Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

There is no other strategy. Where have you been? This is the path. You don’t like the path, then get off it.Yeah, I'm not a fan of that line of reasoning. I'd like to hear a strategy to achieve higher margins indepenent of FSD, meaning sooner.

About time people realized this isn’t going to go in any sort of traditional way; FSD or bust. How many times do you need to be told that before you’ll accept it as the reality?

FSD or bust

FSD or bust

FSD or bust

FSD or bust

FSD or bust

FSD or bust

FSD or bust

Gosh some people are slow learners.

Xepa777

Banned

Keep downvoting me haters, first thing Rob said after the call was “Tesla basically said we’re not giving guidance about margins anymore or care about them.”

Followed by “until FSD is actually happening Wall Street isn’t going to believe Elon and it’s going to be ugly.”

Followed by “I’m surprised the stock price is let down more now.”

I mean, I guess it’s those who hold call options who are downvoting me for telling the truth. Disaster of a call, but not mad, more amused! I’m excited for the destruction of competitors over the next two years due to Teslas prices.

Followed by “until FSD is actually happening Wall Street isn’t going to believe Elon and it’s going to be ugly.”

Followed by “I’m surprised the stock price is let down more now.”

I mean, I guess it’s those who hold call options who are downvoting me for telling the truth. Disaster of a call, but not mad, more amused! I’m excited for the destruction of competitors over the next two years due to Teslas prices.

Gigapress

Trying to be less wrong

How can the 4680 ramp be delayed by 3 years? It was revealed only 2.5 years ago. Was it already six months late when the goals were announced? Is the Cybertruck 5 years late?Then again this could all be a clever cover for the fact that the 4680 is wildly delayed, like 3 year ramp delay. Which is actually what I believed happened, and all this “we’re not working on model 2 cuz model 3/y sales are so dominant” talk was just a cover. That’s why Berlin was hinted to start with 4680 yet to this day doesn’t have it, why semi is delayed, why cybertruck is delayed, etc.

Tesla has repeatedly told shareholders that 4680 ramp was not an impediment to ramp goals and they had a surplus of cells from suppliers. So to be clear, you believe they directly and blatantly lied to shareholders? You are asserting that the following statements were fraudulent?

Elon on the Q4 '21 earnings call: "The fundamental focus of Tesla this year [2022] is scaling output. So both last year and this year, if we were to introduce new vehicles, our total vehicle output would decrease. This is a very important point that I think people do not -- a lot of people do not understand. So last year, we spent a lot of engineering and management resources solving supply chain issues, rewriting code, changing our chips, reducing the number of chips we need, with chip drama central.

And there were not -- that was not the only supply chain issue, so -- just hundreds of things. And as a result, we were able to grow almost 90% while at least almost every other manufacturer contracted last year. So that's a good result. But if we had introduced, say, a new car last year, we would -- our total vehicle output would have been the same because of the constraints -- the chips constraints, particularly.

So if we'd actually introduced an additional product, that would then require a bunch of attention and resources on that increased complexity of the additional product, resulting in fewer vehicles actually being delivered. And the same is true of this year. So we will not be introducing new vehicle models this year. It would not make any sense because we'll still be parts constrained.

We will, however, do a lot of engineering and tooling, whatnot to create those vehicles: Cybertruck, Semi, Roadster, Optimus, and be ready to bring those to production hopefully next year. That is most likely. But like I said, it is dependent on are we able to produce more cars or fewer cars?"

Drew Baglino:

So that [sizeable cell inventory] gives us the ability to be pretty deliberate in the 4680 ramp where we can maximize learning step by step, take engineering downtime to upgrade key pieces of equipment and modify the structural pack designs to improve reliability all while achieving what you just said.

Drew Baglino:

So throughout 2021, we focused on growing cell supply alongside our in-house 4680 effort to provide us flexibility and insurance as we attempt to grow as fast as possible. As we sit today, sales from suppliers is actually -- it sort of exceeds our other factory-limiting constraints that you mentioned, Elon, in 2022, or to say differently, 4680 cells are not a constraint to our 2022 volume plans based on the information we have.

Tony Sacconaghi: "… do you anticipate 4680 being a gating factor for Cybertruck ramp later this year [2023]? …"

Elon Musk: "...We don't anticipate this being any limiting factor for the Cybertruck or anything else." - Q3’22 Earnings Call

Last edited:

At least it was not boring. Lot's of large numbers jumping around.

Some notes mainly copypaste from here and reddit:

Storage deployed up 360% yoy (vs. Q1 2022)

Storage MWh deployed was up 58% qoq

-$0.8B in FX impact

Model 3 - costs 30% less to produce than in 2018

Proceeds from maturities of investments jumped from $19M to $1.6B

4680 COGS down 25% QoQ

4680 TX 50% increase QoQ volume, 12% yield increase

4680 Kato 20% increase QoQ peak rate, 20% yield increase

Remain on track to hit all targets on timeline presented on Battery Day

Drew said 4680 ramp will be ready to support volume cybertruck production “next year”

Cybertruck handover at the end of Q3 this year

Lathrop ramp: rate limited by suppliers (cells & power electronics) - should expand in 2nd half of year

Elon:

Orders in excess of production

Hesitatingly, “FSD this year”!

2023 car volume: shot at 2 million units as upside case, comfortable at 1.8m guide

Zach on 20% margin miss:

Half was due to pricing adjustments later in quarter - other half due to non-recurring items like warranty adjustment & some Autopilot related deferrals.

Some notes mainly copypaste from here and reddit:

Storage deployed up 360% yoy (vs. Q1 2022)

Storage MWh deployed was up 58% qoq

-$0.8B in FX impact

Model 3 - costs 30% less to produce than in 2018

Proceeds from maturities of investments jumped from $19M to $1.6B

4680 COGS down 25% QoQ

4680 TX 50% increase QoQ volume, 12% yield increase

4680 Kato 20% increase QoQ peak rate, 20% yield increase

Remain on track to hit all targets on timeline presented on Battery Day

Drew said 4680 ramp will be ready to support volume cybertruck production “next year”

Cybertruck handover at the end of Q3 this year

Lathrop ramp: rate limited by suppliers (cells & power electronics) - should expand in 2nd half of year

Elon:

Orders in excess of production

Hesitatingly, “FSD this year”!

2023 car volume: shot at 2 million units as upside case, comfortable at 1.8m guide

Zach on 20% margin miss:

Half was due to pricing adjustments later in quarter - other half due to non-recurring items like warranty adjustment & some Autopilot related deferrals.

Krugerrand

Meow

I don’t do options. I just think you’re so off the mark and full of it. Feel free to continue to follow me around. That’s equally as amusing.Keep downvoting me haters, first thing Rob said after the call was “Tesla basically said we’re not giving guidance about margins anymore or care about them.”

Followed by “until FSD is actually happening Wall Street isn’t going to believe Elon and it’s going to be ugly.”

Followed by “I’m surprised the stock price is let down more now.”

I mean, I guess it’s those who hold call options who are downvoting me for telling the truth. Disaster of a call, but not mad, more amused! I’m excited for the destruction of competitors over the next two years due to Teslas prices.

dhrivnak

Active Member

And 2022, 2021, 2020, 2019, and 2018 about full release of FSD.No, Elon says 2023. You're wrong.

Last edited:

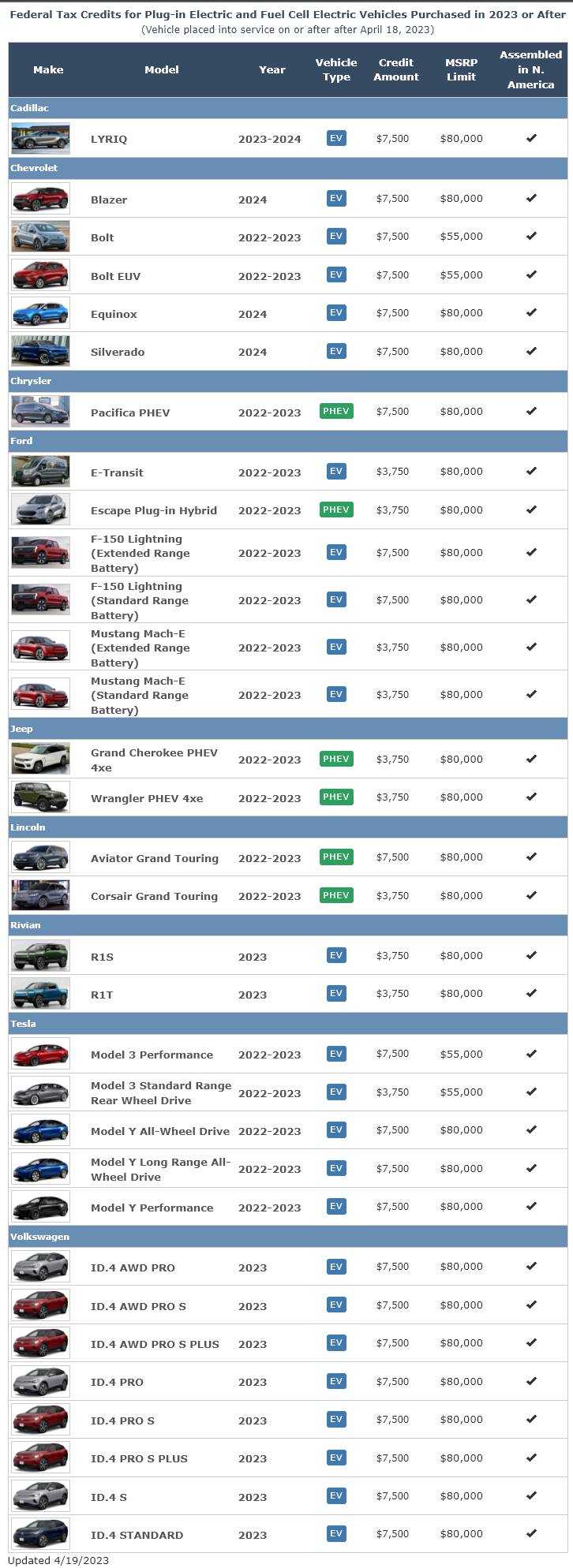

Apparently the IRA Tax Credit list is very fluid, a whack of vehicles were just added including the Rivians qualifying for $3750 and VW's ID.4's qualifying for $7500

Apologies if this was already posted and I missed it

Apologies if this was already posted and I missed it

20% margin for energy business is bad. A gut punch. Unless that number encompasses a drastic pumping of mega pack factories (a very specific hopium interpretation to have), there’s a lot of bad in this call. Anytime Elon has to revert to talking about autonomy as the savior, that’s not good. It’s the same like he’s given every earnings call since like 2016. Throw in some dojo and Optimus projections and yah, it translates to “all your calls are dead for the next 2 years” lol.

And the way analysts keep drilling on pricing and the way the team keeps answering basically comes out to “yah today our production was much higher than sales, so uhhh make the least dumb decision and drop prices.” And they can only do that so much with their margins. It’s why Wall Street momentum really first started dying on the earnings call where Wloj said they weren’t actively working in the cheap car, because the whole “50% growth every year” narrative is dead. It’s actually dead. Until that model 2 comes out. And yah, it’s coming now, but until then we’re going to be in this painful valley which was entirely preventable had they kept to a projected model 2 release rather than putting all eggs on this robotaxi business.

Then again this could all be a clever cover for the fact that the 4680 is wildly delayed, like 3 year ramp delay. Which is actually what I believed happened, and all this “we’re not working on model 2 cuz model 3/y sales are so dominant” talk was just a cover. That’s why Berlin was hinted to start with 4680 yet to this day doesn’t have it, why semi is delayed, why cybertruck is delayed, etc.

Dude! There was this thing that happened in early 2020 ... what was it again? All auto manufacturers put new projects on hold, Tesla was no exception. You can't start new projects when the world's economy is in the shithouse along with non-existent supply chains.

Thekiwi

Active Member

Just a note that the line item “proceeds from maturities of investments” is meaningless to fundamentals or earnings etc.At least it was not boring. Lot's of large numbers jumping around.

Some notes mainly copypaste from here and reddit:

Storage deployed up 360% yoy (vs. Q1 2022)

Storage MWh deployed was up 58% qoq

-$0.8B in FX impact

Model 3 - costs 30% less to produce than in 2018

Proceeds from maturities of investments jumped from $19M to $1.6B

4680 COGS down 25% QoQ

4680 TX 50% increase QoQ volume, 12% yield increase

4680 Kato 20% increase QoQ peak rate, 20% yield increase

Remain on track to hit all targets on timeline presented on Battery Day

Drew said 4680 ramp will be ready to support volume cybertruck production “next year”

Cybertruck handover at the end of Q3 this year

Lathrop ramp: rate limited by suppliers (cells & power electronics) - should expand in 2nd half of year

Elon:

Orders in excess of production

Hesitatingly, “FSD this year”!

2023 car volume: shot at 2 million units as upside case, comfortable at 1.8m guide

Zach on 20% margin miss:

Half was due to pricing adjustments later in quarter - other half due to non-recurring items like warranty adjustment & some Autopilot related deferrals.

It’s just a cash management thing, like an expiry of a fixed term investment of some type, basically the same thing that happens if you have savings in a term deposit that matures - the capital gets returned to you to reinvest in another investment (or you do something else with the cash). So that $1.6B proceeds number is not new money, it is money Tesla had deposited in a previous quarter at some point.

Knightshade

Well-Known Member

Apparently the IRA Tax Credit list is very fluid, a whack of vehicles were just added including the Rivians qualifying for $3750 and VW's ID.4's qualifying for $7500

View attachment 930032

Apologies if this was already posted and I missed it

IIRC all this is based on OEMs self-reporting if they qualify- guess Rivian and VW were late with the paperwork.

Haven’t listened yet but any word on the Roadster or just Elon mumbling about AI and robots and no one understanding but him?

Nothing about Roadster. In general quarterly calls aren't for future product announcements. They are backwards looking and future looking only as far as guesstimates on some key metrics.Haven’t listened yet but any word on the Roadster or just Elon mumbling about AI and robots and no one understanding but him?

bkp_duke

Well-Known Member

Not one question about IRA. Would have been nice to hear some thoughts about it.

Bingo.

I can't find any accounting for it in the report, so I guess Tesla still isn't certain on the manuf credits and is not accounting for them. Could become a windfall later in the year.

StarFoxisDown!

Well-Known Member

Seriously, what a disappointment in the earnings call. Zero clarity on this.Not one question about IRA. Would have been nice to hear some thoughts about it.

EVNow

Well-Known Member

What exactly does this mean ? Would profits have been higher by 800 M … or revenues etc would have been higher ?-$0.8B in FX impart

EVNow

Well-Known Member

I expect it will be in 10-Q.Bingo.

I can't find any accounting for it in the report, so I guess Tesla still isn't certain on the manuf credits and is not accounting for them. Could become a windfall later in the year.

theschnell

Member

I’m pretty sure the answer to those questions is yesWhat exactly does this mean ? Would profits have been higher by 800 M … or revenues etc would have been higher ?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M