Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

I think you will like the white interior. It is very easy to keep clean, and I get compliments on it all the time.I had to spend an extra $1000 on a white interior to get a car.

That would be cool... I wonder what the chances of getting at the data in tabular format is.Yeah, but I wanted to get all the data points and specially the speed, might give us way more info on how efficiency is affected and to extrapolate to higher speeds which truckers drive in other states

Scrape it?

It would definitely be interesting to do a cost analysis of this including labour, cost of acquiring fuel trucks / cubes, installation of chargers, fuel vs electricity, etc. Whether or not we include the $120million semi charging corridor that Tesla is seeking $97m in federal funding to construct.Safety, regulations and cost. There are pretty tight regulations around diesel and gas (at least in Canada). You generally can't have a gas station just anywhere, and it stinks (and is flammable), which you generally don't want toxic fumes around loading zones.

Bulk fuel trucks also cost a lot of fuel to drive around, rendering them pretty inefficient to begin with... And you'd have to pay that driver.

Not saying its going to be massive savings, but it is potentially an advantage that most don't think about because they're used to the inconvenience of taking a separate trip to a gas station.

All to say, to keep it on track, is that once again Tesla's products make financial sense, above and beyond competitors, and their 'demand problem' remains trying to increase production to meet that high demand.

Cheers to the Longs!

Darkfox021

Member

Are you going to include the cost of installing the already installed diesel stations along that corridor in the analysis?It would definitely be interesting to do a cost analysis of this including labour, cost of acquiring fuel trucks / cubes, installation of chargers, fuel vs electricity, etc. Whether or not we include the $120million semi charging corridor that Tesla is seeking $97m in federal funding to construct.

GhostSkater

Member

That would be cool... I wonder what the chances of getting at the data in tabular format is.

Scrape it?

Maybe someone with more knowledge than me can do it, would be happy to process it after

I just wish we could leave something other than Tesla gains to the next generation... some of us in our 60's or older are soon to be experiencing some deadly weather events we can't even conceive of that can come unexpectedly (e.g. New York today!), but we'll soon be gone. I hope that current and future generations can find a way to live with the changes coming (and there will be plenty) as there is currently no way to fix the mess humanity has created for itself.We won’t care; we’ll all be dead.

The Earth will live on, but many species, including possibly man/womankind will not unless they can figure out a way to live with the changes...

Just wait until your Tesla becomes it's own valet as it drops you off at the entrance to the store then drives to an appropriate supercharger and an Optimus comes out to plug it in!@lafrisbee

OT

The Bucee's at Florence, South Carolina. USA, has 128 gas pumps and 12 Tesla Superchargers way off at one edge

(A few years away, but...)

B

betstarship

Guest

Man, the boo birds regarding Tesla sure have come out of the woodwork the past months on this forum.

Buckminster

Well-Known Member

What do we score the Highland transition at? 9/10? Has there been any recognition in the media given the sheer number of logistical changes?

Captkerosene

Member

All of the above is how we got a 15X from the 2019 price - not how we'll get the next 10X. It's not new news for investors. The next 10X will come from doing something the market doesn't really believe or expect: AI and robots.Sure, but both are ignoring Tesla Energy which is on trajectory to be larger than auto, perhaps with less robust margins, although recent results suggest even that may be too pessimistic. The combination of:

- VPP (Virtual Power Plant) with licenses existing in EU, UK, Texas and elsewhere/subsets of these in several places;

-servicing fees for utility-level and other Megapack installations;

That also ignores:

- all the other subscription revenue from everything form Premium Connectivity to FSD;

-rapidly growing Supercharger revenue from non-Tesla and Tesla uses.

I choose to ignore Robotics and RoboTaxi because there is no justifiable way to establish timing or even revenues. No matter the probable future value, I only choose to value that which can be assessed today.

Beyond those items it is clear that very few analysts, including the bulls, can really understand the Tesla manufacturing and logistics advantages. Historically that was a major impediment for APPL and AMZN among many others. The inertia built on traditional thinking about market shares, manufacturing efficiency and distribution excellence all contribute to a serious inability to observe actual changes when it happens. With TSLA that is exacerbated by the power of 120 years worth of evolution built on Fire and Ice. ok, explosions, not really fire.

The positive cash flow in growth is also largely ignored and virtually never valued, probably because it is unprecedented. Realistically, unprecedented things face heavy resistence. Simply understanding TSLA positive cash flow explains how they have negligible leverage which in turn explains how TSLA has enormous resilience to anything adverse.

We'd send far less time aimlessly bleating about quarterly sales and/or production were we to really see TSLA as the value stock champion that it really is.

Making TSLA a 'story stock' really exacerbates volatility and has zero intrinsic value.

Elon has warned us all how bad a conflict with China could be. The world is in the process of choosing sides right now for what could be a big blowout. Who thought that we'd be in a proxy war with Russia? I suspect that our supply chains would dry up if China takes Taiwan. Elon seems (to me) to think they will. I think Tesla would survive, but we're not immune to that kind of trouble. In fact, I'd say we're much more vulnerable than the "average" business.Simply understanding TSLA positive cash flow explains how they have negligible leverage which in turn explains how TSLA has enormous resilience to anything adverse.

TN Mtn Man

Member

Exactly. I think it's highly unlikely any terminal will spend the money to put a Megacharger at every loading dock. I've never heard of one doing so with diesel, which would be much, much less expensive.If refilling while unloading/loading is a big savings, what would stop the company from having a bulk fuel truck pumping diesel into it under the same circumstances?

DragonWatch

Small FootPrint

Forward Observing

Haircut day. Please do not tell the owner, I like the new guy.

Two chairs over, my aging cat like hearing is, on maybe its third life. The owner, Lee, was talking to his customer or rather listening. The customer was excited about a new car coming out not too far down the road. “Hybrid and a little bit of gas.” The gentleman was so excited. Tough road ahead:-( Sorry, hearing good for a life of cannons, missiles and rockets ~ at least I do not need hearing aids.

Yep, old soldiers never die, I am just having a hard time fading away.

Cheers

Haircut day. Please do not tell the owner, I like the new guy.

Two chairs over, my aging cat like hearing is, on maybe its third life. The owner, Lee, was talking to his customer or rather listening. The customer was excited about a new car coming out not too far down the road. “Hybrid and a little bit of gas.” The gentleman was so excited. Tough road ahead:-( Sorry, hearing good for a life of cannons, missiles and rockets ~ at least I do not need hearing aids.

Yep, old soldiers never die, I am just having a hard time fading away.

Cheers

B

betstarship

Guest

I get that the UAW strike is political, but this is a non-political lens (its an economics lens):

September 2023 US Labor Market Update: After Decades of Sluggish Wage Growth, Today’s Manufacturing Workers Are Striking While It’s Still Hot - Indeed Hiring Lab

Production & manufacturing job postings and wage growth remain elevated compared to pre-pandemic norms, but are slowing more quickly than national averages.

www.hiringlab.org

"Employer demand for production & manufacturing workers remains elevated. The Indeed Job Posting Index in that sector was 51.3% above pre-pandemic levels as of September 22, 2023."

The two types of supply chain jobs:

- loading + stocking

- manufacturing + production

If 300k-500k are going to get laid off and the labor market is incredible strong with so many jobs available...I remember tech overhiring during the pandemic, as an example here. Where are all the workers going to go across the supply chain? who's hiring? Manufacturing. The top sectors? Electronics + Automobiles.

Reviving Manufacturing Is the Only Way to Economic Growth

The transition to a service economy has failed.

Quotes from "Stackpath" article:

"Importantly, Ferry provides data that makes clear that “manufacturing is a key contributor to growth because it is the only sector that can create multi-decade broad-based increases in labor productivity, which is the key to rising wages.”"

and

"Ferry goes on to say that “a nation with a significant current account deficit is always in trouble because it is losing share of either its foreign market or its domestic market or both”"

and

"Just about everybody from the conservative right to the liberal left believes that innovation is the primary strategy that America must depend on to compete in the global economy. But the loss of our technologies through partnerships, unfair trade, technology transfer and outsourcing has shown that we are fast losing our technologies to countries like China. Outsourcing and technology transfer agreements are a contradiction to any innovation strategy. Fifty-eight percent of private R&D comes from manufacturing, not services, so increasing manufacturing R&D in the U.S. is the key to an innovation strategy."

==========

Lastly, what's are the occupations with the most workplace injuries? Trucking driving, Nursing Assistants, and Loading/Stocking. What's Tesla Bot working on right now?

Workplace Injury Statistics

Our team has gathered the most up-to-date statistics on workplace accidents, injuries and deaths in the US. Learn more by clicking here.

B

betstarship

Guest

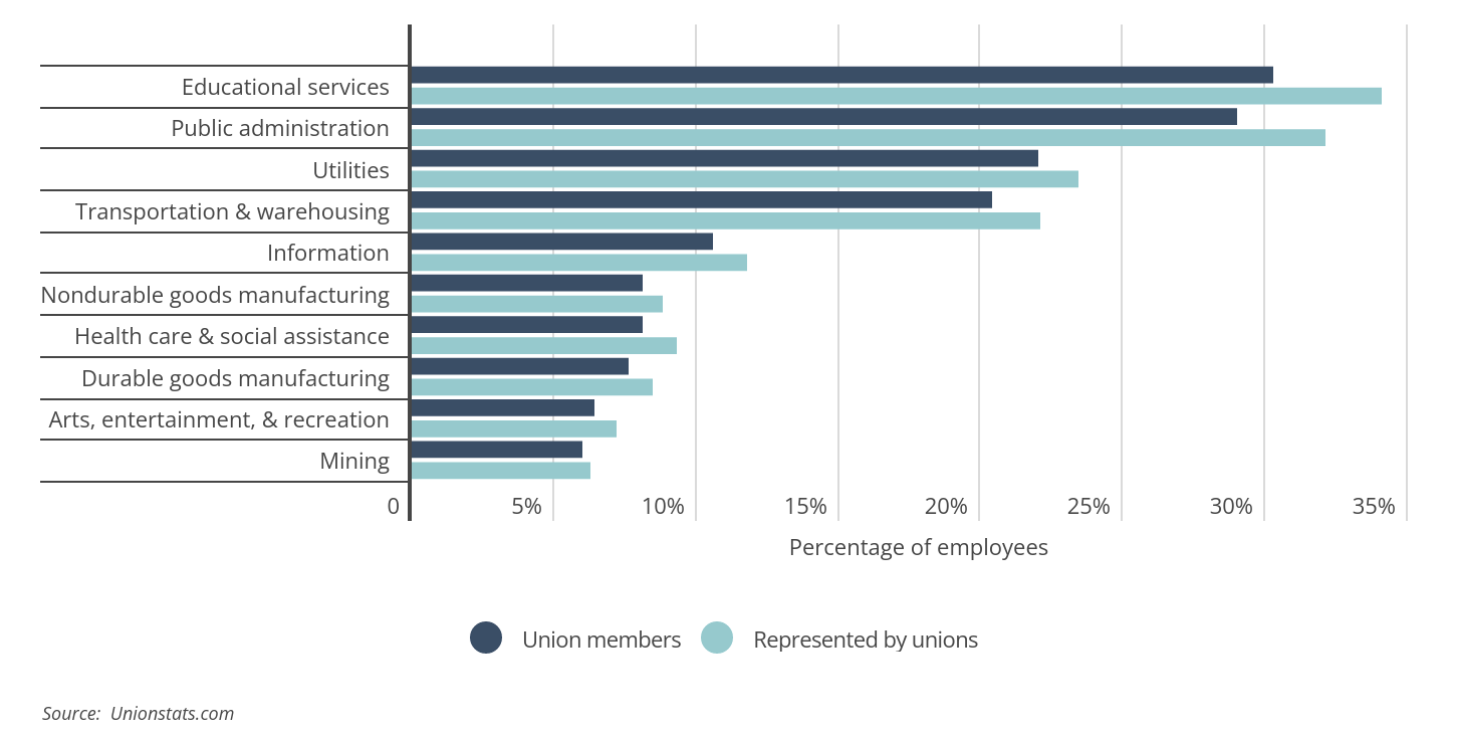

I just looked at it further - what's the highest percent of union workers based on types of occupations?

Source: https://smartestdollar.com/research/the-most-unionized-occupations-2022

Source: https://smartestdollar.com/research/the-most-unionized-occupations-2022

B

betstarship

Guest

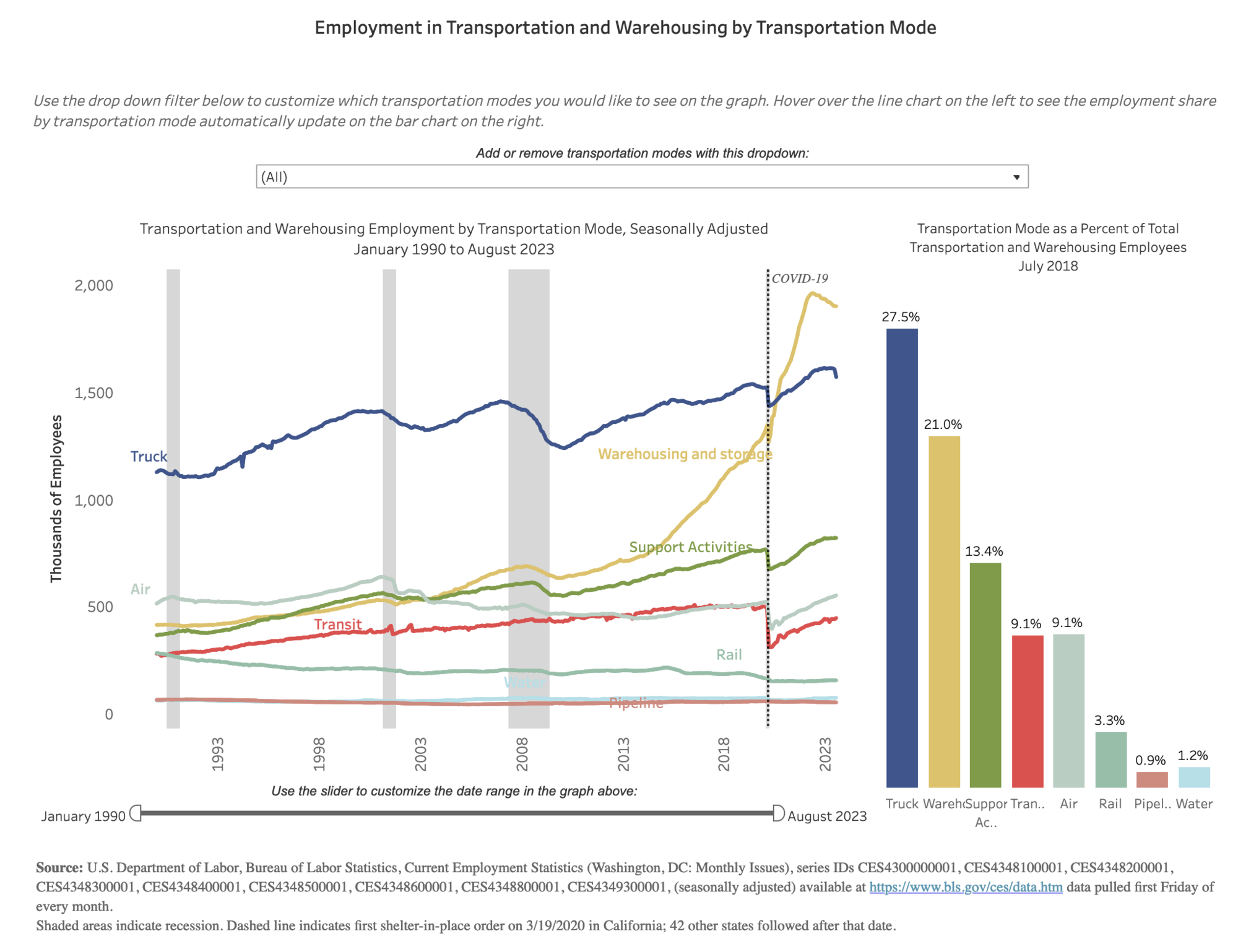

I mean look at this crap:

data.bts.gov

data.bts.gov

We 4x'd on one of the most dangerous occupations out there in 10 years.

Employment-Transportation and Warehousing Sector Total, by Mode, and by Women workers

This page focuses on monthly employment in the transportation and warehousing sector and breaks them down by transportation mode and by women workers.

We 4x'd on one of the most dangerous occupations out there in 10 years.

B

betstarship

Guest

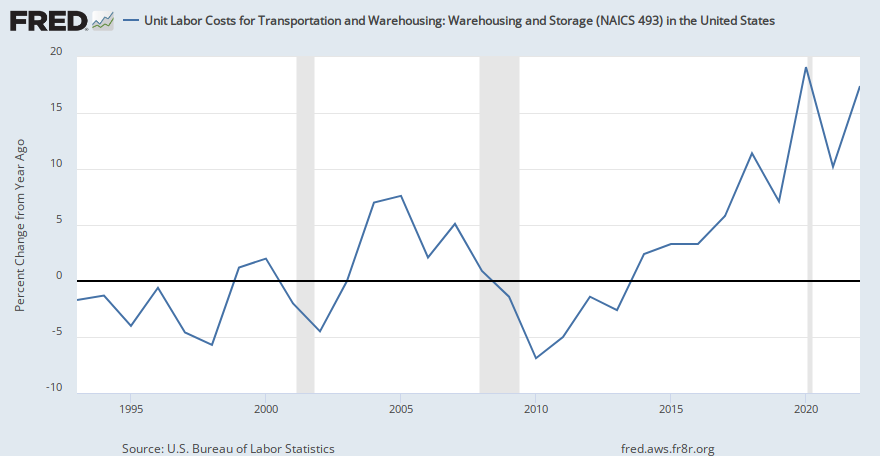

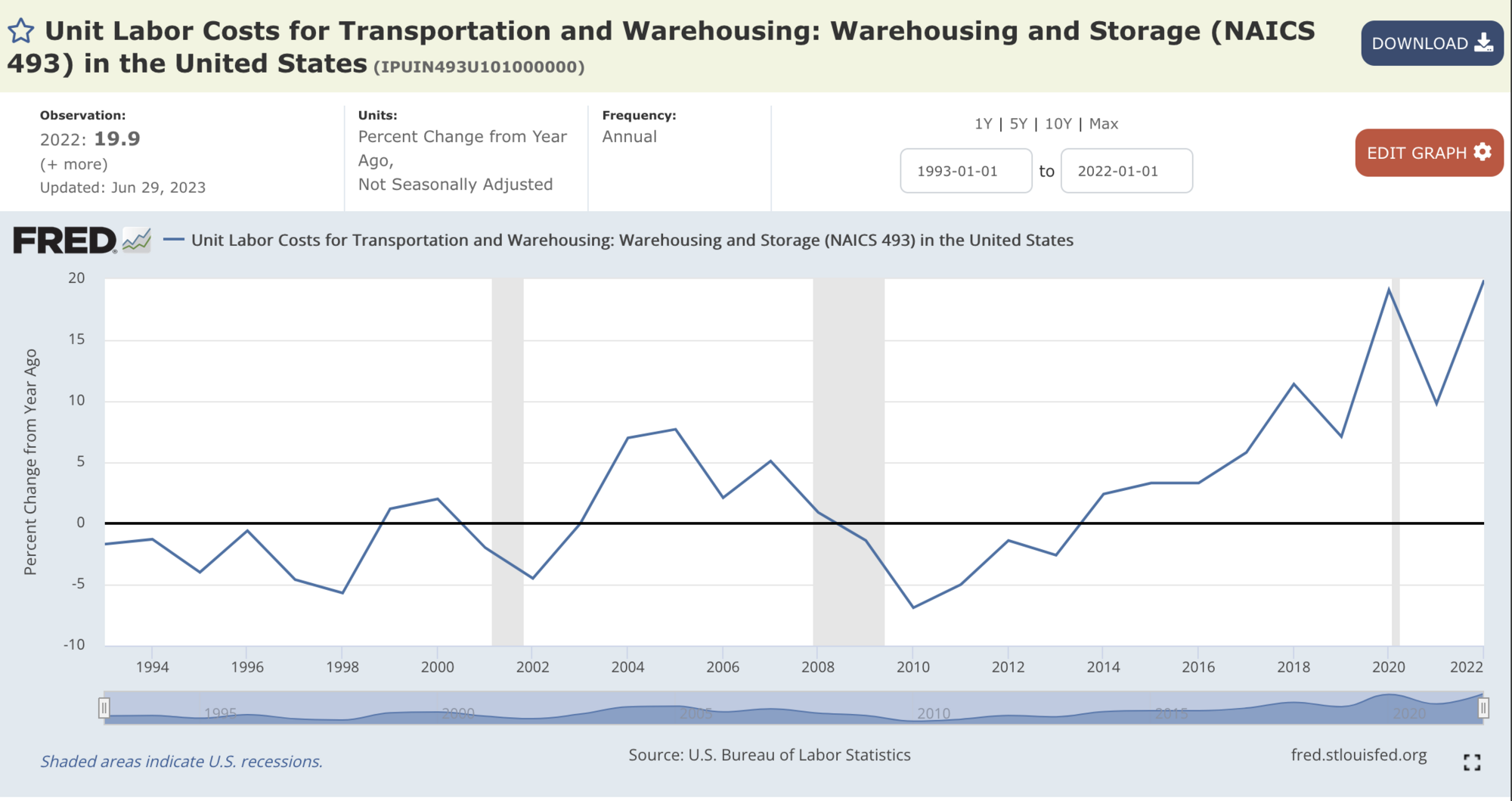

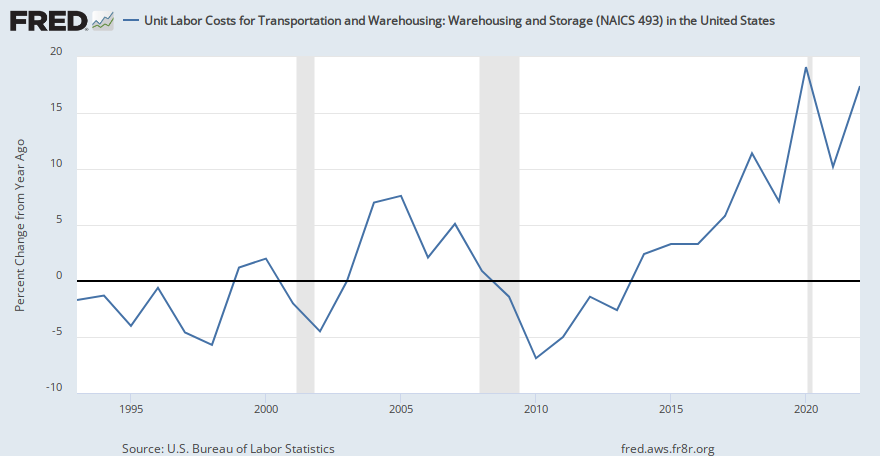

Did all that increase in dangerous work in warehousing and storage (specifically)...I dunno, improve unit costs?

Unit Labor Costs for Transportation and Warehousing: Warehousing and Storage (NAICS 493) in the United States

Graph and download economic data for Unit Labor Costs for Transportation and Warehousing: Warehousing and Storage (NAICS 493) in the United States (IPUIN493U101000000) from 1993 to 2022 about unit labor cost, warehousing, NAICS, transportation, and USA.

fred.stlouisfed.org

JusRelax

Active Member

Who wants to be one of the first to own a cybertruck?

www.teslarati.com

www.teslarati.com

Tesla Cybertruck to be auctioned off at 29th Petersen Gala on Oct 7

An attendee of the 29th Petersen Gala on October 7, 2023, will be going home with a very unique vehicle — a 2024 Tesla Cybertruck.

insaneoctane

Well-Known Member

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M