Comments from last quarter’s call regarding commodity prices and input costs

Zach Kirkhorn

The Austin and Berlin ramp inefficiencies in 4680 will make a substantial amount of progress on that over the course of the year, and that's within Tesla's control. We're doing a lot of work on cost reduction outside of that. And we talked about supply chain costs, expedites, logistics, attacking everything. On the raw materials and inflation side, where lithium is the large driver there and this was a meaningful source of cost increase for us, we'll have to see where lithium prices go.

And we're not fully exposed to lithium prices, but I think in general, as what we've seen from our forecast here, cost per car of lithium in 2023 will be higher than 2022. So that's a headwind that would have to be overcome to return back to those levels. So I don't think we'll get there this year, but I think we'll make progress. And we'll continue to find ways to offset these raw material costs that we don't have control over.

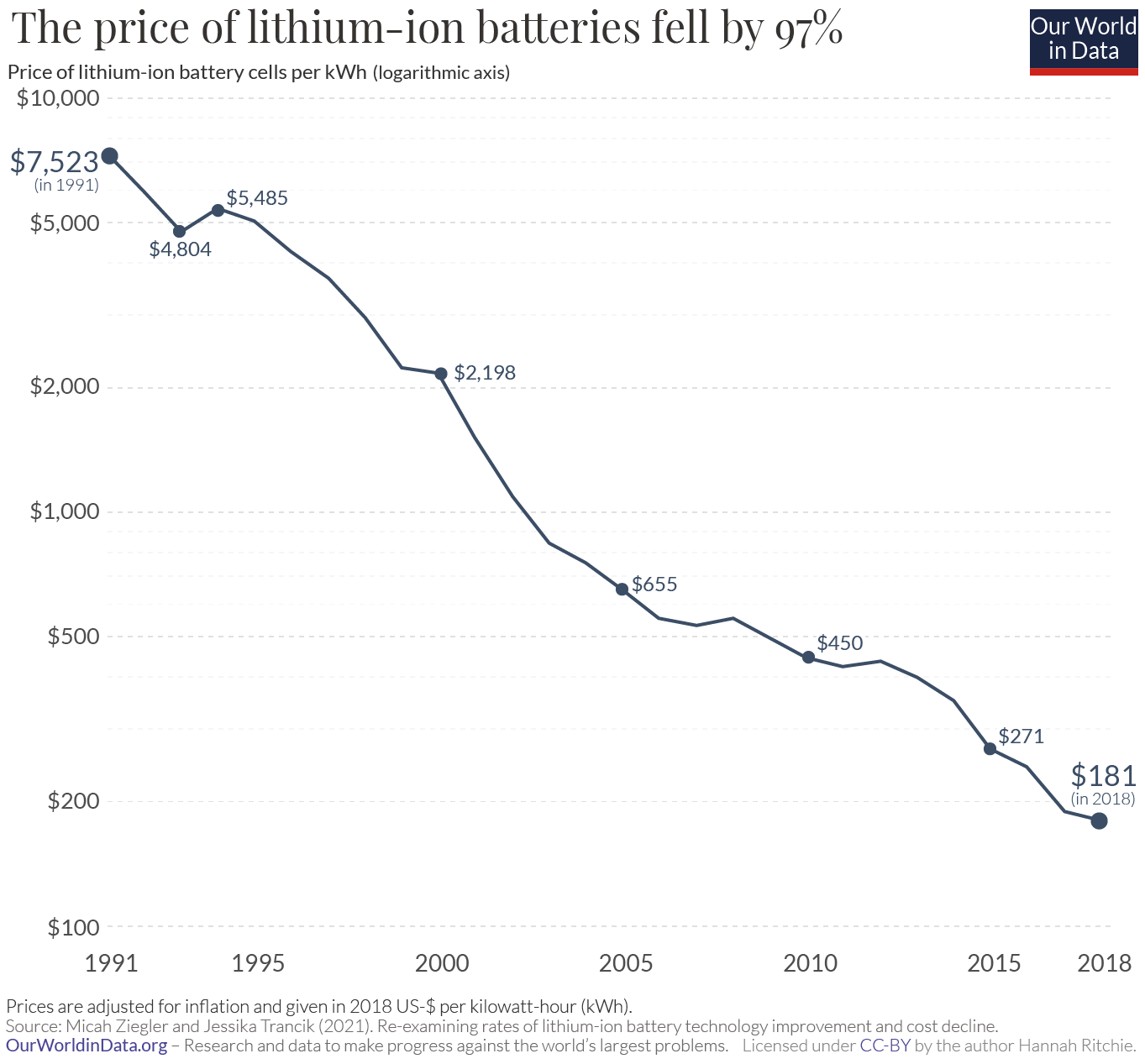

The cost of lithium has been decreasing significantly:

November 2022 : 600000$

April 2023 : 180000$

This decline must be one of the reasons why Tesla believes it can lower the prices of their cars.