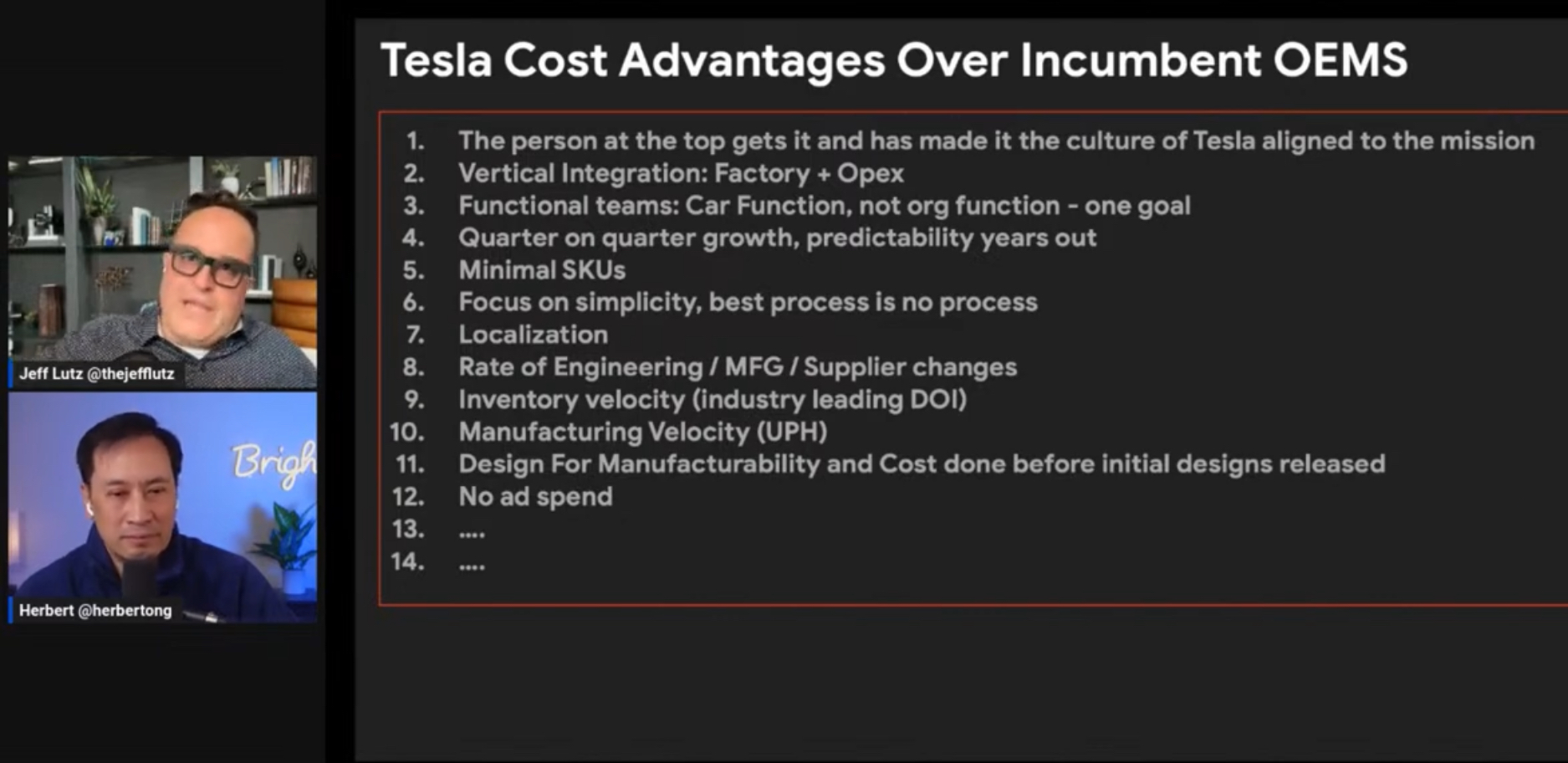

If an hour is too long to watch Brighter with Herbert interview of Jeff Lutz, consider jumping in at 50:00 for the following slide, or just watch the last 6 mins for the wrap up.

Lots of reasons to feel good about margins staying healthy, or at least recovering from any hit.

View attachment 929338

Outline:1. @Tesla 2019 MSRPs vs Today2. What's in COGS (overview)?3. What's #Tesla told us about COGS? 4. 'COVID economies' - Dramatic Impact on COGS5. Reces...

www.youtube.com

I just finished watching this episode.

Jeff Lutz is a great contributor to the TSLA community. As

@Carl Raymond mentions, he does a great job in this video of explaining what's happening with COGS and margins. Some things he glossed over (like a question about when and how material he expects input cost decreases to impact gross margins), probably because he doesn't know and doesn't want to hype things of which he is not sure.

My take-away is that Tesla has all the data (input costs, demand curves and the price elasticity of demand, logistics, utilization costs, impact of price changes versus impact of advertising, etc.) and know what they are doing. Will they make mistakes? Of course they will. But I have never seen a company learn so much, iterate so quickly and improve on their execution as well as Tesla. What gives some angst (and becomes fodder for FUD) is that Tesla thinks outside the box and does things so differently than anyone else - first principles thinking versus reasoning by analogy. Eschewing advertising, constant price changes, setting and communicating ridiculously high goals even if it means sometimes falling short, are all practices that are new and unique to the industry. I have little doubt that in time, these practices will pay off. Just like other new practices that Tesla implemented has paid off handsomely. Think gigafactories, direct sales model, castings, setting up Shanghai GF, vertical integration, structural battery packs, etc.

I will continue to trust them to make the right choices unless and until they prove otherwise.

www.youtube.com

www.youtube.com