 1

I can see pumped water storage which looks very small, can't see battery storage. I guess the storage in my post could be pumped water or battery.I recommend this dynamic website (with real-time data) National Grid: Live instead of tweets, as you can see % by sources over a day, week, year and all time with charts.

Buckminster

Well-Known Member

Btw my favorite quote of Mizuno:

"It's really a question whether Musk is a human or alien".

I wonder if he managed to find out before stepping down.

JRP3

Hyperactive Member

I hope that data is incorrect, we heard 38 delivered more than a month ago.

Per the Bendix recall there were 35 delivered as of March 17th.I hope that data is incorrect, we heard 38 delivered more than a month ago.

Is there an issue with directing production to the internal fleet?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M